Advisor News Insight |

|||

|

EVENTS |

NEWS |

AFRs |

FACTS |

RECOMMENDED

|

|||

| |||

B.E.S.T. UPCOMING CE PROGRAMS |

|||

Virtual Super CE Event |

|||

|

Date / Time:

Thursday, April 21, 2022 / 3:00pm - 4:30pm Eastern Time

Earn up to the maximum amount of CE credit hours of state insurance (amount of credit hours varies by state). CFP® & IWI® (CIMA® / CPWA® / RMA®) professionals may earn 10 CFP® and / or 5 IWI® CE credit hours. This monthly program includes a live webinar presentation, a self-study course and an online examination. |

|||

|

|||

2-Hour CFP® / IWI® Ethics CE Webinar |

|||

|

Date / Time: Wednesday, April 06, 2022 / 2:00pm - 4:00pm Eastern Time Earn 2 CE credit hours of CFP® and IWI® (CIMA® / CPWA® / RMA®) Ethics & NO EXAM! (no state insurance credit) |

|||

|

|||

INDUSTRY NEWS |

|||

Health Care Planning |

|||

2022 Retirement Healthcare Costs Data Report Brief: The Long-Term Impact of Short-Term InflationHealthView Services’ annual Retirement Healthcare Costs Data Reports have provided advisors and clients benchmark data to plan for one of the most significant expenses in retirement – healthcare. For a healthy 65-year-old couple living to actuarial longevity, total lifetime retirement healthcare costs will increase by $85,917 if healthcare inflation is 11.85% (1.5 times the current annual CPI of 7.9%) for two years. For an average 55-year-old couple retiring in 10 years, using the same inflation rate and period, costs will rise by $160,712. |

|||

|

|||

Retirement Planning |

|||

Aligning Retirement Expectations with Financial ResourcesInsured Retirement Institute (IRI) This report demonstrates the comparative financial security today’s retirees enjoy, in contrast to the expectations of workers who will be retiring in the years and decades to come. |

|||

|

|||

New Findings on What Current, Future Retirees Want from AdvisorsJeff Berman, Staff Reporter at ThinkAdvisor Investors who are already retired feel much more secure about their retirement than are near-retirees, according to a new Insured Retirement Institute report on retirement readiness, conducted with American Equity Investment Life Insurance and Eagle Life Insurance Company. |

|||

|

|||

Roth IRA Planning |

|||

Roth IRA Secure Act Regs. Bring New Roth IRA AdvantageSarah Brenner, JD, Director of Retirement Education at Ed Slott and Company, LLC. Good news for Roth IRA beneficiaries! The IRS confirms in the regulations that all Roth IRA owners are considered to have died before their required beginning date. This means no annual RMDs from inherited Roth IRAs are required for beneficiaries subject to the 10-year rule. An inherited Roth IRA offers complete flexibility within the 10-year period and completely avoids the complicated RMD rules. And, best of all, the Roth IRA can grow tax-free for ten years before any distributions are required. |

|||

|

|||

Social Security Planning |

|||

Getting Clients Comfortable Delaying Social Security with Reversible DelaysJeffrey Levine, CFP®, CPA, PFS, CWS, AIF Chief Planning Officer at Buckingham Wealth Partners Social Security benefits are a critical part of many retirement income plans. In such situations, making the best claiming decision (or decisions) can have a big impact on the success of that plan. One such shift in the rules when an individual reaches FRA involves the ability to file for retroactive benefits. |

|||

|

|||

Social Security Retirement Benefit Claiming AgeCongressional Research Service (CRS) Retired workers can claim retirement benefits as early as age 62 (the earliest eligibility age, or EEA). Benefits claimed between age 62 and the FRA, however, are subject to a permanent reduction for early retirement. |

|||

|

|||

Tax Planning |

|||

IRS reminder to many retirees: April 1 is last day to start taking money out of IRAs and 401(k)sInternal Revenue Service (IRS) The Internal Revenue Service reminded retirees who turned 72 during the last half of 2021 that, in most cases, Friday, April 1, 2022, is the last day to begin receiving payments from Individual Retirement Arrangements (IRAs), 401(k)s and similar workplace retirement plans. |

|||

|

|||

Practice Management |

|||

Best Interest Standard of Care for Advisors #84: Compliance with PTE 2020-02: Special Issues: MonitoringC. Frederick Reish, Partner in Faegre Drinker’s Benefits & Executive Compensation Practice Group This article is not about the expanded definition, but instead about a circumstance in which a fiduciary could have more responsibility than anticipated. In the preamble, the DOL discussed whether there is a duty to monitor investments that are made because of fiduciary recommendations to retirement investors. |

|||

|

|||

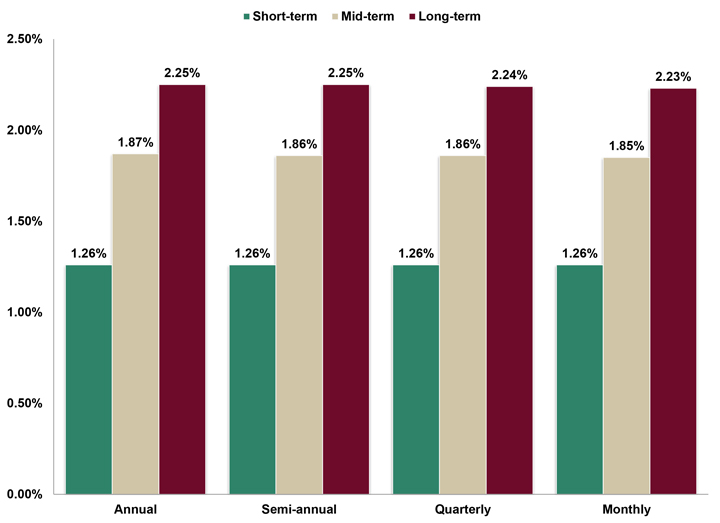

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for April is: 2.2%Break down: |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

A Tax that Impacts Very Few |

|||

|

Source: Internal Revenue Service (IRS) 3,382,000 Americans died in 2020 or 9,240 a day. But of that 2020 death total, just 1,275 Americans paid federal estate taxes in 2020, down from 139,000 in 1976. |

|||

|

|||

Bad Guess |

|||

|

Source: Congressional Budget Office (CBO) As part of a 10-year budget projection made by the Congressional Budget Office in January 2012 (i.e., 10 years ago), our national debt, which was $15.223 trillion as of 12/31/2011, was forecasted to reach $21.665 trillion as of 9/30/2022. Our actual national debt is $30.036 trillion as of 2/10/2022. |

|||

|

|||

Forty Years |

|||

|

Source: Department of Labor Inflation, as measured by the Consumer Price Index, was up +7.48% year-over-year as of 1/31/2022, the highest annual rate recorded in the US since February 1982 when year-over-year inflation was up +7.62%. Just 1-year ago (1/31/2021), year-over-year inflation was up +1.40%. |

|||

|

|||

International Transactions |

|||

|

Source: SWIFT The Society for Worldwide Interbank Financial Telecommunications (SWIFT) was formed 49 years ago in 1973. The non-profit cooperative formed by European bankers operates worldwide in 193 countries and electronically moves transactions between 11,000 financial institutions. |

|||

|

|||

RECOMMENDED READING |

|||

The Peak 65 Generation |

|||

|

Jason J. Fichtner, Ph.D., Vice President & Chief Economist, Bipartisan Policy Center (BPC) The Alliance for Lifetime Income recently published a new economic report about the “Peak 65 Generation” you might be interested in. Peak 65 is a term used to describe the point in time when more Americans will turn age 65 than at any point in history. This will occur in 2024. This fast-approaching milestone requires the urgent attention and collective action of retirement security stakeholders, including policymakers, the financial services industry, employers, and consumers themselves. The report also focuses attention on a looming retirement income crisis in America, which has been dramatically accelerated by the huge increase in Americans retiring prematurely—due to layoffs or by choice—because of the COVID-19 pandemic. |

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

The Advisor’s Guide to IRAs |

|||

|

|||

B.E.S.T. CE PROGRAMS |

|||

Online CE Courses |

|||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP®, CIMA®, CPWA®, and RMA®). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

Virtual Super CE Events |

|||

|

We provide advisors with:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-hour Live Webinar |

|||

“Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP Professionals”

|

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (B.E.S.T.), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. B.E.S.T. is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of B.E.S.T.. THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||