| |

| |

|

|

| |

Estate Planning

How Wealthy Clients Can Save on Taxes with GRATs

The down equity market brought on by the COVID-19 pandemic plus rock-bottom

interest rates have combined to make grantor retained annuity trusts (GRATs) a

very attractive way that wealthy clients can save on federal estate and gift taxes.

This article was written by Dorothy Hinchcliff Editor at Advisor Perspectives.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Health Care Planning

IRS Increases HSA Limits for 2021

The Internal Revenue Service issued its annual inflation

adjustment Wednesday for health savings accounts for 2021, at

a time when many taxpayers are worried about their health in

the midst of the novel coronavirus pandemic. In Revenue Procedure

2020-32, the IRS said for calendar year 2021, the annual limitation

on deductions for an individual with self-only coverage under a high

deductible health plan is $3,600. That’s up from $3,550 this year.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

IRA Planning

Coronavirus-related relief for retirement plans and IRAs questions and answers

Section 2202 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), enacted on March 27, 2020,

provides for special distribution options and rollover rules for retirem ent plans and IRAs and expands permissible

loans from certain retirement plans. The IRS On May 5th,issued informal CARES Act guidance in the form of 14 Questions

& Answers titled “Coronavirus-related relief for retirement plans and IRAs” which can be found at the link below.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Long-Term Care Planning

2020 Alzheimer’s Disease Facts and Figures

2020 Alzheimer’s Disease Facts and Figures is a statistical resource for U.S. data related to Alzheimer’s disease,

the most common cause of dementia. Background and context for interpretation of the data are contained in the Overview.

Additional sections address prevalence, mortality and morbidity, caregiving and use and costs of health care and services.

A Special Report examines primary care physicians’ experiences, exposure, training and attitudes in providing dementia care

and steps that can be taken to ensure their future readiness for a growing number of Americans living with Alzheimer’s and

other dementias.

This report was distributed by the Alzheimer's Association.

|

| |

|

|

| |

|

| |

Long-Term Care Insurance: The SOA Pricing Project

This study provides historical context and reasons underpinning the

uncertainty of the first generations of LTCI pricing. It shows that, for

these same reasons, LTC insurers should be more optimistic about the future

financial risks of this product.

This study is published by the Society of Actuaries (SOA).

|

| |

|

|

| |

|

| |

New Estimates of the Need for Long-Term Care

When the subject of long-term care (LTC) comes up, advisors need to be

able to discuss with clients the likelihood of needing such care and its

potential duration. These discussions feed into decisions about whether

to purchase LTC insurance. In this February 2020 article (and APViewpoint

conversation), Allan Roth got the discussion going in terms of both the

probabilities of needing care and an evaluation of insurance options.

Recently I have analyzed additional data that improves our understanding

of LTC needs and informs the decision-making about insurance.

This article was written by Joe Tomlinson, Contributing Writer at Advisor Perspectives.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

A Stock Indicator that can Improve Retirement Income Decisions

In times of economic turmoil, it’s helpful to know that there is a long-term stock market

indicator that can help us make better retirement income decisions. Numerous economic factors

can inform retirement income decisions, but none has been discussed more than the cyclically-adjusted

price-earnings ratio (CAPE), a long-term measure of how much investors are willing to pay for corporate

earnings.1 This ratio plummeted during the recent stock market drawdown. But historical evidence shows

that as CAPE goes down the percentage that a retiree has been able to withdraw from his or her portfolio

has gone up. Let’s review this evidence and see what it may mean for today’s retirement investors.

This article was written by Justin Fitzpatrick, Co-Founder & CTO of Income

Laboratory, LLC.

|

| |

|

|

| |

|

| |

Can Withdrawal Strategies Be Customized for Clients?

Robo advisors offer commoditized investment solutions for those in the accumulation phase.

But planning a retiree’s withdrawal strategy is much more complex. Joe Tomlinson examines new

research that offers a way to algorithmically determine how to draw down one’s savings. Researchers

have proposed a variety of ways for retirees to turn savings into income, including such methods as

the 4% rule or relying on required minimum distributions (RMDs). Methods proposed have typically been

generic and not customized for individual retirees. Researchers at CANNEX, a Canadian retirement-research

firm, have proposed an approach where the pattern of withdrawals reflects individual client attitudes toward risk.

This article was written by Joe Tomlinson, writer for Advisor Perspectives.

|

| |

|

|

| |

|

| |

Guaranteed Income: The Impact of the SECURE Act

The SECURE Act has three sections that, taken together, should have a positive impact on the provision of

retirement income products in defined contribution plans. While the focus of this article is on the Act’s

fiduciary safe harbor, it summarizes the three provisions and then goes into detail on the fiduciary safe harbor

for selecting an insurance company. But first, let’s look at why this matters.

This article was written by Bruce L. Ashton, and Fred Reish Partners at Faegre Drinker.

|

| |

|

|

| |

|

| |

The gift for retirees bundled in the CARES Act

For many advisors with affluent retiree clients, the CARES Act provision that

may have the biggest impact is its suspension of RMDs during 2020. The move will

have clear implications for tax planning strategies, so it’s incumbent on advisors

to get ahead of their clients’ questions with sound strategic recommendations.

This article was written by Jeffrey Levine CPA/PFS, CFP, MSA, Contributing Writer at Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

A novel proposal to help cash-strapped workers during the coronavirus pandemic

A veritable firestorm was recently ignited by proposals to let cash-strapped Americans

immediately access a portion of their Social Security, in return for reduced benefits later.

This article was written by Lorie Konish, Personal Finance Reporter at CNBC.

|

| |

|

|

| |

|

| |

Should you be able to withdraw some of your future Social Security benefits?

President Donald Trump is reportedly considering another way to get more money to

struggling Americans by letting them take an advance on their Social Security benefits.

Is this a good idea.

This article was written by Mark Hulbert, Senior Columnist of MarketWatch.

|

| |

|

|

| |

|

| |

The future of Social Security in 10 charts

The coronavirus is likely to speed up the insolvency of the Social Security program, but that doesn’t mean it will

fundamentally alter its outlook. To see the latest figures on the program’s financial outlook, and more information on

the 2020 trustees report and the potential impact of the coronavirus click on the Read more button below.

This article was written by Tobias Salinger, Senior Editor of Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Tax Planning

IRS Tax Planning: People First Initiative

IRS is providing relief on a variety of issues ranging from

easing payment guidelines to postponing compliance actions while

our nation deals with COVID-19.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Practice Management

Zoom Etiquette from a Confessed Offender

Sara Grillo outlines several steps you should take to have a successful ZOOM meeting.

This article was written by Sara Grillo, Top Financial Author,

Podcast Host, & Keynote Speakerof Advisor Perspectives.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

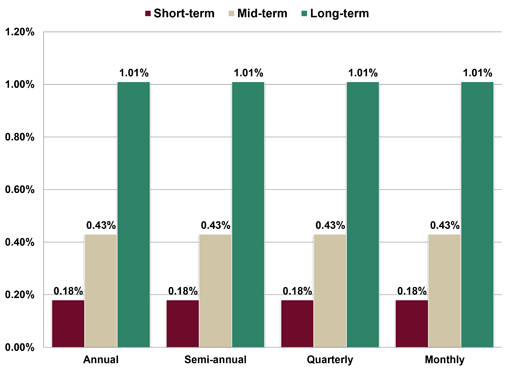

Assumed Federal Rates (AFRs)

§7520 Rate for June is: 0.6%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

Before COVID-19 Hit

59% of Americans surveyed in early February 2020 admit they live “paycheck-to-paycheck” and are unable to

consistently put money away for an emergency or for retirement (Source: Charles Schwab Modern Wealth Survey).

|

| |

|

|

| |

|

| |

Debt Load

The $1.51 trillion of outstanding student loans in the United States are held by

43 million Americans, equal to an average of $35,100 per individual (Source:

Federal Reserve Bank of New York).

|

| |

|

|

| |

|

| |

Down Then Up

Over 23 trading days from 2/19/20 through 3/23/20, the S&P 500 lost 33.8% (total return).

In the subsequent 28 trading days from 3/24/20 through last Friday 5/01/20, the S&P 500 has

gained +26.7% (total return) (Source: BTN Research).

|

| |

|

|

| |

|

| |

No Commute

3 out of 5 Americans (59%) now forced to work from their homes during the

coronavirus crisis would prefer to continue to work from home when the pandemic

subsides, while the remaining 2 out of 5 workers (41%) would choose to work in a

traditional office environment away from home (Source: Gallup).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Not Smart

54% of Americans surveyed in February 2020 say that if they inherited $1 million today, they would “spend it”

as opposed to paying off debt or investing (Source: Charles Schwab Modern Wealth Survey).

|

| |

|

|

| |

|

| |

Shortfall

The Congressional Budget Office (CBO) forecasted on 4/24/20 that our nation’s

fiscal year 2020 budget deficit, i.e., the 12 months ending 9/30/20, will be a

record $3.7 trillion, equal to 18.1% of our economy. That would be our largest

“deficit-to-GDP” percentage since the USA hit 21.0% in 1945 (Source: CBO).

|

| |

|

|

| |

|

| |

Started Off With a Bang

The S&P 500 had a nearly 11-year bull market (exactly 2,756 trading days) that ran from 3/10/09 through 2/19/20,

gaining +529% (total return), equal to an average annual gain of +18.3%. The very first trading day of the bull market

(3/10/09) produced a +6.4% gain (total return), ultimately ranking as the # 2 best trading day out of all 2,756 trading

days (Source: BTN Research).

|

| |

|

|

| |

|

| |

When the Bear Bottoms

The S&P 500 has fallen 34% as of Monday 3/23/20 from its all-time closing high set on 2/19/20, the index’s

12th bear market since the end of WWII. The average return for the S&P 500 in the first-year following the bear

market low close in the previous 11 bears is +39.2%, more than 3 times the +12.6% average gain in the 2nd year

following the bear market low close (Source: BTN Research).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

Income Laboratory, Inc.

Leverage a suite of revolutionary planning tools,

drawn from the best in retirement research and data

science. Income Lab allows you to incorporate real

data and real client behavior into your financial plans.

The result: More income. Less risk. Better retirement.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

2-Hour CFP/CIMA/CPWA Ethics CE Live Webinar

“Ethical Practices for Professionals” (Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring CFP® professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, JUNE 22, 2020

TIME: 2:00PM - 4:00PM EASTERN TIME

CREDIT: 2-HOURS OF CFP/CIMA/CPWA ETHICS CE

(NOTE: This webinar does

NOT include state insurance credit.)

FEE: $49.00 (USD)

PAYMENT OPTIONS:

- CFP ONLY license: $49.00

- CIMA / CPWA ONLY license: $49.00

- CFP AND CIMA / CPWA licenses: $49.00 plus an additional fee of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

|

|

|

Top ↑

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24‑48

hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

|

Top ↑

|

| |

|

| |

Unable to Attend this Month’s Webinar?

Click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need State Insurance or More CFP or CIMA/CPWA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates

and registration information for future webinars by clicking

on the button below. |

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Courses

The Advisors Guide to Social Insurance Programs

The Advisor’s Guide to Social Insurance Programs is an educational tool to help advisors through

the maze of programs, rules and regulations that affect many if not all of their aging Baby Boomer

clients, their spouses and dependents. The course is broken down into three sections to give the

advisor an understanding of the various benefits of the Social Security, Medicare and Medicaid programs.

Updated with 2020 Social Security and Medicare Trustee Report.

|

| |

|

| |

BEST Online CE Courses

BEST is a premier provider of CE for

financial and insurance professionals, to include

State Insurance, CFP® and CIMA®/CPWA® professionals.

BEST courses are updated annually to provide the some of the most accurate and time sensitive content in the industry.

Our CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to one year from date of purchase

- Excellent customer support team

|

Select a button below to order the CE you need today! |

|

|

|

|

|

Already completed your requirements? Please pass on our information to a colleague. |

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the District of Columbia

Order CE courses toll free: 1-800-345-5669 OR send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Virtual Super CE Combines the

Benefits and Convenience of:

- A 1-hour CE live Webinar (1

credit hour of CE may be provided in

most states and for professional

designations)

- A Self-study/Correspondence

Course with an electronic exam (earn

up to 21 hours of state insurance CE

credit, up to 20 hours of CE credit

for CFP and up to 10 hours of CE

credit for CIMA/CPWA professionals)

Contact our Business Development Department to

schedule a customized Virtual Super CE.

Call toll free: 1-800-345-5669

Email:

BusinessDev@brokered.net

Office Hours:

Monday - Friday, 8:30AM - 5:00PM ET

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

|

Top ↑

|

| |