ADVISOR NEWS INSIGHT |

|

| |

Industry News |

|

Annuity Planning |

|

|

Stop Comparing Annuity Payout Rates to the 4% Rule. David Blanchett provides a warning that advisors should not be comparing the payout rate on a nominal annuity to the 4% rule because it is incredibly misleading, they are two very different things. (David Blanchett, Managing Director and Head of Retirement Research, for PGIM DC Solutions, 1/11/23) |

|

Elder Law and Medicaid Planning |

|

|

Key Law Numbers for 2023 Here is a quick link to a reference of the figures for 2023 that are frequently used in elder law and Medicaid planning. (ElderLawNet, Inc., 1/2023) |

|

Retirement Planning |

|

|

SECURE 2.0 Act of 2022, As included in Division T of the “Consolidated Appropriations Act, 2023” For the second time in approximately three years, Congress passed broad legislation with sweeping impacts on retirement savings programs. The SECURE 2.0 Act of 2022 (SECURE 2.0) was included as part of the Consolidated Appropriations Act, 2023, which was passed by Congress on Dec. 23, 2022 and signed into law by the president on Dec. 29, 2022. (Seth J. Hanft, Partner and Christopher R. Switzer, Associate, Baker & Hostetler LLP, 1/4/23) |

|

|

SECURE 2.0 A Quick Reference Guide There are 92 provisions in the new SECURE 2.0 Act—and by at least one assessment, they are “almost universally good, with ‘good’ being defined as ‘helpful to the cause of promoting retirement security.” Group Plan Systems’ Pete Swisher and Cherisha Chapman rank the Top 10 Impact Provisions—and Top 5 new burdens. (Pete Swisher, Managing Partner and Cherisha Chapman, Fiduciary Analyst, Group Plan Systems, LLC ©, 12/23/22) |

|

|

Major SECURE 2.0 Error Puts Catch-Ups in Jeopardy The American Retirement Association (ARA) recently identified what it calls a “significant technical error” in the SECURE 2.0 Act of 2022 regarding catch-up contributions. Specifically, according to wording in the current legislation, beginning in 2024, no participants will be able to make catch-up contributions (pre-tax or Roth). (John Sullivan, Chief Content Officer at the American Retirement Association, 1/24/23) |

|

|

Pocket Guide to SECURE 2.0 In a whirlwind of year-end activity, Congress has at long last succeeded in passing the SECURE 2.0 Act of 2022 (“SECURE 2.0”), with over 92 provisions this pocket guide will help you key in on specific provisions and their effective dates. (Jennifer Rigterink, Alexis Rosett, Heather Monte, Proskauer, 1/11/23) |

|

Social Security Planning |

|

|

Kotlikoff: Don’t Let Social Security Dupe Your Clients Into Claiming Early Typical workers’ lifetime spending could increase by 10.4% if they simply waited until age 70 to start Social Security benefits. But, according to a new study, “How Much Lifetime Social Security Benefits Are Americans Leaving on the Table?” only 10.2% of Americans do so. This means a median loss of “lifetime discretionary spending of $182,370.” To put it bluntly, “You’re giving up eight years of benefits if you take Social Security at age 62,” argues Boston University economics professor Lawrence Kotlikoff. “Your real retirement benefits starting at 70 will be 76% higher through your last year of life, which could be 100.” (Jane Wollman Rusoff, Contributing Editor, ThinkAdvisor, 12/15/22) |

|

|

Why Clients Shouldn’t Claim Social Security Early to Protect Portfolios Postponing Social Security benefits beyond full retirement age is a more effective way to accumulate wealth than claiming early to avoid pulling money out of the market, according to a paper by Wade Pfau and Steve Parrish. Holding off on claiming Social Security benefits also reduces the odds of running out of income in retirement and potentially increases the amount of wealth that can be left to heirs at death. (John Manganaro, Senior Reporter, ThinkAdvisor, 1/9/23) |

|

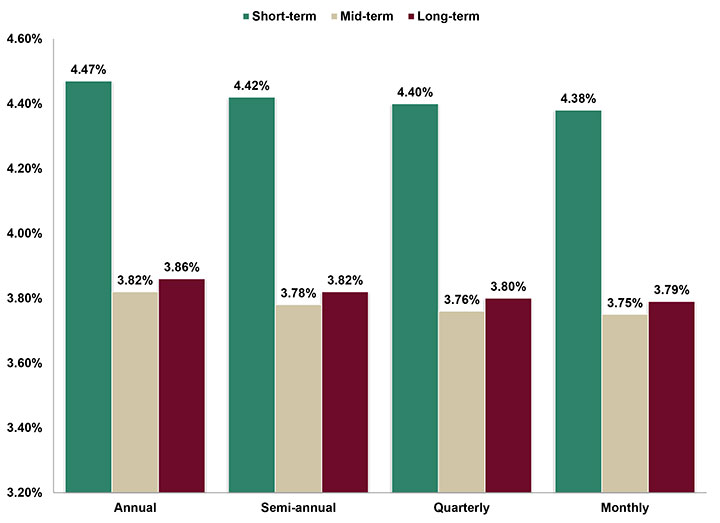

Assumed Federal Rates (AFRs) |

|

§7520 Rate for February is: 4.60% |

|

|

|

|

|

Advisor Tools |

|

2023 Federal Income Tax Guide |

|

|

Our Tax Guide contains tax information such as:

|

|

2023 Social Security & Medicare Reference Guide |

|

|

Our Reference Guide contains information such as:

|

|

Financial / Insurance Calculators & Websites |

|

|

An extensive list of online calculators and informational websites. Explore list |

|

Requirement Updates |

|

State Updates |

|

|

View updates by state, CE requirements and more. View updates |

|

Featured Course |

|

The Advisors Guide to

|

|

|

|

B.E.S.T. CE Online CE |

|

Meet Your CE Requirements

|

|

|

Our online CE courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP®, CIMA®, CPWA®, and RMA®). They are also specifically designed for quick completion and include:

|

|

|

|

Save 20% Off Your Online CE Purchase |

|

|

Simply order courses and enter Promo Code: CENOW in the “Enter promotion code (optional)” input box located on the shopping cart page. (Promo code ONLY valid at time of purchase. Code cannot be combined and expires on 02/28/2023.) |

|

|

|

Disclaimer |

|

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (B.E.S.T.), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. B.E.S.T. is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of B.E.S.T. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES

ONLY AND |

|

Information |

|

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|

Services |

|

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

|

|

*Unsubscribing? Please allow one (1) business days for removal. |

|

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|