ADVISOR NEWS INSIGHT |

|

| |

Industry News |

|

Education Planning |

|

|

The unique benefits of 529 college savings plans A great refresher on 529 Plans. Want to know all there is about the unique benefits of 529 college savings plans? Read this article. (Richard Toolson, CPA, Ph.D., Professor of Accounting, Washington State University, 05/01/2023) |

|

Medicare / HSA Planning |

|

|

Medicare’s Tricky Rules on HSAs After Age 65 Do you have clients who are over age 65, continuing to work, and are enrolled in an HSA plan? Are you aware of the crucial exception for anyone who works past age 65 and wishes to continue contributing to an HSA. Individuals who enroll in Medicare Part A are not allowed to continue funding their HSA, and anyone postponing Medicare enrollment must be diligent about how applying for Social Security or Medicare after age 65 impacts HSA contribution amounts. Get the facts. (Kelley C. Long, CPA/PFS, CFP®, Freelance Writer and Personal Financial Coach, 05/16/2023) |

|

Roth IRA Planning |

|

|

How the Mega-Backdoor Roth Works The “mega-backdoor Roth” is a retirement savings strategy that technically allows individuals to make much larger contributions to certain workplace retirement accounts than the annual elective deferral limits. This article discusses how the strategy works. To utilize a mega-backdoor Roth, the following circumstances must exist:

(Kelley C. Long, CPA/PFS, CFP®, Freelance Writer and Personal Financial Coach, 05/09/2023) |

|

Senior Planning |

|

|

Senior Security Act of 2023 The entire House passed, late Monday, H.R. 2593, the Senior Security Act of 2023, which requires the Securities and Exchange Commission to set up a Senior Investor Task Force to protect senior investors from fraud. The task force at the SEC, will, among other duties, identify challenges that senior investors encounter, including problems associated with financial exploitation and cognitive decline. The group will also consult, as appropriate, with state securities and law enforcement authorities, state insurance regulators and other federal agencies as well as coordinate with other SEC divisions. The taskforce is also charged with submitting a biennial report to Congress. Companion legislation has been introduced in the Senate by Kyrsten Sinema, I-Ariz., and Susan Collins, R-Maine. |

|

Social Security Planning |

|

|

COLA for 2024 Could Be 2.7% for Social Security Inflation At Lowest Point Since March 2021 — Social Security COLA for 2024 Could Be 2.7%. New consumer price data indicates that inflation is at its lowest level since March 2021. That was the start of our recent 40-year storm of two back-to-back years of historically high consumer prices. The Senior Citizens League now estimates that the Social Security cost of living adjustment (COLA) 2024 could be 2.7 percent. (Press Briefing, The Senior Citizens League, 06/13/2023) |

|

|

Proposals to ‘Fix’ Social Security Unless Congress stops kicking the can down the road and musters the will to do something about it, within a decade all Social Security beneficiaries will face a 23% automatic cut. That would reduce the average annual benefit by around $6,000 — or $500 a month. Here are some of the proposed legislation being brought forward by lawmakers. (Brian Anderson, Editor-in-Chief, 401kSpecialist, 04/2023) |

|

Practice Management |

|

|

DOL Confirms New Fiduciary Rule Release Date in Updated Agenda After months of speculation, the Department of Labor’s newly released Spring 2023 regulatory agenda confirms that a fiduciary rule rewrite could be released later this summer; it also provides other key insight for the department’s regulatory plans for the coming months. (Ted Godbout, Writer/Editor, American Retirement Association, 06/15/2023) |

|

Assumed Federal Rates (AFRs) |

|

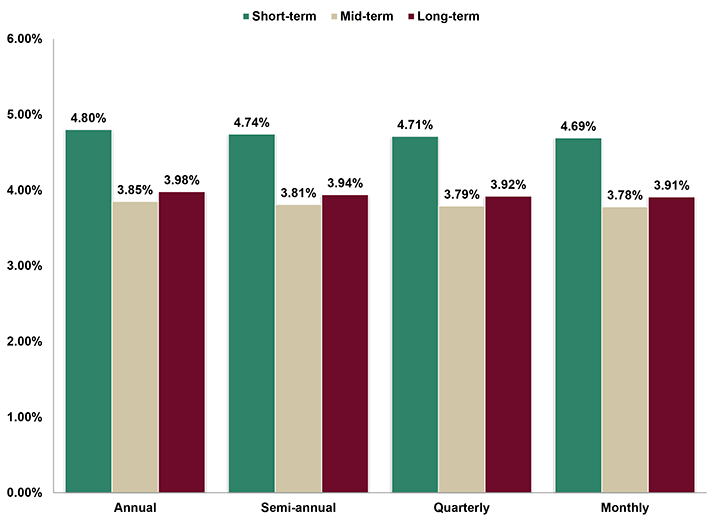

§7520 Rate for July is: 4.60% |

|

|

|

|

|

Advisor Tools |

|

2023 Federal Income Tax Guide |

|

|

Our 2023 Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. It includes detailed information on individual income tax rates, estates and trusts tax rates, and Roth IRA contribution limits. With our guide, you’ll have the information you need to make informed decisions about your finances. |

|

2023 Social Security & Medicare Reference Guide |

|

|

Our 2023 Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. It covers topics such as income limits, deductibles, premiums, and surtaxes. Whether you’re an individual or a financial professional, this guide is a valuable tool for understanding Social Security and Medicare policies. |

|

Financial / Insurance Calculators & Websites |

|

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. Explore list |

|

Requirement Updates |

|

State Updates |

|

|

Stay informed about CE requirements in your state and other important updates. Check out our state updates page for the latest information.

|

|

Featured Course |

|

Advisors Guide

|

|

|

Affordable Care Act of 2010 affect Medicare and Medicaid. |

|

|

|

B.E.S.T. CE Online CE |

|

Don’t let CE requirements be a hassle.

|

|

|

Our courses cover a wide range of topics, so you can find the ones that are most relevant to your practice. And because we’re a State Insurance and CFP Board-approved provider, you can be sure that our courses are high-quality and up-to-date. Here are some additional benefits of taking our online CE courses:

To learn more about our online CE courses, visit our website below or contact us today at 1 (800) 345-5669. |

|

|

|

Disclaimer |

|

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

|

Information |

|

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|

Services |

|

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

|

|

*Unsubscribing? (removed from our mailing list) Please allow one (1) business days for removal. |

|

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|