ADVISOR NEWS INSIGHT |

||

|

News • AFRs • Recommended • Tools • Requirements • Featured • CE |

||

| ||

Industry News |

||

IRA Planning |

||

|

Ed Slott: New IRS Guidance Clarifies 2023 RMDs New guidance issued by the Internal Revenue Service gives IRA providers until April 28 to notify IRA owners who will turn 72 in 2023 that they do not have a required minimum distribution this year, according to Ed Slott of Ed Slott & Co. The Setting Every Community Up for Retirement Enhancement (Secure) 2.0 Act, signed into law by President Joe Biden as part of a spending bill on Dec. 29, 2022, raised the age at which RMDs must start, beginning this year. (Melanie Waddell, Washington Bureau Chief, Investment Advisory Group, 3/20/23) |

||

|

Groom Law Group: SECURE 2.0 Guidance — IRA Reporting Relief for 2023 RMDs SECURE 2.0 followed in the footsteps of the Setting Every Community Up for Retirement Enhancement Act of 2019 (“SECURE Act”) to further delay the required beginning date for required minimum distributions (“RMDs”), and IRA providers have been waiting for the IRS to issue guidance on statements that they were required to issue to IRA owners regarding the need to take 2023 RMDs. (Groom Law Group, 3/15/23) |

||

|

IR-2023-43: IRS Reminder to Many Retirees: Last Day to Start Taking Money Out of IRAs and 401(k)s is April 1 The Internal Revenue Service today reminded retirees who turned 72 during 2022 that, in most cases, Sunday, April 1, 2023, is the last day to begin receiving payments from Individual Retirement Arrangements (IRAs), 401(k)s and similar workplace retirement plans. (IRS, 3/9/2023) |

||

Life Insurance Planning |

||

|

The Policygenius Life Insurance Price Index March 2023 Life insurance rates remain steady in March according to the Policygenius Life Insurance Price Index (PLIPI). While rates saw a slight increase of 1% in February, the average monthly cost of life insurance went up just 0.09% — or 3 cents — this month, essentially remaining unchanged. Compared to the same period last year, the cost of life insurance went up by 0.42% — a negligible average increase of 30 cents per month. (Antonio Ruiz-Camacho, Associate SEO Content Director, Policygenius, 3/1/23) |

||

Retirement Planning |

||

|

Fidelity Research: America’s Retirement Preparedness Level Declines Amid Continued Volatility With each passing year, Americans are getting less ready for the future. That’s the unsettling conclusion of a new study by Fidelity, which found that U.S. adults are less prepared for retirement now than they were three years ago. According to the asset management, brokerage and custodial giant, the average American is on track to have only 78% of the income they’ll need in their post-work years — down from 83% in January 2020. (FMR LLC., 3/21/23) |

||

|

IRS: Retirement Plan and IRA Required Minimum Distribution FAQs Required Minimum Distributions (RMDs) are minimum amounts you must withdraw from your IRA or retirement plan

account when you reach age 72. Beginning in 2023, the SECURE 2.0 Act changes the age RMDs must begin to age 73

for taxpayers that reach age 72 after December 31, 2022. |

||

|

It’s No Longer Your Parents’ Retirement How workers’ need for lifetime-guaranteed income may drive more Americans to consider annuities. The goal of a successful retirement is to have enough guaranteed income to cover basic living expenses and not have to worry about running out of money for the rest of your life. According to recent LIMRA research, workers today do not feel that their households will receive enough lifetime-guaranteed income to cover basic living expenses throughout retirement. (LIMRA, 2/7/23) |

||

|

Pre-Retirees Less Confident Their Retirement Income Will Last to Age 90 Confidence among pre-retirees that they will receive enough income from all their accumulated retirement sources to cover basic living expenses throughout retirement has dropped in four of the last five years. In a new research article, LIMRA raised concerns about the ability of future retirees to cover their basic living expenses in retirement if they cannot secure more sources for lifetime-guaranteed income. (Noah Zuss, Reporter, PLANSPONSOR, 2/13/23) |

||

|

What’s a Safe Withdrawal Rate Today? The safe withdrawal rate is now 3.3%, writes Morningstar Director of Personal Finance Christine Benz. But she adds that retirees could withdraw as much as 5% a year if they obey certain rules and accept certain risks. (Christine Benz, Director of Personal Finance and Retirement Planning, and John Rekenthaler, Director of Research, Morningstar, 12/13/22) |

||

Social Security Planning |

||

|

How to reverse course on collecting Social Security So, what course of action can a practitioner recommend to a client who jumped on the early retirement bandwagon, began collecting Social Security before reaching full retirement age or the age 70 delayed-retirement date, and then looks around and decides he or she would have been better off postponing retirement and receiving a bigger monthly Social Security check down the road? (Barbara Bryniarski, Executive Editor, Parker Tax Publishing, 3/21/23) |

||

Tax Planning |

||

|

Treasury Releases Greenbook On Tax Proposals in Biden’s FY 2024 Budget General Explanations of the Administration’s Fiscal Year 2024 Revenue Proposals with links to the Greenbook and articles on the Budget. (Paul L. Caron, Duane and Kelly Roberts Dean and Professor of Law, Pepperdine Caruso School of Law, 3/13/23) |

||

Practice Management |

||

|

6 Ways to Make Yourself More Valuable to Clients Volatile markets can leave investors worried and confused — and reaching for the phone or email to touch base with their financial advisors for guidance and reassurance. How can advisors maximize and demonstrate their value to clients amid the market turmoil? (Dinah Wisenberg Brin, Reporter & Independent Personal Finance Writer, 3/22/23) |

||

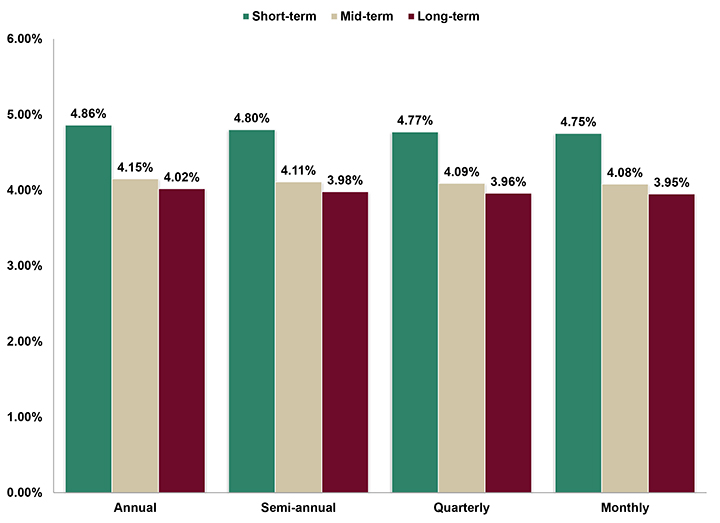

Assumed Federal Rates (AFRs) |

||

§7520 Rate for April is: 5.00% |

||

|

||

|

||

Recommended Reading |

||

|

||

|

||

Advisor Tools |

||

2023 Federal Income Tax Guide |

||

|

Our Tax Guide contains tax information such as:

|

||

2023 Social Security & Medicare Reference Guide |

||

|

Our Reference Guide contains information such as:

|

||

Financial / Insurance Calculators & Websites |

||

|

An extensive list of online calculators and informational websites. Explore list |

||

Requirement Updates |

||

State Updates |

||

|

View updates by state, CE requirements and more. View updates |

||

Featured Course |

||

Small Business Retirement Plans and

|

||

|

||

B.E.S.T. CE Online CE |

||

Meet Your CE Requirements

|

||

|

Our online CE courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP®, CIMA®, CPWA®, and RMA®). They are also specifically designed for quick completion and include:

|

||

|

||

Disclaimer |

||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (B.E.S.T.), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. B.E.S.T. is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of B.E.S.T. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES

ONLY AND |

||

Information |

||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||

Services |

||

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

||

|

*Unsubscribing? (removed from our mailing list) Please allow one (1) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||