| |

| |

|

|

| |

2021 Tax & Social Security Guides

Our 2021 Federal Income Tax and Reference to Social Security & Medicare guides are now available

|

2021 Federal Income Tax Guide |

|

2021 Reference Guide to Social Security

& Medicare |

| |

|

|

| Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

| Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

|

Top ↑

|

| |

|

|

| |

Annuity Planning

Wink, Inc. Releases 3rd Quarter, 2020 Deferred Annuity Sales Results

Wink’s Sales & Market Report is the insurance industry’s #1 resource for annuity sales data since 1997.

Sixty-two indexed annuity providers, 47 fixed annuity providers, 69 multi-year guaranteed annuity (MYGA)

providers, 13 structured annuity providers, and 46 variable annuity providers participated in the 93rd

edition of Wink’s Sales & Market Report for 3rd Quarter, 2020.

This press release was posted by Wink’s RockStars at Wink, Inc..

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

IRA Planning

IRA to HSA: The Only Time It Makes Sense to Move Funds

A little-known rule buried deep on the IRS website presents a once-in-a-lifetime opportunity for

clients with a health savings account — the ability to make a contribution directly from an IRA.

Although this one-time offer isn’t worth the effort for most clients, who’d be better off continuing

to fund both accounts and collect dual tax breaks for doing so, there are a handful of situations where

cash-strapped clients with high medical costs could really benefit from making the move and tapping tax-

and penalty-free funds.

This article was written by Kerri Anne Renzulli, Contributing Writer of Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Medicare & Medicaid Planning

Medicaid Planning Technique Didn’t Work Exactly as Intended

When a family member faces the high cost of long-term

care, it may seem important to do whatever it takes to

preserve their resources. Sometimes, though, a given

Medicaid planning technique may cause problems. That can be

true even if the approach is legal — and sometimes even if

it is effective.

This article was written by Robert B. Fleming, Attorney of Fleming & Curti, PLC.

|

| |

|

|

| |

|

| |

Medicare.gov Compare Tools

“We’ve combined our 8 original provider compare sites, giving you one place to start finding any type of care you need.

New features include updated maps, new filters that help you identify the providers right for you, and a clean, consistent

design that makes it easier to compare providers and find the information that’s most important to you.”

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

Significant Provisions of SECURE 2.0

On October 27, 2020, Ways and Means Committee Chairman Richard E. Neal (D-MA) and Ranking Member Kevin Brady (R-TX)

introduced the Securing a Strong Retirement Act of 2020 (the “Act”). Neal and Brady originally introduced the Setting

Every Community Up for Retirement Enhancement Act (the “SECURE Act”) of 2019. The Act builds on the SECURE Act provisions

to further improve workers’ long-term retirement security and financial wellbeing, and is being referred to as SECURE 2.0.

Note that the Act has not been passed by either the Senate or the House of Representatives, and the provisions may change

as the bill proceeds.

This article was written by Steven Grieb, J.D., CEBS, Senior Compliance Counsel, Retirement Plan Consulting of © Gallagher.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Tax Planning

14 Year-End Tax and Financial Tips

The window of opportunity to trim that 2020 tax bill, save for retirement and leverage strategies to

secure your financial future is closing. To help Americans make these moves before it’s too late, CPA

financial planners with the American Institute of CPAs (AICPA) share the following 2020 year-end tips.

This article was distributed by CPA Practice Advisor.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Practice Management

Can Your Organizational Structure Support Your Firm’s Strategies?

The window of opportunity to trim that 2020 tax bill, save for retirement and leverage strategies to

secure your financial future is closing. To help Americans make these moves before it’s too late, CPA

financial planners with the American Institute of CPAs (AICPA) share the following 2020 year-end tips.

This article was written by Frank Kimball of Kismet Advisory.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

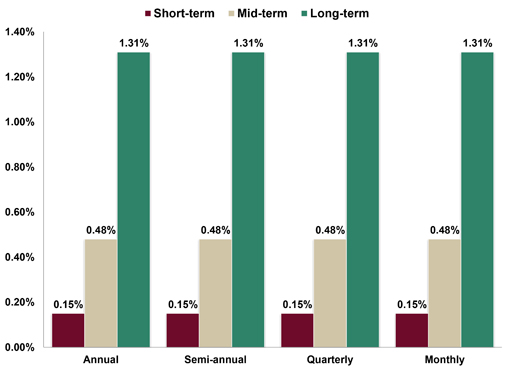

Assumed Federal Rates (AFRs)

§7520 Rate for December is: 0.6%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

14-Year High

New residential construction in the US totaled 139,100 housing units in July 2020,

its highest monthly total recorded since September 2006. The total includes 93,100

single family homes, 700 apartment buildings with 2-4 units and 45,300 apartment buildings

with 5 or more units (source: U.S. Census Bureau).

|

| |

|

|

| |

|

| |

A Big Percentage Event Before

The pandemic pushed the percentage of adults age 18-29 living with a parent to

52% as of the end of July 2020. Surprisingly, the percentage of adults age 18-29

living with a parent as of the end of January 2020, i.e., before the 1st US COVID-19

death, was 46% (source: Pew Research Center).

|

| |

|

|

| |

|

| |

A Majority

52% of US households have investments in US stocks, either through direct ownership of individual stocks or

through pooled accounts such as mutual funds (source: Survey of Consumer Finances).

|

| |

|

|

| |

|

| |

Cutoffs for AGI

For tax year 2017, the latest tax year that the IRS has released data, 143,295,160 tax returns were filed.

98% of the 143.3 million returns reported adjusted gross income less than $339,478. 99% of the 143.3 million

returns reported adjusted gross income less than $515,371 (source: Internal Revenue Service (IRS)).

|

| |

|

|

| |

|

| |

Health Insurance

For workers that access their health insurance through an employer,

the average annual cost for health insurance coverage for a family plan

in 2020 is $20,514, with the employer paying 67% of the total ($13,717)

and the employee paying 33% ($6,797) (source: U.S. Bureau of Labor

Statistics).

|

| |

|

|

|

Top ↑

|

| |

|

| |

I’m Leaving on a (Private) Jet Plane

The California Legislature is debating a bill introduced on 7/27/20 that would retroactively

(to January 2020) raise the state’s top marginal tax rate from 13.3% up to 14.3% at taxable income

levels above $1 million, up to 16.3% on taxable income above $2 million and up to 16.8% on taxable

income above $5 million. The tax increase would impact the estimated ½ of 1% of California taxpayers

who currently pay 40%of the income tax revenue collected within the state (source: Assembly

Bill 1253).

|

| |

|

|

| |

|

| |

It’s About Time

Americans have reduced their outstanding balances on their revolving debt, e.g., credit card debt and

home equity loans, for 6 months in a row, i.e., March 2020 through and including August 2020

(source: Federal Reserve System).

|

| |

|

|

| |

|

| |

Lots of People

22% of Americans (74 million people) are on Medicaid,

the nation’s health care program for low-income Americans

that is jointly funded by the federal government and all 50

states (source: Medicaid).

|

| |

|

|

| |

|

| |

Owners and Renters

The 126.7 million households in the United States as of 9/30/20

were split 67/33 between 85.4 million owners and 41.3 million renters

(source: U.S. Census Bureau).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

Kismet Advisory

We help RIA firms develop and execute on growth strategies. Whether collaborating to develop Strategy,

aligning the organization to execute, or both, we are an extension of your firm.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Recommended Reading

Estate Planning for IRAs and 401Ks

Designed for individuals, advisors and attorneys alike, this handbook examines the new rules and presents

various methods for minimizing the punitive effects of the same, including sample trust forms.

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2021 Tax Guide |

|

2021 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Online CE Courses

At BEST we provide you with a lot of CE credit. Courses are

cost-effective, updated annually and nationally approved for

state insurance and professional designation credits (CFP / CIMA

/ CPWA / RMA).

Courses are specifically designed for

quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final

examinations

- Instant grading

- Course material accessible for up to six (6) months

from date of purchase

- Excellent customer support team

|

| |

|

|

| |

|

| |

BEST Virtual Super CE Course Events

We provide advisors with the maximum amount of

State Insurance CE credit (varies by state) and 10 CE credit hours of CFP and

5 CE credit hours of CIMA/CPWA/RMA credit.

Course includes:

- Study material (pdf format)

- Live webinar (review of study material)

- Electronic exam (50 question exam unless otherwise stated)

Cost is $54.95

per event plus state insurance filing fees when applicable. Additional $10.00

fee per certificate for CFP / CIMA / CPWA / RMA and other professional designations. (maximum $20.00)

If you are unable to attend the live webinar, you may view a recording of the webinar or credit may be

transferred to the next available live webinar. (no credit received for webinars)

NOTE: A $20.00 cancellation fee will

apply for all refunds requested.

|

| |

|

|

| |

|

| |

CFP/CIMA/CPWA/RMA Ethics CE

2-Hour Live Webinar

“Ethical Practices for Professionals” (CFP Course: #248997 | CIMA/CPWA/RMA Course: #18BEST066)

Earn two (2) credit hours of CFP and/or CIMA/CPWA/RMA Ethics CE with NO EXAM! (Price starts at $49.00.)

(“Investments & Wealth Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA® certifications.”)

If you are unable to attend the live webinar, you may view a recording of the webinar or credit may be

transferred to the next available live webinar. (no credit received for webinars)

NOTE: A $10.00 cancellation fee will

apply for all refunds requested.

|

| |

|

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the

District of Columbia

Order CE courses toll free: 1-800-345-5669 OR

send an email to

self_study@brokered.net.

|

| |

|

|

| |

|

| |

Advisor Insight Audio Podcast

Each podcast episode gives you a quick summary of the latest industry news, updates and information.

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR

INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

|

Top ↑

|

| |