Advisor News InsightAFRs | FACTS | WEBSITE | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

|||

|

|||

INDUSTRY NEWS |

|||

Annuity PlanningIRS Addresses Tax Treatment of Non-Qualified Annuities Issued to TrustsThe Internal Revenue Service released a private letter ruling in July, PLR 202031008 (“the Ruling”), which considers how Internal Revenue Code sections 72(q) and (u) apply to an annuity contract issued to a trust. In particular, the Ruling interprets the terms “taxpayer,” “holder” and “held by” in those Code sections in situations where a non-qualified deferred annuity contract is issued to a grantor trust or a non-grantor trust. The Ruling’s analysis and conclusions differ in some respects depending on which of these types of trusts is involved. In addition, although the Ruling does not address sections 72(s) or 72(e)(4)(C), the Ruling has potential implications under those provisions because they also use the term “holder” and “holds,” respectively. |

|||

|

|||

Estate PlanningDoes Your State Have an Estate or Inheritance Tax?This article was written by Janelle Cammenga, Policy Analyst with the Center for State Tax Policy at the Tax Foundation. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both. |

|||

|

|||

IRA PlanningWhen a “Reverse Rollover” Makes SenseThis article was written by Ian Berger, JD IRA Analyst of Ed Slott and Company, LLC. When we think of rollovers, we normally think of moving funds from a 401(k) (or other company plan) to an IRA, but it sometimes makes sense to consider a “Reverse Rollover” — from and IRA to a 401(k). |

|||

|

|||

Retirement PlanningDOL Interprets Five-Part Investment Advice Test and Issues

|

|||

|

|||

Guaranteed lifetime income to support longer retirement: new insightsThis report was developed in Collaboration with the Principal Financial Group. This is the great American spend down challenge: how workers can financially plan for and navigate a retirement that could reach up to 40 years, but may also last just one. There are a number of different ways to create reliable income streams in retirement. In this paper, the focus is on income annuities, which, according to many experts, are a viable and immediately realizable vehicle to help many Americans develop guaranteed lifetime income. |

|||

|

|||

Retirement Planning in the Post-4% WorldThis article was written by David Blanchett,

PhD, CFA, CFP® retirement research for Morningstar’s Investment Today’s low bond yields and high equity valuations have led many to jettison the traditional 4% initial safe-withdrawal rate (SWR) assumption. But I will show that the optimal “safe” withdrawal rate depends considerably on the retiree. |

|||

|

|||

Tax PlanningHere’s how people can request a copy of their previous tax returnTaxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file. |

|||

|

|||

IRS Publication 575The Internal Revenue Service has released a draft version of an important financial services tool: an update of Publication 575: Pension and Annuity Income. The new update is supposed to help taxpayers prepare their personal federal income tax returns for 2020. The publication serves as a kind of retirement arrangement tax encyclopedia. It provides sections on disability pensions, insurance premiums for retired public safety officers and railroad retirement benefits, as well as sections on variable annuities, Section 457 deferred compensation plans and retirement plan distribution rollovers. |

|||

|

|||

State Individual Income Tax Rates and Brackets for 2021This article was written by Katherine Loughead,

Senior Policy Analyst with the Center for State Tax Policy at the Individual income taxes are a major source of state government revenue, accounting for 38 percent of state tax collections in fiscal year 2018, the latest year of data available. |

|||

|

|||

Tax Day for Individuals Extended to May 17: Treasury, IRS extend Filing and Payment DeadlineThe Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days. |

|||

|

|||

Tax and Estate PlanningSanders and Colleagues Introduce Legislation to End Rigged Tax Code as Inequality IncreasesPress release distributed by Bernie Sanders, U.S. Senator for Vermont. In a continued effort to combat rising economic inequality, Sen. Bernie Sanders on Thursday introduced two pieces of legislation to end our rigged tax code and ensure the wealthiest people and largest corporations pay their fair share – the For the 99.5% Act and the Corporate Tax Dodging Prevention Act... The For the 99.5% Act

The Corporate Tax Dodging Prevention Act/p> |

|||

|

|||

ASSUMED FEDERAL RATES (AFRs) |

|||

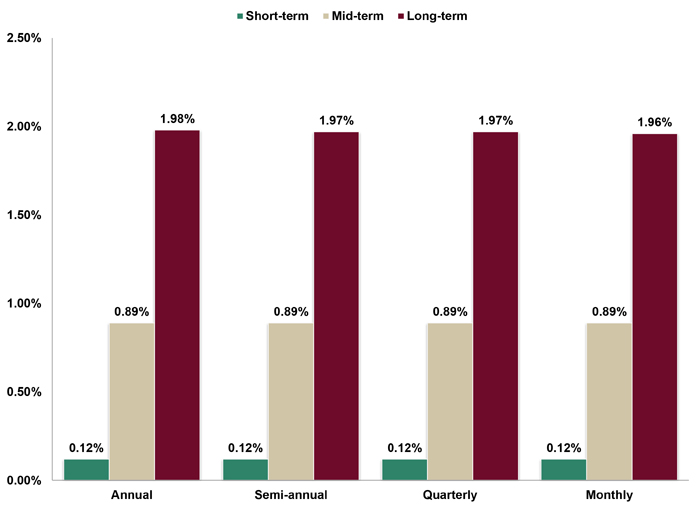

§7520 Rate for April is: 1.0%Break down: |

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Difference of OpinionSource: Internal Revenue Service (IRS) Rock superstar Prince died on 4/21/16, leaving an estate that was valued (for estate tax purposes) at $82 million. The IRS has challenged the valuation techniques utilized by his administrator, upping the estate value at Prince’s death to $163 million. The IRS is asking for an additional $39 million in estate taxes and penalties above what Prince’s estate has already paid. |

|||

|

|||

Estate TaxesSource: IRS The maximum amount that a deceased individual may pass onto his/her heirs federally estate-tax free (with proper planning) rises to $11.7 million in 2021, up from $11.58 million in 2020. The limit was $675,000 in 2001 or 20 years ago. Please consult a tax expert for details. |

|||

|

|||

How Cheap?Source: Freddie Mac At the beginning of 2020, the all-time record low average interest rate nationwide for a 30-year fixed rate mortgage was 3.31% set on 11/22/12. A new record low average rate was established during 16 separate weeks in 2020, the last taking place on 12/24/20 at 2.66%. |

|||

|

|||

It Has Been Done BeforeSource: Center on Budget and Policy Priorities (CBPP) Congressional Democrats are using “budget reconciliation” to move President Joe Biden’s $1.9 trillion COVID-relief plan through the Senate. “Reconciliation bills” are not subject to the “filibuster rule” that ends debate on a piece of legislation only after 60 senators agree to do so, i.e., it would take just 51 senators (instead of 60) to approve the COVID-relief bill. Congress has used the “budget reconciliation” process to enact 21 bills in the last 40 years. |

|||

|

|||

It’s an IndexSource: U.S. Department of Labor (DOL) Inflation, as measured by the “Consumer Price Index” (CPI), was up +1.4% for 2020. The category “food” within the CPI calculation was up +3.9% for the year, “medical care services” was up +2.8%, but “energy” was down 7.0% last year. |

|||

|

|||

Ready to Leave?Source: IncomeTaxPro.net New York residents are currently subject to a top state marginal tax rate of 8.82% at taxable income levels of $1.08 million for an individual return and $2.16 million for a joint return. NY Governor Andrew Cuomo has proposed raising that top marginal rate to 10.86% for the 2022 fiscal year beginning 4/01/21. NYC residents are also subject to a maximum city marginal tax rate of 3.876%, i.e., their total marginal rate could be as high as 14.736% during fiscal year 2022, the highest in the nation. |

|||

|

|||

USEFUL FINANCIAL WEBSITE |

|||

© Income Laboratory, Inc.Income Lab is the industry’s first truly dynamic financial planning platform, where plans are built around realistic ongoing adjustments, not simplistic static assumptions. The platform combines deep pools of market and economic data with powerful analytics and reality-based planning options to improve client outcomes and help advisors differentiate and scale their businesses. |

|||

|

|||

RECOMMENDED READING |

|||

Advisors Guide to Medicare and MedicaidBEST CE COURSE This course provides a detailed study of Medicare, Medigap and Medicaid. In each of these programs, the areas of eligibility, enrollment, benefits, deductibles, and co-payments are analyzed in great detail. This course also includes a chapter on Medicaid Planning discussing the issue of transferring assets during the "crisis stage," use of Trusts, qualifying Medicaid Annuities and Promissory Notes. |

|||

|

|||

ADVISOR TOOLS |

|||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

BEST CE PROGRAMS |

|||

BEST Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP / CIMA / CPWA / RMA). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

BEST Virtual Super CE EventsWe provide advisors with:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|||

|

|||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

|||

BEST INFORMATION |

|||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

*Unsubscribing? Please allow one (1) business day for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||