Advisor News Insight |

|||

|

NEWS |

AFRs |

FACTS |

RECOMMENDED

|

|||

| |||

Have a Safe & Happy Thanksgiving

|

|||

INDUSTRY NEWS |

|||

Charitable Giving |

|||

2022 Annual Charitable Gift ReportBNY Mellon Wealth Management’s 2022 Charitable Gift Report assesses the philanthropic landscape, levels of giving over the past five years, and donor behavior, to provide insights, context and benchmarks. This report provides analytics and observations on the charitable gift annuity (CGA) and charitable remainder trust (CRT) activity during the calendar year 2021 for 101 nonprofit organizations and the BNY Mellon Charitable Gift Fund. |

|||

|

|||

IRA Planning |

|||

The IRS Answers a Crucial Penalty Question for

|

|||

|

|||

The IRS Issues Update on 10-year RMD RuleDJ Shaw, Journalist (freelance) The IRS has issued Notice 2022-53, providing guidance on final regulations related to required minimum distributions under section 401(a)(9) of the Internal Revenue Code that will apply no earlier than the 2023 distribution calendar year. The notice also provides guidance related to certain provisions of section 401(a)(9) that apply for 2021 and 2022. The updated guidance waives the excise tax for those who failed to take a required minimum distribution in 2021 and 2022. |

|||

|

|||

Long-Term Care Planning |

|||

Long-Term Services and Support for Older Americans: Risks and Financing, 2022Richard W. Johnson (Urban Institute) and Judith Dey (U.S. Department of Health and Human Services) A recently released report Richard W. Johnson and Judith Dey of the Urban Institute, “Long-Term Services and Support for Older Americans: Risks and Financing, 2022,” provides the latest numbers. Here are a few of its findings. For Americans turning 65 today:

|

|||

|

|||

What’s the Likelihood You’ll Need Long-Term Care?Harry S. Margolis, Attorney. Author. Biker at Margolis Bloom & D’Agostino None of us knows for sure what aging has in store for us. Will we live into our 90s healthy and spry, get struck down by illness at an early age, or endure years or even decades of disability and incapacity? This uncertainty has great implications for how we live our lives and plan our lives. It influences how much money we will need for retirement, where we choose to live, and when we retire. |

|||

|

|||

Retirement Planning |

|||

2022 RCS Fact Sheet #1: Retirement ConfidenceOne in three Americans feel very confident about their ability to have enough money to live comfortably throughout their retirement years. Workers who say debt is a problem are, not surprisingly, less confident, while those who have a retirement plan are remarkably more confident. |

|||

|

|||

2022 RCS Fact Sheet #3: Preparing For Retirement In AmericaLess than one-third of American workers feel very confident about their ability to afford a comfortable retirement. For some, preparing for retirement causes stress. What are they doing to prepare for retirement?. |

|||

|

|||

Social Security Planning |

|||

Social Security Announces 8.7% Benefit Increase for 2023Social Security Administration (SSA) Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 8.7% in 2023, the Social Security Administration announced today. On average, Social Security benefits will increase by more than $140 per month starting in January. |

|||

|

|||

Tax Planning |

|||

IRS Releases 2023 Plan LimitsPaul Mulholland, Editor at PLANSPONSOR IRS announced the new limits on annual IRA and qualified retirement plan contributions for 2023. The annual contribution limit for workers who participate in 401(k), 403(b) and most 457 plans, as well as the federal government’s Thrift Savings Plan will be increased to $22,500 from $20,500. The annual IRA contribution will increase to $6,500 from $6,000. |

|||

|

|||

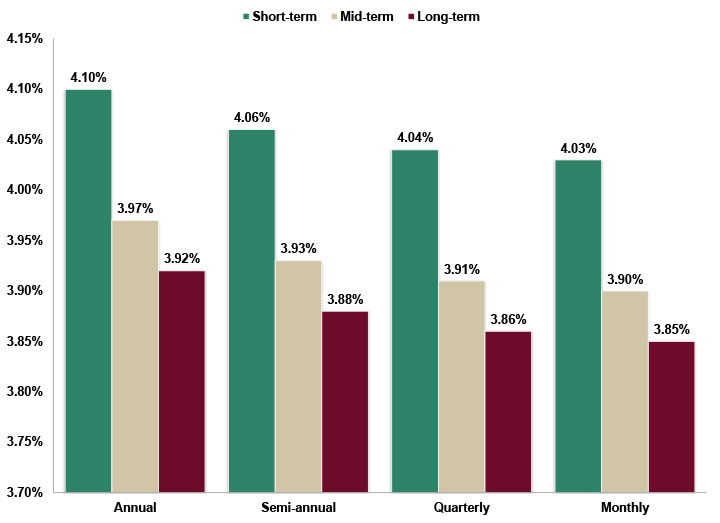

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for November is: 4.8% |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Facts About November |

|||

|

Source: B.E.S.T. November is seen as a time to start finalizing any plans or projects that you had for the year. 63 days and counting. Have you completed your required CE? |

|||

|

|||

How Long Do Recessions Lasts? |

|||

|

Source: Kiplinger The average length of recessions going all the way back to 1857 is less than 17.5 months. Recessions actually have been shorter and less severe since the days of the Buchanan administration. The long-term average includes the 1873 recession – a kidney stone of a downturn that lasted 65 months. The longest post-WWII recession was the Great Recession, which began December 2007 and ended in June 2009, a total of 18 months. Conversely, the two-month Pandemic Recession helped nudge the average length of recession down a notch. |

|||

|

|||

Interesting Facts About Saving Money |

|||

|

Source: DuckstersTM

|

|||

|

|||

Medicare Spending |

|||

|

Source: NHE Fact Sheet, August 2022 Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Among major payers, Medicare is expected to experience the fastest spending growth (7.6 percent per year over 2019-28), largely as a result of having the highest projected enrollment growth. |

|||

|

|||

Physical Money Doesn’t Last Forever |

|||

|

Source: Clever Girl Finance Inc.

|

|||

|

|||

Social Security Provides a Foundation of Retirement Protection for Nearly All People in the U.S. |

|||

|

Source: Social Security Administration (SSA) Almost all workers participate in Social Security by making payroll tax contributions, and almost all older adults receive Social Security benefits. In fact, 97 percent of older adults (aged 60 to 89) either receive Social Security or will receive it. |

|||

|

|||

When Is the Best Time to Buy Stocks in a Recession? |

|||

|

Source: Nasdaq, Inc. The best time to buy stocks is when the NBER announces the start of a recession. It takes the bureau at least six months to determine if a recession has started; occasionally, it takes longer. The average post-WWII recession lasts 11.1 months. Often, by the time the bureau has figured out the start of the recession, it’s close to the end. Many times, investors anticipate the beginning of a recovery long before the NBER does, and stocks begin to rise around the time of the actual economic turnaround. |

|||

|

|||

RECOMMENDED READING |

|||

CE Transformation Playbook |

|||

|

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

|

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

|

|||

Financial / Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

NAIC 4-Hour Long Term Care Course |

|||

|

Prices start at only $13.95.

|

|||

B.E.S.T. CE PROGRAMS |

|||

Online CE Courses |

|||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

Save 20% on Your Order When You Purchase Our Online CE Courses |

|||

|

Simply order courses and enter Promo Code: CENOW in the “Enter promotion code (optional)” input box located on the shopping cart page. (Promo code ONLY valid at time of purchase. Code cannot be combined and expires on 11/30/2022.) |

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY NOTICE | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||