Advisor News InsightAFRs | FACTS | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

||

|

||

INDUSTRY NEWS |

||

Charitable PlanningSenate Bill Proposes Dramatic Changes for Donor Advised Funds and Private FoundationsThis article was written by Dahlia B. Doumar, Partner, Robin Krause, Partner, Tanvi Mirani, Associate, and Justin Zaremby, Associate at Patterson Belknap Webb & Tyler LLP. On June 9, 2021, United States Senators Angus King (Ind.-MA) and Charles Grassley (R-IA) announced plans to introduce the “Accelerating Charitable Efforts Act” or the “ACE Act” (the “Act”) which, if adopted, would implement significant changes with respect to the rules surrounding donor advised funds (“DAFs”) and private foundations. The proposed changes, already being hotly debated in the philanthropic community, would, among other things, mandate operational changes for DAF sponsoring organizations and offer financial incentives (in the form of both excise taxes and tax relief) to motivate donors, sponsoring organizations, and private foundations to distribute funds to public charities at a rapid pace. |

||

|

||

IRA Planning10-Year Rule: Beneficiary Planning “Loophole” ClosedThis article was written by Andy Ives, CFP®, AIF®, IRA Analyst at Ed Slott and Company, LLC. With the passage of the SECURE Act, once common IRA beneficiary planning strategies have been upended. For example, no longer can just anyone stretch payments on an inherited IRA. You must qualify as an “eligible designated beneficiary” (EDB) to stretch using your single life expectancy. As we have written many times, EDBs include surviving spouses, minor children of the account owner (up to majority, or if still in school, up to age 26), disabled and chronically ill individuals, and individuals not more than 10 years younger than the IRA owner. |

||

|

||

Beneficiary Distribution Options for 2021 Traditional IRAs and Roth IRAs (Generalized Summary)The chart was taken from the 2021 Supplement to the 9th Edition of the Roth IRA Answer Book (Wolters Kluwer, 2021). Detailed 2-page chart showing distribution options in 2021 for various kinds of beneficiaries (a surviving spouse who is the sole primary beneficiary, other named individuals, a trust, etc.) under a traditional or Roth IRA, and how they are affected by the IRA owner’s date of death. |

||

|

||

When and for Whom are Roth Conversions Most Beneficial? A New Set of Guidelines, Cautions and CaveatsThis article was written by Edward McQuarrie, Professor Emeritus in the Leavey School of Business at Santa Clara University. Much has changed since penalty-free Roth conversions were inaugurated in 2010. Tax rates have gone up and down. The re-characterization provision went away. Heirs can no longer stretch out inherited Roth accounts over a lifetime. Medicare surcharges were expanded and began to adjust for inflation. The age to begin Required Minimum Distributions was pushed out to age 72 and the IRS changed the RMD divisor tables to further slow the pace of distribution. Given these developments it seemed worthwhile to re-examine the rationale for Roth conversions. |

||

|

||

Long Term Care PlanningWashingtonians for a Responsible Future, Long-Term Care Trust Act Fact SheetResearched and distributed by Washingtonians for a Responsible Future. Washington State has approved the nation’s first publicly-funded long-term care insurance program. The measure, called the Long-Term Care Trust Act, would provide a maximum benefit of $36,500 for people who need assistance with at least three activities of daily living (ADLs) such as bathing, toileting, transferring, dressing, or eating. It would be funded with a payroll tax (or what supporters call a premium) of 0.58 percent of wages starting in 2022. The money would go into a trust fund so it could not be spent on other programs. |

||

|

||

Medicare & Medicaid PlanningCMCS Informational BulletinThe Centers for Medicare & Medicaid Services (CMS) released a Medicaid Informational Bulletin with the updated 2021 Supplemental Security Income (SSI) and Spousal Impoverishment Standards. |

||

|

||

Retirement PlanningHow America Saves 2021, 20th EditionPrepared and distributed by The Vanguard Group, Inc. In this 20th annual survey of its own 1,700 retirement plans and 4.7 million participants, the full-service plan provider and fund giant offers a detailed snapshot of plan design and participant behavior. |

||

|

||

Tax PlanningGeneral Explanations of the Administration’s Fiscal Year 2022 Revenue ProposalsThe Department of the Treasury’s recent “Greenbook” of revenue proposals, taxing transfers of property into and distributions from, certain entities including partnerships. |

||

|

||

Practice Management - IRA RolloversReg BI Compliance Only Partly Covers DOL RequirementsThis article was written by Steven A. Morelli, Editor-in-Chief for InsuranceNewsNet. Broker-dealers, investment advisors and insurance distributors realize that they must prepare to comply with the Department of Labor’s investment advice guidance, but what do they need to do? |

||

|

||

ASSUMED FEDERAL RATES (AFRs) |

||

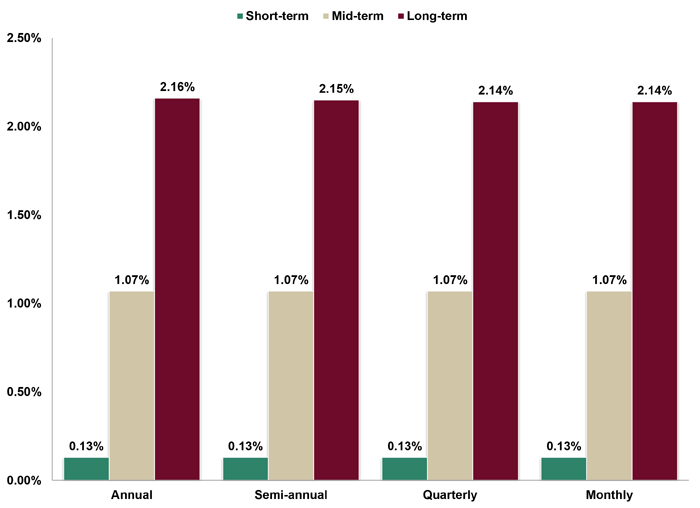

§7520 Rate for July is: 1.2%Break down: |

||

|

||

FINANCIAL FACTS OF THE MONTH |

||

Hard to Catch UpSource: BTN Research A 30-year old who is investing $500 at the beginning of every month in a tax-deferred 401(k) will accumulate $588,032 by age 60 if the funds grow at ⁺7% per year. If that individual was forced to suspend his/her monthly deferral for just 5 years from ages 35-39, he/she would have to earn ⁺8.8% per year from ages 40-60 to accumulate $588,032 by age 60. This mathematical calculation ignores the impact of taxes on the account which are due upon withdrawal, is for illustrative purposes only and is not intended to reflect any specific investment. Actual results will fluctuate with market conditions and will vary. |

||

|

||

Just Pay Your Fair ShareSource: Internal Revenue Service (IRS) A House of Representative subcommittee met on Wednesday (5/12/21) to discuss “reforming the tax code’s advantageous treatment of the wealthy.” The top 1% of US taxpayers (for tax year 2018) reported at least $540,009 of adjusted gross income (AGI), received 21% of all AGI nationwide, and paid 40% of all the federal income taxes that were collected for that tax year. |

||

|

||

Make a Quick DecisionSource: National Association of Realtors Existing homes that were sold nationwide in March 2021 were on the market on average of just 18 days (2½ weeks) before selling. |

||

|

||

Money In, a Lot More OutSource: U.S. Department of Treasury Halfway through fiscal year 2021, i.e., the 6 months ending 3/31/21, the US government has taken in $1.7 trillion of receipts (i.e., taxes), paid out $3.4 trillion of outlays (i.e., spending), resulting in a 2021 fiscal year deficit to date of $1.7 trillion with still 6 months to go in the fiscal year. Last year’s fiscal year 2020 budget deficit of $3.1 trillion is our nation’s all-time record. |

||

|

||

State MoneySource: U.S. Census Bureau The average US state receives 48% of its tax revenue from sales taxes, 41% from income taxes, 6% from license taxes, and 5% from other taxes. |

||

|

||

Tax CheatersSource: IRS The government projected in September 2019 that our nation’s “tax gap,” i.e., the difference between what all taxpayers should have paid compared to what they actually paid, was $441 billion per year. On 4/13/21, IRS Commissioner Charles Rettig testified before the Senate Finance Committee that the “tax gap” could be as high as $1 trillion annually, or more than double the previous estimate. |

||

|

||

RECOMMENDED READING |

||

|

||

|

||

ADVISOR TOOLS |

||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

||

REQUIREMENT UPDATES |

||

|

View updates by state, CE requirements and more by clicking on the link below. |

||

|

||

BEST CE PROGRAMS |

||

Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP/CIMA/CPWA/ RMA). Our CE courses are specifically designed for quick completion and include:

|

||

|

||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

||

|

||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

||

|

||

DISCLAIMER |

||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

||

INFORMATION |

||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||

SERVICES |

||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

||

*Unsubscribing? Please allow one (1) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||