Advisor News InsightAFRs | FACTS | WEBSITE | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

|

|

|

INDUSTRY NEWS |

|

Elder PlanningConsiderations for Recognizing and Addressing Participants with Diminished CapacityThis report, produced by the Advisory Council on employee Welfare and Pension Benefit Plans, offers recommendations to mitigate risks to individuals resulting from diminished mental capacity, including potential financial exploitation. |

|

|

|

|

Top ↑ |

|

Estate PlanningHow Lady Bird Deeds Protect a Medicaid Recipient’s Home for Their Loved OnesThis article was written by the American Council on Aging. A lady bird (ladybird) deed (also called an enhanced life estate deed, lady bird trust or a transfer on death deed) is a type of life estate deed. In simple terms, a life estate is a form of co-ownership in a piece of property, and a deed is a document that legally transfers the property from one owner to another. For the purposes of Medicaid estate planning, a lady bird deed is specifically referring to one’s primary home. In explanation of what this type of deed is, it is also important to discuss the topic of a traditional, or standard, life estate deed. |

|

|

|

|

Top ↑ |

|

IRA PlanningRecharacterizing An IRA Contribution - Still In The Toolbox!This article was written by Andy Ives, CFP®, AIF® IRA Analyst at Ed Slott and Company, LLC. Roth IRA contributions can be recharacterized, Roth conversions cannot. A Roth IRA contribution can be recharacterized (changed) to a Traditional IRA contribution. The opposite is also true. A Traditional IRA contribution can be recharacterized to a Roth contribution. This can be done for any reason. As long as the recharacterization is done by October 15th of the year after the contribution, it is a perfectly acceptable transaction in the eyes of the IRS. |

|

|

|

|

Top ↑ |

|

Retirement PlanningDavid Blanchett’s 6 Predictions for Retirement Planning in 2021This article was written by David M. Blanchett, head of retirement research for Morningstar Investment Management LLC. It’s that time of the year again. Yes, it’s the holidays, but more importantly, it’s time for people to guess what’s going to happen in the new year other than failed resolutions. David Blanchett of Morningstar, has made his 6 predictions for retirement planning in 2021. |

|

|

|

Does Your Retirement Plan Guard Against the ‘Survivor Trap’?This article was written by Derek Ghia, CFP®, Managing Director at Greensview Wealth Management. Don’t let a lack of retirement planning leave your spouse vulnerable. Protect their retirement dreams from falling income and rising taxes by taking these proactive steps. |

|

|

|

How Much Taxes Will Retirees Owe on Their Retirement Income?This report was developed by Anqi Chen and Alicia H. Munnell of the Center for Retirement Research at Boston College. Four out of five retired households will pay little or no income taxes. But the tax rates at the highest income levels are meaningful, averaging 11 percent of household income and as much as 23 percent at the very top. These estimates come from a new analysis by the Center for Retirement Research that sheds light on a potentially important consideration that is often overlooked by people approaching retirement age. |

|

|

|

Nearing Retirement? Take Another Look at Roth ConversionsThis article was written by Daniel Fan, J.D., LL.M., CFP, Director of Wealth Planning at First Foundation Advisors. Some start those conversations sooner than others, but if they’re smart, by the time they’ve reached their 50s or early 60s, a married couple will have created a solid financial plan that will provide enough income to pay for the retirement lifestyle they have both been dreaming about. |

|

|

|

Retirement & Divorce: New Report Highlights What We Don’t KnowThis report was developed by United States Government Accountability Office (GAO). Each year, roughly 2 million individuals divorce in the United States. Overall, more than one-third of adults 50 or older have experienced a divorce at some point, 3 and among those adults, the divorce rate more than doubled from 1990 to 2015, according to Pew Research Center analysis of American Community Survey data. Given these trends, ensuring spouses are aware of the ability to seek access to a share of their spouse’s retirement benefits in the event of a divorce and understand how to do so is important for retirement security—particularly for women because they could be more likely to face poverty in retirement. |

|

|

|

|

Top ↑ |

|

Social Security PlanningSocial Security Benefit CalculationThis Congressional Research Service Report explains how Social Security retirement and disability benefits are calculated. Released January 19, 2021. |

|

|

|

The Growing Gap in Life Expectancy by Income: Recent Evidence and Implications for the Social Security Retirement AgeLife expectancy is a population-level measure that refers to the average number of years an individual will live. |

|

|

|

The Social Security Retirement Age (updated January 8, 2021)This Congressional Research Service report, updated on January 8, 2021, describes how the retirement age is calculated and how it affects the amount of benefits. PDF, 28 pp. |

|

|

|

|

Top ↑ |

|

Tax PlanningAnnual Guide to State Taxes in RetirementThis article was written by Justin Fitzpatrick, Co-Founder & CIO at IncomeLab. The Income Lab annual state tax guide provides retirees tips and tricks for reducing their annual state tax bills. The guide details each state’s policies that can used to save your clients a significant amount of money. |

|

|

|

Boiling Down a Biden Plan for Estate PlanningThis article was written by various authors from Bloomberg Tax. Joe Biden’s tax plan includes reversing many Tax Cuts and Jobs Act provisions and enacting provisions to narrow the income gap between lower income and wealthy Americans. |

|

|

|

IRS ups fees for private letter rulingsThis article was written by Michael Cohn, Editor-in-chief at AccountingToday.com. The Internal Revenue Service is increasing many of the fees for requests for private letter rulings by 26.7 percent, starting Feb. 4. |

|

|

|

Tax Analysts Makes Federal tax Library Available For FreeThis article was written by Paul Caron, Duane and Kelly Roberts Dean Professor of Law of Caruso School of Law. Today Deloitte Tax LLP (“Deloitte”) announced an agreement with Tax Analysts, the publisher of the Tax Notes product portfolio, to make the nonprofit’s federal tax law library available to the general public. Placing Tax Notes’ entire federal tax law library in front of a paywall is a win for tax policy transparency, as it grants the public easy access to timely information and updates on a platform that is intuitive and reliable. Tax Notes’ federal tax law library is part of an extensive suite of daily tax news, analysis, research and reference tools. As part of Deloitte Tax’s sponsorship, visitors to the site can now access details about the federal code, regulations, and other primary source documents, including the Internal Revenue Code of 1986; proposed, final and temporary regulations; rules for lawyers, accountants and others practicing before the IRS; Treasury decisions, IRS guidance, and private rulings; court and legislative documents; public comments on regulations; rate tables; and other correspondence, press releases and miscellaneous tax documents. |

|

|

|

Tax Notes Federal Tax LibrarySearchable library of federal tax law primary materials, available for free from Tax Analysts. The library includes Internal Revenue Code, Regulations, IRS rulings, court cases, selected briefs and pleadings, and legislative documents. Sponsored by Deloitte Tax, LLP. |

|

|

|

|

Top ↑ |

|

ASSUMED FEDERAL RATES (AFRs) |

|

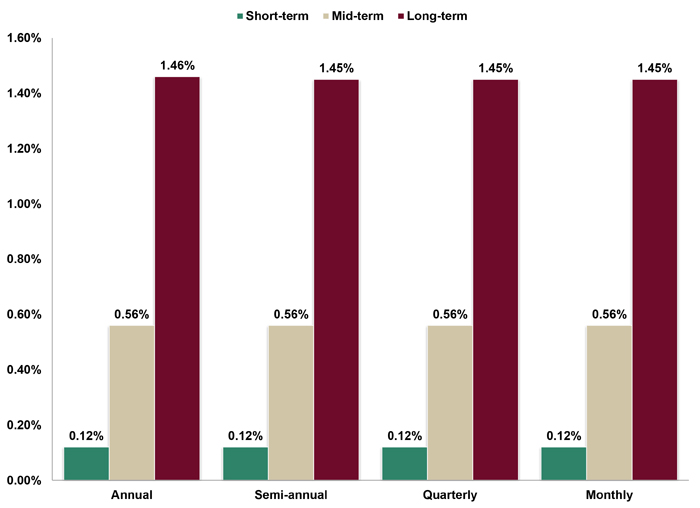

§7520 Rate for February is: 0.6%Break down: |

|

|

|

|

Top ↑ |

|

FINANCIAL FACTS OF THE MONTH |

|

Every DaySource: Government Accountability Office An estimated 10,800 Americans will turn 65 years old each day this year (2021), i.e., 1 every 8 seconds. This group represents the 11th year of 19 years of “Baby Boomers” turning age 65. An estimated 11,500 Americans will turn 65 years old each day in the year 2029. |

|

|

|

High-FlyersSource: BTN Research. The NASDAQ Composite gained +44.9% (total return) in 2020 and has gained +98.1% (total return) over the last 2 years (2019-2020), its best 2-year run since 1998- 1999. The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system. |

|

|

|

Honest?Source: Internal Revenue Service (IRS). The government projects that an average US taxpayer pays 84% of his/her total federal income tax bill (mostly driven by unreported income), creating an estimated $441 billion annual “tax gap,” i.e., the difference between what all taxpayers should have paid compared to what they actually paid. |

|

|

|

Is This You?Source: U.S. Census Bureau. 62% of the average net worth of an American household comes from just 2 assets – the equity they have built up in their home and the value of their retirement accounts. |

|

|

|

Long-TermSource: BTN Research. The S&P 500 has gained an average of +10.9% per year (total return) over the last 50 years (i.e., 1971-2020). The index has been positive in 16 of the last 18 years. Over the long-term, the S&P 500 has been up during 40 of the last 50 years, i.e., 80% of the time. |

|

|

|

|

Top ↑ |

|

OverspendingSource: U.S. Department of the Treasury. The national debt of the United States was $27.56 trillion as of the close of business on Wednesday 12/30/20, an increase of $4.36 trillion during calendar year 2020. |

|

|

|

Small Guys/Gals RuleSource: U.S. Small Business Administration – Office of Advocacy. Small American businesses, defined as having less than 500 employees, are responsible for 44% of US economic activity. |

|

|

|

Start Saving NowSource: College Board. A child born in 2020 that begins kindergarten in the fall of 2025 would attend college between the years of 2038 and 2042. If that child attended an average public in-state 4-year college and if the annual price increases for public colleges that have occurred over the last 30 years(+5.0% per year) continued into the future, the aggregate 4-year cost of the child’s college education (including tuition, fees, room & board) would be $231,779 or $57,945 per year. |

|

|

|

Take the Other Guy’s MoneySource: SurveyMonkey.com. 67% of 3,477 Americans surveyed in early November 2020 believe that federal income taxes should be raised for any taxpayer making $400,000 or more. |

|

|

|

TaxesSource: IRS. The top 3% of US taxpayers in tax year 2018 reported at least $286,106 of adjusted gross income (AGI) but paid 53% of all federal income tax. The 97% of taxpayers who reported less than $286,106 of AGI paid the remaining 47% of federal income tax that was collected in tax year 2018. |

|

|

|

Was Private, Now PublicSource: College Board. The cost of tuition, fees, room and board at an average public 4-year college for the current 2020-2021school year is $22,180. The cost of tuition, fees, room and board at an average private 4-year college for the 2000-2001school year, i.e., 20 years ago, was $22,240. |

|

|

|

|

Top ↑ |

|

USEFUL FINANCIAL WEBSITE |

|

Grow Your Client Base In 2021Advisors: Looking to effortlessly grow your client base in 2021? White Glove’s premium done-for-you service is aligned with your goals to achieve optimal results. Click below for more info. |

|

|

|

|

Top ↑ |

|

RECOMMENDED READING |

|

Life Insurance Planning and Ethical PracticesEdward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA®, CERS®, CPRC®, CPFA®, Founder, President and CEO of Broker Educational Sales & Training, Inc., (BEST) This course will provide a review of the historical evolution of life insurance and into the 21st century, examining its many forms, other types of benefits, and making it the foundation for financial planning. (This course is pending approval.) |

|

If you are currently in need of CE credit, please visit our online CE courses by clicking on the link below. |

|

|

|

|

Top ↑ |

|

ADVISOR TOOLS |

|

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|

|

Top ↑ |

|

REQUIREMENT UPDATES |

|

|

View updates by state, CE requirements and more by clicking on the link below. |

|

|

|

|

Top ↑ |

|

BEST CE |

|

BEST Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP / CIMA / CPWA / RMA). Our CE courses are specifically designed for quick completion and include:

|

|

|

|

BEST Virtual Super CE EventsWe provide advisors with:

|

|

|

|

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|

|

|

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|

|

|

|

Top ↑ |

|

DISCLAIMER |

|

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

|

|

Top ↑ |

|

BEST INFORMATION |

|

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|

|

Top ↑ |

|

SERVICES |

|

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|

*Unsubscribing? Please allow one (1) business days for removal. |

|

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|

|

Top ↑ |

|