Advisor News Insight |

|||

|

|||

THANK YOU |

|||

Thank you for your business in 2020. It has been a pleasure helping you reach your goals, and we look forward to working with you again in the new year. We at BEST wish all of you and your families a prosperous and wonderful 2021! |

|||

INDUSTRY NEWS |

|||

Charitable GivingCOVID relief 2.0 Could Offer Some Donors a Bigger Charitable Tax DeductionThis article was prepared and distributed by Don’t Mess With Taxes®. The Senate measure being promoted by Majority Leader Mitch McConnell (R-Kentucky) would expand the tax deduction that filers who don’t itemize could claim on their 2020 tax returns. Under the Coronavirus Aid, Relief and Economic Security (CARES) Act enacted in late March, filers who choose to use the standard deduction could claim up to $300 in cash donations (which, under Internal Revenue Service rules, include gifts via credit card) to qualified charities. This would reduce the taxpayers’ gross income, thereby reducing the amount of taxable income and, if things go as planned, their eventual tax bills. |

|||

|

|||

Charitable PlanningIRS Reminds Taxpayers of Special $300 Charitable Deduction for Non-ItemizersThis provision prepared and distributed by the Internal Revenue Service (IRS). The Internal Revenue Service today reminded taxpayers of a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year. Following special tax law changes made earlier this year, cash donations of up to $300 made before December 31, 2020, are now deductible when people file their taxes in 2021. |

|||

|

|||

|

Top ↑ |

|||

Estate PlanningBob Dylan’s tax planning could be tangled up in…green?This article was written by Ed Slott, CPA President of Ed Slott and Company, LLC. Bob Dylan has sold his immense collection of songs. The financial details were not disclosed, but most commentators estimate the deal is worth hundreds of millions of dollars. Dylan may have had his eye specifically on year-end tax planning as an added incentive here since he was able to lock-in today’s low tax rates. Even on this kind of gigantic capital gain, the top federal tax bill will only be 23.8% (the 20% long-term capital gain rate plus the 3.8% tax on net investment income = 23.8%), plus any applicable state income taxes. |

|||

|

|||

|

Top ↑ |

|||

Heath Care PlanningCMS Office of the Actuary Releases 2019 National Health ExpendituresTotal national healthcare spending in 2019 grew 4.6%, which was similar to the 4.7% growth in 2018 and the average annual growth since 2016 of 4.5%, according to a study conducted by the Office of the Actuary at the Centers for Medicare & Medicaid Services (CMS) and published today ahead of print by Health Affairs. |

|||

|

|||

|

Top ↑ |

|||

Incapacitation PlanningThe Tool Kit for Health Care Advance PlanningThis Tool Kit was prepared and distributed by the American Bar Association. Good advance planning for health care decisions is, in reality, a continuing conversation—about values, priorities, the meaning of one’s life, and quality of life, especially under the present COVID-19 Pandemic. To help you in this process, this tool kit from the ABA contains a variety of self-help worksheets, suggestions, and resources. There are 8 tools in all, each clearly labeled and user-friendly. The tool kit does not create a formal advance directive for you. Instead, it helps you do the much harder job of discovering, clarifying, and communicating what is important to you in the face of serious illness. |

|||

|

|||

|

Top ↑ |

|||

IRA PlanningDubious Multi-Layered CRD Tax StrategyThis article was written by Andy Ives, CFP®, AIF® and IRA Analyst at Ed Slott and Company, LLC. Recently we became aware of a multi-layered tax strategy that we think is a bridge too far when it comes to Coronavirus-related distributions (CRDs). In fact, it may even be outright tax fraud. |

|||

|

|||

|

Top ↑ |

|||

Medicare & Medicaid Planning2021 Spousal Impoverishment and Home Equity Figures ReleasedThis report was prepared by the CMS. The Centers for Medicare and Medicaid Services (CMS) has released its Spousal Impoverishment Standards for 2021. |

|||

|

|||

How the Hold Harmless Provision Protects Your BenefitsThis article was written by Darlynda Bogle, Assistant Deputy Commissioner, Social Security Administration (SSA). Social Security works together with the Centers for Medicare & Medicaid Services to make sure you won’t have a reduction in your Social Security benefits as a result of Medicare Part B premium increases. A special rule called the “hold harmless provision” protects your Social Security benefit payment from decreasing due to an increase in the Medicare Part B premium. The Part B base premium for 2021 is $148.50, which is $3.90 higher than the 2020 base premium. |

|||

|

|||

|

Top ↑ |

|||

Retirement PlanningLabor Department Unveils Final Fiduciary RuleThe Labor Department finalized its exemption that is widely seen as a replacement to the agency’s now-defunct 2016 fiduciary rule. The final rule effectively replaces a reactivated 1975 rule, which states that a person who provides investment advice for a fee and meets the criteria of a five-part test is considered a fiduciary under the Employee Retirement Income Security Act. |

|||

|

|||

Lifetime Income to Support Longer LifeRetirement Innovation and the New Age of LongevityThis study was developed by The Longevity Project in collaboration with the Principal Financial Group. The average American turning age 65 today can expect to live 40% longer than someone who turned 65 in 1950. Further, the number of Americans retiring every day has more than doubled over the last 20 years. Regardless, only 7 percent of retirees and pre-retirees are counting on annuities to be an important part of their retirement portfolio, according to a new study from Principal Financial Group and the Stanford Center on Longevity. |

|||

|

|||

|

Top ↑ |

|||

Social Security PlanningHow to Fix Social SecurityThis report was prepared and distributed by the Urban Institute. Two competing Congressional proposals illustrate opposing strategies for eliminating the program’s long-term financing gap. A plan from Representative John Larson (D-CT) achieves solvency by raising revenue; former representative Sam Johnson (R-TX) gets there by cutting costs. How would these proposals affect workers, beneficiaries, and the program’s finances? |

|||

|

|||

|

Top ↑ |

|||

Tax PlanningIRS Issues Scam Alert with Approach of Holidays and Tax SeasonWarnings issued by the IRS. The IRS and the Security Summit partners issued warnings to all taxpayers and tax professionals to beware of scams and identity theft schemes by criminals taking advantage of the combination of holiday shopping, the approaching tax season, and Coronavirus concerns. |

|||

|

|||

|

Top ↑ |

|||

Practice ManagementElder Investment Fraud and Financial Exploitation: Checklist for LawyersThis checklist was developed as part of a collaboration. (see below) This checklist was developed as part of the Elder Investment Fraud and Financial Exploitation Prevention Program (EIFFE Legal) in collaboration between the American Bar Association Commission on Law and Aging and the Investor Protection Trust. (March 2020). Financial Advisors should review. |

|||

|

|||

|

Top ↑ |

|||

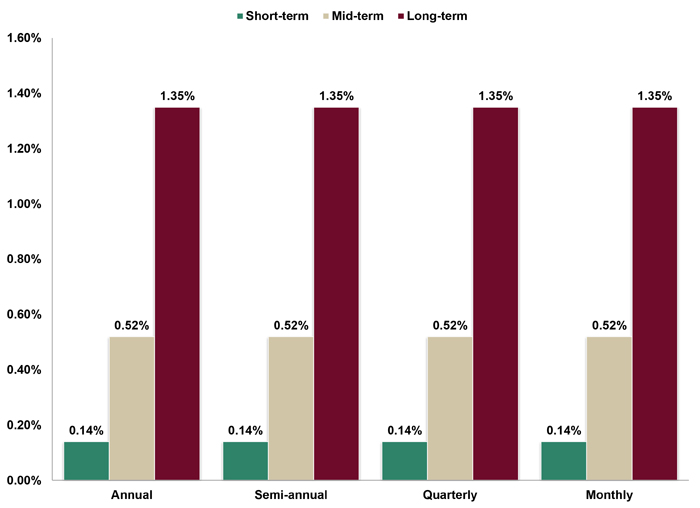

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for January is: 0.6%Break down: |

|||

|

|||

|

Top ↑ |

|||

FINANCIAL FACTS OF THE MONTH |

|||

During a PandemicSource: National Association of Realtors®. The median sales price of existing homes sold in the United States was $313,000 in October 2020, an all-time record both on a nominal basis (i.e., not adjusted for inflation) and on an inflation-adjusted basis. |

|||

|

|||

Less TaxesSource: Internal Revenue Service (IRS). $250,000 of taxable income on a joint return in 2020 creates $48,159 of federal income tax. $250,000 of taxable income on a joint return in 2010 created $60,281 of federal income tax. |

|||

|

|||

TaxesSource: IRS. To take deductions on Form 1040, a taxpayer can use the “standard deduction” or the taxpayer can “itemize deductions” if the latter is greater than the former. The “standard deduction” will be $25,100 for married couples filing jointly and $12,550 for individuals in 2021. Please consult a tax expert for details. |

|||

|

|||

We Were in a War ThenSource: Office of Management and Budget (OMB). The US budget deficit for fiscal year 2020, i.e., the 12 months ending 9/30/20, was $3.1 trillion or 15.2% of the size of the US economy. That’s the largest “debt-to-GDP” ratio since the measurement reached 21.0% in 1945 or 75 years ago. |

|||

|

|||

Work from HomeSource: Stanford Institute for Economic Policy Research. 65% of Americans surveyed in late June 2020 have internet capabilities that are fast enough to support workable video conferencing. |

|||

|

|||

|

Top ↑ |

|||

USEFUL FINANCIAL WEBSITE |

|||

Connect with Prospects (Virtually!)Source: White Glove. Google searches for ‘financial advice,’ ‘financial advisor’ and ‘webinars’ are at an all-time high. It’s clear that people need guidance on essential topics more than ever...but how does an advisor or an estate planning attorney go about connecting with prospects in the middle of a pandemic? This is where White Glove Virtual Seminars come in. Their done-for-you, pay-per-attendee solution arms financial advisors and other service professionals with everything they need to connect with prospects, educate the public and solidify themselves as thought leaders in their communities while abiding by social distancing regulations...all from their laptops. For a limited time, first-time users can take advantage of $500 off their first Virtual Seminar. Visit their website and call the Virtual Seminars contact number on the homepage to learn more. |

|||

|

|||

|

Top ↑ |

|||

ADVISOR TOOLS |

|||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|||

|

Top ↑ |

|||

REQUIREMENT UPDATES |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

|

Top ↑ |

|||

BEST CE |

|||

BEST Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP / CIMA / CPWA / RMA). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

BEST Virtual Super CE EventsWe provide advisors with:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|||

|

|||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|||

|

|||

|

Top ↑ |

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

|||

|

Top ↑ |

|||

BEST INFORMATION |

|||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

|

Top ↑ |

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||

|

Top ↑ |

|||