Advisor News InsightAFRs | FACTS | RECOMMENDED | TOOLS | REQUIREMENTS | BEST CE |

|||

IN LOVING MEMORY OF DAN BARRETT | |||

| |||

INDUSTRY NEWS |

|||

Health Care PlanningA Comparison of Tax-Advantaged Accounts for Health Care ExpensesThis Congressional Research Service report provides a brief summary of each tax-advantaged account for health care expenses, highlighting key aspects regarding eligibility, contributions, withdrawals, and the treatment of unused balances for that particular account, as well as data on availability and use. It also provides a side-by-side comparison of these accounts along related topics. |

|||

|

|||

Health Care Costs in Retirement Remain a Top StressorThis article was written by John Manganaro, Managing Editor at PlanAdvisor.com. Fidelity’s latest analysis shows people often underestimate the potential cost of health care in retirement, even after two decades of watching health care costs increase year-over-year. Fidelity published its 20th annual health care cost estimate, finding a couple retiring today will need approximately $300,000 to cover medical expenses. This is up 30% from 10 years ago and 88% since 2002, when the yearly tracking project began. |

|||

|

|||

IRS Announces HSA Limits For 2022Revenue Procedure 2021-25 provides the 2022 inflation adjusted amounts for Health Savings Accounts (HSAs) as determined under § 223 of the Internal Revenue Code and the maximum amount that may be made newly available for excepted benefit health reimbursement arrangements (HRAs) provided under § 54.9831-1(c)(3)(viii) of the Pension Excise Tax Regulations. For calendar year 2022, the annual limitation on deductions under § 223(b)(2)(A) for an individual with self-only coverage under a high deductible health plan is $3,650. For calendar year 2022, the annual limitation on deductions under § 223(b)(2)(B) for an individual with family coverage under a high deductible health plan is $7,300. For calendar year 2022, a “high deductible health plan” is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,400 for self-only coverage or $2,800 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $7,050 for self-only coverage or $14,100 for family coverage. |

|||

|

|||

IRA PlanningIs the Secure Act Good or Bad for Trusteed IRAs?This article was written by Natalie Choate, Attorney at Nutter McClennen & Fish LLP. Depending on your view, the Secure Act has either “killed” the trusteed IRA or given it a new lease on life. I’m in the latter camp. From my angle, the trusteed IRA is the perfect cure for one of the biggest Secure Act-created problems – namely, how to control distributions to a beneficiary under the 10-year rule. But if you’re a financial advisor looking for a sales pitch for the trusteed IRA, the Secure Act made your job harder. |

|||

|

|||

Medicare PlanningThe Great Medigap Debate – What is Best?This article was written by Joanne Giardini-Russell, Medicare Nerd & Owner at Giardini Medicare. How do you choose a Medigap product? And who do you purchase it from? |

|||

|

|||

Retirement PlanningU.S. Retirement Assets in 2020The Federal Reserve’s Financial Accounts of the United States reported that the total amount of U.S. retirement assets (outside of Social Security) was $37.0 trillion at the end of 2020. |

|||

|

|||

What’s in the New SECURE Act 2.0?This article was written by Ted Godbout, Writer/Editor at American Retirement Association. The House Ways & Means Committee approved the Securing a Strong Retirement Act of 2021 (H.R. 2954) (a.k.a. the “SECURE Act 2.0”) on May 5 by a unanimous voice vote. Other than a manager’s amendment that made technical clarifications to the underlying bill, no additional amendments were offered during the markup. The new Securing a Strong Retirement Act of 2021 (H.R. 2954) now contains about 45 provisions, including new revenue offsets to pay for the bill. |

|||

|

|||

Social Security PlanningSocial Security: Who Is Covered Under the Program?Social Security pays cash benefits to about 65 million people each month. In all cases, a Social Security beneficiary becomes eligible for benefits either by working in a job that is covered by Social Security (a covered worker), by having a close family relationship to a covered worker, or both (among other requirements). |

|||

|

|||

Supplemental Security Income for Children with DisabilitiesThis article was written by Jonathan Stein, Of Counsel at Community Legal Services, Philadelphia and Linda Landry, Senior Attorney at Disability Law Center, Boston. SSI helps low income families care for their children with mental or physical disabilities. It can be difficult to meet a child’s disability-related needs. SSI can help meet these and other needs to ensure the best outcome for the child. |

|||

|

|||

Tax PlanningThe 3.8% Net Investment Income Tax: Overview, Data, and Policy OptionsSince 2013, certain higher-income individuals have been subject to a 3.8% “unearned income Medicare contribution” tax, more commonly referred to as the net investment income tax (NIIT). The statutory authority for the tax is included in Internal Revenue Code Section 1411. The tax was included as a revenue-raising offset in the Health Care and Education Reconciliation Act of 2010 (HCERA, P.L. 111-152), shortly after the Patient Protection and Affordable Care Act (P.L. 111-148) was signed into law. These two laws are commonly referred to as the Affordable Care Act or ACA. |

|||

|

|||

ASSUMED FEDERAL RATES (AFRs) |

|||

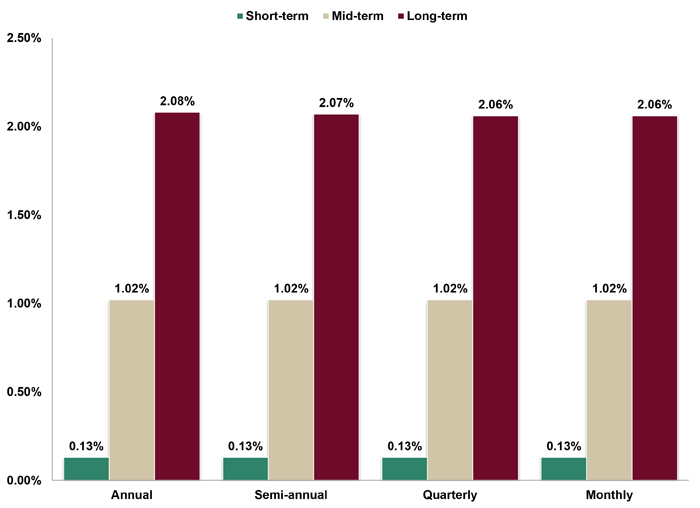

§7520 Rate for June is: 1.2%Break down: |

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Adding More DebtSource: Federal Reserve Bank of New York Total US household debt, including mortgages, credit cards and auto loans, was $12.67 trillion as of 12/31/08. Over the next 5 years, total household debt fell $1.15 trillion to $11.52 trillion as of 12/31/13. But over the last 7 years, total household debt has increased $3.04 trillion to $14.56 trillion as of 12/31/20. |

|||

|

|||

Almost All Sent outSource: American Rescue Plan Act of 2021 As of 4/21/21, 159 million stimulus payments totaling $376 billion have been disbursed under the 3/11/21 “American Rescue Plan Act.” 22% of the $1.9 trillion bill, or $411 billion, was scheduled to be paid to eligible Americans in the form of $1,400 payments. |

|||

|

|||

Have Kids, Get MoneySource: Tax Policy Center An estimated 40% of the 126 million households in the United States have children under the age of 18, or 50 million households. An estimated 90% of the 50 million households (45 million) will qualify for the expanded Child Tax Credit (CTC) per the American Rescue Plan Act of 2021. The new CTC could pay $300 per month per child under age 6and $250 per month per child between ages 6-17beginning 7/01/21. Please consult a tax expert for details. |

|||

|

|||

Highest EverSource: Internal Revenue Service (IRS) The top capital gains tax rate in 2021 for a married filing joint taxpayer with taxable income of at least $496,600 is 23.8%. On Thursday 4/22/21, reports surfaced that the White House favors increasing the top capital gains tax rate in 2022 for a married filing joint taxpayer with taxable income of at least $1 million to 43.4%. The highest capital gains tax rate in U.S. history is 39.875%, last levied in 1978. |

|||

|

|||

Hope They Stay LowSource: Congressional Budget Office (CBO) U.S. federal debt is expected to push well past 100% of GDP – levels not seen since 1945 and 1946 in response to World War II. Even though debt expanded by $4 trillion last year, interest payments on that debt declined by approximately 8%. |

|||

|

|||

In the Right DirectionSource: Centers for Disease Control and Prevention (CDC) U.S. deaths from all causes (e.g., natural causes, cancer, heart disease, COVID, etc.) for the week ending Saturday 1/02/21 peaked at 84,192 (12,027 per day), but has since fallen for the next 15 weeks to 32,343 deaths for the week ending Saturday 4/17/21 or 4,620 per day. |

|||

|

|||

InfrastructureSource: American Society of Civil Engineers (ASCE) American roads and bridges will require an estimated $2.8 trillion of repairs and upgrades over the 10 years from 2020-2029. |

|||

|

|||

No CommuteSource: U.S. Census Bureau 3 out of every 4 American families (73%) reporting household income of at least $200,000 switched to a “work-from-home” structure when the pandemic began in 2020. |

|||

|

|||

Wait Till the Cost of Money Goes UpSource: U.S. Department of the Treasury During fiscal year 2020, i.e., the 12 months ending 9/30/20, the US government spent $345 billion for interest payments on the national debt or $945 million a day. 5 years earlier, i.e., fiscal year 2015, the U.S. government spent $223 billion for interest payments on the national debt or $611 million a day. |

|||

|

|||

RECOMMENDED READING |

|||

2021 Investment Company FACT BOOKInvestment Company Institute (ICI) [This Fact Book provides] detail on the remarkable range of products our industry has created to help investors save for their goals, on how our industry is evolving ... to meet investors’ changing demands, and on the substantial declines in fund fees Main Street investors incur to gain exposure to stocks and bonds through pooled, professionally managed funds.... [It also provides] considerable detail ... about the tens of millions of U.S. households that use funds to save for their goals and how funds support them as they save for retirement and education. |

|||

|

|||

ADVISOR TOOLS |

|||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

BEST CE PROGRAMS |

|||

BEST Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP/CIMA/CPWA/ RMA). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

BEST Virtual Super CE EventsWe provide advisors with:

|

|||

|

|||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|||

|

|||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (BEST), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. BEST is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. BEST does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of BEST. THIS

NEWSLETTER IS PROVIDED FOR |

|||

BEST INFORMATION |

|||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||