Advisor News InsightAFRs | FACTS | WEBSITE | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

||

|

||

INDUSTRY NEWS |

||

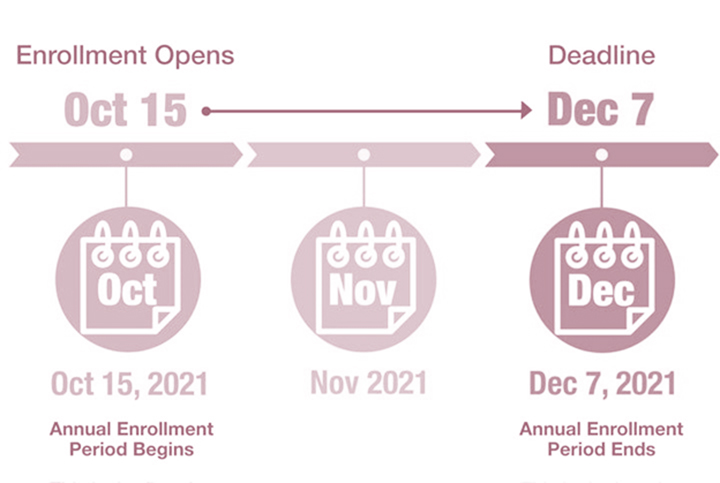

Medicare Open Enrollment 2022 GuideMedicare open enrollment for 2022 coverage starts on October 15, 2021 and continues through December 7, 2021.Everything you need to know about this year’s enrollment dates, coverage costs, eligibility details and opportunities to change coverage. |

||

|

||

|

||

401(k) Planning401(K) RETIREMENT PLANS: Many Participants Do Not Understand Fee Information, but DOL Could Take Additional Steps to Help ThemAlmost 40 percent of 401(k) plan participants do not fully understand and have difficulty using the fee information that the Department of Labor (DOL) requires plans to provide to participants in fee disclosures, according to GAO’s analysis of its generalizable survey (see figure). GAO assessed participants’ understanding of samples from several large plans’ fee disclosures and other information about fees, and asked general knowledge questions about fees. |

||

|

||

Annuity PlanningDo You Need an Annuity for Retirement Income?By Amy C. Arnott, CFA, Portfolio Strategist for Morningstar. Some guidelines on figuring out if an annuity makes sense for you, and if so, how much to allocate. |

||

|

||

Roth IRA PlanningCongress Looks To Eliminate Back-Dorr Roth StrategiesBy Sarah Brenner JD, Director of Retirement Education at Ed Slott and Company, LLC. The House Ways and Means Committee has released a draft of proposed changes to retirement accounts, including adding income limits for conversions and eliminating the back-door Roth conversion strategy. These proposals are designed to raise revenue and are likely, at least in part, a response to recent headlines about large Roth IRAs held by billionaires. Unless otherwise noted, the proposals would be effective for 2022. Here is what this means for your retirement account. |

||

|

||

Tax PlanningBills To Be Considered On House FloorThe House of Representatives is getting closer to voting on a huge package of budget legislation that could lead to many federal benefits program and tax changes — including a 50% cut in the “basic exclusion amount” that determines which estates pay the federal estate tax. House leaders have posted a collection of eight big PDF files related to the budget reconciliation process, with the bill number H.R. 5376, on their list of “Bills to Be Considered on the House Floor” this week. |

||

|

||

Tax Reform Update: Ways and Means Committee ProposalDistributed by Conway Wealth Group On September 13, 2021, House Ways and Means Committee Chairman Richard E. Neal (D-MA) released legislative text for the budget reconciliation bill that the Democrats are currently working on. On September 15th, the Ways and Means Committee advanced the legislation in a near party-line vote of 24-19, so it now heads to the House Budget Committee. |

||

|

||

The Made in America Tax Plan ReportThe U.S. Department of the Treasury released the Made in America Tax Plan Report to provide additional depth on the plan first announced last week as part of President Biden’s American Jobs Plan, a comprehensive proposal aimed at increasing investment in infrastructure, the production of clean energy, the care economy, and other priorities. |

||

|

||

Ways and Means Releases List of Tax Provisions for Budget BillBy Alistair M. Nevius, J.D. Editor-in-Chief, tax, magazines & newsletters at AICPA. The House Ways and Means Committee on Monday released legislative text for proposed tax changes to be incorporated in the budget reconciliation bill known as the “Build America Back Better” act. The committee plans to mark up the bill on Tuesday and Wednesday. The proposal would raise tax rates for corporations and individuals and make many other changes to the Internal Revenue Code. Here are highlights of the proposed changes. |

||

|

||

Will Taxes Rise for the Wealthy?By Michael Townsend, Managing Director, Legislative and Regulatory Affairs and Hayden Adams, CPA, CFP®, Director of Tax and Financial Planning, Schwab Center for Financial Research at Charles Schwab & Co., Inc. The U.S. House Ways & Means Committee recently approved a package of tax increases on the wealthy to help fund a $3.5 trillion “Build Back Better Act,” an economic package that includes expanded Medicare, free community college, universal prekindergarten, and more. |

||

|

||

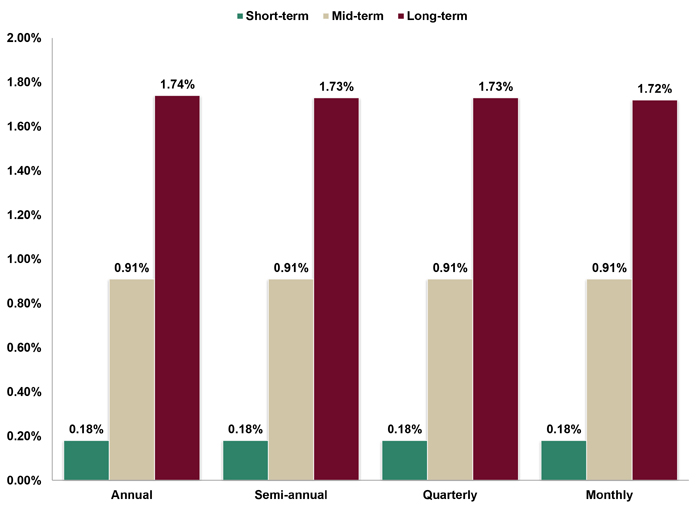

ASSUMED FEDERAL RATES (AFRs) |

||

§7520 Rate for October is: 1.0%Break down: |

||

|

||

FINANCIAL FACTS OF THE MONTH |

||

Better This YearSource: Federal Reserve Bank of New York Approximately 1 out of every 7 “recent graduates” from college (13.6%) was unemployed in June 2020. Just 1 out of every 16 “recent graduates” from college (6.2%) was unemployed in June 2021. |

||

|

||

Consecutive BearsSource: BTN Research Over the last 75 years, the shortest time period between the end of one bear market for stocks and the beginning of another bear market for stocks is 26 months. The S&P 500 fell 22% during a bear market that ended on 10/07/66. The next bear market for the stock market, an 18-month long tumble o f 36% began its downward slide on 11/29/68. The latest bear market for stocks, a decline of 34% over just 33 days, ended on 3/23/20 or 17 months ago. |

||

|

||

Debt LimitSource: Congressional Budget Office The Treasury Department reset our nation’s debt ceiling limit 5 weeks ago on Sunday 8/01/21 to our government’s outstanding debt as of that date, i.e., $28.428 trillion. Since 8/01/21, the government has taken “extraordinary measures” to borrow funds without “breaching” the new debt ceiling. The government will “run out of cash” in the next 2 months unless the debt ceiling is raised again. |

||

|

||

Down, but Still a Long LifeSource: National Vital Statistics Report Life expectancy at birth dropped to 77.3 years in 2020, down from 78.8 years in 2019. Life expectancy at birth was 77.4 years in 2005. |

||

|

||

End of LifeSource: National Center for Health Statistics More Americans died in 2020 (3.381 million) than in any year in US history. |

||

|

||

Losing GroundSource: U.S. Bureau of Labor Statistics Wages and salaries of all “civilian workers,” defined as workers in the private sector along with workers for state and local governments (but not federal government workers), increased by +3.2% on a year-over-year basis as of 6/30/21. Inflation, as measured by the “Consumer Price Index” (CPI), was up +5.4% over the same 12-month period. |

||

|

||

Lots of People Need HelpSource: Centers for Medicare & Medicaid Services Medicare covers 61.2 million Americans, while Medicaid covers 73.8 million low-income Americans. |

||

|

||

To the Heirs or to Charity?Source: Federal Reserve System 26% of the $137 trillion net worth held by Americans as of 3/31/21 is owned by US citizens at least age 70, i.e., $35 trillion. |

||

|

||

Where the Wealth IsSource: National Reverse Mortgage Lenders Association The amount of equity American seniors at least age 62 have in their homes has doubled since the end of 2011, rising from $4 trillion as of 12/31/11 to $8 trillion as of 12/31/20. |

||

|

||

USEFUL FINANCIAL WEBSITE |

||

|

||

Exit Planning Institute™The Authority in Exit Planning & Value AccelerationExit Planning Institute™ is an education company that certifies and supports more than 2,600 CEPAs (and counting), as well as thousands of advisors worldwide through national, regional, chapter, and virtual education. |

||

|

||

RECOMMENDED READING |

||

|

||

|

||

ADVISOR TOOLS |

||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

||

REQUIREMENT UPDATES |

||

|

View updates by state, CE requirements and more by clicking on the link below. |

||

|

||

BEST CE PROGRAMS |

||

Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP, CIMA, CPWA and RMA). Our CE courses are specifically designed for quick completion and include:

|

||

|

||

Virtual Super CE EventsLive Webinar Presentation: It’s All About Income We provide advisors with:

|

||

|

||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

||

|

||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

||

|

||

DISCLAIMER |

||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND |

||

INFORMATION |

||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||

SERVICES |

||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

||

*Unsubscribing? Please allow one (1) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||