ADVISOR NEWS INSIGHT |

||

|

News • AFRs • Recommended • Tools • Requirements • Featured • CE |

||

| ||

Remember Pat Tillman |

||

Industry News |

||

Estate Planning |

||

|

Increasing number of U.S. households prioritizing wealth transfer A broader swath of the American public is now involved in wealth transfers, according to a report by Hearts & Wallets, and the trend is driven in part by the shift toward 401(k) plans. Sixty-one percent of households expect to receive an inheritance, have already gotten an inheritance or plan to leave an inheritance, up from 46% in 2015. Nearly two thirds of U.S. households are now involved in intergenerational wealth transfer, with growth seen in both wealthy households and lower-asset households. (Ayo Mseka, Journalist, InsuranceNewsNet, 4/20/2023) |

||

Social Security Planning |

||

|

Fact Sheet: 2023 Social Security and Medicare Trustees Reports On March 31, 2023, The Social Security and Medicare Trustees today released their annual reports on the financial state of the Social Security and Medicare programs over the next 75 years. The latest Social Security projections show the program is quickly headed toward insolvency and highlight the need for trust fund solutions sooner rather than later to prevent across-the-board benefit cuts or abrupt changes to tax or benefit levels. (U.S. Department of the Treasury, 3/31/2023) |

||

|

New Inflation Data Shows 2024 Social Security COLA Still Headed Below 3% Latest forecast for next year’s cost of living adjustment stays below 3%, which would be significantly below this year’s 8.7% increase.

|

||

Tax Planning |

||

|

IRS Tax Tip 2023-51: Filing a final tax return for someone who has died After someone with a filing requirement passes away, their surviving spouse or representative

should file the deceased person’s final tax return. On the final tax return, the surviving spouse

or representative should note that the person has died. The IRS doesn’t need a copy of the death

certificate or other proof of death. The IRS has released the following Tax Tip 2023-51.

|

||

Wealth Planning |

||

|

New York Life Wealth Watch survey finds key financial differences among American families Against a backdrop of economic challenges, adults are beginning to feel less positive about the current state of their finances in 2023, according to the latest findings from the New York Life Wealth Watch survey. Financial confidence levels vary across generations, parental status and between men and women:

(New York Life Insurance Company, 4/19/2023) |

||

Practice Management |

||

|

Staff Bulletin: Standards of Conduct for Broker-Dealers and Investment Advisers Care Obligations The Securities and Exchange Commission released guidance for advisors and brokers on meeting their care obligations when providing investment advice and recommendations to retail investors. In its new guidance, released in Q&A form, SEC staff focuses primarily on the Care Obligation of Regulation Best Interest for broker-dealers and the duty of care enforced under the Investment Advisers Act of 1940 for investment advisors. (U.S. Securities and Exchange Commission) |

||

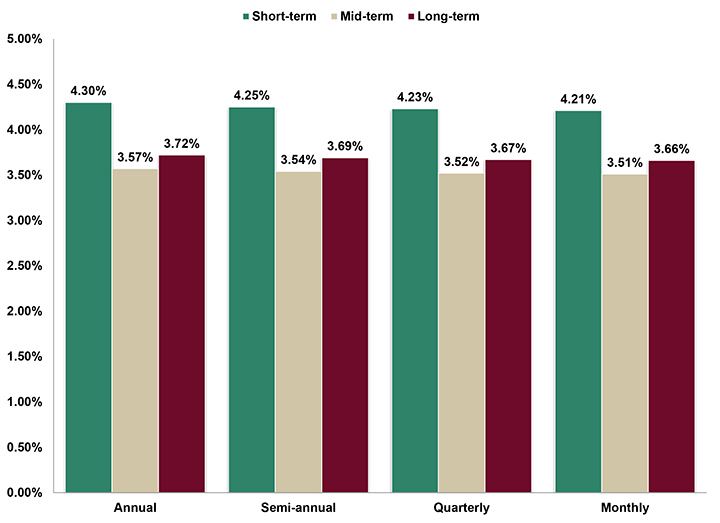

Assumed Federal Rates (AFRs) |

||

§7520 Rate for May is: 4.40% |

||

|

||

|

||

Recommended Reading |

||

|

||

|

||

Advisor Tools |

||

2023 Federal Income Tax Guide |

||

|

Our Tax Guide contains tax information such as:

|

||

2023 Social Security & Medicare Reference Guide |

||

|

Our Reference Guide contains information such as:

|

||

Financial / Insurance Calculators & Websites |

||

|

An extensive list of online calculators and informational websites. Explore list |

||

Requirement Updates |

||

State Updates |

||

|

View updates by state, CE requirements and more. View updates |

||

Featured Course |

||

The Advisors Guide to

|

||

|

||

B.E.S.T. CE Online CE |

||

Meet Your CE Requirements

|

||

|

Our online CE courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP®, CIMA®, CPWA®, and RMA®). They are also specifically designed for quick completion and include:

|

||

|

||

Disclaimer |

||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (B.E.S.T.), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. B.E.S.T. is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of B.E.S.T. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES

ONLY AND |

||

Information |

||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||

Services |

||

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

||

|

*Unsubscribing? (removed from our mailing list) Please allow one (1) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||