Advisor News Insight |

|||||||||||||||||||||||||

|

News • AFRs • Website • Tools • Requirements • Featured • CE |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Wishing you a safe and happy |

|||||||||||||||||||||||||

INDUSTRY NEWS |

|||||||||||||||||||||||||

Social Security Planning |

|||||||||||||||||||||||||

2026 Cost-of-Living (COLA) Fact SheetBased on the increase in the Consumer Price Index (CPI-W) from the third quarter of 2024 through the third quarter of 2025, Social Security beneficiaries and Supplemental Security Income (SSI) recipients will receive a 2.8 percent COLA for 2026. The Fact Sheet provides other important 2026 Social Security information. (Social Security Administration (SSA), 10/24/2025) |

|||||||||||||||||||||||||

Maximizing Social Security with Survivor BenefitsA case study explores Social Security claiming strategies for a woman eligible for survivor benefits from two ex-husbands. The study compares three strategies, showing a potential difference of $130,000 in lifetime benefits between the most and least optimal strategies. The most effective strategy involves claiming a reduced benefit on one ex-husband’s record at age 60, and then switching to a full benefit on the other ex-husband’s record at age 67. (John Manganaro, Senior Reporter, ThinkAdvisor, 10/02/2025) |

|||||||||||||||||||||||||

Tax Planning |

|||||||||||||||||||||||||

IRS Reveals Tax Adjustments for 2026The Internal Revenue Service (IRS) released its annual 2026 inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other changes. The adjustments, reflected in Revenue Procedure 2025-32, reflect notable changes under the One, Big, Beautiful Bill. The tax year 2026 adjustments generally apply to tax returns filed in 2027. (IRS, 10/09/2025) |

|||||||||||||||||||||||||

5 Key Questions to Calculate the New Alternative Minimum TaxThe alternative minimum tax (AMT) represents one potential caveat to the widespread and, mostly, correct belief that the One Big Beautiful Bill Act cut everyone’s payments to Uncle Sam. This article discusses five key questions for financial advisors, tax professionals and clients to help understand the potential AMT exposure. OBBBA tweaked the rules in ways that will hike the number of households subject to it. (Tobias Salinger, Chief Correspondent, Financial Planning, 10/20/2025) |

|||||||||||||||||||||||||

2026 Tax Calculator: How the One Big Beautiful Bill Act’s Tax Changes Will Affect YouThe Tax Foundation has built a new interactive tax calculator tool that helps demonstrate how the OBBBA tax provisions will impact taxpayers in different scenarios in 2026. The calculator allows users to compare how different sample taxpayers fare or to input a custom taxpayer. (Garrett Watson, Director of Policy Analysis, Peter Van Ness, Research Software Developer, Tax Foundation, 10/01/2025) |

|||||||||||||||||||||||||

Estate Planning |

|||||||||||||||||||||||||

Estate-Planning Techniques in Volatile MarketsTariffs, persistently high inflation and market volatility can stress even the most carefully designed financial plans. This article explores key estate-planning strategies designed to provide stability, protect assets and ensure your client’s financial intentions are honored, regardless of what the market may bear, especially in down markets with high interest rates. (Martin Behn, Partner, and Justin Hilton, Associate, Lathrop GPM, 04/23/2025) |

|||||||||||||||||||||||||

Retirement Planning |

|||||||||||||||||||||||||

PSCAs 2025 HSA SurveyAcknowledging the significant potential role of Health Savings Accounts (HSAs) as a retirement savings vehicle, PSCA created a committee in 2016 to study the intersection of HSAs and retirement. In the spring of 2017, PSCA conducted its first snapshot survey of companies that offer HSA-qualifying health plans to establish a baseline on HSA plan design and use. This was followed by a comprehensive benchmarking survey in 2019. Since then, PSCA has conducted an annual HSA survey, providing valuable benchmarking data and insights into the evolving landscape of HSA programs. (Plan Sponsor Council of America, 2025) |

|||||||||||||||||||||||||

Practice Management |

|||||||||||||||||||||||||

Advisers Face a Fiduciary Challenge When Discussing Alternatives to Trump AccountsWhile Trump Accounts offer some benefits for early savings, investment advisers need to be cautious when recommending alternatives like 529 plans or Roth IRAs, as those suggestions could create fiduciary conflicts. (Jeff Briskin, Principal, Briskin Consulting, 10/01/2025) |

|||||||||||||||||||||||||

The 4 Types of High-Growth AdvisorsConsistent organic growth is a major challenge for financial professionals, with sourcing new clients their primary obstacle and building multigenerational client relationships their highest hurdle, according to a recent report by Osaic. They divided the advisors into three core groups:

From 2021 to 2023, top-growing Osaic financial professionals grew on average by 22%, compared with the market’s performance of 1.7%. Which type of advisor are you? (Michael S. Fischer, Contributing Writer, ThinkAdvisor, 10/15/2025) |

|||||||||||||||||||||||||

ASSUMED FEDERAL RATES (AFRs) |

|||||||||||||||||||||||||

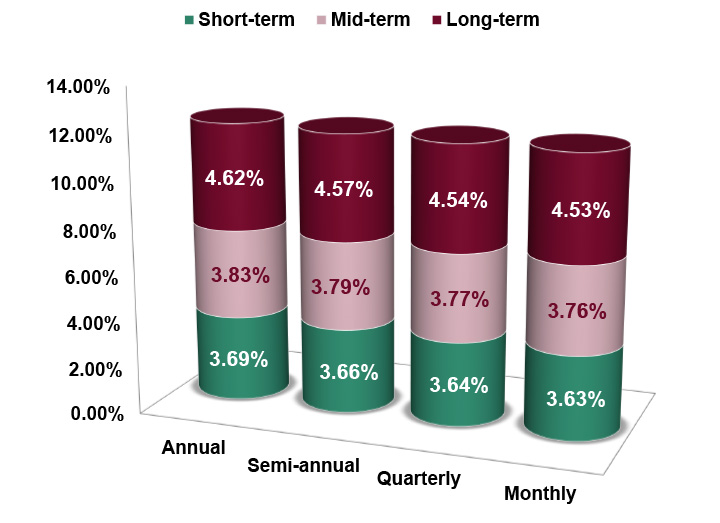

§7520 Rate for November is: 4.60% |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

USEFUL FINANCIAL WEBSITE |

|||||||||||||||||||||||||

CareScount®Calculate the Cost of Long-Term Care Near YouCareScout® has teamed up with its parent company, Genworth®, to bring you the industry-standard tool for understanding long-term care costs. |

|||||||||||||||||||||||||

ADVISOR TOOLS |

|||||||||||||||||||||||||

Free 2025 Federal Income Tax and

|

|||||||||||||||||||||||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

|||||||||||||||||||||||||

STATE REQUIREMENT UPDATES |

|||||||||||||||||||||||||

Stay Up-to-Date on Your

|

|||||||||||||||||||||||||

FEATURED COURSE(S) |

|||||||||||||||||||||||||

CE Credits |

|||||||||||||||||||||||||

B.E.S.T. CE PROGRAMS |

|||||||||||||||||||||||||

CFP® Ethics CE WebinarJoin Us for Our Upcoming Live Webinar and

|

| When: Thursday, November 13, 2025 | Where: 2-hour Live webinar (GoToWebinar platform) |

| Time: 2:00 p.m. - 4:00 p.m. ET | Price: See detailed pricing options below. |

2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required.

This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit.

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| CFP® credit ONLY: | $61.50 | CFP® credit PLUS IAR credit: | $92.50 | |

| IWI credit ONLY: | $59.00 | IWI credit PLUS IAR credit: | $90.00 | |

| IAR credit ONLY: | $65.00 | CFP® credit PLUS IWI credit PLUS IAR credit: |

$117.50 | |

| CFP® credit PLUS IWI credit: | $86.50 |

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.)

Registering includes the following three web pages: (each may open in a separate window)

- Payment: Enter your payment information. A detailed breakdown of costs and fees will appear before you confirm your payment.

- Attendee Registration: Fill out the Attendee Registration form to provide your contact details and any other information necessary to receive your CE credit.

- GoToWebinar Registration: Enter your First Name, Last Name and Email Address, then click the ‘Register’ button to complete registration for the live webinar.

NOTE: Do not close any of your web pages / browsers

until you are completely done registering. (SEE ABOVE.)

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024.

IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®)

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

IAR Ethics Virtual Super CE Program

Join Us for Our Upcoming Live Webinar and

Meet your 6-hour IAR Ethics and

Professional Responsibility CE Requirement.

Starting at only $74.95.

Also approved for 6 CE credit hours of CFP® and / or

6 CE credit hours of IWI (CIMA® / CPWA® / RMA®) in addition to IAR CE credits.

(CFP® and IWI ONLY credits are NOT available.)

IAR Ethics Virtual Super CE Program Agenda

|

Our Virtual Super CE Program Consists of the Following:

- 1-hour live webinar presentation: Ethical Practices and Professional Responsibility

(No CE credit.) - Self-study course: Ethics for Financial and Insurance Professionals (Course #: C25280)

- Virtual final exam (online): Requires you to spend 6 hours of reading and reviewing the self-study course material PRIOR to taking the exam. The 60-question exam requires an invite code that is given to all attendees during the live webinar presentation. To receive CE credit, advisors must obtain a passing grade of 70% or higher. If the exam is not passed on the first attempt, students have two (2) additional retakes for a maximum of three (3) attempts.

This presentation is designed to present financial and insurance professionals with the ethical practices and standards required when conducting business in their state.

This course is designed to meet the mandatory 6-hour CE credit requirement under the Ethics and Professional Responsibility for Investment Adviser Representatives (IARs).

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| IAR credit ONLY: | $74.95 | IAR PLUS IWI credits: | $99.95 | |

| IAR PLUS CFP® credits: | $99.95 | IAR PLUS CFP® PLUS IWI credits: |

$124.50 |

NOTE: The IAR governing board filing fee of $3.00 per credit hour/per student is included in the base price. If you add CFP® and/or IWI CE credits, an additional certificate fee of $25.00 will be added per designation. Pricing options are listed on the payment/registration page and an itemized price breakdown during checkout.

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

DISCLAIMER

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.).

Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content.

It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T.

Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness.

THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR

LEGAL ADVICE.

B.E.S.T. INFORMATION / SERVICES

B.E.S.T. Links

Resources

Access a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings.

Social Media

Physical Address & Hours of Operation

© 1992 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

7137 Congress Street, New Port Richey, FL 34653 | Toll Free:

1-800-345-5669

Hours of Operation: Monday - Friday, 8:30 a.m. to 5:00 p.m.

Eastern Time

Miscellaneous

About Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe*

*Remove from mailing list. Please allow up to five (5) business days for removal.

Ensure newsletter delivery to your inbox by adding [email protected] to your address book.