ADVISOR NEWS INSIGHT |

||

|

News • AFRs • Website • Recommended • Tools • Requirements • Featured • CE |

||

| ||

Industry News |

||

Annuity Planning |

||

|

Reason You Should Retain Your Deferred Annuity When You Retire Do you have clients who purchased an annuity many years ago, now they are in retirement, and they come to you and ask for your advice about what to do with the annuity? Well, here is an article written by Steve Parrish, JD, RICP®, CLU®, ChFC®, AEP®, with the Retirement Income Center at the American College of Financial Services, he explains that there are several options for an annuity that you retain- annuitizing the contract, exercising the Guaranteed Lifetime Withdrawal Benefit (GLWB), and doing a 1035 exchange. Steve Parrish, JD, RICP®, CLU®, ChFC®, AEP®, Contributor, Forbes Media LLC., 2/8/23 |

||

IRA Planning |

||

|

Investor Alert: Self-Directed IRAs and the Risk of Fraud The SEC’s Office of Investor Education and Advocacy, the North American Securities Administrators Association (NASAA), and the Financial Industry Regulatory Authority (FINRA) are updating this Investor Alert to warn investors of potential risks associated with self-directed Individual Retirement Accounts (self-directed IRAs). Self-directed IRAs allow investment in a broader – and potentially riskier – portfolio of assets than other types of IRAs. Those assets may include real estate, private placement securities, precious metals and other commodities, and crypto assets. Investors should be mindful that investing through self-directed IRAs raises risks, including fraudulent schemes, high fees, and volatile performance. SEC, 2/7/23 |

||

Long-Term Care Planning |

||

|

Costs of Long-Term Care in Your State Planning for long-term care can be challenging, but this calculator will help you determine the current and

future costs of in-home care, adult day care, and nursing home care your state.

|

||

|

Multiple States Considering Implementing Long-Term Care Tax Thirteen states, including California, New York, Pennsylvania, Illinois, Michigan, and Minnesota, are considering following Washington’s lead in taxing those who do not own Long-Term Care Insurance. The tax is intended to help fund the Medicaid program, the country’s primary payor of long-term health care expenses. LTC News, 10/29/21 |

||

Medicare/Medicaid Planning |

||

|

Projected Savings Medicare Beneficiaries Need for Health Expenses Remained High in 2022 The Employee Benefit Research Institute (EBRI) in a new study has estimated that savings target for Medicare beneficiaries to cover premiums, deductibles, and prescription drugs in retirement remains high. A 65-year-old man enrolled in a Medigap plan with average premiums will need to have saved $96,000 to have a 50 percent chance of having enough to cover premiums and median prescription drug expenditures, and a woman will need to have saved $116,000. Paul Fronstin, Director of the Health Research and Education Program and Jake Spiegel, Research Associate, Employee Benefit Research Institute, 2/9/23 |

||

Retirement Planning |

||

|

Beware of Stealth Tax Increases in SECURE 2.0 The setting every community up for retirement enhancement (SECURE) 2.0 Act (SA 2.0) was a much-needed piece of legislation that addresses several issues around retirement that affect working and retired Americans. The legislation offers improvements, but as is often the case when Washington tries to “fix” things, there are some unintended consequences. (Matthew J. Spradlin, CFP®, Director, Wealth Manager, Godfrey & Spradlin, Private Wealth Advisory of Steward Partners Investment Solutions, LLC, 2/20/23) |

||

|

Determining Sustainable Spending from an Investment Portfolio in Retirement Determining the sustainable spending rate from a diversified investment portfolio in retirement requires making decisions about longevity and market returns. The final section in this chapter provides an opportunity to integrate this discussion in order to obtain a better sense about sustainable distributions from an investment portfolio in retirement. |

||

|

Employment Extenders: A (labor) force to be reckoned with In recent years, Americans have been retiring later and later in life. But are they working longer because they want to, or because they need to? According to new research, the difference is not so clear-cut. That’s the upshot of a new study, “Employment Extenders: A labor force to be reckoned with,” conducted by Voya Cares, a research division of the investment firm Voya Financial, and Easterseals, a nonprofit that provides services to disabled Americans. The study surveyed 1,062 adults over age 50 who either delayed or plan to delay their retirement — a group called “employment extenders” — and asked them why they had or would postpone leaving the workforce. Voya Financial, 1/20/23 |

||

|

Where You Need More Than $1 Million To Retire LendingTree study calculates how much people need to retire in each U.S. metro using different methods: based on the amount retirees spend in a year and on the median annual earnings of people ages 55 to 64. They found that it takes more than $1 million to retire with an average lifestyle in nearly 40% of the 384 U.S. metros based on the former assessment, but significantly less on the latter assessment. Julie Ryan Evans, Freelance Writer and Kali McFadden, Production Manager, LendingTree, 1/23/23 |

||

Social Security Planning |

||

|

Social Security Expansion Act Would Guarantee Solvency for 75 Years The Social Security Expansion Act introduced earlier this week by Senators Bernie Sanders, I-Vermont, and Elizabeth Warren, D-Massachusetts, aims to make Social Security solvent through the end of the 21st century, while also enhancing benefits. (Paul Mulholland, Editor, PlanAdviser, 2/17/23) |

||

|

Report from the Social Security Office of the Chief Actuary Estimated that enactment of the Social Security Expansion Act would extend the ability of the OASDI program to pay scheduled benefits in full and on time throughout the 75-year projection period. |

||

|

Social Security Expansion Act Fact Sheet A statement from Senator Sanders’ office, based on the study conducted by the Social Security’s Chief Actuary. |

||

Practice Management |

||

|

U.S. Securities and Exchange Commission (SEC) 2023 Examination Priorities The SEC, which oversees more than 15,000 registered investment advisors and 3,500 brokerages, released its list of 2023 Examination Priorities. Among the topics regulators are calling on advisors and brokerages to pay particular attention to are a new marketing rule governing how firms can advertise their services to the public and a nearly 3-year-old regulation calling on brokers to put clients’ interests ahead of their own. SEC, 2023 |

||

Assumed Federal Rates (AFRs) |

||

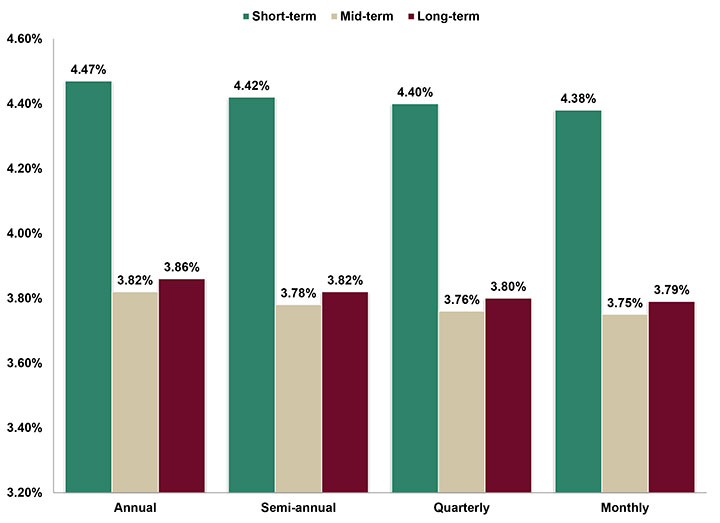

§7520 Rate for March is: 4.40% |

||

|

||

|

||

Useful Financial Website |

||

|

John Hancock State-Facilitated Retirement Plans Thirty-two percent of private industry workers don’t have access to a retirement plan at work, according to the Bureau of Labor Statistics (BLS). To help address this issue, many states—and a couple of cities—are enacting state-mandated retirement programs. While these programs have many positives, they’re also an opportunity for you to showcase your value to small business owners by offering alternative solutions tailored to their needs. John Hancock has created a state-facilitated retirement website. This site provides a wealth of information to help you build your understanding and position your retirement plan services as the better approach. It includes:

|

||

|

||

Recommended Reading |

||

|

||

|

||

Advisor Tools |

||

2023 Federal Income Tax Guide |

||

|

Our Tax Guide contains tax information such as:

|

||

2023 Social Security & Medicare Reference Guide |

||

|

Our Reference Guide contains information such as:

|

||

Financial / Insurance Calculators & Websites |

||

|

An extensive list of online calculators and informational websites. Explore list |

||

Requirement Updates |

||

State Updates |

||

|

View updates by state, CE requirements and more. View updates |

||

Featured Course |

||

Guide to Retirement Planning Strategies |

||

|

Health Savings Accounts, Medicare, and LTC Planning with the use of LTCI and Hybrid LTCI policies, as well as the use of reverse mortgages. |

||

|

||

B.E.S.T. CE Online CE |

||

Meet Your CE Requirements

|

||

|

Our online CE courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP®, CIMA®, CPWA®, and RMA®). They are also specifically designed for quick completion and include:

|

||

|

||

Disclaimer |

||

|

Reproductions of our Advisor News Insight newsletter are prohibited unless you have received prior authorization from Broker Educational Sales & Training, Inc. (B.E.S.T.), but you are free to email this copy (in its entirety) to colleagues. This newsletter may not be posted to any website without written consent. This newsletter is a digest of information published by a variety of web-based sources and is published as a service to our users. B.E.S.T. is not the author of the material unless specifically noted. Articles are copyrighted to their publishers. All links were tested before this newsletter was emailed to ensure that they are still functional, but publishers move and/or delete articles. Therefore, we cannot guarantee that the links provided will remain operational. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. Reliance on this material should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness. Opinions expressed are those of the author of the article and do not necessarily reflect the positions of B.E.S.T. THIS

NEWSLETTER IS PROVIDED FOR INFORMATIONAL PURPOSES

ONLY AND |

||

Information |

||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||

Services |

||

|

Unsubscribe* • About B.E.S.T. • Contact Us • Privacy Notice • Refund Policy |

||

|

*Unsubscribing? (removed from our mailing list) Please allow one (1) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||