Advisor News Insight |

|||

|

NEWS | AFRs | FACTS | RECOMMENDED | TOOLS | REQUIREMENTS | FEATURED | B.E.S.T. CE |

|||

| |||

INDUSTRY NEWS |

|||

Estate Planning |

|||

DeSantis Delivers An Estate Tax Savings Gift For FloridiansLeimberg Information Services, Inc. Newsletters Governor Ron DeSantis approved a new law limiting claims by creditors against the settlors of certain trusts under special circumstances. The legislation includes a provision amending Florida Statute 736.0505(3) which will make certain Spousal Limited Access Trusts (SLATs) more attractive to Florida residents who form them after June 30, 2022, by allowing the contributing spouse to be a beneficiary of the trust following the death of the beneficiary spouse. |

|||

|

|||

IRA Planning |

|||

Ed Slott Warns Advisors: Know IRS’ Secure Act RMD Regs or Risk Getting SuedMelanie Waddell, Washington Bureau Chief, Investment Advisory Group Advisors “cannot ignore” the IRS’ recently released proposed regulations on how to handle required minimum distributions under the Setting Every Community Up for Retirement Enhancement (Secure) Act of 2019, “because it’s going to trip you up and it could cause everything from embarrassment to litigation.” The key point to know about the regs, according to Slott, is that they affect clients’ beneficiaries. |

|||

|

|||

Get Ready for New DOL Rollover Rules on July 1Melanie Waddell, Washington Bureau Chief, Investment Advisory Group Advisors take note: Starting on July 1, advisors and firms under the Labor Department’s new fiduciary prohibited transaction exemption, PTE 2020-02, “Improving Investment Advice for Workers & Retirees,” will need to provide to the participant, in writing, the specific reasons why a rollover is in [their] best interest. |

|||

|

|||

Medicare Planning |

|||

Disability & Medicare Eligibility and Enrollment — What You Need to Know In 2022Some people can qualify for Medicare due to disability. In this case, if your client has a qualifying disability, he or she is eligible for Medicare even if they are not yet age 65. To find out if your client’s disability qualifies for disability benefits or for Medicare, they should speak with Social Security directly, but in general, they would become eligible the 25th month of receiving Social Security Disability Insurance benefits (SSDI). |

|||

|

|||

Retirement Planning |

|||

2021 Retirement Risk Survey: Report of FindingsThe Society of Actuaries (SOA) released its eleventh iteration of the Retirement Risk Survey series that has been conducted every two years since 2001. The survey was to evaluate Americans’ retirement concerns and preparedness, their income and spending in retirement, how they plan for change in retirement, the impact of shocks and unexpected events, and their views on health and caregiving. |

|||

|

|||

2022 Paycheck or Pot of Gold Study: The Great Retirement DecisionMetLife Services and Solutions, LLC. Deciding if and when workers plan to retire is important but, for near-retirees, the “great retirement decision” is whether to take one’s accumulated savings as a paycheck (i.e., monthly annuity payments) or a perceived “pot of gold” (i.e., a lump sum) — or some combination of the two. This is arguably one of the most important decisions a person will make about their retirement and, in addition to how much they have saved, will largely dictate whether they can enjoy a secure retirement. |

|||

|

|||

Inside the Minds of Plan Participants: What’s Next?Alliance Bernstein (AB) latest participant survey chronicles the attitudes, resilience, and adjustments of American workers through these latest turbulent times of COVID-19, climate change, political anxiety and economic challenges. Yet throughout these daunting obstacles, their survey respondents seem to have held steadier through the storms than they have expected. |

|||

|

|||

Latest Guide to Retirement Underscores Changing Landscape (2022)J.P. Morgan says retiree income replacement needs have risen across the income spectrum and now range from 72% to 98%, depending on factors such as pre-retirement income level and location. Download the 10th Annual Edition of the Guide to Retirement. |

|||

|

|||

Retirement Plan Landscape Report: An In-Depth Look at the Trends and Forces Reshaping U.S. Retirement PlansMorningstar Investment Management LLC. Morningstar’s newly launched Center for Retirement & Policy Studies has released their latest Retirement Plan Landscape Report (March 2022). This report explores four aspects of the U.S. retirement system. First, it examine major trends in the U.S. system in terms of coverage, assets, and the number of plans. Second, it takes a deep dive on the costs to workers and retirees of these plans and their investments. Third, it looks at the kind of investments these plans hold. Although this report is mostly focused on defined-contribution, or DC, plans, the plan concludes by examining defined-benefit, or DB, plans, which continue to contribute to millions of Americans’ retirement security. Note that this report is limited to plans that are covered by Title I of the Employee Retirement Income Security Act of 1974, or ERISA, as these plans file the Form 5500 annually, providing a starting point for analysis. |

|||

|

|||

Roth IRA Planning |

|||

When and for Whom are Roth Conversions Most Beneficial? A New Set of Guidelines, Cautions and Caveats.Edward F. McQuarrie, Professor at Santa Clara University - Leavey School of Business This paper re-examines the rationale for Roth conversions. While the benefits from a Roth conversion are often small and slow to arrive, a Roth conversion will almost always pay off if given enough time, i.e., for life spans that extend past 90 and so long as annual distributions from converted amounts are not taken. Roth conversions work because of compounding, which requires the conversion to be left undisturbed for a long time. The paper elucidates the role played by the mathematics of compounding in underwriting the success of Roth conversions. |

|||

|

|||

Practice Management |

|||

A Profound Opportunity for AdvisorsJohn Manganaro, Managing Editor of planadviser.com A new survey report notes that women control a third of total U.S. household financial assets today — more than $10 trillion — and as much as $30 trillion more is expected to shift into the hands of U.S. women over the next five years. |

|||

|

|||

Women and Wealth Insight ResearchU.S. Bank’s latest research shows that women — particularly younger women — are taking control of more of the financial decisions for their families, associate financial planning with feelings of confidence, joy, and excitement, and are confident they will be able to retire when they’re ready. |

|||

|

|||

ASSUMED FEDERAL RATES (AFRs) |

|||

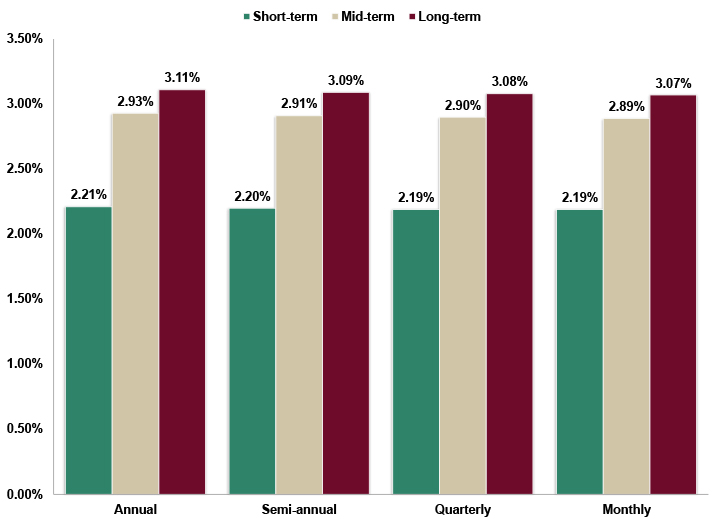

§7520 Rate for June is: 3.6%Break down: |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Big Change |

|||

|

Source: U.S. Department of Labor Inflation, using the “Consumer Price Index” as the measurement, was up +8.5% for the 1-year ending 3/31/2022. That’s more inflation than the United States experienced over the 4 years of 2017-2020 when the CPI advanced +7.9% over the entire 4 years. |

|||

|

|||

Can You Afford It Now? |

|||

|

Source: Society of Actuaries 2021 Retirement Risk Survey 24% of 1,168 American retirees surveyed in June 2021 indicated that they had to pay for major home repairs during retirement. |

|||

|

|||

High, Low |

|||

|

Source: U.S. Bureau of Labor Statistics For the 9 years from 1973-1981, inflation (using the “Consumer Price Index”) averaged +9.2% per year. For the 9 years from 2012 to 2020, inflation averaged +1.6% per year. |

|||

|

|||

Stocks |

|||

|

Source: Siblis Research From 12/31/2019 to 12/31/2021, the value of all US individual stocks increased by $19.5 trillion (+57%) to $53.4 trillion, before falling $5.1 trillion (10%) in the 1Q 2022 to $48.3 trillion. |

|||

|

|||

RECOMMENDED READING |

|||

Win True: How You Win Matters On and Off the Bike |

|||

|

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

Download the Reference Guide below: |

|||

Financial / Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

NAIC 4-Hour Long-Term Care Insurance |

|||

|

Complete your NAIC 4-hour Long-Term Care Insurance CE requirement quickly and easily. The “NAIC 4-Hour Long-Term Care Insurance” online course allows for convenient access to course material and includes: self-paced courses; unlimited retakes of review questions and final examination; instant grading; course material accessible for up to one year from date of purchase; and excellent customer support. Price starts at only $13.95. |

|||

|

|||

B.E.S.T. CE PROGRAMS |

|||

Online CE Courses |

|||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI®). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

NAIC 4-Hour LTC Insurance Virtual Super CE |

|||

|

Date: Tuesday, June 21, 2022

Starting at only $35.00, you can earn 4 CE credit hours of Long-Term Care (LTC) Insurance, 4 CE credit hours of CFP® and 4 CE credit hours of IWI® (CIMA® / CPWA® / RMA®). (Advisors in the states of Colorado and Indiana may receive 5 CE credit hours of LTC.) Advisors are provided with:

|

|||

|

|||

CFP® & IWI® Ethics CE 2-hour Live Webinar |

|||

“Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP Professionals”

|

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||