| |

| |

|

|

| |

Annuity Planning

Secure Act’s 401(k) Annuity Options: The Pros and Cons

The Secure Act contains provisions that will impact nearly every client saving for retirement—along with many who have

already begun taking withdrawals from qualified plans and IRAs. The Secure Act provisions impacting lifetime income options

in defined contribution plans have the potential to be some of the most significant.

This article was written by William H. Byrnes,

Esq., LL.M., CWM, Executive Professor and Associate Dean of Special Projects at Texas

A&M University School of Law and Robert Bloink, Esq., LL.M.,

Author for ThinkAdvisor.

|

| |

|

|

|

Top ↑

|

| |

|

| |

Charitable Planning

QCD After the SECURE Act

The original rules for QCD are that if you are over age 70½ years old (subject to RMDs under the pre-SECURE rules), you can make a

direct distribution to a charitable organization from your IRA. (Only IRAs are allowed to make QCD distributions). By qualifying this

direct distribution as a QCD, you do not have to include the amount of the distribution as income on your tax return. After the SECURE

Act passed, QCD now has a few differences.

This article was written by Jim Blankenship,

CFP®, EA, founder and principal of

Blankenship Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

| |

Educational Planning

SECURE Act Allows 529 Plans to Repay (Some) Student Loan Debt

One reason many people can’t contribute as much as they’d like—or should—to their 401k is they have competing financial priorities such as

paying down student loan debt. But one 529-plan related provision in the SECURE Act may help that problem, if in a roundabout way. Until now,

529 funds could not be used to repay student loan debt. But the SECURE Act opens the door for families to take tax-free 529 plan distributions

of as much as $10,000 for student loan repayment.

This article was written by Brian Anderson, Managing Editor of 401(k) Specialist.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Estate Planning

Top Ten Estate Planning and Estate Tax Developments of 2019

Ron Aucutt’s annual list (with detailed analysis) of the 2019 Top Ten estate planning and estate developments include topics addressing business valuation,

“clawback” and portability, the deductibility of estate and trust administration expenses, electronic wills, retirement planning, legislative issues including

introduced legislation that may foreshadow future law, and states’ income taxation of trusts and estate taxation of QTIP trusts.

This article was written by Ronald D. Aucutt, Senior Fiduciary Counsel at Bessemer Trust.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

IRA Planning

IRA Required Minimum Distributions: SECURE Act Changes When Distributions Must Begin

On Friday, January 24, the Internal Revenue Service (IRS)

issued Notice 2020-6 providing reporting relief as it

relates to RMD statement reporting for 2020.

|

| |

|

|

|

Top ↑

|

|

|

| |

| |

Retirement Planning

Bridging Accumulation To Income

When thinking about retirement today, many Americans are focused on their accumulation strategy, and worrying about if they will have enough to retire.

Certainly saving for retirement is no small feat. But once they have reached their accumulation goals, clients may not be thinking about what comes next.

Working with them to create a formal retirement income strategy can go a long way in helping to reduce risks to their retirement savings, and boost their

confidence as they head into this next phase of their lives.

This article was written by Kelly LaVigne,

JD Vice President of Advanced Markets for

Allianz Life Insurance Company of North America.

|

| |

|

|

| |

|

| |

Examining the Nest Egg The Sources of Retirement Income for Older American

The National Institute on Retirement Security (NIRS) issued a report examining the sources of retirement income for older Americans—finding that

while many Americans rely on Social Security throughout retirement, only some are receiving the benefit. According to the report, 40% of older American

retirees rely only on Social Security income in retirement, while only 6.8% receive income through Social Security, a defined benefit (DB) plan and a defined

contribution (DC) plan. The report found roughly the same number of older Americans will receive income from DB plans, as from DC plans. However, this is likely

to change, as the American workforce steers away from pensions.

This report was issued by the NIRS.

|

| |

|

|

| |

|

| |

Millennials & Retirement 2020

Millennials’ retirement expectations are similar to previous generations – they hope to retire with adequate income that will last.

However, a survey by the Insured Retirement Institute (IRI) finds that these expectations are not well aligned with the retirement planning

steps millennials have taken thus far. The oldest millennials are about 40 years old, approaching their peak earning years with about 25 years

to go before reaching traditional retirement age. The youngest of this generation has 40 or more years until retirement.

This report prepared and distributed by the Insured Retirement Institute (IRI).

|

| |

|

|

| |

|

| |

QLAC: A Way To Secure Retirement Income Later In Life

Turning age 72 is an important milestone if you have a traditional IRA or 401(k). That’s when you must begin taking mandatory minimum yearly withdrawals,

known as required minimum distributions (RMDs) from these accounts.2 But what if you don’t need that money for current living expenses and would prefer to

receive guaranteed lifetime income later in retirement? Fortunately, the US Treasury Department issued a rule creating Qualified Longevity Annuity Contracts

(QLACs) in 2014.

This article was distributed by Fidelity.

|

| |

|

|

| |

|

| |

The Time Is Now: Next Steps Towards A More Secure Retirement For All Americans

Given the fact that nearly half of households headed by someone age 55 or older have no retirement savings and that one estimate puts the median

retirement account balance across all savers at $40,000, the Aspen Institute Financial Security Program convened its third annual Leadership Forum on

Retirement Savings. More than 70 experts and industry leaders explored feasible solutions over the course of two days. By Forum’s end, participants had

identified five ideas most ready for advancement.

This report was distributed by the

Aspen Institute Financial Security Program.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

Should Clients Take a Lump-Sum Social Security Payment?

Advice from many experts today is that people should delay claiming their Social Security benefits for as long as possible, or until age 70,

when they have to claim them. But what do advisors tell clients who have delayed taking Social Security even after reaching full retirement age

(FRA), and when they make the claim, the government offers them a lump-sum retroactive payment up to six months? Should they take it or not, and

what’s the downside, if there is one?

This article was written by Ginger Szala,

Executive Managing Editor of Investment Advisor Magazine.

|

| |

|

|

| |

|

| |

This New Year, See What You Can Do Online at SocialSecurity.gov

Are you looking for new ways to save time this new year? Social Security offers many of its services online by signing up for a secure my Social Security account.

This article was written by Darlynda Bogle,

Assistant Deputy Commissioner for

Social Security Administration.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

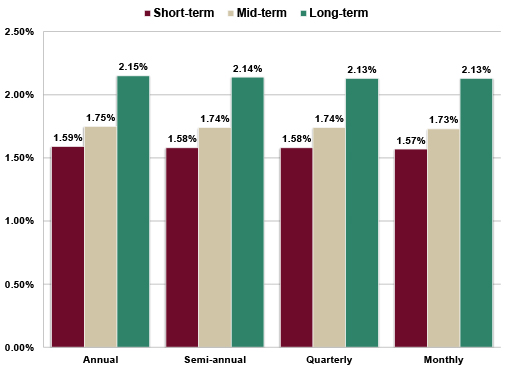

Assumed Federal Rates (AFRs)

§7520 Rate for February is: 2.2%

Breakdown:

|

| |

|

|

| |

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

Back and Forth

In national elections going back to 1928, the United States has elected 7 Republican presidents (beginning with Hoover and ending with Trump)

and 7 Democratic presidents (beginning with FDR and ending with Obama) (Source: BTN Research).

|

| |

|

|

| |

|

| |

I Don't Agree

The 4 new rotating voting members of the Federal Open Market Committee (FOMC) in 2020 are the regional Fed bank presidents from

Cleveland (Loretta Mester), Philadelphia (Patrick Harker), Dallas (Robert Kaplan) and Minneapolis (Neel Kashkari). Mester cast 2

dissenting votes in 2016 while Kashkari cast 3 dissenting votes in 2017. Harker and Kaplan, both regional Fed presidents since 2015,

have never cast a dissenting FOMC vote. The #1 FOMC meeting this year is set for January 28-29 (Source: U.S. Federal Reserve System).

|

| |

|

|

| |

|

| |

Population Profile

13.7% of the US population (44.7 million individuals), approximately 1 out of every 7people,

was born outside the United States (Source: U.S. Census Bureau).

|

| |

|

|

| |

|

| |

Soldiers

The US military has at least 10,000 troops today in each of 3 different countries –

Afghanistan (14,000), Kuwait (13,000) and Qatar (13,000) (source: The Washington Post).

|

| |

|

|

| |

|

| |

Super Game

Super Bowl #54 will be held in Miami on 2/02/20. No team in NFL history has ever played in the

Super Bowl on their home field. Next year’s game (2021) will be played in Tampa, FL (source: National Football League (NFL)).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Three

If the USA’s GDP growth for 2019 that will be reported on 1/30/20 shows an increase of at least +3% for last year,

it will end a record streak of 13 consecutive years of “sub +3%” growth (2006-2018). The next longest streak in our

history of “sub +3%” growth are the 4 years from 1930-1933 (source: U.S. Department of Commerce).

|

| |

|

|

| |

|

| |

Time in the Market

Since 1950 (i.e., 1950-2019), the S&P 500 index has been up 54% of 17,613 trading days,

60% of 840 months, 66% of 280 quarters and 73% of 70 years (source: BTN Research).

|

| |

|

|

| |

|

| |

Unlikely

The Fed Funds futures market is forecasting an 87% chance of no change in rates by the Federal Reserve at

this week’s meeting as of the close of trading last Friday 1/24/20 (source: CME Group).

|

| |

|

|

| |

|

| |

Up vs. Down

The split between “up” and “down” trading days for the S&P 500 over the last 50 years (i.e., 1970-2019,

encompassing a total of 12,613 trading days) is 53% “up” and 47% “down.” The split during calendar year 2019

(there were 252 trading days last year) was 60/40 (source: BTN Research).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

The OKR Goal Setting & Leadership System, Free eBook & Resources

Today OKRs are used by some of the world’s fastest growing teams and companies. S. Jay Coulter, CFP®, CIMA® has customized the OKR system for financial advisors, teams and firms.

Because he has witnessed the powerful transformative ability of OKR’s, he is giving you the system for free.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

CFP Ethics Webinar

“Ethical Practices for

Professionals”(Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring CFP® professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, FEBRUARY 10,

2020

TIME: 2:00PM - 4:00PM

EASTERN TIME

CREDIT: 2-HOURS OF CFP

ETHICS CE

(NOTE: This webinar does

NOT include state insurance credit.)

FEE: $49.00 (USD)

PAYMENT OPTIONS:

- CFP ONLY

license: $49.00

- CIMA / CPWA

ONLY license: $49.00

- CFP AND

CIMA / CPWA licenses: $49.00 plus an additional fee

of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24

- 48 hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

| |

|

| |

|

Click on the “Upcoming webinars” button below to view

future CFP Ethics Webinar dates/times.

Unable to attend this month’s webinar? Receive updates

and registration information for future webinars by clicking

on the “Subscribe” button below.

|

| |

|

|

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Courses

The Advisors Guide to IRAs

This is a continuing education course that covers all aspects of Individual Retirement Accounts.

The course is designed to help the financial advisor or insurance professional benefit the client

with more in-depth information concerning the history and specific types of IRAs; investing; protections;

estate planning; and, education.

BEST courses have been updated for 2020, including the provisions signed into law for the SECURE Act of 2019.

|

| |

|

| |

BEST Online CE Courses is Back!

Broker Educational Sales & Training, Inc. (BEST)

is a premier provider of continuing education for insurance and financial professionals, to include

State Insurance professionals,

CFP® certificants and

CIMA/CPWA designees.

BEST provides the most relevant, timely and reliable CE course content in the industry.

Courses are approved in all 50 states and the District of Columbia and credits are maximized to allow for

quick and easy completion.

Our CE courses are:

- Cost-effective

- Hassle-free

- Specifically designed for quick completion with accurate, current and relevant topics and include:

- Online access to state approved course material

- Unlimited retakes of review questions and final examinations

- Instant grading

- Submission of credits to the Department of Insurance

- Unbeatable customer service

Our CE courses help advisors stay abreast of the latest changes in industry rules and regulations

and provides instruction on new products and planning techniques. Although the compliance

department of any broker-dealer will be very proactive in ensuring that all CE requirements

related to licensure are met, independent agents and brokers must assume this responsibility themselves.

|

| |

|

|

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up-to-date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the District of Columbia

Order CE courses toll free: 1-800-345-5669 OR send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Super CE Program

When it comes to making a decision on how to fulfill one’s continuing education (CE) requirement,

there has been a long-standing debate about online vs. classroom study. Although the options lead to a

similar end result, the two mediums could not be more different. Online learning essentially allows you

to study at your own pace, while classroom training tends to be carried out by certified trainers with

real-life experience.

Main reasons to schedule a Super CE program:

- A unique live CE delivery method that grants advisors several hours of CE in just one-hour of classroom time

- Allows advisors to review the self-study materials on their own time, while meeting most, if not all, of their credit requirements in one sitting

- Wholesalers will have an opportunity to showcase their industry knowledge while pitching their products to the attendees

|

| |

|

|

| |

| |

|

| |

What Advisors Say...

“Thanks! This was the most enjoyable CE I’ve completed

in my over 14+ years as an advisor. I’ll be back.” ~

Raymond James Advisor

“I didn’t even need the CE, but took the class to

expand my knowledge and understanding. Thank you BEST.”

~ Merrill Lynch Advisor

“BEST has perfected the Super CE program!” ~

Morgan Stanley Advisor

“Productive & effective use of time in meeting

Continuing Education requirements.” ~ Wells Fargo

Advisor

“Excellent program, well worth the time!” ~ UBS

Advisor

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

| |

|

Top ↑

|

| |