| |

| |

|

|

| |

Charitable Giving

INSIGHT: Donor-Advised Funds in the New Decade

Donor-advised funds (DAFs) hit a turning point in past decade. Their “hockey stick” growth trajectory has drawn attention across sectors,

including philanthropy and finance. From 2010 to 2018 (the latest DAF Report data available), the number of DAFs increased 300%. Grants from

DAFs to mission-driven charities tripled from $7.24 billion to $23.42 billion over the same time period. Americans are changing the way they

manage their personal and philanthropic finances in the 21st century and relying on experts for guidance.

This article was written by Eileen R. Heisman,

President and CEO of National Philanthropic Trust.

|

| |

|

|

|

Top ↑

|

| |

|

| |

Elder Law Planning

Fighting Fraud: Senate Aging Committee Identifies Top 10 Scams Targeting Our Nations Seniors

This Report identifies the ten most prevalent (by number of complaints to the Senate Aging Committee’

Fraud Hotline) scams perpetrated against older Americans. Tables also bread down the data by State.

This report was distributed by the United States Senate Special Committee on Aging.

|

| |

|

|

|

Top ↑

|

| |

|

| |

State Not Entitled to Recover Medicaid Benefits From Community Spouse’s Annuity

A Massachusetts court held that the state is not entitled to recover Medicaid benefits from a community spouse’s annuity.

Dermody v. The Executive Office of Health and Human Services (Mass. Super. Ct., No. 1781CV02342, Jan. 16, 2020).

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Estate Planning

State Adult Guardianship Legislation Summary: Directions of Reform ‑ 2019

This 2019 legislative summary reviews approximately 58 enactments from 33 states, as compared with 29 enactments from 18 states in 2018.

An earlier version of this 2018 legislative summary [January – August] was published as part of the National Guardianship Association’s 2019

NGA Legal and Legislative Review, presented at the 2019 NGA National Conference.

This summary was prepared by the Commission on Law

and Aging American Bar Association.

|

| |

|

|

| |

|

| |

State Estate Taxes Not Dead Yet

While state estate taxes might not be completely on the way out, the trend of subjecting fewer estates

to the tax continues. Estate-tax exemption amounts are rising in 2020 in half the states with the tax.

This article was written by Rocky Mengle, Tax Editor of Kiplinger.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Financial Planning

Don’t Leave It All on the Field - Why Athletes Require Special Planning

The professional athlete needs the same sound foundation of financial and estate planning that all wealthy clients require.

However, the professional athlete typically faces many unique circumstances that must be integrated into the planning process.

Movie stars, musicians, entertainers, and others with ‘star’ power encounter some of the challenges common to athletes, so that

the applicability of some of the planning ideas discussed here will be broader than merely for athlete clients.

Commentary by K. Eli Akhavan, Esq., Evan Bloom, Esq., Jonathan Shenkman, MBA, Martin M. Shenkman, Esq. Ben Utecht, and Eido M. Walny, Esq.1.

|

| |

|

|

|

Top ↑

|

|

|

| |

| |

Life Insurance Planning

Why life insurance is the new stretch IRA

Advisors should move quickly with new estate planning advice for clients now that the Secure Act has passed.

This law, which eliminated the stretch IRA plan for most non-spouse beneficiaries and replaced it with a 10‑year rule,

is already effective for deaths that occurred in 2020. While planners can still help clients maintain their goals, the

vehicle used to transfer money after death will have to change from the IRA to — I propose — the better, more tax-friendly

life insurance.

This article was written by Ed Slott, CPA President of at Ed Slott and Company, LLC.

|

| |

|

|

|

Top ↑

|

|

|

| |

| |

Medicare Planning

Beware Medicare’s Part B Premium Penalty and

Surcharge Traps

A single, 68 year‑old lady, who I’ll call Sue, contacted me last week. She was absolutely besides herself.

She recently enrolled in traditional (Parts A, B, and D) Medicare and was hit with huge Part B and Part D monthly

premiums. She had no idea why it was so high. After many letters, calls, and meetings with Social Security, she still

had no idea.

This article was written by Laurence Kotlikoff, Professor of Economics of at Boston University.

|

| |

|

|

|

Top ↑

|

|

|

| |

| |

IRA Planning

How the Secure Act Impacts Successor Beneficiaries

The SECURE Act is a game changer for successor beneficiaries. Successor beneficiaries who inherit in 2020 or

later do not get to continue the stretch. Instead, they are subject to the 10‑year payout rule. This is true even

if the original IRA owner died prior to 2020.

This article was written by Sarah Brenner, JD,

IRA Analyst of Ed Slott and Company, LLC.

|

| |

|

|

|

Top ↑

|

|

|

| |

| |

Retirement Planning

Has the Secure Act created financial insecurity in your life?

The Secure Act, which was signed by President Trump in December, does a number of things that change the rules around retirement plans.

I keep seeing estimates that there are 29 provisions, but they really boil down to five major items.

This article was written by Keith Stevens, Journalist at MarketWatch.com.

|

| |

|

|

| |

|

| |

Reverse Mortgages, Financial Inclusion, and Economic Development: Potential Benefit and Risks

Reverse mortgages seem like a great idea for hordes of baby boomers who don’t have enough income to maintain their lifestyles,

or – worse – to buy basic necessities when they retire. Although some advisors and academics have demonstrated how reverse mortgages

are good wealth management tools for certain clients, a new working paper from the World Bank examines why they haven’t worked to solve

inadequate retirement savings and longevity risk.

This paper was written by various authors of World Bank.

|

| |

|

|

| |

|

| |

What is Holding Back Use of Reverse Mortgages?

This paper examines the state of reverse mortgage markets in selected countries around the world and considers the potential benefits

and risks of these products from a financial inclusion and economic benefit standpoint. Despite potentially increasing demand from aging

societies -- combined with limited pension income -- a series of market failures constrain supply and demand. . The paper concludes that

these still seem to be largely products of last resort rather than well-considered purchases as part of good retirement planning.

This article was written by Dorothy Hinchcliff, Editor of Advisor Perspectives.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

Get Your Social Security Benefit Statement

Tax season is approaching, and we have made replacing your annual Benefit Statement even easier.

The Benefit Statement, also known as the SSA‑1099 or the SSA‑1042S, is a tax form we mail each year

in January to people who receive Social Security benefits. It shows the total amount of benefits you

received from us in the previous year so you know how much Social Security income to report to the IRS

on your tax return.

|

| |

|

|

| |

|

| |

Social Security: The Windfall Elimination Provision (WEP) GAO Report - Updated February 10, 2020

The windfall elimination provision (WEP) is a modified benefit formula that reduces the Social Security benefits of

certain retired or disabled workers who are also entitled to pension benefits based on earnings from jobs that were not

covered by Social Security and thus not subject to the Social Security payroll tax. Its purpose is to remove an unintended

advantage or “windfall” that these workers would otherwise receive as a result of the interaction between the regular Social

Security benefit formula and the workers’ relatively short careers in Social Security-covered employment.

This report was prepared and distributed by the Congressional Research Service.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

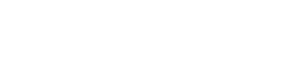

Assumed Federal Rates (AFRs)

§7520 Rate for March is: 1.8%

Breakdown:

|

| |

|

|

| |

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

Change in the Law

The newly passed SECURE Act allows Americans to withdraw money from a pre-tax 401(k) or

IRA without paying a 10% penalty for an “early withdrawal” if the funds are used to cover

costs related to childbirth or adoption. The withdrawal would be subject to ordinary income

tax. Please consult a tax expert for details (Source: SECURE Act of 2019).

|

| |

|

|

| |

|

| |

Coronavirus Impact

China is forecasted to have used 25% less oil per day in February 2020 when compared to its

actual usage in February 2019, a drop of 3.2 million barrels a day, i.e., from a consumption

of 12.9 million barrels a day to 9.7 million barrels a day (Source: International Energy Agency (IEA)).

|

| |

|

|

| |

|

| |

Famous Muscle Car

The 1968 Ford Mustang Bullitt GT driven by actor Steve McQueen in the 1968 movie “Bullitt”

was purchased by private investor Robert Kiernan for $3,500 in 1974. Kiernan’s son Sean sold

the car at auction in Florida on Friday 1/10/20 for $3.4 million, resulting in an annual pre-tax

gain of +16.1% over the entire 46-year holding period (Source: Mecum Auctions).

|

| |

|

|

| |

|

| |

Fewer Tools Available

The Fed cut short-term interest rates by 5 percentage points during the nation’s last recession

(a downturn that ran from 12/2007 to 6/2009), an action that could not be replicated today since

the Fed’s key short-term rate is 1.75% (Source: The Federal Reserve).

|

| |

|

|

| |

|

| |

Golfing Longevity

49-year old Phil Mickelson was ranked as one of the top 50 golfers in the world for 1,353

consecutive weeks (26 years) until early November 2019 (Source: PGA).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Half of All Taxpayers

50% of American taxpayers reported less than $41,740 of adjusted gross income for tax year 2017.

There were 143.3 million tax returns filed for tax year 2017 (Source: Internal Revenue Service (IRS)).

|

| |

|

|

| |

|

| |

I Have to Tell You Everything?

The IRS estimates that US taxpayers voluntarily pay 83.6% of the federal income taxes

that would be paid if all taxpayers were completely honest, the result of tax returns not

being filed, income being underreported, and taxes being underpaid. IRS enforcement, i.e.,

audits, has increased the “net compliance rate” to 85.8% (Source: IRS).

|

| |

|

|

| |

|

| |

Millions Died

The most lethal health epidemic in the last 500 years was the worldwide flu outbreak

that occurred in the fall of 1918 that killed 50 million people globally, including

675,000 Americans. 195,000 Americans died in October 1918, the deadliest month in our

nation’s history (Source: Centers for Disease Control and Prevention).

|

| |

|

|

| |

|

| |

Requires Bigger Contribution

CalPERS is the largest state pension fund in the country with assets of $401 billion.

CalPERS lowered its assumed rate of return (i.e., its discount rate) from 7.5% in fiscal

year 2017 to 7.375% for fiscal year 2018 and announced on 1/21/20 an additional reduction

to 7.0% (Source: California Public Employees' Retirement System (CalPERS)).

|

| |

|

|

| |

|

| |

That Job Was Filled

The USA has tracked job openings nationwide since December 2000. The number of job

openings as of November 2019 was 6.800 million, down 561,000 from the prior month, the

3rd largest month-over-month decline in the statistic’s history (Source: U.S. Bureau of Labor

Statistics).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

Form 5500 Search Site

This search tool allows you to search for Form 5500 series returns/reports filed since January 1, 2010.

Posting on the web does not constitute acceptance of the filing by the U.S. Department of Labor, the Pension

Benefit Guaranty Corporation, or the Internal Revenue Service.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Recommended Reading |

|

“Tackling the Tax Code: Efficient and Equitable Ways to Raise Revenue”

This free eBook is about taxes. It poses a simple question: Given that the United States needs more revenue, how should we raise it?

The answers come from some of our nation’s foremost tax policy scholars and experts. The Hamilton Project commissioned them to come

|

forward with proposals to address our government’s pressing need for revenue under the economic conditions that prevail today. |

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

2-Hour CFP/CIMA/CPWA Ethics CE Live Webinar

“Ethical Practices for

Professionals” (Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring CFP® professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, MARCH 23, 2020

TIME: 2:00PM - 4:00PM

EASTERN TIME

CREDIT: 2-HOURS OF CFP/CIMA/CPWA

ETHICS CE

(NOTE: This webinar does

NOT include state insurance credit.)

FEE: $49.00 (USD)

PAYMENT OPTIONS:

- CFP ONLY

license: $49.00

- CIMA / CPWA

ONLY license: $49.00

- CFP AND

CIMA / CPWA licenses: $49.00 plus an additional fee

of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24‑48

hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

|

Top ↑

|

| |

|

| |

Unable to Attend this Month’s Webinar?

Click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need State Insurance or More CFP or CIMA/CPWA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates

and registration information for future webinars by clicking

on the button below. |

| |

|

|

|

Top ↑

|

| |

|

| |

1-Hour CE Live Webinar

“Washington Update: The SECURE Act –

What You Need to Know”

During this live webinar, Ed will provide financial and insurance professionals with

a clear understanding of certain provisions of the SECURE Act that will affect individuals and businesses large and small.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, MARCH 23, 2020

TIME: 11:00AM - 12:00PM

EASTERN TIME

CREDIT: 1-HOUR OF CLASSROOM (GENERAL) CE

FEE: $29.95 (USD)

PAYMENT OPTIONS:

- State Insurance* ONLY license: $29.95

- CFP ONLY license: $29.95

- CIMA / CPWA ONLY license: $29.95

- State Insurance*, CFP AND CIMA / CPWA licenses: $29.95

plus an additional fee of $25.00

(“Investments & Wealth

Institute® has accepted this 1-hour live webinar for 1 hour

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

|

*PLEASE BE AWARE that this webinar is NOT approved for State Insurance in the following states:

MA, MN, NJ, NY, OK, and SD. (NO state insurance credit will be given to advisors in the states listed above.)

|

| |

|

|

| |

|

| |

About the Webinar

This one (1) credit hour live webinar will provide financial and insurance professionals with a clear

understanding of certain provisions of the SECURE Act that will affect individuals and businesses large and small.

Learning Objectives

Upon completion of this webinar, advisors will be able to:

- Describe the background and purpose of the SECURE Act

- Explain the primary provisions of the SECURE Act affecting individuals

- Recognize the potential tax impacts related to IRA contributions and withdrawals by participants and beneficiaries under the SECURE Act

- Identify the alternatives to the Stretch IRA strategy

- Explain the primary provisions of the SECURE Act affecting businesses who offer a qualified retirement plan to their employees

- Describe the Income Solutions under the SECURE Act with the use of Annuities as an investment in a 401(k) plan

|

|

Top ↑

|

| |

|

| |

Need 2 Credit Hours of CFP/CIMA/CPWA Ethics CE?

See

information in the previous section of this newsletter or

click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need More State Insurance, CFP or CIMA/CPWA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates and registration information for future webinars by clicking on the button below.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Courses

Retirement Planning

This course has been developed to give the advisor (licensed agent) a complete guide in the retirement planning strategy process.

The course will focus on the five step retirement planning process and examine the various risk factors needed to be considered when

developing a retirement plan for your client. It will examine the various sources of retirement income based on the three-legged stool

(Social Security, Employer Sponsored Retirement Plans, Savings and IRAs) and introduce a fourth leg to the stool consisting of insurance

products and working in retirement. Also addressed is the complex topic of retirement plan distributions and the many rules and regulations

that surround this issue. Finally, the course addresses the subject of health care and long-term care planning in retirement with a discussion

of Health Savings Accounts, Medicare, and LTC Planning with the use of LTCI and Hybrid LTCI policies as well as the use of reverse mortgages.

(BEST courses have been updated for 2020, including the provisions signed into law for the SECURE Act of 2019.)

|

| |

|

| |

BEST Online CE Courses

BEST is a premier provider of CE for

financial and insurance professionals, to include

State Insurance, CFP® and CIMA®/CPWA® professionals.

BEST courses are updated annually to provide the some of the most accurate and time sensitive content in the industry.

Our CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to one year from date of purchase

- Excellent customer support team

|

Select a button below to order the CE you need today! |

|

|

|

|

|

Already completed your requirements? Please

pass on our information to a colleague.

|

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the District of Columbia

Order CE courses toll free: 1-800-345-5669 OR send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Super CE Program

When it comes to making a decision on how to fulfill one’s continuing education (CE) requirement,

there has been a long-standing debate about online vs. classroom study. Although the options lead to a

similar end result, the two mediums could not be more different. Online learning essentially allows you

to study at your own pace, while classroom training tends to be carried out by certified trainers with

real-life experience.

Main reasons to schedule a Super CE program:

- A unique live CE delivery method that grants advisors several hours of CE in just one-hour of classroom time

- Allows advisors to review the self‑study materials on their own time, while meeting most, if not all, of their credit requirements in one sitting

- Wholesalers will have an opportunity to showcase their industry knowledge while pitching their products to the attendees

|

| |

|

|

| |

| |

|

| |

What Advisors Say...

“Thanks! This was the most enjoyable CE I’ve completed

in my over 14+ years as an advisor. I’ll be back.” ~

Raymond James Advisor

“I didn’t even need the CE, but took the class to

expand my knowledge and understanding. Thank you BEST.”

~ Merrill Lynch Advisor

“BEST has perfected the Super CE program!” ~

Morgan Stanley Advisor

“Productive & effective use of time in meeting

Continuing Education requirements.” ~ Wells Fargo

Advisor

“Excellent program, well worth the time!” ~ UBS

Advisor

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

| |

|

Top ↑

|

| |