|

|

| |

|

|

| |

Tax Planning for 2020

The SECURE Act

The SECURE Act -- the most impactful retirement plan legislation since the Pension Protection Act of 2006 --

was included in the bipartisan spending bill signed by US President Donald Trump on December 20, 2019. The SECURE Act

will advance the goals of increasing access to defined contribution plans, promoting lifetime income options, and facilitating

retirement plan design and administration. These article focuses on the Act’s impact on retirement plans.

|

| |

|

|

| |

|

| |

Key Changes for your clients’ 2020 Tax Returns

Clients should expect major changes to their 2020 tax returns, according to this article in Motley Fool.

For example, the IRS has issued the new 1040-SR tax form to make it easier for retirees to file their returns.

Clients can save more in their retirement accounts, while divorced couples can no longer claim alimony deductions

next year. Taxpayers can also see inflation-related adjustments, such as higher standard deductions and higher

exemption from the AMT.

This article was written by Dan Caplinger,

Director of Investment Planning for Motley Fool.

|

| |

|

|

|

Top ↑

|

|

|

|

| |

Health Care Planning

HSA Planning When Both Spouses Have A High-Deductible Health Plan (HDHP)

Financial advisors with clients who are married and have mixed health insurance coverage can help their clients understand their

actual HSA contribution limits, as these limits depend on the type of plan each spouse has. For spouses covered by separate self-only

HDHP plans, each can contribute up to the maximum, self-only limit to their respective HSAs, but they can’t make up for any contribution

shortfalls of the other spouse.

This article was written by Jeffrey Levine,

CPA/PFS, CFP®, CWS®, MSA CEO, Director of Financial Planning for

Blueprint Wealth Alliance.

|

| |

|

|

|

Top ↑

|

| |

|

| |

IRA Planning

IRS Releases Proposed New Life Expectancy Table

IRS has issued new proposed life expectancy tables for calculating required minimum distributions (RMDs) from IRAs and employer plans.

This has been a long time coming as the tables currently in use were issued back in 2002. The new tables account for increased life expectancy

and should result in lower RMDs for most IRA owners and beneficiaries. The new tables are currently only proposed, and a hearings and comment

period has been scheduled before they can be finalized. If all goes as planned, they would be used for calculating 2021 RMDs. RMDs for 2020 are

not affected and cannot be calculated using the new tables. Here are some takeaways on the new tables:

- The new tables account for people living longer and include older account owners. While the current tables stop at age 115+, the new

ones include retirement account owners up to age 120+. Great news for those IRA owners who are age 119 who will be able to take slightly

smaller RMDs!

- The new factor for age 70 is 29.1 and the new factor for age 71 is 28.2. These will be the factors that many IRA owner will use to

calculate their first RMDs. This is an increase from the current factors of 27.4 and 26.5, respectively. These new higher factors mean that

IRA owners will be taking less each year as RMDs, allowing more tax-deferred growth over the years and resulting in more retirement savings.

- There is a transition rule for those beneficiaries using non-recalculated single life expectancies to calculate RMD from inherited IRAs.

They will be allowed to switch to the new life expectancy tables.

- Those taking substantially equal periodic payments [72(t) payments] using the current life expectancy tables will also be allowed to switch

to the new tables without concern of modifying the current payment plan.

|

| |

|

|

| |

|

| |

Systemic IRA Trust Compliance Issue Can Have Big Tax and Penalty Impact

Post-death rules governing IRAs, particularly those involving trusts, are complicated and if not strictly

adhered to can lead to severe ramifications for the intended beneficiaries. One such rule, often referred to

as the “documentation rule” may not seem that complicated at first glance, but failure to meet its requirements

can result in confiscatory penalties.

This paper was distributed by Estate Planning Review—The Journal, a monthly publication of

Wolters Kluwer Tax & Accounting.

|

| |

|

|

| |

|

| |

The Role of IRAs in US households Saving for Retirement, 2019

Among the findings of this Research Perspective from the Investment Company Institute: IRAs play an increasingly

important role in retirement savings. But few Americans contribute directly to IRAs. Instead, most are funded by

rollovers from retirement plans.

This report was prepared by Sarah Holden,

Senior Director and Daniel Schrass,

Economist both of the Retirement and Investor Research Division at the Investment Company Institute (ICI).

|

| |

|

|

|

Top ↑

|

|

|

|

| |

Medicare & Medicaid Planning

The 2020 SSI and Spousal Impoverishment Standards

The Centers for Medicare & Medicaid Services (CMS) released an Informational Bulletin with the updated 2020 Supplemental Security Income (SSI) and Spousal Impoverishment Standards.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

2021 Pension Mortality Improvement Rates Published by IRS

IRS Notice 2019-67 specifies updated mortality improvement rates and static mortality tables to be used for

defined benefit pension plans under Section 430(h)(3)(A) of the Internal Revenue Code (Code) and Section 303(h)(3)(A)

of the Employee Retirement Income Security Act (ERISA). These updated mortality improvement rates and static tables

apply for purposes of calculating the funding target and other items for valuation dates occurring during the 2021

calendar year.

This article was written by John Manganaro,

Deputy Editor of planadvisor.com.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

The Positive Impact of Claiming Social Security Later

The most popular age for claiming Social Security benefits is age 62, the first year in which the benefits are available to people,

according to the Center for Retirement Research at Boston College.

Thirty-five percent of men and 39% of women claim their benefits at that age. A mere 23% of men claim their Social Security benefit at

full retirement age, and just 16% of women wait until that time.

The problem with that, according to a study by the Center, is that retirees would get substantially more in their Social Security check

if they waited until age 70 to sign up.

This article was written by Lee Barney,

Managing Editor of planadvisor.com.

|

| |

|

|

|

Top ↑

|

|

|

|

| |

Practice Management

4 strategies to help increase communication with clients

A survey from YCharts revealed that many advisory clients would like more personalized and frequent communication from their advisors.

The study recommended four steps advisors should take to improve frequency and quality of communications, including creating new opportunities

for communication and understanding how to service different clients.

This article was written by Ginger Szala,

Executive Managing Editor of Investment Advisor magazine.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

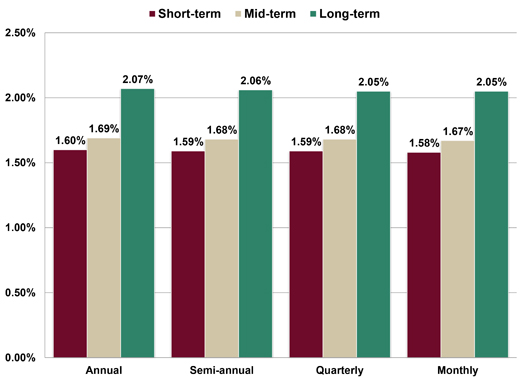

Assumed Federal Rates (AFRs)

§7520 Rate for January is: 2.0%

Breakdown:

|

| |

|

| |

| |

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

Financial Facts of the Month

Backstop

The Pension Benefit Guaranty Corporation (PBGC) was forced to take over an average of 5½ failed private

pension plans each month over the last 5 fiscal years, i.e., 2015-2019 (Source: PBGC).

|

| |

|

|

| |

|

| |

Buckeye Brains

The state of Ohio has correctly backed the winner of the U.S. presidential election in the last 14 races for the White House, i.e., 1964-2016 (Source: usconstitution.net).

|

| |

|

|

| |

|

| |

Down But Still a Bull

The bull market for the S&P 500 is 129 months old as of today. During the bull run, the stock index has overcome

14 drops of at least 5%, including 6 drops of at least 10% (Source: S&P Dow Jones Indices).

|

| |

|

|

| |

|

| |

Estate Shift

Shifting future growth out of an estate has always been an effective course to take. The specter of the 2026 tax cliff warrants greater planning urgency.

Also, in order to avoid application of transfer taxes to valuation increases, clients should consider making gifts sooner rather than later. For example,

$1 million growing at an after-tax rate of return of just 3% from January 1, 2020 to December 31, 2025 (5 years) will increase in value by $159,247. Getting

that growth out of an estate saves 40% of that amount, or $63,710 (Source: unknown).

|

| |

|

| |

If They Are Right

55% of 3,400 high net-worth individuals surveyed in October 2019 anticipate a “significant drop” in financial

markets before the end of 2020 (Source: UBS Investor Watch).

|

| |

|

|

| |

|

| |

Long-term Guess

When President Franklin D. Roosevelt proposed the Social

Security retirement program in 1935, FDR’s financial people

projected that total Social Security expenditures would

reach $1.3 billion in 1980 or 45 years into the future. The

actual Social Security outlays in 1980 were $149 billion.

Thus, the analysts’ 1935 estimate represented less than 1%

of actual 1980 Social Security expenditures (Source: U.S. Social

Security Administration (SSA)).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Old and Still Owning Money

In 2016, 46% of American homeowners ages 65-79 had outstanding mortgage debt on their primary residence,

almost double from the 24% of this age bracket that had mortgage debt 30 years earlier (Source: Joint Center

for Housing Studies of Harvard University).

|

| |

|

|

| |

|

| |

That Would Hurt

Individual income taxes paid by American taxpayers would have to increase by +57% in order to eliminate our

$984 billion deficit from fiscal year 2019 (Source: U.S. Department of Treasury).

|

| |

|

|

| |

|

| |

The Next Ten-Year Guess

Actual Social Security outlays for fiscal year 2019, i.e., the 12 months ending 9/30/19, were $988 billion,

24% of the nation’s total outlays of $4.1 trillion. In August 2019, the Congressional Budget Office projected

that Social Security outlays for fiscal year 2029 will be $1.82 trillion, 26% of the nation’s estimated outlays

of $7.0 trillion for fiscal year 2029 (Source: Congressional Budget Office (CBO)).

|

| |

|

|

| |

|

| |

The Risk of Just One Stock

56 individual stocks within the S&P 500 are up at least +50% YTD through the close of trading last Friday,

including 11 stocks that are up at least +75% YTD. There are also 13 stocks that are down at least 30% YTD,

including 4 stocks down at least 50% (Source: BTN Research).

|

| |

|

|

| |

|

| |

Up Again

The bond market has had just 3 down years in the last 40 years, i.e., 1979-2018. The bond market is up +8.8 YTD

(total return) through 11/27/19. The Bloomberg Barclays Aggregate bond index, calculated using 6,000 publicly traded

government and corporate bonds with an average maturity of 5 years, was used as the bond measurement (Source: BTN Research).

|

| |

|

|

| |

|

| |

Would You Live This Way?

For the recently completed fiscal year 2019, i.e., the 12 months ending 9/30/19, the US government had total

tax receipts of $3.462 trillion and total outlays of $4.447 trillion, analogous to taking in $1 of tax revenue

but spending $1.28 (Source: U.S. Department of Treasury).

|

| |

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

CFP Ethics Webinar

“Ethical Practices for

Professionals”

(Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring CFP® professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®,

CRPC®

DATE: MONDAY, JANUARY 13,

2020

TIME: 2:00PM - 4:00PM

EASTERN TIME

CREDIT: 2-HOURS OF CFP

ETHICS CE

(NOTE: This webinar does

NOT include state insurance credit.)

FEE: $49.00 (USD)

PAYMENT OPTIONS:

- CFP ONLY

license: $49.00

- CIMA / CPWA

ONLY license: $49.00

- CFP AND

CIMA / CPWA licenses: $49.00 plus an additional

fee

of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA®

certifications.”)

|

| |

|

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24

- 48 hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

| |

|

| |

|

Click on the “Upcoming webinars” button below to view

future CFP Ethics Webinar dates/times.

Unable to attend this month’s webinar? Receive updates

and registration information for future webinars by clicking

on the “Subscribe” button below.

|

| |

|

|

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®,

CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

Featured Self-Study CE Courses

“BEST CE Courses Updated for 2020”

BEST courses have been updated for 2020, including provision of the SECURE Act of 2019.

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up-to-date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the

District of Columbia

Order CE courses toll free: 1-800-345-5669 OR

send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

|

| |

|

| |

|

|

| |

Super CE Program

Top 5 reasons to schedule a Super CE program:

- Classroom course: 1-hour (instructor-led)

- Self-Study/Correspondence course: Provides up to 21

hours of state insurance CE and 5 or 10 hours of

professional designation CE

- Increase meeting attendance and leverage your time

- Assist advisors in meeting their mandatory CE

requirements

- Position your company’s strategy, product solutions and

value-added programs

|

|

|

| |

|

| |

What Advisors Say...

“Thanks! This was the most enjoyable CE I’ve completed

in my over 14+ years as an advisor. I’ll be back.” ~

Raymond James Advisor

“I didn’t even need the CE, but took the class to

expand my knowledge and understanding. Thank you BEST.”

~ Merrill Lynch Advisor

“BEST has perfected the Super CE program!” ~

Morgan Stanley Advisor

“Productive & effective use of time in meeting

Continuing Education requirements.” ~ Wells Fargo

Advisor

“Excellent program, well worth the time!” ~ UBS

Advisor

|

|

Top ↑

|

| |

|

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR

INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

| |

|

Top ↑

|

| |