Advisor News Insight |

|||

|

NEWS |

AFRs |

FACTS |

RECOMMENDED

|

|||

| |||

INDUSTRY NEWS |

|||

IRA Planning |

|||

4 Tips to Avoid Rollover Problems Under New DOL RuleEd McCarthy, CFP®, RICP® Freelance Financial Writer for various publications A new rule from the Labor Department for advisors and firms working with potential client rollovers went into effect Friday. Faegre Drinker partners Fred Reish and David Porteous share insights on potential compliance problems with the new prohibited transaction exemption, PTE 2020-02. |

|||

|

|||

Long-Term Care Planning |

|||

Long-term care premium hike: Round threeLow interest rates that have hobbled insurers’ investment returns, increased longevity, and lower-than-expected lapse rates have all contributed to the repeated need to increase LTC premiums. But understanding the reasons behind a price hike doesn’t make it any easier to swallow. It’s time (again) to reassess our LTC policies and review our options. |

|||

|

|||

Retirement Planning |

|||

How Well Do Retirees Assess the Risks They Face in Retirement?Wenliang Hou, ASA, CFA, PhD (He/Him) Quantitative Analyst at Fidelity Investments Planning for retirement has always been hard, because retirees face numerous risks – including outliving their money (longevity risk), investment losses (market risk), unexpected health expenses (health risk), the unforeseen needs of family members (family risk), and even retirement benefit cuts (policy risk). The questions are:

To answer these questions, download brief. |

|||

|

|||

Should Consumers Annuitize at Normal Retirement Age?John H. Robinson, Founder and Owner of Financial Planning Hawaii and a Cofounder of Nest Egg Guru For more than a decade, researchers have been sounding the alarm that those approaching retirement face unprecedented portfolio depletion risk. Specifically, the traditional metrics applied by financial advisors to client portfolios to assess sustainability may be overly optimistic relative to the economic reality and that popular retirement spending paradigms, such as the vaunted 4% rule, put consumers at serious risk of running out of money before they run out of time. With conditions ripe for an existential threat to individually managed retirement portfolios, some researchers have suggested that consumers’ desire for financial security in retirement will be better served with annuities. |

|||

|

|||

Tax Planning |

|||

An Empirical Evaluation of Tax-Loss Harvesting AlphaAdvances in financial technology have made tax-loss harvesting strategies more feasible for retail investors. We evaluate the magnitude of this “tax alpha” using historical data from the Center for Research in Securities Prices monthly database for the 500 securities with the largest market capitalization from 1926 to 2018. Given long- and short-term capital gains tax rates of 15% and 35%, respectively we find that a tax-loss harvesting strategy yields a tax alpha of 1.10% per year from 1926 to 2018. When constrained by the wash sale rule, the tax alpha decreases from 1.10% per year to 0.85% per year. |

|||

|

|||

Buyer Beware: The Reality of Tax-Loss Harvesting BenefitsManeesh Shanbhag, Founder and Chief Investment Officer of Greenline Partners Our goal as investment advisors is to help investors cut through the noise and complexity created by our industry. Tax loss harvesting is a popular strategy that we have become well versed in, and we believe that claims that tax-loss harvesting can add 1-2% of annualized return into eternity are grossly overstated. |

|||

|

|||

The Risky Side of Tax-Loss Harvesting that Advisors

|

|||

|

|||

Practice Management |

|||

How the Wealthy Respond To InflationInflation is impacting everyone, even affluent households. According to the latest report from the Bureau of Labor Statistics, the annual inflation rate at the end of May 2022 was 8.6%, the highest level since 1981, as measured by the consumer price index. The common belief is that inflation impacts the middle and lower class more dramatically, but even wealthier households are feeling the pinch…and some of their reactions could even hurt the economy more. |

|||

|

|||

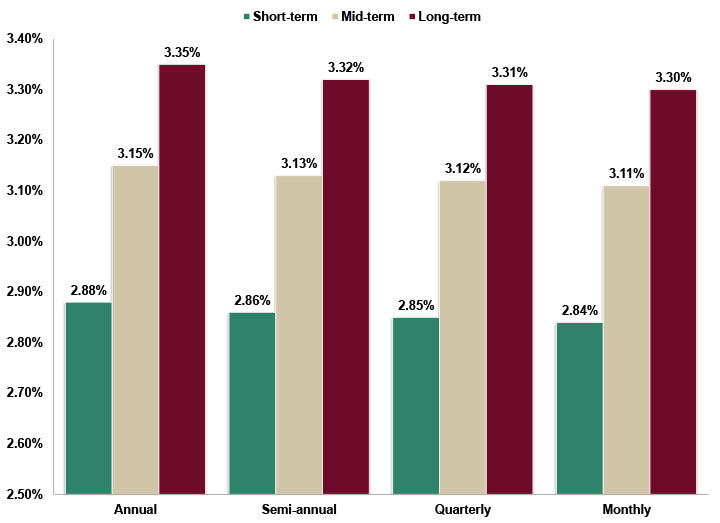

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for August is: 3.8% |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Top 10 Personal Financial Statistics for 2022 |

|||

|

Source: Capital Counselor

|

|||

|

|||

RECOMMENDED READING |

|||

WOMEN WI$E |

|||

|

|||

|

gives us tremendous freedom. On the other, it imposes a daunting responsibility.” Blayney and Fox also offer a crash course on reverse mortgages, explaining Fox’s own decision to tap her home’s equity to create a stand-by line of credit or meet unforeseen financial needs. When it comes to estate planning, the authors appeal to women’s sense of order, posing the question: “Does your estate plan leave a legacy or a mess?” They offer guidance on how to tie up financial and legal loose ends. Alexandra Armstrong, herself a legend in the financial planning profession, called “Women Wi$e” a “valuable resource for both financial planners and their female clients and belongs in every financial planner’s library.” |

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

The Advisor’s Guide to IRAs |

|||

|

Complete your CE requirement quickly and easily. This online course allows for convenient access to course material and includes: self-paced courses, unlimited retakes of review questions and final examination, instant grading, course material accessible for up to one year from date of purchase, and excellent customer support. Prices start at only $29.95. |

|||

|

|||

B.E.S.T. CE PROGRAMS |

|||

Online CE Courses |

|||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

CFP® & IWI Ethics CE 2-hour Live Webinar |

|||

“Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP Professionals”

|

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||