| |

| |

|

|

| |

| |

|

“This pandemic is world reset. We have a chance to change the world. What is has proven is no matter what your politics,

no matter what your religion, no matter what your job status. We are all brother and sister in the world together. Human

kindness has come out in so many ways. Can't buy a mask, people make it for you. Don't have food, let me drop some off at

your porch. Love is all around you. All you have to do is look! I think the world needs a hippie right now and I am going to

be a tad optimistic. Some advise from the original hippie. Love Thy Neighbor As Yourself. Let's have that as the new rule in

this world reset.”

~ Johnny Corn

|

| |

|

|

| |

Charitable Giving

QCDs Still Available in 2020 and Still a Good Strategy

As the coronavirus pandemic has raged on, we have seen

devastating images of

overwhelmed hospitals and long lines of cars at food banks. If you are fortunate

enough to have money to spare, you might be thinking about how you can help. One

option to consider is a qualified charitable distribution (QCD).

This article was written by Sarah Brenner, JD and IRA Analyst of Ed Slott and

Company, LLC.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Estate Planning

Heckerling Musings 2020 and Estate Planning Current Developments

Bessermer Trust's annual Heckerling Musings and Estate Planning Current Developments is accompanied by a

one-hour video. in which Senior Fiduciary Counsel Steve Akers discusses current estate planning developments,

including observations from the ACTEC Annual Meeting, the 2020 Heckerling Institute on Estate Planning, and

planning observations about the SECURE Act.

This article was written by various authors of Bessemer Trust

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

IRA Planning

Fixing Unwanted RMDs Taken Before The CARES Act Waiver Of 2020 RMDs

With the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act by Congress last month,

Americans were provided with a more-than-$2 trillion emergency fiscal relief package that included benefits

for many individuals, small business owners, healthcare providers, and government entities. For financial

advisors with clients who have retirement accounts or who are beneficiaries of retirement accounts, one

particular provision of interest established by Section 2203 of the CARES Act is the suspension of Required

Minimum Distributions (RMDs) during 2020.

This article was written by Michael E. Kitces, MSFS, MTAX, CFP, CLU, ChFC, RHU, REBC, CASLt of kitces.com.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Medicare & Medicaid Planning

2020 Annual Report of The Boards of Trustee of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds

The 2020 Medicare Trustees Report, officially called "The Boards of Trustee of the Federal Hospital Insurance and Federal Supplementary Medical

Insurance Trust Funds." presents the current and projected financial status of the trust funds.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

Bucket Strategies – Challenging Previous Research

Adoptees of bucket strategies were rewarded over the past two months, as their cash reserves have buffered them psychologically

from the market decline. Such strategies avoid taking withdrawals from stocks when the market is down, as it is now. But do bucket

strategies provide a financial benefit – as some claim – or are any benefits purely behavioral? Prominent thought leaders in retirement

planning advocate for bucket strategies, but there are studies that demonstrate such strategies perform poorly. However, my research shows

that those studies rely too heavily on a narrow set of historical data, and should be viewed skeptically. I’ll sort out the arguments and

provide results from my own analysis.

This article was written by Joe

Tomlinson an actuary and financial planner, and his work mostly focuses on research related to retirement planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Roth IRA Planning

Opinion: COVID-19 crisis creates a perfect opportunity for Roth IRA conversions

The financial fallout from the COVID-19 crisis might create a once-in-a-lifetime opportunity to do Roth conversions at an affordable

tax cost and gain some insurance against future tax rate increases. In this column, I’ll explain why I say that. But first some necessary background information.

This article was written by Bill Bischoff.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

Coronavirus may hurt Social Security benefits

The coronavirus pandemic and accompanying economic upheaval could have lasting and ugly effects on Social Security benefits for

millions of Americans, according to a new report. Falling wages “can have significant implications for the Social Security benefits

of those currently nearing retirement,” Alicia Munnell, the director of the Center for Retirement Research at Boston College, wrote

in an April 28 study of the 2020 Social Security and Medicare Boards of Trustees’ annual report

This article was written by Tobias Salinger, Senior Editor for Financial Planning.

|

| |

|

|

| |

|

| |

Social Security and the coronavirus: A second look. Assessing the virus’ long-term impacts is incredibly difficult

Might Social Security be one of the unexpected casualties of the coronavirus? That impact of the pandemic on Social Security didn’t received

much attention in the dark days of March, as the world focused on the more immediate devastation wrought by the virus. Now that the dust has settled,

at least for the moment—with the S&P 500® more than 20% higher than its March low and with many states and countries making tentative plans to start

reopening their economies—some of us are beginning to consider some of the pandemic’s longer-term consequences. And that’s why Social Security’s

solvency is back on retirees’ radar screens. This week alone, there were no fewer than three various nightmare scenarios involving coronavirus’ impact

on Social Security.

This article was written by Mark Hulbert of

MarketWatch.

|

| |

|

|

| |

|

| |

Social Security’s Financial Outlook: The 2020 Update in Perspective

The Center for Retirement Research at Boston College has released a new study, Social Security' Financial Outlook:

the 2020 Update Perspective. Based on the 2020 Trustees Report, which was prepared before the onset of the COVID-19

pandemic and shutdown of the economy, shows an increase in the program’s 75-year deficit from 2.78 percent to 3.21 percent

of taxable payroll. The depletion date for the trust fund remains at 2035. The 2020 Trustees Report confirms what has been

evident for almost three decades – namely, Social Security is facing a long-term financing shortfall that equals 1 percent

of GDP. The changes required to fix the system are well within the bounds of fluctuations in spending on other programs in

the past.

This article was written by Alicia H. Munnell, Director of the Center for Retirement Research at Boston College.

|

| |

|

|

| |

|

| |

The 2020 OASDI Trustees Report

The 2020 OASDI Trustees Report, officially called "The 2020 Annual Report of the Board of Trustees of the Federal

Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds," presents the current and projected

financial status of the trust funds.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Tax Planning

Savvy ways to gift assets while also cutting tax rates

When clients seek to offer financial support to family members, shifting money “upstream” or “downstream”

can be an appealing and tax-efficient way to transfer assets. Aid to aging parents is termed “upstream” gifting,

while “downstream” transfers refer to plans involving younger generations — although the so-called kiddie tax can

add an extra layer of complexity.

This article was written by Donald Jay Korn, Contributing Writer for Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Practice Management

Our Best Practices for Working From Home

For most of us, life today bears very little resemblance to our normal, old life. Just about every facet of life has changed due to the coronavirus pandemic.

The protocol may differ depending on where you live, what your job is. But the world, and life, haven’t stopped. We’ve all adapted—very quickly and continuously—

to a constantly changing environment. Perhaps the most visible change is that many of us are working from home (WFH). For some, this is the standard, but for many

this is a new and challenging endeavor. The addition of spouses and kids makes the balance and equation infinitely more complex. For me and many of my regional director

colleagues, working from home is actually the norm. I have been working out my home on and off for the past 10 years. So I thought it may help if I share some of the key

principles I have found help me maintain productivity and sanity.

This article was written by Martin Roche of Russell Investments.

|

| |

|

|

| |

|

| |

SEC details Reg BI compliance goals as enforcement deadline looms

While the coronavirus creates turmoil in the economy and markets, the SEC is moving ahead with plans to enforce the biggest change in advisor

standards of conduct in years – and the agency is shedding new light on what it is prioritizing. High on the agency’s list? Evidence that firms

have made a "good-faith" effort to comply with Regulation Best Interest and related rules, according to the commission. The SEC had recently announced

that the coronavirus pandemic that has effectively shut down huge portions of the economy would not delay the June 30 compliance date for the regulations.

This article was written by Kenneth Corbin, Financial Planning contributing writer Boston and Washington.

|

| |

|

|

|

Top ↑

|

| |

| |

|

|

| |

|

| |

|

|

| |

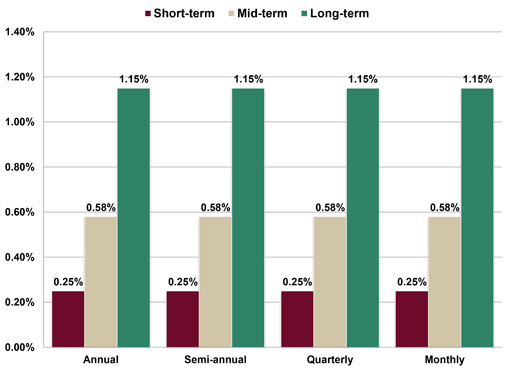

Assumed Federal Rates (AFRs)

§7520 Rate for May is: 1.3%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

A Terrible Three Months

68 individual stocks in the S&P 500 index were down at least 50% YTD as of the end of the 1st quarter 2020, including 7 stocks down at least 75% YTD (Source: BTN Research).

|

| |

|

|

| |

|

| |

Before Coronavirus

44% of hourly paid workers in the United States experienced a “financial hardship” during 2019, e.g.,

difficulty paying rent/mortgage, a utility bill, a medical bill or buying food (Source: Urban Institute).

|

| |

|

|

| |

|

| |

Bonds

Long-dated Treasuries produced a +32.6% total return over the 1-year ending 3/31/20. The Bloomberg Barclays Long US Treasury Index,

which includes all Treasury securities with a remaining maturity of at least 10 years and having at least $250 million of outstanding

face value, was used as the proxy (Source: Bloomberg).

|

| |

|

|

| |

|

| |

Impact of Inflation

To rank in the top 1% of US taxpayers took $80,580 of adjusted gross income (AGI) in 1980. To rank in the top 25% of US taxpayers took $83,682 of AGI in 2017 (Source: Internal Revenue Service (IRS)).

|

| |

|

|

| |

|

| |

Second Best Stock Month

April has been the # 2 best month for the S&P 500 over the last 30 years, i.e.,

1990-2019, having gained an average of +1.67% (total return), trailing only

November’s +1.78% average gain (Source: BTN Research).

|

| |

|

|

| |

|

| |

The Year After

The S&P 50Az0 has achieved an average annual total return of +14.8% in the calendar year after the

16 down years that have taken place in the stock market over the last 75 calendar years (1945-2019).

That result is +3.5 percentage points greater than the entire 75-year average annual return of +11.3%

for the index (Source: BTN Research).

|

| |

|

|

| |

|

| |

"Time In" vs. "Timing"

The split between “up” and “down” time periods for the S&P 500 from 1950 to the end of 2019, i.e.,

the last 70 years, as measured by: Days: 54% “up” and 46% “down”; Months: 60% up, 40% down; Quarters:

66% up, 34% down; Years: 73% up, 27% down; 5-Year Rolling Time Periods: 79% up, 21% down; and finally

10-Year Rolling Time Periods: 89% up, 11% down (Source: BTN Research).

|

| |

|

|

| |

|

| |

You Get a Whole Row to Yourself

95,085 travelers went through TSA screening at US airports last Thursday 4/16/20,

down 96% from the 2,616,158 screened passengers on Tuesday 4/16/19 or one year earlier

(Source: Transportation Security Administration).

|

| |

|

|

| |

|

| |

Your Life

If you were born in 1987 and you turn age 33 in 2020, you have lived through 5 bear markets and 3 recessions,

the 1987 “Black Monday” stock market crash on Wall Street, the 9/11 terrorist attacks, the 2008 global real estate

crisis, and now the 2020 pandemic. You have also lived through 4 bull markets (including the 11-year bull that ended

on 2/19/20), 4 economic expansions and you have benefited from the lowest interest rates in history. Your life expectancy

as of today: 47.3 additional years on earth (Source: BTN Research).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

Connect with Prospects (Virtually!)

Google searches for ‘financial advice,’ ‘financial advisor’ and ‘webinars’ are at an all-time high. It’s clear that people need guidance on

essential topics more than ever...but how does an advisor or an estate planning attorney go about connecting with prospects in the middle of a pandemic?

This is where White Glove Virtual Seminars come in. Their done-for-you, pay-per-attendee solution arms financial advisors and other service professionals with

everything they need to connect with prospects, educate the public and solidify themselves as thought leaders in their communities while abiding by social distancing regulations...all from their laptops.

For a limited time, first-time users can take advantage of $500 off their first Virtual Seminar. Visit their website and call the Virtual Seminars contact number on the homepage to learn more.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

2-Hour CFP/CIMA/CPWA Ethics CE Live Webinar

“Ethical Practices for Professionals” (Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring CFP® professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: MONDAY, MAY 18, 2020

TIME: 2:00PM - 4:00PM EASTERN TIME

CREDIT: 2-HOURS OF CFP/CIMA/CPWA ETHICS CE

(NOTE: This webinar does

NOT include state insurance credit.)

FEE: $49.00 (USD)

PAYMENT OPTIONS:

- CFP ONLY license: $49.00

- CIMA / CPWA ONLY license: $49.00

- CFP AND CIMA / CPWA licenses: $49.00 plus an additional fee of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

| |

|

| |

The webinar consists of:

- Five learning objectives:

-

Identify the structure and content of the

revised Code and Standards, including

significant changes and how the changes

affect CFP® professionals.

-

Act in accordance with CFP Board’s fiduciary

duty.

-

Apply the Practice Standards when providing

Financial Planning.

-

Recognize situations when specific

information must be provided to a Client.

-

Recognize and avoid, or fully disclose and

manage, Material Conflicts of Interest.

- Five

vignettes (review questions)

-

Interactive polling questions at the end of each

learning objective (except for Learning Objective

Number Four)

- Five

interactive quiz questions after all Learning

Objectives have been presented (credit received for

attendee time logged and participation, no

examination required)

- Webinar

Evaluation Form after the presentation has ended

(will open after the presenter has ended the

webinar. You will also receive a follow-up email 24‑48

hours AFTER the webinar has concluded, with a

link to access the online Evaluation Form.)

|

|

Top ↑

|

| |

|

| |

Unable to Attend this Month’s Webinar?

Click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need State Insurance or More CFP or CIMA/CPWA Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates

and registration information for future webinars by clicking

on the button below. |

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Courses

The Advisors Guide to Social Insurance Programs

The Advisor’s Guide to Social Insurance Programs is an educational tool to help advisors through

the maze of programs, rules and regulations that affect many if not all of their aging Baby Boomer

clients, their spouses and dependents. The course is broken down into three sections to give the

advisor an understanding of the various benefits of the Social Security, Medicare and Medicaid programs.

BEST courses have been updated for 2020, including the provisions signed into law for the SECURE Act of 2019.

|

| |

|

| |

BEST Online CE Courses

BEST is a premier provider of CE for

financial and insurance professionals, to include

State Insurance, CFP® and CIMA®/CPWA® professionals.

BEST courses are updated annually to provide the some of the most accurate and time sensitive content in the industry.

Our CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to one year from date of purchase

- Excellent customer support team

|

Select a button below to order the CE you need today! |

|

|

|

|

|

Already completed your requirements? Please pass on our information to a colleague. |

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the District of Columbia

Order CE courses toll free: 1-800-345-5669 OR send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Virtual Super CE Combines the

Benefits and Convenience of:

- A 1-hour CE live Webinar (1

credit hour of CE may be provided in

most states and for professional

designations)

- A Self-study/Correspondence

Course with an electronic exam (earn

up to 21 hours of state insurance CE

credit, up to 20 hours of CE credit

for CFP and up to 10 hours of CE

credit for CIMA/CPWA professionals)

Contact our Business Development Department to

schedule a customized Virtual Super CE.

Call toll free: 1-800-345-5669

Email:

BusinessDev@brokered.net

Office Hours:

Monday - Friday, 8:30AM - 5:00PM ET

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

| |

|

Top ↑

|

| |