| |

| |

|

|

| |

Medicare 2020 AEP

October 15 - Dec 17 Open enrollment Period

The Medicare Open Enrollment Period, often called

the Annual Election Period (AEP), is the time when

individuals can change their Medicare Advantage and/or

Medicare Part D plans.

This is also the time to switch from original Medicare

(Part A & B) to Medicare Advantage (Part C) or vice/versa.

Receive up to 20 credit hours of State Insurance CE credit and 10 CE credit hours of

CFP and 5 CE credit hours of CIMA/CPWA/RMA credit by registering for our

Virtual Super CE Event:

- 1.5 Hour Live Webinar Presentation: “Planning with Social Security and Medicare.”

- Electronic Exam: “The Advisors Guide to Social Insurance Programs.”

|

| |

|

|

| |

|

| |

Charitable Planning

Using a “Testamentary” Charitable Gift Annuity (T-CGA) To “Stretch” The IRA Payout

The stretch IRA was a popular tool for extending the benefits of a tax-deferred account to a non-spouse beneficiary.

The goal was to minimize the tax impact of the required minimum distributions (RMDs). Typically, it worked by having the

account owner designate a child or grandchild as the beneficiary, who was then allowed to stretch the RMDs out over their

own lifetime. This meant smaller distributions, less tax paid, and more tax-deferred growth on the remaining assets in the

account.

This article was written by Bryan K. Clontz, Ph.D., CFP®, CAP®, Contributor at Forbes.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Estate Planning

Does Your State Have an Estate or Inheritance Tax?

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or

inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

Maryland is the only state to impose both now that New Jersey has repealed its inheritance tax.

This article was written by Janelle Cammenga, Policy Analyst with the Tax Foundation’s Center for State Tax Policy.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Life Insurance Planning

GAO Tells Lawmakers Offshore Variable Life Can Be Abused

Federal law provides certain tax benefits for transactions involving genuine insurance products,

including insurance products held offshore. While taxpayers may lawfully hold offshore insurance

products, they contain features that make them vulnerable for use in abusive tax schemes.

|

| |

|

|

| |

|

| |

IRS Finalizes Regulations on Hedge Funds as an Asset Class for Variable Annuities, Endowments and Life Insurance Contracts

The Internal Revenue Service has issued final regulations that remove the look-through rule to assets of nonregistered hedge

funds whose interests are available for sale to other than insurance-dedicated vehicles for purposes of satisfying the diversification

requirements of Section 817 of the Internal Revenue Code. The final regulation was effective March 1, 2005, and adopts, with modification,

the proposed regulations published on July 30, 2003. The use of insurance-dedicated vehicles still will be available.

This article was written by a Staff Writer at ThinkAdvisor.com.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

Emergency Fund For Retirement: How Much Do You Need To Save?

During your working years, you know how important it is to have emergency savings in some form.

And yet, while the sources of the stats will vary, it is well known that many Americans do not have

sufficient emergency savings to cover unexpected expenses.

As you head into retirement, do you still need the cushion provided by an emergency fund? The

answer may surprise you.

Yes, retirees need a stash of cash. It’s even more important as you head into years with a fixed

income and a higher potential for unforeseen medical expenses. The amount you need in an emergency

fund during retirement will depend on your lifestyle, location and existing retirement savings and

income.

This article was written by E. Napoletano, Contributor at Forbes.

|

| |

|

|

| |

|

| |

The biggest risk retirees face: Hint: It’s almost certainly not what you think it is

How much does the stock market in a typical year deviate from its long-term average?

I’m willing to bet that your answer was way off, since virtually everyone gets it wrong.

And that’s disturbing, since the incorrect answer leads to major retirement portfolio mistakes.

Underestimate stocks’ volatility and you most likely will be led to make your retirement portfolio

too risky. Overestimate it and you will be scared away from equities.

This article was written by Mark Hulbert, Contributor at MarketWatch.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

Qualifying for Supplemental Security Income with Social Security

SSA pays monthly Supplemental Security Income (SSI) to people with disabilities

who have low income and few resources, and people who are age 65 or older without

disabilities who meet the financial limits.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Tax Planning

Your First Look At 2021 Tax Rates: Projected Brackets, Standard Deductions & More

The U.S. Bureau of Labor Statistics reported that the consumer price index (CPI) has increased by 0.4% for August.

Over the last 12 months, the index increased 1.3% before seasonal adjustment; this figure has been on the way up since

the end of May 2020. In contrast, the chained CPI increased 1.0% over the last 12 months. What that means for taxpayers

is that inflation adjustments will appear smaller: Most inflation-adjusted amounts, including the threshold dollar amounts

for tax rate brackets, are projected to rise by about 1%.

This article was written by Kelly Phillips Erb, Senior Contributor at Forbes.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

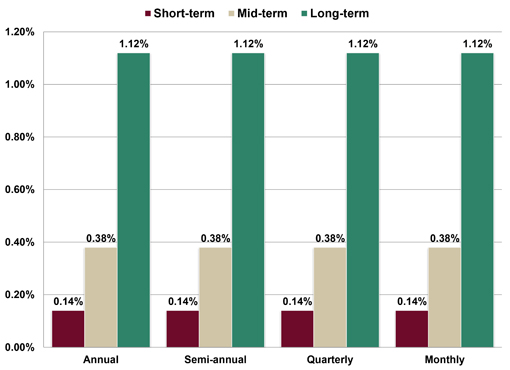

Assumed Federal Rates (AFRs)

§7520 Rate for October is: 0.4%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

Before Election Day

The S&P 500 has lost 1.1% on average (total return) over the 3 months

leading up to the last 8 presidential elections, i.e., the 3 months of

August-September-October over the 8 election years from 1988 through 2016.

The stock index was up in 5 of the 8 election years from August-to-October

but has been down in 2 of the last 3 election years over the 3-month period

(source: BTN Research).

|

| |

|

|

| |

|

| |

Bucs and Brandy?

Super Bowl #55 is scheduled to be held on 2/07/21 in Tampa, FL, the 5th time the city of

Tampa has hosted the championship game. No NFL team in history has ever played in the Super

Bowl on their home field (source: National Football League (NFL)).

|

| |

|

|

| |

|

| |

Calm Before the Storm?

Banks repossessed 230,305 homes in calendar year 2018. Banks repossessed 143,955 homes in

calendar year 2019. Through 7/31/20, banks had repossessed just 40,080 homes YT (source: Attom

Data Solutions).

|

| |

|

|

| |

|

| |

COVID-19s Adverse Effect on Various Government Trust Funds

The Congressional Budget Office (CBO) recently reported that the COVID-19 pandemic will have an adverse effect on various government trust funds. It will accelerate when those trust funds will be insolvent.

The dates are: Highway Trust Fund: 2021, Medicare Hospital Insurance: 2024, Social Security OASDI: 2031 (source: CBO).

|

| |

|

|

| |

|

| |

Get It and Spend It

74% of Americans spent their $1,200 per person stimulus payment

from the 3/27/20 CARES Act within 4 weeks of receipt. 159 million

Americans received the one-time nontaxable cash payment (source:

Money/Morning Consult survey).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Just Got More Expensive

A homeowner that refinances his/her mortgage after 9/01/20 may be subject to a new charge of ½ of 1% on the total loan value.

As of 9/01/20, Fannie Mae and Freddie Mac, government sponsored enterprises that buy mortgages from the lenders that originate

the debt, have added a 0.5% fee to refinanced loans they purchase. Lenders are expected to pass the cost on to consumers

(source: Fannie Mae).

|

| |

|

|

| |

|

| |

Might As Well Stay

Only 7% of workers “auto-enrolled” in an employer’s 401(k) plan elect to “opt-out” of the plan,

i.e., 93% of all employees remain in the plan (source: Vanguard Research).

|

| |

|

|

| |

|

| |

Only Half?

In order to approve a vaccine, the Food and Drug Administration requires that

the vaccine must be at least 50% effective, i.e., the “yet to be approved” COVID-19

vaccine must prevent half the people who receive the vaccine from becoming infected

with the COVID-19 virus (source: U.S. Food and Drug Administration).

|

| |

|

|

| |

|

| |

Please Vote

The 2020 presidential election will take place on 11/03/20 about 2 months from today.

138 million Americans voted in the 2016 presidential election, equal to 58.1% of the

nation’s voting-eligible population, i.e., 100 million voting-eligible Americans did not

vote in the 2016 race (source: United States Elections Project).

|

| |

|

|

| |

|

| |

Retirement Savings Distributed Very Unevenly

According to a recent report in The Wall Street Journal, retirement savings are distributed very unevenly.

The below shows retirement account savings (401(k)s and IRAs) by savings percentile. (source: The Wall Street Journal).

- 90th percentile - $320,000

- 80th percentile - $125,000

- 70th percentile -$56,000

- 60th percentile - $24,000

- 50th percentile - $7,800

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

2-Hour CFP®/CIMA®/CPWA®/RMA®

Ethics CE Live Webinar

“Ethical Practices for Professionals”

(Course#: 248997)

During this live webinar, Ed will present the CFP Board’s

Ethics CE program to help bring financial professionals up-to-date on

the new Code and Standards.

PRESENTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

DATE: WEDNESDAY, OCTOBER 21, 2020

TIME: 2:00PM - 4:00PM EASTERN TIME

CREDIT: 2-HOURS OF CFP ETHICS CE

(also approved for CIMA®/CPWA®/RMA® Ethics)

FEE: $49.00 (USD)

(NOTE: This webinar does

NOT include state insurance credit.)

PAYMENT OPTIONS:

- CFP ONLY license: $49.00

- CIMA / CPWA ONLY license: $49.00

- CFP® AND CIMA® / CPWA® / RMA® licenses: $49.00 plus an additional fee of $25.00

(“Investments & Wealth

Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA®

certifications.”)

|

| |

|

|

|

|

|

Top ↑

|

| |

|

| |

Instructor

Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA®, CERS®, CPRC®, CPFA®,

is the Founder, President and CEO of Broker Educational Sales & Training, Inc., (BEST).

|

| |

|

|

| |

|

| |

Unable to Attend this Month’s Webinar?

Click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need State Insurance or More CFP or CIMA/CPWA/RMA Credits?

View our Virtual Super CE events OR online course catalogs by clicking on the corresponding button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates

and registration information for future webinars by clicking

on the button below.

|

| |

|

|

|

Top ↑

|

| |

|

|

BEST Virtual Super CE Events

Event #1: “The Advisors Guide to Social Insurance Programs”

Up to 20 credit hours of State Insurance CE credit and

10 CE credit hours of CFP and 5 CE credit hours of CIMA®/CPWA®/RMA® credit.*

DATE: TUESDAY, OCTOBER 13, 2020

TIME: 1:00PM - 2:30PM

EASTERN TIME

CREDIT:

Click here to view credit hours by state.

FEE: $54.95 (USD)

(*plus state roster fees and $10.00 per additional professional certificate)

EVENT INFORMATION:

Electronic Exam: Self-study course – “The Advisors Guide to Social Insurance Programs”

The link to the electronic exam will be provided at the end of the live webinar

Exam will be accessible between 10/13/20 – 10/27/20

Pass/Fail will be displayed immediately upon completion

(Unlimited retakes available)

|

| |

|

|

|

Top ↑

|

| |

|

| |

Instructor

Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA®, CERS®, CPRC®, CPFA®,

is the Founder, President and CEO of Broker Educational Sales & Training, Inc., (BEST).

|

| |

|

|

| |

|

| |

Unable to Attend this event?

Click on the button below to view our events schedule.

|

| |

|

|

| |

|

| |

Need 2 Credit Hours of CFP®/CIMA®/CPWA®/RMA® Ethics CE?

See information in the previous section of this newsletter or

click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need More State Insurance, CFP® or CIMA®/CPWA®/RMA® Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates and registration information for future webinars by clicking on the button below.

|

| |

|

|

|

Top ↑

|

| |

|

|

Event #2: “The Advisors Guide to IRAs”

Up to 15 credit hours of State Insurance CE credit and

10 CE credit hours of CFP and 5 CE credit hours of CIMA®/CPWA®/RMA® credit.*

DATE: TUESDAY, OCTOBER 20, 2020

TIME: 1:00PM - 2:30PM

EASTERN TIME

CREDIT:

Click here to view credit hours by state.

FEE: $54.95 (USD)

(*plus state roster fees and $10.00 per additional professional certificate)

EVENT INFORMATION:

Electronic Exam: Self-study course – “The Advisors Guide to IRAs”

The link to the electronic exam will be provided at the end of the live webinar

Exam will be accessible between 10/20/20 – 11/3/20

Pass/Fail will be displayed immediately upon completion

(Unlimited retakes available)

|

| |

|

|

| |

|

| |

Instructor

Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA®, CERS®, CPRC®, CPFA®,

is the Founder, President and CEO of Broker Educational Sales & Training, Inc., (BEST).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Unable to Attend this event?

Click on the button below to view our events schedule.

|

| |

|

|

| |

|

| |

Need 2 Credit Hours of CFP/®CIMA®/CPWA®/RMA® Ethics CE?

See information in the previous section of this newsletter or

click on the button below to view our Ethics live webinar schedule.

|

| |

|

|

| |

|

| |

Need More State Insurance, CFP® or CIMA®/CPWA®/RMA® Credits?

View our online course catalogs by clicking on the button below.

|

| |

|

|

| |

|

| |

Subscribe (Sign up)

Receive updates and registration information for future webinars by clicking on the button below.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Insight Audio Podcast

HOSTED BY: EDWARD J. BARRETT

CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC®

Below is a list of available Advisor Insight Audio Podcast episodes:

2019

2018

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE

CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Featured Self-Study CE Course

The Advisor’s Guide to Social Insurance Programs

The Advisor’s Guide to Social Insurance Programs is an educational tool to help advisors through

the maze of programs, rules and regulations that affect many if not all of their aging Baby Boomer

clients, their spouses and dependents. The course is broken down into three sections to give the

advisor an understanding of the various benefits of the Social Security, Medicare and Medicaid programs.

Updated with 2020 Social Security and Medicare Trustee Report.

|

| |

|

| |

BEST Online CE Courses

BEST is a premier provider of CE for

financial and insurance professionals, to include

State Insurance, CFP® and CIMA®/CPWA® professionals.

BEST courses are updated annually to provide the some of the most accurate and time sensitive content in the industry.

Our CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to one year from date of purchase

- Excellent customer support team

|

Select a button below to order the CE you need today! |

|

|

| |

|

|

|

|

|

Already completed your requirements? Please click on the button below to pass on our information to a friend or colleague.

|

|

|

|

|

|

Top ↑

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the

District of Columbia

Order CE courses toll free: 1-800-345-5669 OR

send an email to

self_study@brokered.net.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Virtual Super CE Program Combines the Benefits and Convenience of:

- Live Webinar Presentation: A 1 hour CE live webinar (optional 1 credit hour of CE credit may be provided in most states, except MA, and for professional designations)

- Self-Study Course: A Self-study Course with an electronic exam (earn up to 21 hours of state insurance CE credit

(varies by state), 10 hours of CFP® CE credit and 5 hours of CIMA® / CPWA® / RMA® CE credit)

- Electronic Exam: Self-study course (exam requires an invite code which is given to all attendees during the live webinar)

|

| |

|

|

| |

|

| |

|

Contact our Business Development Department to

schedule a customized Virtual Super CE.

Call toll free: 1-800-345-5669

Email:

BusinessDev@brokered.net

Office Hours:

Monday - Friday, 8:30AM - 5:00PM ET

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR

INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

|

Top ↑

|

| |