Advisor News Insight |

|||||

|

EVENTS |

NEWS |

AFRs |

FACTS |

TOOLS

|

|||||

| |||||

B.E.S.T. UPCOMING CE PROGRAMS |

|||||

Virtual Super CE Event |

|||||

|

Date: Thursday, May 26, 2022

Earn up to the maximum amount of CE credit hours of state insurance (amount of credit hours varies by state). CFP® and IWI® (CIMA® / CPWA® / RMA®) professionals may earn 10 CFP® and / or 5 IWI® CE credit hours. This monthly program includes a live webinar presentation, a self-study course and an online examination. |

|||||

|

|||||

2-Hour CFP® / IWI® Ethics CE Webinar |

|||||

|

Date / Time: Wednesday, May 18, 2022 / 2:00pm - 4:00pm Eastern Time Earn 2 CE credit hours of CFP® and IWI® Ethics with NO EXAM! (no state insurance credit) |

|||||

|

|||||

INDUSTRY NEWS |

|||||

Annuity Planning |

|||||

Portfolio Income Insurance: Understanding the Benefits of a Contingent Deferred AnnuityDr. Finke, the Frank M. Engle Chair of Economic Security at The American College of Financial Services, examines a novel, pure insurance solution for designing reliable retirement spending plans for individual investors, and the various potential benefits. The solution in question, a Contingent Deferred Annuity (“CDA”), unbundles insurance protections from underlying investments enabling Registered Investment Advisors (RIAs) to wrap client brokerage accounts, IRAs, or Roth IRAs with portfolio income insurance. |

|||||

|

|||||

Wisconsin The Latest State To Adopt New Annuity Sales RegsTargeted News Service (Press Releases) Legislation signed into law by Wisconsin Governor Tony Evers greatly enhances protections for consumers seeking lifetime income from annuities. Wisconsin is the 23rd state that as part of a nationwide, bipartisan effort has adopted measures implementing the’ best interest of consumer enhancements’ in the National Association of Insurance Commissioners (NAIC). |

|||||

|

|||||

Business Planning |

|||||

Introduction to U.S. Economy: The Business Cycle and GrowthCongressional Research Services This In Focus from the Congressional Research Services (updated January 13, 2022), discusses the business cycle, how recessions are determined, and potential causes and effects of these fluctuations in the economy. |

|||||

|

|||||

Estate Planning |

|||||

8th Annual Non-Grantor Trust State Income Tax ChartThe 8th Annual Non-Grantor Trust State Income Tax Chart was recently updated to take into consideration changes from the past year. Advisors should be taking advantage of the opportunity to avoid the tax drag inherent in many trusts that accumulate income that is subject to state income tax even if not sourced to that state. In fact, it is somewhat shocking that this concept isn’t the most talked about concept among the financial planners whose assets under management are ratably affected by this tax drag. |

|||||

|

|||||

IRA Planning |

|||||

Best Interest Standard of Care for Advisors #87: Specific Reasons for Rollover Recommendations That Won’t Work (Part 1)C. Frederick Reish is a partner in Faegre Drinker’s Benefits & Executive Compensation practice group These articles focus on the requirement in PTE 2020-02 that financial institutions and investment professionals provide participants with the “specific reasons” why a rollover recommendation is in the best interest of the participant. |

|||||

|

|||||

Best Interest Standard of Care for Advisors #88: Specific Reasons for Rollover Recommendations That Won’t Work (Part 2)C. Frederick Reish is a partner in Faegre Drinker’s Benefits & Executive Compensation practice group These articles focus on the requirement in PTE 2020-02 that financial institutions and investment professionals provide participants with the “specific reasons” why a rollover recommendation is in the best interest of the participant. |

|||||

|

|||||

Pew Survey Explores Consumer Trend to Roll Over Workplace Savings Into IRA PlansThe survey asked participants a series of questions about whom they had consulted in deciding what to do with their retirement savings and how they planned to handle their savings (in the case of those still working), or what they had done with their savings (in the case of retirees). |

|||||

|

|||||

Medicare Planning |

|||||

The two kinds of Medicare Special Enrolment PeriodsThere are actually two kinds of Medicare Special Enrollment Periods. A Medicare Special Enrollment Period allows you to switch plans or sign up for Medicare outside of the standard Medicare enrollment periods. |

|||||

|

|||||

Retirement Planning |

|||||

Buck Up, Boomers. You’re Still Better Off Than Your Parents.Allison Schrager, Bloomberg Opinion columnist. There has never been a generation in better shape for retirement, even with soaring inflation and volatile markets. This is a hard time to retire. The market is down 7% from last year and the rate of inflation has risen to 8.5%. Both are brutal to your bottom line when you’re on a fixed income. But buck up! As bad as things seem, odds are you are in better shape than your parents or grandparents were. And if they got through retirement comfortably, so will you. |

|||||

|

|||||

J.P. Morgan Retirement Insights: Guide to Retirement 2022Updated annually, the award-winning* Guide to Retirement provides an effective framework for supporting your retirement planning conversations with clients. It includes charts and graphs to help you explain complex topics in a clear and concise manner. A description and audio commentary are available for every slide. |

|||||

|

|||||

Reverse Mortgage May Not Be A Last Resort Any LongerSusan B. Garland, former Editor of Kiplinger’s Retirement Report Until recently, it was conventional wisdom that a reverse mortgage was a last-resort option for the oldest homeowners who desperately needed cash. But a growing number of researchers say these loans could be a good option for people earlier in their retirement like [those] who are not needy at all. The article offers the basics about reverse mortgages and offers some insights into the thinking about greater utility of reverse mortgages. The article discusses downsides for folks to consider as well. |

|||||

|

|||||

Using Retirement Account Features for Short-Term SavingsCongressional Research Services A report from the Congressional Research Service describes how defined contribution plans can be used to help employees build emergency savings. It notes there are two current features of retirement plans that could be used as a platform for short-term savings: deemed Roth individual retirement accounts and after-tax accounts in qualified DC plans. The proposals discussing these features note that modifications regarding withdrawal frequency or account balance restrictions might be necessary. |

|||||

|

|||||

Roth IRA Planning |

|||||

Backdoor Roth IRA Conversions: Beware the Pro Rata RuleGinger Szala, Executive Managing Editor of Investment Advisor magazine Despite the unknown future of backdoor Roth IRAs, they remain a viable instrument in an advisor’s toolkit. We asked advisors what they saw as the main dangers of backdoor Roths, and the consensus was clear: misunderstanding the pro rata rule. The pro rata rule stipulates how the Internal Revenue Service will treat pretax and after-tax contributions when the client does a Roth conversion. |

|||||

|

|||||

Social Security Planning |

|||||

Everything You Need to Know About Social Security’s Retirement Earnings TestJoe Elsasser, Founder and President of Covisum® If you have clients making Social Security claiming decisions, you’ve likely heard them lament their belief that they can’t claim because they “make too much.” The root of the complaint is the retirement earnings test, which limits the amount of work-related income a person can have and still claim benefits before reaching full retirement age. |

|||||

|

|||||

Social Security Administration (SSA) to Resume In-Person Services at Local Social Security OfficesSSA announced that local Social Security offices will restore in-person services, including for people without an appointment, on April 7, 2022. |

|||||

|

|||||

Social Security Spousal Benefits OptionsMary Beth Franklin, Contributing Editor at Investment News How to switch from receiving Social Security benefits as a spouse based on his wife’s earnings record to his own maximum retirement Social Security benefits when he turns 70. |

|||||

|

|||||

Practice Management |

|||||

Trust in Financial Services Firms Highest in Over a DecadeTed Godbout, Writer/Editor at American Retirement Association Consumer trust in saving, investing and advice relationships is at its highest level since 2010, according to a new report by Hearts & Wallets. Nearly half (47%) of surveyed customers report high trust (item 2 on a 10-point scale) for both primary and secondary relationships, up over 10 percentage points from 2010, the firm reports. |

|||||

|

|||||

ASSUMED FEDERAL RATES (AFRs) |

|||||

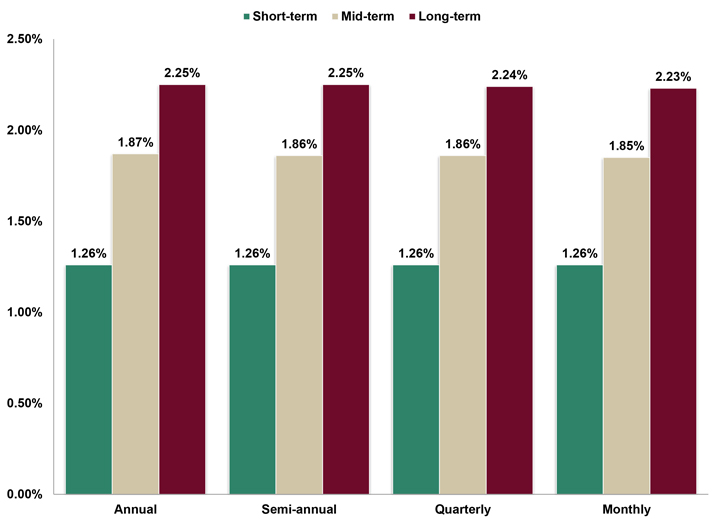

§7520 Rate for May is: 3.0%Break down: |

|||||

|

|||||

|

|||||

FINANCIAL FACTS OF THE MONTH |

|||||

Brand New Homes |

|||||

|

Source: U.S. Census Bureau The median sales price of a new home sold in the USA in January 2022 was $423,300, an all-time record high both on a nominal basis and on an inflation-adjusted basis. |

|||||

|

|||||

Credit Technology |

|||||

|

Source: U.S. Department of Labor (DOL) An average American worker has increased his/her productivity by +52% in the last 22 years, i.e., an average worker can complete in 1 hour, 58 minutes as of 12/31/2021 the same amount of work that it took him/her 3 hours to finish as of 12/31/1999. |

|||||

|

|||||

Fewer Babies |

|||||

|

Source: Centers for Disease Control and Prevention (CDC) The United States had 3.611 million births in 2020, a total that is projected to fall by 300,000 to 3.3 million when the final 2021 birth total is reported. US births were 3.96 million in 2011. |

|||||

|

|||||

Head Shaker |

|||||

|

Source: The White House The White House forecasted on 3/28/2022 that our national debt will reach $44.8 trillion as of 9/30/2032 (i.e., 10 ½ years down the road), up from $30.3 trillion as of 3/30/2022. |

|||||

|

|||||

I’m Going Elsewhere |

|||||

|

Source: DOL 47.4 million Americans quit their full-time jobs in 2021, the highest annual number recorded in the United States based on data tracked since 2001. |

|||||

|

|||||

Less Thank What You Think |

|||||

|

Source: Federal Housing Finance Agency (FHFA) The average single family home in the United States has appreciated just +4.7% per year over the 25 years from 12/31/1996 to 12/31/2021. |

|||||

|

|||||

Need Rain |

|||||

|

Source: U.S. Bureau of Reclamation The water level at Lake Powell dropped to 3,523.13 feet on Thursday 3/31/2022, its lowest level ever. Lake Powell supplies water to Arizona, Nevada and California. |

|||||

|

|||||

Stock and Inflation |

|||||

|

Source: BTN Research During the 16 highest inflation years over the last 100 years, i.e., 1922-2021, the S&P 500 has been “up” 8 years and “down” 8 years. The index’s average return for all 16 years is a gain of +3.9% per year (total return). The “Consumer Price Index” was used as the inflation benchmark. |

|||||

|

|||||

Way Up |

|||||

|

Source: The White House Per President Biden’s 3/28/2022 budget projection, Social Security outlays will increase by +79% over the next 10 years, Medicare outlays will rise +118% and interest costs will rise +213%. |

|||||

|

|||||

Workers Need a Plan |

|||||

|

Source: Georgetown University Center for Retirement Initiatives 10 US states have enacted legislation that provide “Auto-IRA” pre-tax retirement accounts for private sector workers who are employed by businesses that do not provide a pretax retirement plan option. The 10 states are California, Colorado, Connecticut, Illinois, Maine, Maryland, New Jersey, New York, Oregon and Virginia. |

|||||

|

|||||

ADVISOR TOOLS |

|||||

2022 Federal Income Tax Guide |

|||||

|

Our Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||||

2022 Social Security & Medicare Reference Guide |

|||||

|

Our Reference Guide contains information such as:

Download the Reference Guide below: |

|||||

Financial / Insurance Calculators & Websites |

|||||

|

An extensive list of online calculators and informational websites. |

|||||

REQUIREMENT UPDATES |

|||||

State Updates |

|||||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||||

|

|||||

FEATURED COURSE |

|||||

The Advisor’s Guide to IRAs |

|||||

|

|||||

B.E.S.T. CE PROGRAMS |

|||||

Online CE Courses |

|||||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI®). Our CE courses are specifically designed for quick completion and include:

|

|||||

|

|||||

Virtual Super CE Events |

|||||

|

We provide advisors with:

|

|||||

|

|||||

CFP® & IWI® Ethics CE 2-hour Live Webinar |

|||||

“Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP Professionals”

|

|||||

|

|||||

Self-Study CE Course List |

|||||

|

As a top-notch continuing education provider we:

|

|||||

|

|||||

DISCLAIMER |

|||||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

|||||

INFORMATION |

|||||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||||

SERVICES |

|||||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||||