Advisor News Insight |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

NEWS |

AFRs |

FACTS |

WEBSITE |

RECOMMENDED

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

INDUSTRY NEWS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Annuity Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SC and MN Have Become the 24th and the 25th States to Adopt an Annuity Sales Standards UpdateSouth Carolina and Minnesota have become the 24th and the 25th states to adopt an annuity sales standards update created by the NAIC. In Minnesota lawmakers had to make the change in their state by passing a bill, SF 4108. The bill passed 66-0 in the state Senate and 129-4 in the state House. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Estate Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Estate Planning for America’s Wealthiest InvestorsEstate planning is something that many investors avoid at all costs. Discussing what happens after someone passes away is a challenging topic for anyone. Skipping this important step in financial planning can have disastrous consequences for an investor’s estate, including those investors at the highest levels of wealth. Have the wealthiest Americans completed their estate planning? The answer may surprise you. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Where Not to Die In 2022: The Greediest Death Tax StatesAshlea Ebeling, Senior Contributor at Forbes Media, LLC In all, 17 states and the District of Columbia levy estate and/or inheritance taxes. Maryland is the outlier that levies both. If you live in one of these states—or might retire to one—pay attention. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Health Care Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Americans Dangerously Out of Touch with Retirement Healthcare CostsThe 2022 Fidelity Retiree Health Care Cost Estimate reveals Americans lowball expected costs by more than a quarter of a million dollars, meaning they will need 7x more than they expect. According to the 21st annual Retiree Health Care Cost Estimate, a 65-year-old couple retiring this year can expect to spend an average of $315,000 in healthcare and medical expenses throughout retirement, according released today by Fidelity Investments. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Health Care in Retirement Will Cost an Average of $315,000Noah Zuss, Reporter, PLANSPONSOR, at ISS Governance Fidelity Investment’s 2022 Retiree Health Care Cost Estimate increased 5% from 2021, and the figure has nearly doubled since the initial $160,000 estimate in 2002. For 2021, Fidelity’s health care cost estimate was $300,000. For 2022, Fidelity estimates that a 65-year-old couple retiring this year can expect to spend an average of $315,000 on health care costs throughout retirement. The estimates for single retirees are $150,000 for men and $165,000 for women. For single retirees, the 2021 estimate was $157,000 for women and $143,000 for men. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inflation’s Impact on Health Care Costs in RetirementRebecca Moore, Managing Editor, Special Content at Institutional Shareholder Services An analysis from HealthView Services shows how inflation dramatically increases what future retirees will have to pay for health care. The research report, “The Long-Term Impact of Short-Term Inflation,” shows that even a short period of high inflation will significantly impact retirement health care costs and budgets. Assuming that health care inflation will continue at a historical average of 1.5 to two times the Consumer Price Index over a period of one to two years, before returning to an average normalized inflation rate of around 5.9%, HealthView Services estimates that for an average 65-year-old couple, lifetime retirement health care costs will grow by an additional $85,917, for a total of $673,587. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRA Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ready for PTE 2020-02 July 1 Enforcement?Ed McCarthy, freelance writer of various publications The July 1 enforcement date for the Department of Labor’s new best-interest rollover documentation requirements has been widely publicized, but that doesn’t mean all advisers are ready. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Medicare & Medicaid Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The 2022 Supplement Security Income (SSI) and Spousal Impoverishment StandardsCenters for Medicare & Medicaid Services (CMS) The Centers for Medicare & Medicaid Services (CMS) released a CMCS Informational Bulletin with the updated 2022 Supplemental Security Income (SSI) and Spousal Impoverishment Standards. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Retirement Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ten Key Retirement Statistics & Facts for 2022By Mira Rakicevic and Medically Reviewed by Nikola Djordjevic, MD Saving for retirement may be more critical now than ever, considering the challenging times and the economic uncertainty we live in. To that end, here are 30 must-know retirement statistics and facts about retirement you should be familiar with. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Missing Middle: How Tax Incentives for Retirement Savings Leave Middle-Class Families BehindThis report from the National Institute on Retirement Security (NIRS) documents how the current tax incentives fail to promote adequate retirement security for the middle class. It considers the impact of factors including marginal tax rates, retirement plan participation, and income distribution on retirement saving levels. Finally, this research discusses potential solutions that could enhance retirement security for the many working families left behind by existing programs. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Social Security Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2022 Annual Report of the Social Security Board of TrusteesSocial Security Administration The Social Security Board of Trustees has released its annual report on the financial status of the Social Security Trust Funds. The combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance (OASI and DI) Trust Funds are projected to become depleted in 2035, one year later than projected last year, with 80 percent of benefits payable at that time. The OASI Trust Fund is projected to become depleted in 2034, one year later than last year's estimate, with 77 percent of benefits payable at that time. The DI Trust Fund asset reserves are not projected to become depleted during the 75-year projection period. Other highlights of the Trustees Report include:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Social Security’s Financial Outlook: The 2022 Update in PerspectiveAccording to Alicia Munnell, of the Center for Retirement Research at Boston College, she writes that the 2022 Trustees Report contains no real news about the overall future of the Social Security program. The Trustees did not change any of the ultimate economic or demographic assumptions, and the 75-year deficit declined only very slightly – 3.42 percent of taxable payrolls in 2022 compared to 3.54 percent in 2021 and that the trust fund depletion date moved back one year –from 2034 to 2035. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Planning |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRS Tax Tip 2022-95Tax credits and deductions can help lower the amount of tax owed. All taxpayers should begin planning now to take advantage of the credits and deductions they are eligible for when they file their 2022 federal income tax return next year. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Practice Management |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In First Reg. BI Action, SEC Hits BD Over Sales of Risky Bonds to RetireesMelanie Waddell, Washington Bureau Chief, Investment Advisory Group The Securities and Exchange Commission levied its first Regulation Best Interest enforcement action by charging registered broker-dealer Western International Securities Inc. and five of its registered reps with violating Reg BI through L Bond sales. Firms and Reps should view this case as the SEC announcement to the financial services world that it is ready, willing, and able to bring Reg. BI cases. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Re-Discovery Meeting: A Communication Strategy For Supporting And Retaining Newly Widowed ClientsMeghaan R. Lurtz, PH.D., FBS Senior Research Associate at Kitces.com Did you know that 80% of widows leave their advisor within the first two years of becoming a widow? And many reports blame this phenomenon on unsatisfactory advisor communication. As a widow navigates through the difficult transition after losing a spouse, an advisor can be one of the most sustaining relationships in their life. By doing their best to mindfully communicate with recently widowed clients about their changing values and needs in a genuine, honest, and compassionate way, advisors can help them effectively plan for and support their changing needs. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ASSUMED FEDERAL RATES (AFRs) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

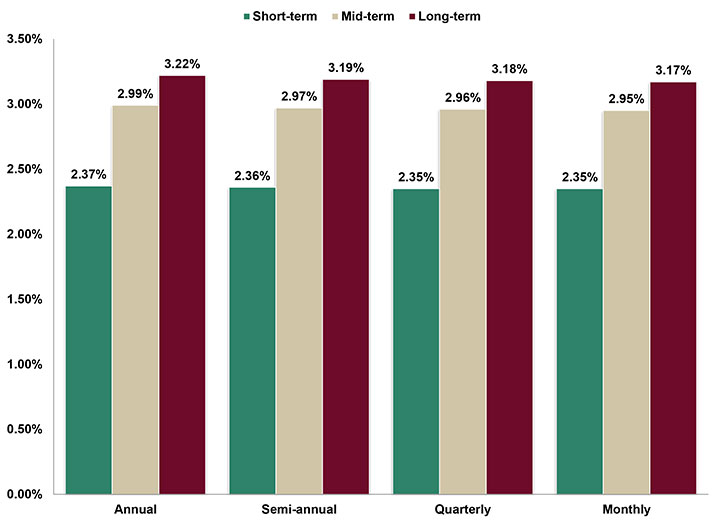

§7520 Rate for July is: 3.6%Break down: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL FACTS OF THE MONTH |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Be Careful |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Federal Trade Commission 46,000 Americans reported being scammed out of an estimated $1 billion from crypto currency cons over the period from January 2021 to March 2022. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Big Jump |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: U.S. Department of the Treasury The yield on the 10-year T-note has increased 1.29 percentage points from 12/31/2021 (1.50%) to Friday’s close 5/20/2022 (2.79%). The yield on the 10-year T-note has increased at least 1.29 percentage points over the course of 8 calendar years in the last 50 years, most recently in 2009. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Dollars In, Dollars Out |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Medicare At the end of 2021, Medicare was covering 63.8 million Americans (19% of our population). The program was cash positive in 2021, taking in $888 billion of income (including $5 billion of interest income) while paying out $839 billion in benefits. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Funding a Retirement |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: BTN Research The S&P 500 has averaged +9.8% per year (total return) over the 25 years ending 12/31/2021. A lump-sum of $865,656 (in a pre-tax account) will sustain a 20-year payout of $100,000 per year (i.e., $2 million of gross distributions before taxes) assuming the funds continue to earn +9.8% annually. This mathematical calculation ignores the ultimate impact of taxes on the account which are due upon withdrawal, is for illustrative purposes only and is not intended to reflect any specific investment or performance. Actual results will fluctuate with market conditions and will vary. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In the Year 2034 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Social Security Trustees 2022 Report Social Security trustees announced on 6/02/2022 that the trust fund backing the payment of Social Security benefits (OASI retirement benefits) would be zero in 2034. A zero “trust fund” does not mean the payment of Social Security benefits would also go to zero, but rather would drop to 77% of their originally promised levels through the year 2096. When the trustees released their report in 2007 (i.e., 15 years ago), the Social Security Trust Fund was projected to be depleted in 2042. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Long-Term Issue |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Social Security Trustees 2022 Report The estimated Social Security shortfall today (i.e., a present value number) between the future taxes anticipated being collected and the future benefits expected to be paid out over the next 75 years is $20.4 trillion. The entire $20.4 trillion deficit could be eliminated by an immediate 3.24 percentage point increase in the combined Social Security payroll tax rate (from 12.40% to 15.64%) or an immediate 20.3% reduction in benefits that are paid out to current and future beneficiaries. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Stocks and Rate Hikes |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: BTN Research Between 6/30/2004 and 6/29/2006, the Fed raised interest rates 17 times. Each rate hike was 0.25 percentage points, a total increase of 4.25 percentage points. That took the Fed’s target short-term rate from 1.00% to 5.25%. From the close of trading on 6/30/2004 to the close of trading on 6/29/2006, the S&P 500 gained +15.7% (total return) over the 2- years, or +7.6% per year. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

That’s Inflation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: U.S. Department of Labor Inflation, using the “Consumer Price Index” as the measurement, was up +9.0% in 1978, up +13.3% in 1979, up +12.5% in 1980, and up +8.9% in 1981. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You Snooze, You Lose |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Freddie Mac A buyer of an average-priced existing US home ($266,300) in January 2020 (at the beginning of the global pandemic) who put 10% down would have a $1,078 monthly principal and interest payment on a 3.51% national average 30-year fixed rate mortgage. A buyer of an average priced existing US home ($375,300) in March 2022 who put 10% down would have a $1,746 monthly principal and interest payment on a 4.67% national average 30-year fixed rate mortgage. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Work from Home, Start a Business |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: U.S. Census Bureau Americans filed 4.35 million “new business” applications in 2020 and 5.36 million in 2021, surpassing the previous US record high of 3.50 million filed in 2019. Before 2017, “new business” applications in the US had not exceeded 3 million in a single year. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

USEFUL FINANCIAL WEBSITE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRS Tax Tips |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Check out a listing of tax tips from the IRS. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RECOMMENDED READING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No Longer Awkward: Communicating with Clients Through the Toughest Times of Life |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ADVISOR TOOLS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2022 Federal Income Tax Guide |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Our Tax Guide contains tax information such as:

Download the Tax Guide below: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2022 Social Security & Medicare Reference Guide |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Our Reference Guide contains information such as:

Download the Reference Guide below: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Financial / Insurance Calculators & Websites |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

An extensive list of online calculators and informational websites. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

REQUIREMENT UPDATES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

State Updates |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

View updates by state, CE requirements and more by clicking on the link below. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FEATURED COURSE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Advisor’s Guide to IRAs |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Complete your CE requirement quickly and easily. This online course allows for convenient access to course material and includes: self-paced courses, unlimited retakes of review questions and final examination, instant grading, course material accessible for up to one year from date of purchase, and excellent customer support. Prices start at only $19.95. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.E.S.T. CE PROGRAMS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Online CE Courses |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI®). Our CE courses are specifically designed for quick completion and include:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CFP® & IWI® Ethics CE 2-hour Live Webinar |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP Professionals”

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Self-Study CE Course List |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

As a top-notch continuing education provider we:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

DISCLAIMER |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

INFORMATION |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SERVICES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY POLICY | REFUND POLICY |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Unsubscribing? Please allow one (1) business days for removal. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||