Advisor News InsightAFRs | FACTS | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

|||

|

|||

INDUSTRY NEWS |

|||

Annuity PlanningMajority of Gen X Investors Interested in Annuities, as 9 Out of 10 Retirement Investors Look for Protected IncomePrepared and distributed by Protected Lifetime Income. Inaugural Protected Retirement Income and Planning Study reveals important generational differences and increasing consumer demand for protected income. |

|||

|

|||

Charitable GivingClients are Upping Charitable Giving in the Wake of the PandemicBy Mark Schoeff Jr., Senior Reporter at InvestmentNews. Although the biggest reward of giving is psychological, the tax benefits can make doing good feel even better financially. |

|||

|

|||

Estate PlanningThe Many Sides of a GiftDistributed by Andersen Tax LLC. The tax planning environment was (and still is) incredibly favorable, with interest rates at historic lows and rapidly changing valuations on which to capitalize, creating the perfect storm of wealth transfer activity. But while tax motivations often start the conversation and are certainly one driver of wealth transfer, equal if not more important considerations are understanding and embracing donative intent and the need for succession planning, which can create a more robust, holistic, and ultimately successful wealth transfer process. |

|||

|

|||

Health Savings AccountsIRS Announces 2022 HSA and HRA LimitsThe IRS has announced the 2022 calendar year dollar limits for health savings account (“HSA”) contributions, the minimum deductible amounts and maximum out-of-pocket expenses for high deductible health plans (“HDHPs”) and the HRA excepted benefit limit. By law, these limits are indexed annually to adjust for inflation. NOTE: The HDHP out-of-pocket maximum includes in-network deductibles, copayments and coinsurance, but does not include premiums. For 2022, the HSA contribution limit for a self-only HSA is $3,650 (a $50 increase from calendar year 2021) and $7,300 for a family HSA (a $100 increase from calendar year 2021). To qualify as an HDHP in 2022, a plan must have a minimum annual deductible of at least $1,400 for self-only coverage (no change), and $2,800 for family coverage (no change). The maximum out-of-pocket expenses permitted for an HDHP is $7,050 for self-only coverage (a $50 increase) and $14,100 for family coverage (a $100 increase). The maximum for excepted benefit HRAs (see the Alert of 6/18/19) remains at $1,800. |

|||

|

|||

IRA PlanningPeter Thiel’s $5 Billion Roth IRA: Tax Pro Jeffrey Levine

|

|||

|

|||

LTC PlanningWhat Level of Long-Term Services and Support Do Retirees Need?By Anek Belbase, Anqi Chen, and Alicia H. Munnell. All of the authors are affiliated with the Center for Retirement Research at Boston College. Anek Belbase is a research fellow; Anqi Chen is a research economist and assistant director of savings research; and Alicia H. Munnell is director and the Peter F. Drucker Professor of Management Sciences at Boston College’s Carroll School of Management. The goal of this three-part series of briefs is to help retirees, their families, and policymakers better understand the likelihood that 65-year-olds — over the course of their retirement — will experience disability that seems manageable, catastrophic, or somewhere in-between. This initial brief begins by describing the risk of needing different levels of support during retirement. |

|||

|

|||

Retirement PlanningConversation Conundrum – Despite Lingering Worry, Majority of Americans are Reluctant to Discuss Retirement ConcernsResearched and distributed by Allianz Life Insurance Company of North America. Allianz Life Study identifies opportunity for financial professionals to help clients – including those already in retirement — address risks. |

|||

|

|||

Tackling Retirement RisksResearched and distributed by Merrill, A Bank of America Company. Few Americans feel very secure about retirement. In 2007, 41% of retirees said they were “very confident” about having enough money to live comfortably throughout their retirement years. By 2020, that figure had fallen to 27%. This discouraging statistic suggests an important question: What can you do to create a more secure retirement? Fortunately, there are avenues you can take to help boost your retirement finances. Doing so involves mitigating key retirement risks. |

|||

|

|||

What’s in the New SECURE Act 2.0?By Ted Godbout, Writer/Editor at American Retirement Association. New retirement bill marked up in the House Ways and Means Committee. On May 5th, 2021, the Securing a Strong Retirement Act of 2021, known as SECURE 2.0, passed unanimously out of the Ways and Means Committee. The new SECURE Act 2.0 of 2021now contains about 45 provisions, including new revenue offsets to pay for the bill. |

|||

|

|||

Social Security PlanningWhat Did You Earn At Your First Job? Social Security Can Tell YouBy Darlynda Bogle, Assistant Deputy Commissioner at the Social Security Administration. Ever wonder what you earned the year you worked your first job? Or perhaps any other year you worked? We can tell you. Your earnings history is a record of your progress toward your future Social Security benefits. We keep track of your earnings so we can pay you the benefits you’ve earned over your lifetime. This is why reviewing your Social Security earnings record is so important. |

|||

|

|||

Practice ManagementWirehouses Fall Flat on Adviser Satisfaction: J.D. PowerBy Nicole Casperson, FinTech reporter for InvestmentNews. Despite payout rates and branding that suggest higher levels of support, the top brokerage firms are not meeting adviser expectations, according to a recent survey of over 3,000 advisers. |

|||

|

|||

Why Athletes Are Going BrokeBy John Hilton, Senior Editor at InsuranceNewsNet. Professional athletes encounter a lot of the financial risks and rewards that come with big-money careers. Meet pro athletes who became financial success stories in their post-playing days — as well as a few who didn’t. |

|||

|

|||

ASSUMED FEDERAL RATES (AFRs) |

|||

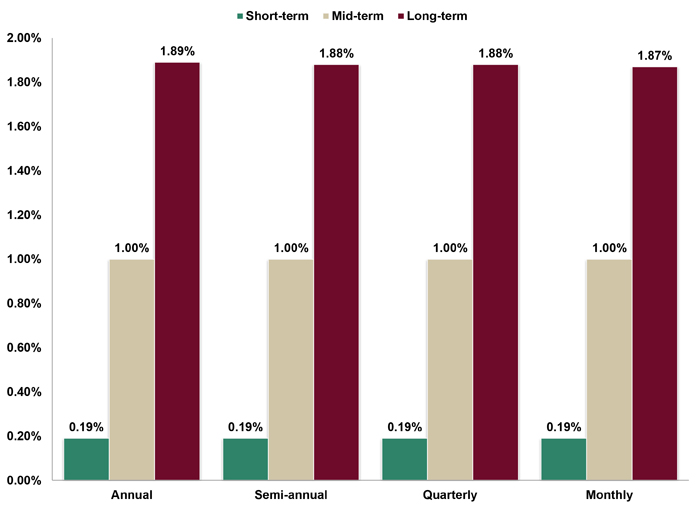

§7520 Rate for August is: 1.2%Break down: |

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Heading out of TownSource: U.S. Census Bureau Between 7/01/19 and 6/30/20, 5 of the 10 largest cities in the United States saw their populations decline–New York City, Los Angeles, Chicago, Philadelphia and San Jose. |

|||

|

|||

Honest?Source: U.S. Department of the Treasury The US government projected on Thursday 5/20/21 that an average US taxpayer pays 84% of his/her total federal income tax bill (the underpayment of taxes is largely driven by unreported income), creating an estimated $584 billion annual “tax gap,” i.e., the difference between what all taxpayers should have paid each year compared to what they actually paid. |

|||

|

|||

Joints for JabsSource: Washington Liquor and Cannabis Board Between 6/07/21 and 7/12/21, adults at least age 21in the state of Washington will receive 1 marijuana joint if they receive a COVID-19 vaccination shot. |

|||

|

|||

Keeping Up with InflationSource: Social Security Administration, U.S. Department of Labor Over the last 25 calendar years, i.e., 1996-2020, “cost of living adjustments” (COLA) for Social Security benefits has increased +68.3%. Over the last 25 calendar years, i.e., 1996-2020, inflation as measured by the “consumer price index” (CPI), has increased +69.7%. |

|||

|

|||

Once InSource: SECURE Act 2.0 Congress is debating legislation (known as SECURE Act 2.0) that would require any employer with at least 10 employees who sponsors a 401(k) plan to automatically enroll eligible employees at a 3% contribution rate. Employees would retain the right to opt out of the plan. |

|||

|

|||

Really LowSource: U.S. Department of the Treasury As of 7/9/21, the yield on the 10-year Treasury note has been below 2% for 462 consecutive trading days, i.e., since 8/01/19, the longest stretch below 2% in US history. |

|||

|

|||

RECOMMENDED READING |

|||

|

|||

|

|||

ADVISOR TOOLS |

|||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

BEST CE PROGRAMS |

|||

Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP, CIMA, CPWA, and RMA). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

Virtual Super CE EventsWe provide advisors with:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|||

|

|||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||