ADVISOR NEWS INSIGHT |

|

| |

|

Wow, it’s another year! Happy New Year! I wanted to thank you for your continued support for receiving the B.E.S.T. monthly newsletter. For the past 12 years, the B.E.S.T. monthly newsletter has been sent out to over 65,000 financial and insurance professionals from across the country. The purpose of the newsletter is to provide you, the financial/insurance professional, with what I believe to be pertinent articles, white papers, posts, podcasts, web links, and books, that I have read and reviewed, to assist you in providing the most competent and professional services to your clients. I certainly hope I have achieved that goal and look forward to providing those services to you in 2023. So once again, I thank you and wish you and your families a safe, happy, healthy, and prosperous New Year! Edward J. Barrett CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC® CPFA®, CEPA®, AIF®, Founder, President, and CEO. |

|

Industry News |

|

Retirement Planning |

|

|

Biden Signs $1.7T Spending Bill, Brings SECURE 2.0 to Life President Joe Biden signed the bill that includes the Setting Every Community Up for Retirement Enhancement (Secure) 2.0 Act of 2022, on Thursday, December 29, 2022. The main part of the bill that carried the Secure 2.0 legislation through Congress, H.R. 2617, provides the funding needed to keep many parts of the federal government running. The Secure 2.0 section includes sections that could lead to big changes for financial advisors, retirement plan sponsors, retirement plan administrations and life insurance agents who sell annuities. (Allison Bell, Insurance Editor, ThinkAdvisor, 12/30/22) Read more

| Download Act

|

|

|

KPMG has provided a detailed description of specific provisions in the SECURE Act 2.0

|

|

|

Morningstar Advises 3.8% “Safe” Withdrawal Rate, Balanced Portfolio Morningstar increased its recommended withdrawal rate for retirees from last year and continues to see best outcomes for participants in both bonds and stocks. For retirees who seek a fixed real withdrawal from their portfolio in retirement, a starting withdrawal rate of 3.8% is safe in Morningstar’s model over a 30-year time horizon, assuming a 90% success rate (defined here as a 90% likelihood of not running out of funds) and a balanced portfolio. That is appreciably higher than the 2021 figure, which was 3.3% for a balanced portfolio with a 90% success rate. (Morningstar, Inc., December 2022) |

|

|

SECURE ACT 2.0 Brings a Litany of Retirement Changes This article from the Wagner Law Group highlights some of the key provisions organized by the same headings used in the Act. (Roberta Watson, Partner, Barry Salkin, of Counsel and Alexander Olsen, Partner, The Wagner Law Group, 12/29/22) |

|

Social Security Planning |

|

|

How Much Lifetime Social Security Benefits Are Americans Leaving On the Table? Optimizing the choice of when to claim Social Security can produce a more than 10% increase in the average worker’s lifetime income, yet few Americans appear to be making optimized claiming decisions. This is the hallmark finding in the latest paper published by the National Bureau of Economic Research, aptly titled “How Much Lifetime Social Security Benefits Are Americans Leaving On the Table?” The analysis flatly states that Americans are “notoriously bad savers,” suggesting their Social Security claiming decisions are a big reason why. (By David Altig, Laurence J. Kotlikoff, and Victor Yifan Ye, National Bureau of Economic Research, November 2022) |

|

College Planning |

|

|

Beginning Phased Implementation of the FAFSA Simplification Act (EA ID: GENERAL-21-39) The FAFSA Simplification Act, which was passed on December 27, 2020, as part of the Consolidated Appropriations Act, 2021, replaces the EFC with the Student Aid Index (SAI). This will slightly change the calculation of a student’s or family’s ability to pay for higher education. If you are working with your clients in helping them with their dependent’s college education planning here is a high-level must read overview of these changes. (Federal Student Aid, 6/11/2021) |

|

Life Insurance Planning |

|

|

ACLI 2022 Life Insurance Fact Book RECORD HIGH: nearly $200 billion in life insurance and annuity benefits provided families and retirees with financial security in 2021. (American Council of Life Insurers (ACLI), 11/28/22) |

|

|

Life Insurance Statistics, Data and Industry Trends 2022 The life insurance industry in the U.S. is vast, taking in billions of dollars in premiums each year. Here Forbes breaks life insurance statistics down into meaningful segments. (Chauncey Crail, Contributor / Advisor, Forbes Media LLC., 9/7/22) |

|

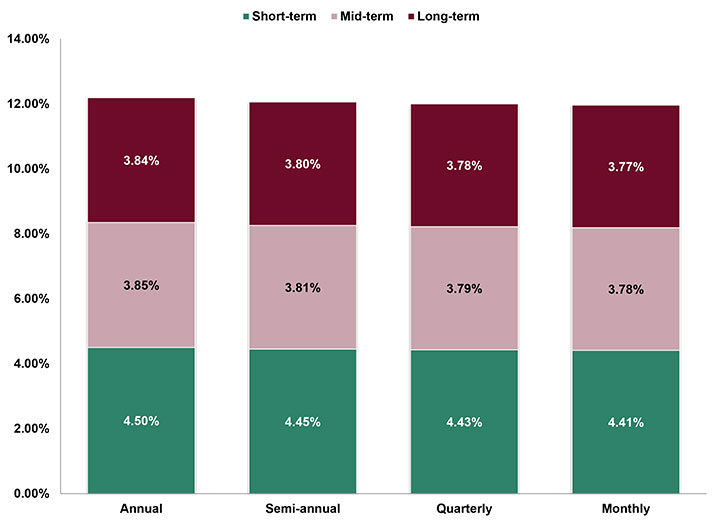

Assumed Federal Rates (AFRs) |

|

§7520 Rate for January is: 4.60% |

|

|

|

|

|

Advisor Tools |

|

2023 Federal Income Tax Guide |

|

|

Our Tax Guide contains tax information such as:

|

|

2023 Social Security & Medicare Reference Guide |

|

|

Our Reference Guide contains information such as:

|

|

Financial / Insurance Calculators & Websites |

|

|

An extensive list of online calculators and informational websites. Explore list |

|

Requirement Updates |

|

State Updates |

|

|

View updates by state, CE requirements and more. View updates |

|

Featured Course |

|

The Advisors Guide to

|

|

|

|

B.E.S.T. CE Online CE |

|

Meet Your CE Requirements

|

|

|

Our online CE courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP®, CIMA®, CPWA®, and RMA®). They are also specifically designed for quick completion and include:

|

|

|

|

Save 20% Off Your Online CE Purchase |

|

|

Simply order courses and enter Promo Code: CENOW in the “Enter promotion code (optional)” input box located on the shopping cart page. (Promo code ONLY valid at time of purchase. Code cannot be combined and expires on 01/31/2023.) |

|

|

|

Disclaimer |

|

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (B.E.S.T.), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. B.E.S.T. is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of B.E.S.T. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES

ONLY AND |

|

Information |

|

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|

Services |

|

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

|

|

*Unsubscribing? Please allow one (1) business days for removal. |

|

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|