Advisor News Insight |

||

|

News • AFRs • Website • Tools • Requirements • Featured • CE |

||

|

||

INDUSTRY NEWS |

||

Estate Planning |

||

Trust Strategies for a Changing Tax LandscapeFamily offices that cater to high-net-worth and ultra-high-net-worth families face the intricate challenge of balancing estate and tax planning strategies amidst evolving tax laws. To address this, strategies like wait-and-see, standby trust and flexible trust have emerged as effective tools for managing uncertainty and optimizing wealth transfer. Here’s a detailed look at these strategies and their applications in family office planning. (Matthew F. Erskine, Managing Partner and Attorney, Erskine & Erskine, 03/17/2025) |

||

Long-Term Care Planning |

||

Opinion: Households Plan for Long-Term Care, but Those Plans May Not Reflect RealityWhile medical risks are highly uncertain and potentially expensive, much of these risks are insured by Medicare (and Medicaid for those eligible for both programs). Long-term-care risks, in contrast, are not well insured. Only 3% of all U.S. adults or 15% of those ages 65 and older have long-term-care insurance. A major finding was that people had little idea of the likelihood of needing long-term care or of the potential costs of that care. (Alicia H. Munnell, Columnist, MarketWatch, 03/12/2025) |

||

Retirement Planning |

||

As Life Expectancy Rises, Retirement Strategies LagLife expectancy is improving, but the financial services industry remains “remarkably unprepared” for retirees living longer, according to a new white paper from Dunham & Associates Investment Counsel. (Elijah Nicholson-Messmer, Data and Retirement Reporter, FinancialPlanning, 03/14/2025) |

||

Roth IRA Planning |

||

Deciphering the Rules for Roth 401(k)-To-Roth IRA RolloversMore and more 401(k) plans are making Roth employee contributions available, and employees leaving their jobs often want to roll over Roth 401(k) funds to a Roth IRA. What tax rules apply to distributions of amounts rolled over? Warning: The rules are complicated because they involve two five-year holding periods, one for the Roth 401(k) distribution and the other for the Roth IRA distribution. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 03/03/2025) |

||

Roth Conversions are the Retirement Version of ‘Buy the Dip’When stocks fall, it can be a good time to get money out of tax-deferred accounts to avoid a ticking tax time bomb When the stock market is roiling and having big dips on any given day, the standard advice is to keep your hands off your 401(k). The one caveat? When you’re contemplating a Roth conversion. (Beth Pinsker, CFP®, Personal Finance Editor and Writer, Various companies, 03/17/2025) |

||

Small Business Retirement Planning |

||

Access Gaps Remain as State-Facilitated Retirement Plans Near $2BNearly half (47%) of U.S. private sector workers still lack access to workplace retirement plans, according to Georgetown University’s Center for Retirement Initiatives. But according to a new study conducted by the Georgetown University Center for Retirement Initiatives, significant access gaps remain, as 47% of U.S. private sector full-time and part-time workers older than 18—59 million workers—lack access to employer-sponsored retirement savings plans. (Remy Samuels, Reporter, Planadviser®, 03/18/2025) |

||

Social Security Planning |

||

2026 Social Security COLA March Projection Dips After Inflation SlowsThis October, the SSA will determine the new cost-of-living-adjustment (COLA) by comparing the CPI-W data from July, August, and September of 2025 to the same data from 2024. Retirees are likely to see only a modest rise in Social Security benefits next year when the Social Security Administration (SSA) announces the 2026 cost-of-living (COLA) increase in the fall. (Donna Levalley, Retirement Writer, Kiplinger, 03/20/2025) |

||

Social Security New Rule: Overpayments Must Be Paid Back 100%. Why It MattersAs of March 27, the SSA will require beneficiaries who have been accidentally overpaid to repay 100% of the money, reversing a previous policy that allowed for only 10% recoupment. The SSA points out that the withholding rate change only applies to new overpayments related to Social Security benefits. The withholding rate for current beneficiaries with an overpayment before March 27 will not change and will continue under the current repayment terms, so no action is required. (Kathryn Pomroy, Contributor, Kiplinger , 03/11/2025) |

||

Practice Management |

||

5 Lessons for Advisors Working with High Net Worth ClientsWorking with high net worth individuals is one of the most reliable ways for financial advisors to elevate their practice. But how exactly can advisors stand out to these clients? New research published this month in the Journal of Financial Planning helps answer that question. (Elijah Nicholson-Messmer, Data and Retirement Reporter, FinancialPlanning, 03/12/2025) |

||

ASSUMED FEDERAL RATES (AFRs) |

||

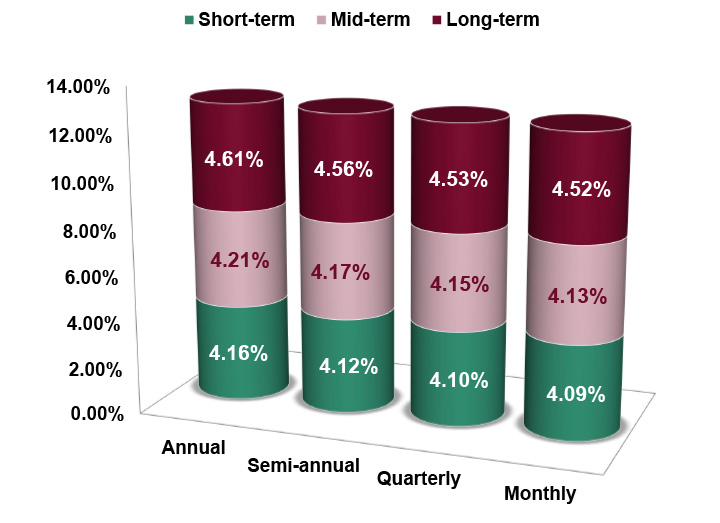

§7520 Rate for April is: 5.00% |

||

|

||

USEFUL FINANCIAL WEBSITE |

||

The UHNW InstituteInsightful Education. Actionable Ideas. Meaningful Collaboration.As a nonprofit think tank and learning exchange, The UHNW Institute is elevating the wealth management industry to a new standard so that families and their advisors can foster prosperous and meaningful relationships from one generation to the next. |

||

ADVISOR TOOLS |

||

Free 2025 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

STATE REQUIREMENT UPDATES |

||

Stay Up-to-Date on Your

|

||

FEATURED COURSE(S) |

||

CE Credits |

||

B.E.S.T. CE PROGRAMS |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, April 24, 2025 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.) Registering includes the following three web pages: (each may open in a separate window)

NOTE: Do not close any of your web pages / browsers |

||

|

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Meet Your 6-hr or 12-hr IAR CE Requirement—Online and On Your Schedule!B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit Hours | Starting at $47.95* This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs). What’s Included in the Course:

Online Exam:

Bonus Credits:

Ready to Enroll? Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence! |

||

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95* This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements. What’s Included in the Online Course:

Online Exam:

Bonus Credits:

Why Choose This Course?

Get Started Today Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go! |

||

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

DISCLAIMER |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

|

||

B.E.S.T. INFORMATION / SERVICES |

||

B.E.S.T. Links |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||