ADVISOR NEWS INSIGHT |

||||||||||||||||||||||||||||||||||||

|

News • AFRs • Recommended • Tools • Requirements • Featured • CE |

||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

Industry News |

||||||||||||||||||||||||||||||||||||

Estate Planning |

||||||||||||||||||||||||||||||||||||

|

Fidelity® Research Spotlights Significant Growth Opportunity for Advisors with Young Investors New research from Fidelity Investments® shows that 63% of Gen YZ investors believe working with an advisor is key to achieving financial success and 60% feel a heightened need to engage a financial advisor this year due to economic uncertainty. With 57% of existing client assets expected to pass to the next generation by 2045, this presents a significant growth opportunity for financial advisors ‒ and potential looming business vulnerability for those who do not prioritize engaging with this group, as firms with a younger client base are growing nearly 10 times faster than their peers. (Anjelica Sena, Director, Investments & Institutions Communications, Fidelity Investments, 01/24/2023) |

||||||||||||||||||||||||||||||||||||

Health Care Planning |

||||||||||||||||||||||||||||||||||||

|

HSA and HRA Limits for 2024 The IRS has announced the 2024 calendar year dollar limits for health savings account (“HSA”) contributions, the minimum deductible amounts, and maximum out-of-pocket expenses for high deductible health plans (“HDHPs”) and the health reimbursement account (“HRA”) excepted benefit limit. By law, these limits are indexed annually to adjust for inflation. |

||||||||||||||||||||||||||||||||||||

|

2024 vs. 2023 HSA Dollar Limits

The maximum amount that employers may contribute to EB-HRAs for plans years beginning in 2024 is $2,100, up from $1,950 in 2023. |

||||||||||||||||||||||||||||||||||||

Life Insurance Planning |

||||||||||||||||||||||||||||||||||||

|

AG 49-B & Life Insurance Illustrations: What You Need to Know The National Association of Insurance Commissioners (NAIC) has recently revisited Actuarial Guideline 49-A (AG 49-A). The Life Actuarial Task Force approved a revised version of AG 49-A called “AG 49-B” which dictates how you may illustrate an indexed universal life (IUL) insurance policy. The result of these changes will impact the maximum illustrated rates on all Index Universal Life Insurance (IUL) product line. Note: AG-49 B only impacts illustrations, not how an IUL product operates or performs. (Scott Hall, Author, figblueprintTM, 04/20/2023) |

||||||||||||||||||||||||||||||||||||

Medicare Planning |

||||||||||||||||||||||||||||||||||||

|

Medicare Advantage Overview: A Primer on Enrollment and Spending Enrollment in Medicare Advantage plans has increased rapidly in recent years. The share of eligible Medicare beneficiaries enrolled in MA rose from 25% in 2010 to 47% in 2021 (27.6 million enrollees). Payments to MA plans more than doubled between 2015 and 2021 (from $175 to $361 billion), taking the share of total Medicare Parts A & B spending on MA from 38% to 54%. (ASPE, Issue Brief, 05/25/2023) |

||||||||||||||||||||||||||||||||||||

Retirement Planning |

||||||||||||||||||||||||||||||||||||

|

America’s lack of retirement savings could cost governments $1.3 trillion As Americans with insufficient retirement savings leave the workforce over the next 20 years, they will severely strain state and federal budgets to the tune of $1.3 trillion, according to a study released by the Pew Charitable Trusts. The study estimates that the federal government will get hit with $964 billion in additional costs to fund public assistance programs for financially vulnerable retiree households. At the state level, the cost over the 20-year window between 2021 and 2040 is projected to be $334 billion. (John Scott, Project Director, Retirement Savings, and Andrew Blevins, Officer, Retirement Savings, The Pew Charitable Trusts, 05/11/2023) |

||||||||||||||||||||||||||||||||||||

Social Security Planning |

||||||||||||||||||||||||||||||||||||

|

Maximize Your Social Security Benefits by Changing Your Thinking When it comes to Social Security retirement benefits, many folks look at the payments as something they’ve earned… and that’s not totally off base if you happen to receive benefits, because the amount of the benefit that you receive is a direct result of your earnings over your career. But really, Social Security is something else altogether. (Jim Blankenship, CFP®, EA, independent, fee-only, Financial Planner, 05/15/2023) |

||||||||||||||||||||||||||||||||||||

State Automated Retirement Programs |

||||||||||||||||||||||||||||||||||||

|

Connecticut HB 6552 The Nutmeg State’s House of Representatives has voted in favor of a bill that would make a variety of adjustments to the Connecticut Retirement Security Program, the state-run program that provides coverage for private-sector employees whose employers do not. The legislation would make a variety of changes to the Connecticut Retirement Security Program. HB-6552 passed in the Connecticut House on May 17 in an 88-61 vote. It was put on the Senate calendar on May 19. |

||||||||||||||||||||||||||||||||||||

|

Minnesota HF 0782 Minnesota became the latest state to officially launch a state-sponsored retirement plan for private-sector employees lacking coverage. Governor Tim Walz signed HF0782, the Minnesota Secure Choice retirement program, into law on 5/26/2023, making it one of 12 states offering an auto-IRA for previously uncovered private sector workers. The legislation would require employers that employ five or more workers to participate in Secure Choice if they do not already offer a plan. |

||||||||||||||||||||||||||||||||||||

|

Pennsylvania HB 577 The Pennsylvania House of Representatives on May 24 passed HB 577, a bill that would create the Keystone Saves Program, which would be an automatic enrollment payroll deduction IRA retirement savings program. Thee bill also would create the Keystone Saves Program Fund, the Keystone Saves Administrative Fund and the Keystone Saves Program Advisory Board. It further addresses the powers and duties of the state Treasury Department in relation to the program, including investment and fiduciary responsibilities and implementation. |

||||||||||||||||||||||||||||||||||||

Tax Planning |

||||||||||||||||||||||||||||||||||||

|

IRS Releases Fiscal Year 2022 Data Book Describing Agency’s Activities The Internal Revenue Service issued its annual Data Book detailing the agency’s activities during fiscal year 2022 (Oct. 1, 2021 ‒ Sept. 30, 2022), including revenue collected and tax returns processed. |

||||||||||||||||||||||||||||||||||||

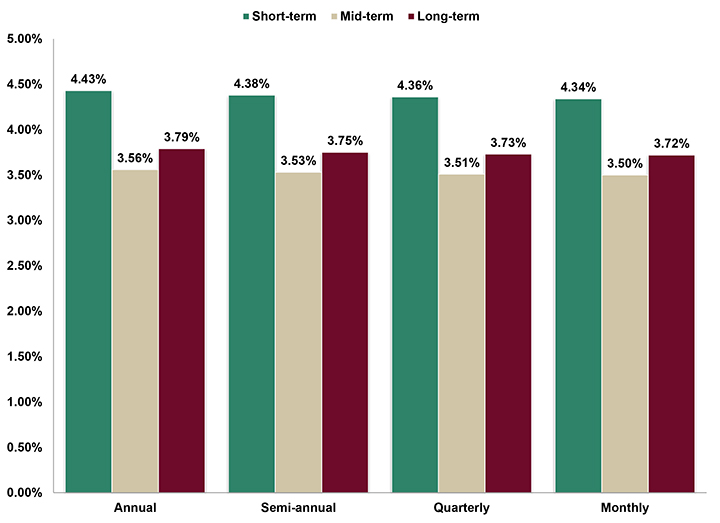

Assumed Federal Rates (AFRs) |

||||||||||||||||||||||||||||||||||||

§7520 Rate for June is: 0.00% |

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

Recommended Reading |

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

Advisor Tools |

||||||||||||||||||||||||||||||||||||

2023 Federal Income Tax Guide |

||||||||||||||||||||||||||||||||||||

|

Our 2023 Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. It includes detailed information on individual income tax rates, estates and trusts tax rates, and Roth IRA contribution limits. With our guide, you’ll have the information you need to make informed decisions about your finances. |

||||||||||||||||||||||||||||||||||||

2023 Social Security & Medicare Reference Guide |

||||||||||||||||||||||||||||||||||||

|

Our 2023 Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. It covers topics such as income limits, deductibles, premiums, and surtaxes. Whether you’re an individual or a financial professional, this guide is a valuable tool for understanding Social Security and Medicare policies. |

||||||||||||||||||||||||||||||||||||

Financial / Insurance Calculators & Websites |

||||||||||||||||||||||||||||||||||||

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. Explore list |

||||||||||||||||||||||||||||||||||||

Requirement Updates |

||||||||||||||||||||||||||||||||||||

State Updates |

||||||||||||||||||||||||||||||||||||

|

Stay informed about CE requirements in your state and other important updates. Check out our state updates page for the latest information.

|

||||||||||||||||||||||||||||||||||||

Featured Course |

||||||||||||||||||||||||||||||||||||

The Advisors Guide to IRAs |

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

B.E.S.T. CE Online CE |

||||||||||||||||||||||||||||||||||||

Don’t let CE requirements be a hassle.

|

||||||||||||||||||||||||||||||||||||

|

Our courses cover a wide range of topics, so you can find the ones that are most relevant to your practice. And because we’re a State Insurance and CFP Board-approved provider, you can be sure that our courses are high-quality and up-to-date. Here are some additional benefits of taking our online CE courses:

To learn more about our online CE courses, visit our website below or contact us today at 1 (800) 345-5669. |

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

Disclaimer |

||||||||||||||||||||||||||||||||||||

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||||||||||||||||||||||||||||||||||||

Information |

||||||||||||||||||||||||||||||||||||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||||||||||||||||||||||||||||||||||||

Services |

||||||||||||||||||||||||||||||||||||

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

||||||||||||||||||||||||||||||||||||

|

*Unsubscribing? (removed from our mailing list) Please allow one (1) business days for removal. |

||||||||||||||||||||||||||||||||||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||||||||||||||||||||||||||||||||||||