Advisor News InsightAFRs | FACTS | WEBSITE | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

INDUSTRY NEWS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Annuity PlanningWhat Is the Value of Annuities?This study was written & prepared by Gal Wettstein, a senior research economist at the Center for Retirement Research at Boston College (CRR). Alicia H. Munnell, director of the CRR and the Peter F. Drucker Professor of Management Sciences at Boston College’s Carroll School of Management. Wenliang Hou, a quantitative analyst with Fidelity Investments and a former research economist at the CRR. Nilufer Gok is a research associate at the CRR. Deciding whether to buy an annuity is one of the more complicated calculations an investor might have to make. Not all annuities are the same. Nor are investors. And a new study from Boston College says that demographics play a crucial role in determining the value of an annuity to any given investor. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Estate Law PlanningThe Top 10 Elder Law Decisions of 2020This prepared and distributed by Elder Law Answers. ElderLawAnswers’ annual roundup of the top 10 elder law decisions for the past year. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Health Care PlanningCognitive Overload: The Coming Surge in Diminished Capacity Cases and What Wealth Management Firms Can Do to Protect Their Clients and ThemselvesWhitepaper distributed by Whealthcare Planning, LLC. A new white paper released Tuesday at the annual meeting of the American Society for Aging details how financial advice companies can better support at-risk aging clients. This whitepaper explores the opportunities, risks, and realities of diminished decision-making capacity for financial services firms. It summarizes the current demographic trends, the nature of the risks to financial services firms, the regulatory environment, and the path forward for firms seeking to better protect their clients — and themselves. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRA PlanningMaking a 2020 Roth IRA ContributionThis article was written by Sarah Brenner, JD Director of Retirement Education at Ed Slott and Company, LLC. The IRS has delayed the deadline for filing federal income taxes until May 17, 2021. This also extends the deadline for making a 2020 Roth IRA contribution. A Roth IRA offers the promise of tax-free withdrawals in retirement if you follow the rules. If you are deciding whether a 2020 Roth IRA contribution is the right move for you, here are some things to keep in mind. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Must Death Distributions Under 10-Year Rule Be Taken Annually?This article was written by Kimberly Shaw Elliott , ERISA Investment Lawyer and Barry Salkin, ERISA and Employee Benefits Lawyer at The Wagner Law Group. Just in the nick of time for filing 2020 federal income tax returns, the IRS issued a revised Publication 590-B (2020), Distributions from Individual Retirement Accounts (IRAs) (“Pub 590-B”). In it, the IRS in an example suggests that taxpayers who inherit IRAs and are not eligible designated beneficiaries must take a distribution for each of the 10 years following the IRA owner’s death. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Rollovers, Regular Basis Focus of DOL GuidanceThe Labor Department’s new guidance on fiduciary investment advice provides important insights on the agency’s perspective on the new rule, particularly as it relates to rollover advice — and a reminder that other changes may well lie ahead. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Retirement PlanningEBRI Issue Brief: “Retirees in Profile: Evaluating Five Distinct Lifestyles in Retirement”This report was written by Zahra Ebrahimi, Research Associate at Employee Benefit Research Institute (EBRI). Based on a survey of 2,000 retired households aged 62 to 75 and with fewer than $1 million in financial assets, the Employee Benefit Research Institute (EBRI) developed a series of “retiree profiles” based on retirees’ financial statuses, including the levels of financial assets, annual income, debt, and homeownership, in addition to a few spending-behavior factors. From there, they identified distinguishing characteristics — demographics, retirement income, debt, health insurance, long-term-care coverage, and spending patterns — of the retiree profiles. EBRI also examined the spending-down strategies and plans used by each type of retiree. And finally, they looked at how retirees of different types rated their retirement life satisfaction. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Retirement Confidence SurveyThis survey was prepared and distributed by EBRI. The Retirement Confidence Survey (RCS) gauges the views and attitudes of working-age and retired Americans regarding retirement, their preparations for retirement, their confidence with regard to various aspects of retirement, and related issues. The RCS is the longest-running survey of its kind and is conducted annually by the Employee Benefit Research Institute (EBRI) and the independent research firm Greenwald & Associates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Social Security PlanningMassMutual Explores Near-Retiree Knowledge of Social Security Retirement Benefits During the COVID-19 PandemicThis article was written by Nevin E. Adams, JD at American Retirement Association. According to the latest MassMutual Social Security consumer poll, more than a third (35%) of near-retirees (age 55 to 65) failed a basic knowledge quiz about Social Security retirement benefits and another 18% of respondents earned a grade of D. Only 3% of respondents received an A+ by answering all 12 true/false statements correctly. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

New Fact Sheets Added to Your Online StatementThis article was written by Darlynda Bogle, Assistant Deputy Commissioner at the Social Security Administration (SSA). Your Social Security Statement, available on my Social Security, tells you how much you or your family can expect to receive in disability, survivor, and retirement benefits. SSA has added new fact sheets to accompany the online Statement. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax PlanningHow Much Taxes Will Retirees Owe on Their Retirement IncomeThis article was written by Anqi Chen, Assistant Director of Savings Research at Center for Retirement Research at Boston College (CRR) and Alicia H. Munnell, Director of the CRR and Peter F. Drucker Professor of Management Sciences at Boston College’s Carroll School of Management. To evaluate their retirement resources, many households may forget that not all of these resources belong to them; they will need to pay some portion to the federal and state governments in taxes. The question is just how large the tax burden is for the typical retired household and for households at different income levels. A recent study conducted by the Centers for Retirement Research at Boston College estimates lifetime taxes for a group of recently retired households. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRS Lists Solo 401(k) Plans as AuditThis article was written by Christine P. Roberts, Benefits (ERISA) Attorney at Mullen & Henzell L.L.P. If your client’s sponsors a “solo 401(k)” plan, it may be in the crosshairs of the Internal Revenue Service. The Service’s TE/GE (Tax Exempt and Government Entities) division has identified one-participant 401(k) plans as among its current audit initiatives. In its web posting announcing the initiative, TE/GE states: “[t]he focus of this strategy is to review one-participant 401(k) plans to determine if there are operational or qualification failures, income and excise tax adjustments, or plan document violations.” |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRS Postpones Deadlines for 2020 IRA Contributions and Other TransactionsThe IRS recently issued Notice 2021-21, in which they provide a list of transactions and reports for which deadlines are postponed. This postponement is in response to the ongoing COVID-19 pandemic and applies to Taxpayers Affected by COVID-19 Emergency. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRS: SECURE Act’s 10-year RMD Rule is not What You ThoughtThis article was written by Ed Slott, Benefits (ERISA) Attorney at Ed Slott and Company, LLC In late March, IRS released IRS Publication 590-B, which contains the tax rules on withdrawing funds from individual retirement accounts. Normally this is a wrap-up of rules to use as guidance in preparing tax returns. But not this time. In this new 2021 version, updated on March 25, the IRS included explained how the SECURE Act rules would work for post-death distributions to IRA beneficiaries — and the rules are not what anyone thought they would be. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Practice ManagementDOL Releases Fiduciary GuidanceThe U.S. Department of Labor’s Employee Benefits Security Administration has issued guidance on fiduciary investment advice for retirement investors, employee benefit plans and investment advice providers. The guidance relates to the department’s “Improving Investment Advice for Workers & Retirees” exemption and follows its Feb. 12, 2021, announcement that that exemption would go into effect as scheduled on Feb. 16, 2021. The guidance is in the form of two documents. The first, “Choosing the Right Person to Give You Investment Advice: Information for Investors in Retirement Plans and Individual Retirement Accounts,” includes questions a retirement investor can ask when interviewing potential advice providers, background information to help them understand the purpose of each question, and investor-focused frequently asked questions about the exemption. The second, and arguably more relevant to readers, is a set of compliance-focused frequently asked questions — with guidance for investment advice providers who are relying, or planning to rely, on the exemption. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ASSUMED FEDERAL RATES (AFRs) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

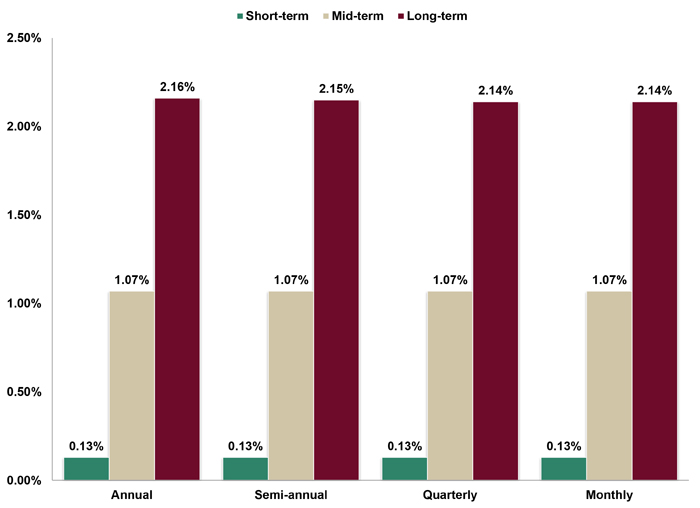

§7520 Rate for May is: 1.2%Break down: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL FACTS OF THE MONTH |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Long OverdueSource: American Society of Civil Engineers (ASCE) The federal gas tax is 18.4 cents per gallon today, but the tax has not been raised since 10/01/93 or nearly 27½ years ago. However 37 US states have raised their respective state gas tax since 2010. Gas taxes are used to fund improvements to highways and bridges. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Not GoingSource: National Student Clearinghouse 2.17 million freshmen started college in the fall of 2020, down 13% (327,513 fewer students) from the 2.50 million freshmen that began college in the fall of 2019. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Women RuleSource: National Student Clearinghouse Research Center The 17.8 million college students who enrolled in the fall of 2020 were split 41% male and 59% female. 17.8 million students are down just 2.5% from the 18.2 million students who enrolled in the fall of 2019. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Your HomeSource: Federal Housing Finance Agency 62% of home mortgages (33.4 million) are federally backed, i.e., the loans are guaranteed by Fannie Mae, Freddie Mac, the Federal Housing Administration or the Veterans Benefits Administration. The government announced on 2/16/21 that the moratorium on foreclosures and evictions on federally backed, single-family home mortgages had been extended to 6/30/21. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

USEFUL FINANCIAL WEBSITE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Grow Your Client Base In 2021Advisors: Looking to effortlessly grow your client base in 2021? White Glove’s premium done-for-you service is aligned with your goals to achieve optimal results. Click below for more info. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RECOMMENDED READING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Value of Retirement Planning as an Ongoing Serviceby Justin Fitzpatrick, PhD, CFA, CFP® Co-Founder & CIO of © Income Laboratory, Inc. Set your practice apart with retirement planning as an ongoing service. Our research explores the value gained by advisors who abandon static retirement income planning and adopt new processes for the development, implementation and ongoing management of dynamic plans. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Top ↑

Our Tax Guide contains tax information such as: Download the Tax Guide below: Our Reference Guide contains information such as: Download the Reference Guide below: An extensive list of online calculators and informational websites. View updates by state, CE requirements and more by clicking on the link below. At BEST we provide you with a lot of CE credit. Courses are

cost-effective, updated annually and nationally approved for

state insurance and professional designation credits (CFP/CIMA/CPWA/ RMA). Our CE courses are specifically designed for

quick completion and include: We provide advisors with: Earn two (2) credit hours of CFP/CIMA/CPWA/RMA Ethics CE with NO EXAM! (“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for

2 hours of CE credit towards the CIMA®, CPWA® and

RMA® certifications.”) WEBINAR DOES

NOT INCLUDE STATE INSURANCE CREDIT! *PAYMENT OPTIONS: NOTE: Attendees MUST participate in all exercises and polling questions during the webinar.

Credit received for attendee time logged and participation, NO EXAM at end of webinar.

(A $10.00 cancellation fee will apply for all refunds requested.) As a top-notch continuing education provider we: Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues. This newsletter may not be posted

to any website without written consent. This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted. Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational. BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST. THIS

NEWSLETTER IS PROVIDED FOR © 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

UNSUBSCRIBE* |

ABOUT BEST |

CONTACT US |

PRIVACY POLICY |

REFUND POLICY *Unsubscribing? Please allow one (1) business days for removal. Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |