Advisor News Insight |

|||

| |||

THANK YOU |

|||

Thank you for your business in 2021. It has been a pleasure helping you reach your goals, and we look forward to working with you again in the new year. We at BEST wish all of you and your families a safe, prosperous and wonderful 2022! |

|||

INDUSTRY NEWS | |||

IRA Planning |

|||

Exceptions to the Pro-Rata Rule – Ways to

|

|||

|

|||

Medicare & Medicaid Planning |

|||

Some Social Security checks to decline in 2022 due

|

|||

|

|||

Retirement Planning |

|||

2022 U.S. Retirement Market Outlook:

|

|||

|

|||

Guide Clients on Retiring in Uncertain MarketsMay 6, 2021 | Vanguard Perspective Clients don’t always have the luxury of choosing to retire as financial markets are rising. Yet, the timing of clients’ transition out of the working world can have a tremendous impact on their retirement savings longevity. As Vanguard research has shown, sequence-of-return risk—the threat to a successful retirement posed by a concentrated run of poor market performance—can be substantial, especially if it happens early in retirement. This risk can mean lower-than-hoped-for retirement income, early exhaustion of retirement savings principal, or both. |

|||

|

|||

Tax-Efficient Retirement Distributions with

|

|||

|

|||

The Importance of Marginal Tax Rates in Retirement Planning (Podcast)Dr. William Reichenstein, CFA Principal – Research About This Episode: We published an article in late September, Pay Attention to Marginal Tax Rates and Not Tax Brackets, that highlighted how the analytic framework for providing retirement income planning advice can be improved. It focused on three decisions that investors sometimes need to make: (1) whether to convert funds this year from a tax-deferred account (TDA), like a 401(k), to a Roth account; (2) whether to contribute this year to a TDA or a Roth account; and (3) how to tax-efficiently withdraw funds in retirement, where withdraw is interpreted broadly to include Roth conversions. The author of that article is with me today to discuss how advisors should approach those decisions. |

|||

|

|||

Social Security Planning |

|||

Six Steps for Effective Social Security ClaimingWade Pfau Ph.D., CFA, RICP Founder of Retirement Researcher Clients struggle with making right the Social Security claiming decision. This article provides a six-step process to guide clients through the complexity of Social Security. |

|||

|

|||

Tax Planning |

|||

Senate Finance Committee Releases Tax Provisions of Build Back Better ActPaul Bonner, Senior Editor at The Tax Adviser The Senate Finance Committee released its portion of the Build Back Better Act on Saturday containing tax provisions and other updated legislative text. In an announcement, committee Chair Sen. Ron Wyden, D-Ore., said the committee had made “targeted improvements” in the 1,180-page portion of the act, which was passed in its entirety by the House on Nov. 19 (H.R. 5376; see prior coverage of its tax and other provisions). |

|||

|

|||

Practice Management |

|||

10 Worst Financial Advisors in America: 2021Jeff Berman, Staff Reporter at ThinkAdvisor This past year offered an extensive list of advisors and brokers who qualify for the dubious distinction of being one of the worst financial advisors of the year. As usual, we have seen a fair share of advisors conducting Ponzi schemes, stealing from older adults and other clients, forging clients’ signatures, and creating elaborate investment scams in 2021. |

|||

|

|||

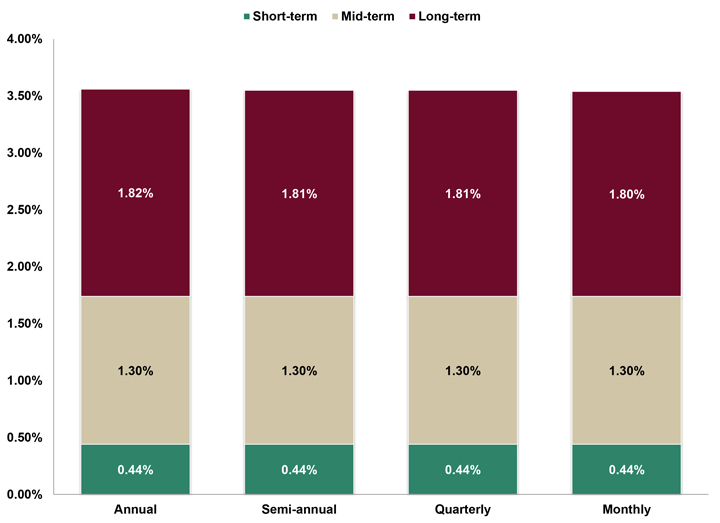

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for January is: 1.6%Break down: |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Jobless Benefits |

|||

|

Source: U.S. Department of the Treasury 24% of the outlays of the government, i.e., $1.649 trillion out of $6.818 trillion, during fiscal year 2021 were payments for “income security,” i.e., 6 different programs that keep Americans “healthy and safe,” but mostly unemployment benefits. 12% of the outlays of the government, i.e., $515 billion out of $4.447 trillion during fiscal year 2019 (pre-pandemic) were payments for “income security.” |

|||

|

|||

Major Ports |

|||

|

Source: Financial Times 40% of the cargo imported into the United States via ships come into the 2 California ports of Los Angeles and Long Beach. |

|||

|

|||

One Opinion |

|||

|

Source: Jeremy Siegel Jeremy Siegel, Professor of Finance at Wharton, predicted on 11/24/21 a target value of 5000 for the S&P 500 during 2022. The S&P 500 closed on Friday 12/10/21 at 4712. |

|||

|

|||

One Year |

|||

|

Source: The American Presidency Project The midterm elections will be held on 11/08/2022. All 435 House seats and 34 of 100 Senate seats will be contested. The President’s party has lost House seats in 18 of the last 20 midterms, while the President’s party has lost Senate seats in 14 of the last 20 midterms. |

|||

|

|||

Taxes |

|||

|

Source: Tax Policy Center HR #5376, aka “The Build Back Better Act,” is estimated to raise taxes on the top 1% of US taxpayers and lower taxes on the other 99% of taxpayers. The top 1% of taxpayers, approximately 1.4 million tax returns, would see an average annual federal tax increase of $54,360. |

|||

|

|||

The Highest Rate to Pay |

|||

|

Source: Internal Revenue Service (IRS) The highest individual marginal tax rate in 2022 (37% under current law) comes into play for single taxpayers at $539,000 of taxable income and at $647,850 of taxable income for married filing jointly taxpayers. |

|||

|

|||

What Has Changed? |

|||

|

Source: Attom Data Solutions 20,331 homes have been repossessed by lenders nationwide YTD through 10/31/21. That’s down from 50,238 homes repossessed for all of 2020, 143,955 homes in 2019, 230,305 homes in 2018 and 291,579 homes in 2017. |

|||

|

|||

Women |

|||

|

Source: Center for Disease Control and Prevention (CDC) 2 of every 3 caregivers (67%) in the United States are women, caring for children, aging parents or other individuals with illnesses or disabilities. |

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial/Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

Guide to Retirement Planning Strategies |

|||

|

|||

BEST CE PROGRAMS |

|||

Online CE Courses |

|||

|

At BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP, CIMA, CPWA, and RMA). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-hour Live Webinar |

|||

“Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP Professionals”

|

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||