| |

| |

|

|

| |

Health Care Planning

Employee Health Benefits Costs Strolled Higher:

2020 Milliman Medical Index

In 2020, the cost of healthcare for a hypothetical American family of four covered by

an average employer-sponsored preferred provider organization (PPO) plan is $28,653, according

to the Milliman Medical Index (MMI).

This article was written by several authors Milliman.

|

| |

|

|

| |

|

| |

This is How Much Retiring Couples Will Spend on Healthcare

According to a new report by Milliman, a healthy 65-year-old couple retiring in 2020 is projected to

spend approximately $351,000 in today’s dollars ($535,000 in future dollars) on healthcare over their

lifetime, down from a $369,000 projection in the 2019 report. And a healthy 45-year-old couple is projected

to spend approximately $505,000 in today’s dollars ($1.4 million in future dollars) on healthcare over their

lifetime, down from $532,000 in the 2019.

This article was written by Brian Anderson, Managing Editor of 401(k) Specialist.

|

| |

|

|

| |

|

| |

The U.S. Spends $2,500 Per Person on Health Care Administrative Costs. Canada Spends $550. Here’s Why

“Administrative costs now make up about 34% of total health care expenditures in the United States – twice the

percentage Canada spends, according to a new study published in the Annals of Internal Medicine. These costs have

increased over the last two decades, mostly due to the growth of private insurers’ overhead.

This article was written by Abigail Abrams , is a politics writer for TIME.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

IRA Planning with CRUT

The Slow-Drip IRA to a CRUT - Using a Parent’s Retirement Assets for the Child’s Retirement Income

For people who also want to benefit a charity, if the beneficiary of a parent’s retirement account is a

tax-exempt charitable remainder unitrust (‘CRUT’), then the parent’s retirement account can be a source of

steady retirement income for the child. Although this concept is already widely known among estate planners,

what many people don’t realize is that the child’s retirement income can be significantly increased by delaying

distributions from the retirement account to the CRUT. Rather than liquidating the retirement account shortly

after the owner’s death, distributions from the retirement account to the CRUT can be deferred.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Medicare & Medicaid Planning

Medicare & Other Health Benefits: Your Guide to Who Pays First

Some people with Medicare have other health coverage that must pay before Medicare pays its share of the bill.

This guide tells you how Medicare works with other kinds of coverage and who should pay your bills first.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

Building Better Retirement Systems in the Wake of the Global Pandemic

In the wake of the global pandemic known as COVID-19, retirees, along with those

hoping to retire someday, have been shocked into a new awareness of the need for better

risk management tools to handle longevity and aging. This paper offers an assessment of

the status quo prior to the spread of the coronavirus, evaluates how retirement systems

are faring in the wake of the shock. Next we examine insurance and financial market

products that may render retirement systems more resilient for the world’s aging population.

Finally, potential roles for policymakers are evaluated.

This article was written by Olivia S. Mitchell, International Foundation of Employee Benefit Plans Professor, Professor of Business Economics and Public Policy Professor of Insurance and Risk Management Executive Director, Pension Research Council at The Wharton School, The University of Pennsylvania.

|

| |

|

|

| |

|

| |

IRS Releases Notice 2020–51 Guidance on Waiver of 2020 Required Minimum Distributions

The Internal Revenue Service has announced that anyone who already took a required minimum distribution (RMD) in 2020 from certain retirement accounts now has the opportunity to roll those funds back into a retirement account following the CARES Act RMD waiver for 2020. The 60-day rollover period for any RMDs already taken this year has been extended to August 31, 2020, to give taxpayers time to take advantage of this opportunity.

The IRS described this change in Notice 2020-51 (PDF). The Notice also answers questions regarding the waiver of RMDs for 2020 under the Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act. The CARES Act enabled any taxpayer with an RMD due in 2020 from a defined-contribution retirement plan, including a 401(k) or 403(b) plan, or an IRA, to skip those RMDs this year. This includes anyone who turned age 70 1/2 in 2019 and would have had to take the first RMD by April 1, 2020. This waiver does not apply to defined-benefit plans.

In addition to the rollover opportunity, an IRA owner or beneficiary who has already received a distribution from an IRA of an amount that would have been an RMD in 2020 can repay the distribution to the IRA by August 31, 2020. The notice provides that this repayment is not subject to the one rollover per 12-month period limitation and the restriction on rollovers for inherited IRAs.

The notice provides two sample amendments that employers may adopt to give plan participants and beneficiaries whose RMDs are waived a choice as to whether or not to receive the waived RMD.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

Social Security Administration Unveils New Retirement Benefits Portal

The redesigned portal will make it easier for individuals to find out how to Learn,

Apply, and Manage retirement benefits. Individuals can also learn how to create their

own my Social Security account to see their latest Social Security Statement, review

their earnings history, and receive personalized estimates of future benefits based on

their real earnings.

|

| |

|

|

| |

|

| |

Social Security Benefits Lose 30% of Buying Power Since 2000 No COLA Likely For 2021

Social Security benefits have lost 30 percent of buying power since 2000, according to the

latest Social Security Loss of Buying Power study released today by The Senior League (TSCL).

"This year’s study found a 3 percentage point gain in the buying power of Social Security benefits

over 2019,” says study author Mary Johnson, a Social Security policy analyst for the League. “That

should indicate that most retirees may have seen at least some prices come down on certain items —

such as lower electric bills, as well as lower prices on eggs, fresh fruits, and vegetables.

This article was prepared and distributed by The Senior Citizens League.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Practice Management

Earning Investors Trust

“Retail investors who don’t have financial advisors may be a hard group to convince to employ one,

as the majority of them don’t trust the financial services industry – but neither do nearly half of

retail investors with an advisor, according to a recent survey. Only 33% of retail investors without

an advisor trust the industry, CFA Institute found. That figure rises to only 57% for retail investors

with an advisor, according to the survey.

|

| |

|

|

| |

|

| |

Millionaires in America 2020: All 50 States Ranked

When it comes to where millionaires live in America, the rich keep getting richer.

Market research firm Phoenix Marketing International notes that although the total number

of millionaire households rose for the 11th straight year in 2019, The gains were

disproportionately seen in states that already had more than their fair share of millionaires.

Indeed, a record 6.71% (or 8,386,508 out of 125,018,808 total U.S. households) can now claim

millionaire status. That's up from 6.21% in 2018 and just 5.81% in 2017.

This article was written by Dan Burrows, Contributing Writer at Kiplinger.com.

|

| |

|

|

| |

|

| |

What Independent Broker-Dealers Need to Know and Do for

Reg BI

On June 5, 2019, the United States Securities and Exchange Commission (“Commission”) adopted Rule 15l-1

(“Regulation Best Interest” or Reg BI) under the Securities Exchange Act of 1934 (“Exchange Act”), which has

a compliance date of June 30, 2020. Reg BI became effective September 10, 2019. Notwithstanding the host of

issues arising from the global pandemic, an economic recession and significant market volatility across essentially

every sector, the Commission has made clear that the deadline for compliance with Reg BI and the related Form CRS

requirements will not be delayed or extended.

This article was written by Daniel Scott Furst, guest contributor at Advisor Perspectives.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

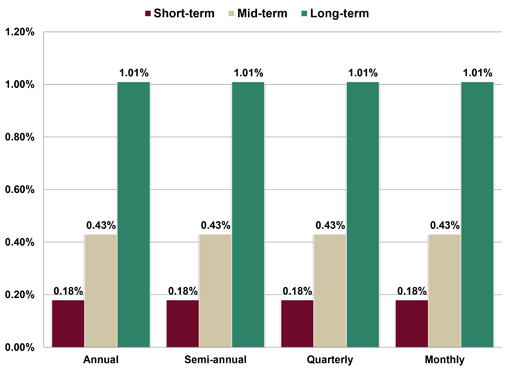

Assumed Federal Rates (AFRs)

§7520 Rate for July is: 0.6%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

Buried Within

On page 1,066 of the 1,815-page HEROES Act is a provision that would

allow cannabis businesses to maintain federal bank accounts, something

not currently allowed (Source: HEROES Act).

|

| |

|

|

| |

|

| |

Could This Housing Trend Reverse?

In the 3 years through 3/31/20, the number of US households

(both owners and renters) has increased by +5.5 million to

124.4 million. The number of owner households has increased by

+5.6 million to 81.3 million while the number of renter households

has declined by 0.1 million to 43.1 million (Source: U.S. Census Bureau).

|

| |

|

|

| |

|

| |

In the Year 2034

Social Security trustees announced on 4/22/20 that the

trust fund backing the payment of Social Security benefits

(OASI retirement benefits) would be zero in 2034. A zero

“trust fund” does not mean the payment of Social Security

benefits would also go to zero, but rather would drop to 76%

of their originally promised levels through the year 2095.

When the trustees released their report in 2010 (i.e., 10 years

ago), the Social Security Trust Fund was projected to be depleted

in 2040 (Source: Social Security Trustees 2020 Report).

|

| |

|

|

| |

|

| |

Just My Cell

90 million landline phones in the United States

have been eliminated in the last 20 years. There

are 124 million households in the United States as

of 12/31/19 (Source: USTelecom).

|

| |

|

|

| |

|

| |

Long-Term Issue

The estimated Social Security shortfall today (i.e., a

present value number) between the future taxes anticipated

being collected and the future benefits expected to be paid

out over the next 75 years is $16.8 trillion. The entire $16.8

trillion deficit could be eliminated by an immediate 3.14 percentage

point increase in the combined Social Security payroll tax rate (from

12.40% to 15.54% ) or an immediate 19% reduction in benefits that are

paid out to current and future beneficiaries (Source: Social Security

Trustees 2020 Report).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Optimistic Outlook

The market was up 37.7% as of June 3 in the 50 trading days since the bear market bottom.

This was the strongest 50-day rally in history. In the seven times the market1 has risen 25%

or more in 50 days, the stock market has always been higher six and 12 months later (Source:

Bloomberg, Morningstar and FactSet).

|

| |

|

| |

Social Distancing Already

35 million Americans live alone, i.e., 28% of the households in the

United States have just a single person living in the house/apartment

(Source: U.S. Census Bureau).

|

| |

|

|

| |

|

| |

Student Loans

On page 1,400 of the 1,815-page HEROES Act is a

provision that would (forgive up to $10,000 of every

federal student loan (Source: HEROES Act).

|

| |

|

|

| |

|

| |

Would You Pay More?

If US airlines were to stop booking passengers into “middle seats”

in order to achieve some level of “social distancing,” they would need

to raise ticket prices by +43% to recover lost revenue (Source: International

Air Transport Association).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

Social Security Administration Unveils New Retirement Benefits Portal

The redesigned portal will make it easier for individuals to find out how to Learn,

Apply, and Manage retirement benefits. Individuals can also learn how to create their

own my Social Security account to see their latest Social Security Statement, review

their earnings history, and receive personalized estimates of future benefits based on

their real earnings.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

2-Hour CFP/CIMA/CPWA Ethics CE Live Webinar

“Ethical Practices for Professionals” (Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring CFP® professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, JULY 20, 2020

TIME: 2:00PM - 4:00PM EASTERN TIME

CREDIT: 2-HOURS OF CFP/CIMA/CPWA ETHICS CE

(NOTE: This webinar does

NOT include state insurance credit.)

FEE: $49.00 (USD)

PAYMENT OPTIONS:

- CFP ONLY license: $49.00

- CIMA / CPWA ONLY license: $49.00

- CFP AND CIMA / CPWA licenses: $49.00 plus an additional fee of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

|

|

|

Top ↑

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24‑48

hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

|

Top ↑

|

| |

|

| |

Unable to Attend this Month’s Webinar?

Click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need State Insurance or More CFP or CIMA/CPWA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates

and registration information for future webinars by clicking

on the button below. |

| |

|

|

|

Top ↑

|

| |

|

| |

BEST Virtual Super CE Events

“The Advisors Guide to Social Insurance Programs”

Up to 20 credit hours of State Insurance CE credit and

10 CE credit hours of CFP and 5 CE credit hours of CIMA/CPWA/RMA credit. 1

DATES: TUESDAY, JULY 14, 2020

OR

TUESDAY, JULY 28, 2020

TIME: 1:00PM - 2:30PM

EASTERN TIME

CREDIT: Click here to view credit hours by state.

FEE: $54.95 (USD) (plus state roster fees and $10.00 per additional professional certificate)

EVENT INFORMATION:

Electronic Exam: Self-study/Correspondence course –

“The Advisors Guide to Social Insurance Programs”

The link to the electronic exam will be provided at the end of the live webinar

Date 1: Exam will be accessible between 7/14/20 – 7/28/20 2

Date 2: Exam will be accessible between 7/28/20 – 8/11/20 2

Pass/Fail will be displayed immediately upon completion

(Unlimited retakes available)

|

| |

|

|

| |

|

| |

Instructor

Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA®, CERS®, CPRC®, CPFA®,

is the Founder, President and CEO of Broker Educational Sales & Training, Inc., (BEST).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Need 2 Credit Hours of CFP/CIMA/CPWA Ethics CE?

See

information in the previous section of this newsletter or

click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need More State Insurance, CFP or CIMA/CPWA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates and registration information for future webinars by clicking on the button below.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Course

Estate Planning

There is a widespread misconception that “estate planning” is of importance only to the wealthy. This is due, in part, to the emphasis of the

financial service industry on planning for estate taxes, which only concern larger estate owners. The truth of the matter is, every person, young

or old, who has a family or owns property, needs an estate plan. A good estate plan will allow a person to reach desired economic, legal, and personal

objectives. Estate Planning is an educational tool to help financial advisors through the maze of programs, rules and regulations that affect many if not all

of their clients, their spouses and dependents. |

| |

|

| |

BEST Online CE Courses

BEST is a premier provider of CE for

financial and insurance professionals, to include

State Insurance, CFP® and CIMA®/CPWA® professionals.

BEST courses are updated annually to provide the some of the most accurate and time sensitive content in the industry.

Our CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to one year from date of purchase

- Excellent customer support team

|

Select a button below to order the CE you need today! |

|

|

|

|

|

Already completed your requirements? Please click here to pass on our information to a colleague. |

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the District of Columbia

Order CE courses toll free: 1-800-345-5669 OR send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Virtual Super CE Combines the

Benefits and Convenience of:

- A 1-hour CE live Webinar (1

credit hour of CE may be provided in

most states and for professional

designations)

- A Self-study/Correspondence

Course with an electronic exam (earn

up to 21 hours of state insurance CE

credit, up to 20 hours of CE credit

for CFP and up to 10 hours of CE

credit for CIMA/CPWA professionals)

Contact our Business Development Department to

schedule a customized Virtual Super CE.

Call toll free: 1-800-345-5669

Email:

BusinessDev@brokered.net

Office Hours:

Monday - Friday, 8:30AM - 5:00PM ET

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

|

Top ↑

|

| |