Advisor News Insight |

|||

|

|||

Happy Holidays & Merry Christmas |

|||

INDUSTRY NEWS |

|||

2022 Tax & Social Security GuidesOur 2022 Tax & Social Security guides are now available. Please click on a button below to download a color and/or B&W version of the guides. |

|||

2022 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2022 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Education PlanningGrandparent 529 Plans Get A Boost From New FAFSA FormBy Robert Farrington, Senior Contributor at Forbes. It’s important for parents to understand how funds in a 529 plan can affect a student’s eligibility for federal student aid — and how the owner of the account can affect the outcome. Funds held in a parent-owned 529 plan are listed as a parental asset, which hasn’t changed. Up until recently though, 529 plans owned by grandparents were held to a different standard. Funds held by grandparents did not need to be listed on the FAFSA form, but any withdrawals from them used for college expenses needed to be listed as untaxed student income in the following year. Unfortunately, this later effect has been shown to reduce student aid eligibility by up to 50%. But, here’s the good news: Recent changes to FAFSA rules will upend all of this for grandparent-held 529 accounts in the near future. |

|||

|

|||

Estate PlanningDeath Tax Is on Life Support, IRS Data ShowsBy Jacquelyne J. Mingle, Partner at Fleming & Curti PLC. Only 1,275 estate tax returns were filed in 2020, resulting in $9.3 billion in tax revenue... As recently as 2018, the amount collected was more than twice that, $20 billion, with 5,500 returns filed. |

|||

|

|||

Medicaid Planning2022 SSI and Spousal Impoverishment StandardsCMCS Informational Bulletin provides an update on the 2022 Supplemental Security Income (SSI) and Spousal Impoverishment Standards. Certain Medicaid income and resource standards are adjusted beginning each January in accordance with changes in the SSI federal benefit rate (FBR) and the Consumer Price Index (CPI). |

|||

|

|||

NAELA News 50 State Medicaid ChartThis chart from the National Academy of Elder Law Attorneys (NAELA) will serve as a valuable reference tool for advisors and attorneys to use in cross-border Medicaid planning for their clients with interests in multiple states. It provides an easy way to compare Medicaid planning strategies, eligibility limits, and common elder planning/Medicaid planning across state lines. |

|||

|

|||

Medicare PlanningMedicare Part B Premium Jumps 15%By Ricardo Alonso-Zaldivar, Health Care Reporter at the Associated Press. Remember last month when SSA announced the 2022 COLA-maybe not groundbreaking, but a nice “raise” for beneficiaries. Well, what SSA gave, Medicare takes away, with their announcement regarding the 2022 premium. Alzheimer’s drug cited as Medicare premium jumps by $21.60 explains that Medicare’s “Part B” outpatient premium will jump by $21.60 a month in 2022, one of the largest increases ever. Officials said Friday a new Alzheimer’s drug is responsible for about half of that. The increase guarantees that health care will gobble up a big chunk of the recently announced Social Security cost-of-living allowance, a boost that had worked out to $92 a month for the average retired worker, intended to help cover rising prices for gas and food that are pinching seniors. |

|||

|

|||

Retirement PlanningThe State of Retirement Income, Safe Withdrawal RatesBy various authors at Morningstar. The safe withdrawal rate is now 3.3%, writes Morningstar Director of Personal Finance Christine Benz. But she adds that retirees could withdraw as much as 5% a year if they obey certain rules and accept certain risks. |

|||

|

|||

Practice ManagementHouse Approves Financial Exploitation Prevention BillBy Ted Godbout, Writer/Editor at American Retirement Association. The House of Representatives approved bipartisan legislation last week that would give the financial industry better tools to address suspected financial exploitation of seniors. H.R. 2265 would address suspected financial exploitation and abuse of seniors by codifying an SEC “no action letter” by amending the Investment Company Act to allow a company or agent of the company to postpone a payment or redemption of security if it was reasonably believed that such redemption was requested through the financial exploitation of a security holder. |

|||

|

|||

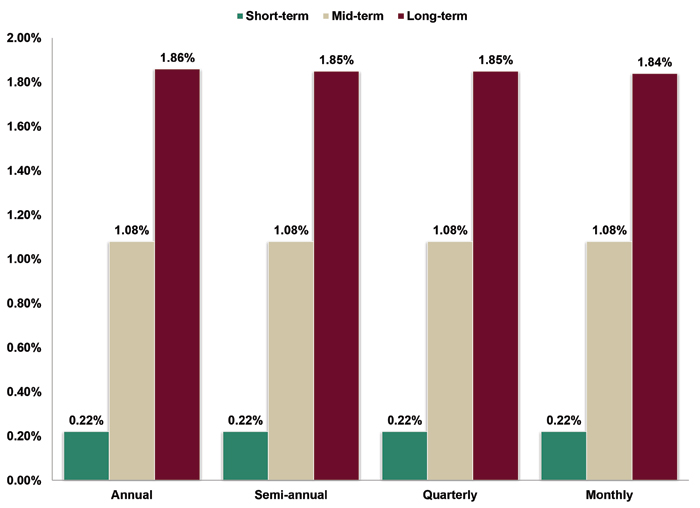

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for December is: 1.6%Break down: |

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

CheaperSource: U.S. Department of the Treasury The average interest rate that the government pays on its interest-bearing debt as of 9/30/21 was 1.605%, down from 2.492% as of 9/30/19, allowing the USA to borrow 55.3% more money today than it borrowed 2 years ago and still have the same out-of-pocket interest expense cost. |

|||

|

|||

Hitting BombsSource: PGA 61 PGA golfers averaged at least 300 yards for “driving distance” during the 2020-2021 wraparound season, topped by Bryson DeChambeau’s record setting 323.7-yard average. 20 years ago (2001), just 1 golfer (John Daly) averaged more than 300 yards per drive. |

|||

|

|||

Just Five Surplus YearsSource: U.S. Department of the Treasury The budget deficit for the United States in fiscal year 2021 (i.e., the 12 months that ended 9/30/21) was $2.772 trillion. The U.S. has run a budget deficit in 56 of the last 61 fiscal years, i.e., 1961-2021. The only surplus years were 1969, 1998, 1999, 2000 and 2001. |

|||

|

|||

May I Ask You?Source: Department of Health & Human Services The HIPPA Privacy Rule (Health Insurance Portability and Accountability Act) was enacted in 1996 or 25 years ago. HIPPA does not prohibit a business from asking an employee if they have received a COVID-19 vaccine, but it does regulate how and when a business may use or disclose information about an employee’s vaccination status. |

|||

|

|||

Same for You?Source: Federal Reserve System The total household net worth in America is up +47% in the last 4 years and is up +89% in the last 8 years. The total US household net worth was $74.8 trillion as of 6/30/13, was $96.2 trillion as of 6/30/17 and was $141.7 trillion as of 6/30/21. |

|||

|

|||

Up and DownSource: Bureau of Economic Analysis The nation’s personal savings rate, which soared during the early months of the pandemic, has now fallen back to its pre-pandemic levels. The savings rate was 7.5% in November 2019, rose to 33.8% in April 2020, and now has come back to 7.5% in September 2021. |

|||

|

|||

FEATURED COURSE |

|||

|

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2022 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

BEST CE PROGRAMS |

|||

Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP, CIMA, CPWA and RMA). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY

AND |

|||

INFORMATION |

|||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

*Unsubscribing? Please allow one (1) business day for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||