| |

| |

|

|

| |

Annuity Planning

Actuaries suggest annuities to manage longevity risk

A report by the Society of Actuaries, Managing Post-Retirement Risks:

Strategies for a Secure Retirement (Risk Chart), on how retirees can manage

the risk of outliving their resources suggests two types of annuities: immediate

payout annuities and deferred annuities. Other possible strategies cited include

delaying Social Security and reverse mortgages.

This article was prepared and distributed by Society of Actuaries.

|

| |

|

|

| |

|

| |

List of states drafting annuity sales rules gets longer

Idaho, Ohio, Rhode Island and Kentucky have joined the growing list of states working to

adopt annuity sales rules based on a model law adopted by the National Association of Insurance

Commissioners. The NAIC is working on a frequently asked questions document to help state legislators

and insurance departments as they go through the adoption process.

This article was written by John Hilton, Senior Editor, InsuranceNewsNet.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Education Planning

As coronavirus muddies college planning, 529 plans can help

How do advisors help clients plan for college when its value is unclear

during the coronavirus-era of virtualized learning? In some cases using

tax-deferred 529 plans may help clients navigate some of the uncertainty,

especially with the passage of of two recent federal acts: the SECURE Act,

federal spending legislation that includes provisions for retirement savings

that passed in December, and the CARES Act, which became law in March to help

Americans weather the pandemic. The changes are among a wide array of options

offered by 529 plans that clients may want to reconsider now, advisors say.

This article was written by Ann Marsh, Senior Editor and the West Coast Bureau Chief, Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

IRA Planning

IRS: New law provides relief for eligible taxpayers who need funds from IRAs and other retirement plans

The Internal Revenue Service provided a reminder today that the Coronavirus Aid, Relief, and Economic Security (CARES) Act

can help eligible taxpayers in need by providing favorable tax treatment for withdrawals from retirement plans and IRAs and

allowing certain retirement plans to offer expanded loan options.

|

| |

|

|

| |

|

| |

Rollovers Must Be Completed by August 31

The IRS extended the rollover deadline for RMDs already taken this year

(normally, rollovers must be completed within 60 days). The original due date

for rollovers was July 15, 2020, for RMDs taken between February 1 and May 15.

Now, retirees who took an RMD between January 1 and June 30 have until August 31, 2020,

to repay the distributed funds. That gives everyone a little more time to put the money

back into an IRA or 401(k) plan to avoid paying tax on a previous 2020 distribution.

The deadline is August 31.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

From assets to income: A goals-based approach to retirement spending

Vanguards research paper From assets to income: A goals-based approach to retirement spending

shows advisors how to help their clients implement a personalized spending strategy. The resulting

plan is a customized, responsive formula that can help reduce clients’ anxiety and stress about their

ability to meet retirement income goals, regardless of the market environment.

The report/white paper were prepared and distributed by The Vanguard Group, Inc.

|

| |

|

|

| |

|

| |

Retirement Savings for Freelancers: Solo 401(k) vs. SEP IRA

SELF-EMPLOYED PEOPLE can still save for retirement – and benefit from valuable tax breaks –

even if they don’t have a job with a 401(k). Whether you’re starting your own business, freelancing

on the side to earn some extra income or you lost your job and are doing some consulting work, you

can save for the future in a tax-advantaged retirement savings plan. Freelancers who don’t have any

employees generally have two main options: a simplified employee pension or a solo 401(k). Here’s how

they both work and how to pick the best plan for you.

This article was written by Kimberly Lankford, Contributor, U.S. News.

|

| |

|

|

| |

|

| |

The Relationship Between an Advisor and Retired Clients

An investor is most likely to employ a financial advisor when they are approaching retirement.

Many investors would benefit from an earlier relationship with an advisor, even if retirement income

is their only goal in their investment decisions. But many investors choose to wait until they near

retirement to discuss with an advisor their needs and desires as it relates to their investment portfolio.

This article was distributed by Spectrem Group.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

Timing a Social Security claim when you have children

With the high incidence of divorce and remarriage these days,

it’s not unusual to hear stories about families headed by older

fathers — some old enough to claim Social Security — with school-age

children at home. When it comes to timing benefits for minor dependents,

deciding when to claim Social Security is a major decision that’s complicated

by the father’s age and whether he is still working.

This article was written by Mary Beth Franklin, CFP®, Contributing Editor, InvestmentNews.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Tax Planning

Former Kiddie Tax Rules Restored

The latest version of the kiddie tax, which was still in its infancy,

was effectively wiped away when the Further Consolidated Appropriations Act,

2020, P.L. 116-94, was enacted at the end of 2019, thus nullifying changes

that were included in the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97.

This article explains how the kiddie tax calculations have changed once again, why Congress

repealed the TCJA's version of the kiddie tax, and how best to deal with these changes for

children subject to this tax.

This article was written by various authors that are all faculty members in the Department of Accountancy at Northern Illinois University in DeKalb, Ill.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Practice Management

Personalized and Frequent Contact Is What Clients Want Now

Two big questions advisors must ask now are how has their business changed due to

the pandemic, and how are they evolving to be sustainable going forward? These questions

were addressed in a recent webinar held by Envestnet, pulling from their team of experts.

“In these times, advice becomes more relevant and more important,” said John Harris, Envestnet’s

managing director of global advisory sales.

This article was written by Ginger Szala, Executive Managing Editor, Investment Advisor Magazine.

|

| |

|

|

| |

| |

|

| |

U.S. Department of Labor Proposes to Improved Investment Advice and Enhance Financial Choices for Workers and Retirees

The Employee Benefits Security Administration (EBSA) has unveiled a new sales standard proposal that could affect investment

advice fiduciaries that help retirement savers roll cash from retirement plans into individual retirement accounts (IRAs). EBSA

is an arm of the U.S. Department of Labor (DOL), and the new draft is likely to set off a new wave of battles over who should

regulate annuity sellers, and how.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

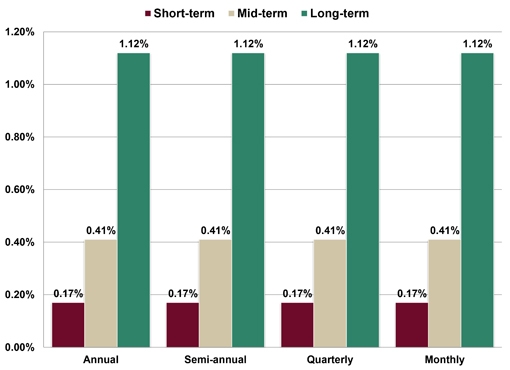

Assumed Federal Rates (AFRs)

§7520 Rate for August is: 0.4%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

All for Exactly the Same Services

Private US health insurance pays on average $241 for health care services for

every $100 that Medicare pays and for every $72 that Medicaid pays (source: RAND, Health Affairs).

|

| |

|

|

| |

|

| |

Expensive Education

Outstanding student loan debt in the USA was $1.54 trillion

as of 3/31/20, up +103% from $760 billion as of 3/31/10 (Source: Federal Reserve Bank of New York).

|

| |

|

|

| |

|

| |

Funding A Retirement

I The S&P 500 has averaged +10.2% per year (total return) over the 25 years ending 12/31/19.

A lump-sum of $838,914 (in a pre-tax account) will sustain a 20-year payout of $100,000 per

year (i.e., $2 million of gross distributions before taxes) assuming the funds continue to

earn +10.2% annually (Source: BTN Research).

|

| |

|

|

| |

|

| |

Last Month, Last Year

The U.S. government suffered an $864 billion budget deficit during June 2020, i.e.,

$241 billion of tax receipts vs. $1.1 trillion of outlays. The US government had a

$984 billion budget deficit for the entire 2019 fiscal year, i.e., the 12 months ending

9/30/19 (Source: U.S. Department of the Treasury).

|

| |

|

|

|

Top ↑

|

| |

|

| |

No Hurry to Retire

45% of American workers expect to work past age 65. 30 years ago, just 18% of

American workers anticipated working past age 65 (Source: Employee Benefit Research

Institute 2019).

|

| |

|

|

| |

|

| |

Not Inflation, But Deflation

The Consumer Price Index (CPI) fell 0.1% on a month-over-month basis in May 2020,

the 3rd consecutive month of “negative inflation.” The last calendar year in which

inflation was negative, i.e., deflation, was 1954 or 66 years ago (Source: U.S. Bureau

of Labor Statistics).

|

| |

|

|

| |

|

| |

Tax Planning

Grantor retained annuity trusts (GRATs) are used to transfer appreciating assets to heirs.

GRATs become more effective as interest rates drop because any appreciation in excess of the

Section 7520 interest rate passes to heirs free of gift tax. A $10 million GRAT established in

May 2019 earning 6% when the Section 7520 rate was 2.8% could pay $1 million per year to the

grantor for 10 years, $4.7 million to the heirs after 10 years with only a $1.4 million taxable

gift. A $10 million GRAT established in May 2020 earning 6% when the Section 7520 rate is 0.8%

could pay $1 million per year to the grantor for 10 years, $4.7 million to the heirs after 10 years

with only a $426,000 taxable gift. Please consult a tax expert for details (Source: Journal of Accountancy).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

2-Hour CFP/CIMA/CPWA/RMA Ethics CE Live Webinar

“Ethical Practices for Professionals” (Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring financial professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, August 24, 2020

TIME: 2:00PM - 4:00PM EASTERN TIME

CREDIT: 2-HOURS OF CFP ETHICS CE

(also approved for CIMA/CPWA/RMA Ethics)

FEE: $49.00 (USD)

(NOTE: This webinar does

NOT include state insurance credit.)

PAYMENT OPTIONS:

- CFP ONLY license: $49.00

- CIMA / CPWA ONLY license: $49.00

- CFP AND CIMA / CPWA licenses: $49.00 plus an additional fee of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

|

|

|

Top ↑

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24‑48

hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

|

Top ↑

|

| |

|

| |

Unable to Attend this Month’s Webinar?

Click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need State Insurance or More CFP or CIMA/CPWA/RMA Credits?

View our Virtual Super CE events OR online course catalogs by clicking on the corresponding button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates

and registration information for future webinars by clicking

on the button below. |

| |

|

|

|

Top ↑

|

| |

|

| |

BEST Virtual Super CE Event

“Estate Planning”

Up to 20 credit hours of State Insurance CE credit and

10 CE credit hours of CFP and 5 CE credit hours of CIMA/CPWA/RMA credit.*

DATES: TUESDAY, AUGUST 25, 2020

TIME: 1:00PM - 2:30PM

EASTERN TIME

CREDIT: Click here to view credit hours by state.

FEE: $54.95 (USD)

(*plus state roster fees and $10.00 per additional professional certificate)

EVENT INFORMATION:

Electronic Exam: Self-study/Correspondence course –

“Estate Planning”

The link to the electronic exam will be provided at the end of the live webinar

Exam will be accessible between 8/25/20 – 9/8/20

Pass/Fail will be displayed immediately upon completion

(Unlimited retakes available)

|

| |

|

|

| |

|

| |

Instructor

Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA®, CERS®, CPRC®, CPFA®,

is the Founder, President and CEO of Broker Educational Sales & Training, Inc., (BEST).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Need 2 Credit Hours of CFP/CIMA/CPWA/RMA Ethics CE?

See

information in the previous section of this newsletter or

click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need More State Insurance, CFP or CIMA/CPWA/RMA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates and registration information for future webinars by clicking on the button below.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Course

The Advisors Guide To 401(k) Plans

This course has been developed to enhance the Advisor’s 401(k) knowledge and

provide updates on the most recent 401(k) plan guidance. With recent tax law

changes, Department of Labor requirements and court settlements, this course extends

beyond the basics to cover special 401(k) testing rules and design options, as well as,

ERISA and fiduciary responsibilities of the “parties of interest.” |

| |

|

| |

BEST Online CE Courses

BEST is a premier provider of CE for

financial and insurance professionals, to include

State Insurance, CFP® and CIMA®/CPWA® professionals.

BEST courses are updated annually to provide the some of the most accurate and time sensitive content in the industry.

Our CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to one year from date of purchase

- Excellent customer support team

|

Select a button below to order the CE you need today! |

|

|

|

|

|

Already completed your requirements? Please click here to pass on our information to a colleague. |

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the District of Columbia

Order CE courses toll free: 1-800-345-5669 OR send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Virtual Super CE Combines the Benefits and Convenience of:

- Live Webinar Presentation: A 1 hour CE live webinar (optional 1 credit hour of CE credit may be provided in most states, except MA, and for professional designations)

- Self-Study/Correspondence Course: A Self-study/Correspondence Course with an electronic exam (earn up to 21 hours of state insurance CE credit

(varies by state), 10 hours of CFP CE credit and 5 hours of CIMA/CPWA/RMA CE credit)

- Electronic Exam: Self-study/Correspondence course (exam requires an invite code which is given to all attendees during the live webinar)

|

| |

|

|

| |

|

| |

|

Contact our Business Development Department to

schedule a customized Virtual Super CE.

Call toll free: 1-800-345-5669

Email:

BusinessDev@brokered.net

Office Hours:

Monday - Friday, 8:30AM - 5:00PM ET

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

|

Top ↑

|

| |