Advisor News Insight |

|||||||||||||||

|

|||||||||||||||

INDUSTRY NEWS |

|||||||||||||||

Charitable Planning |

|||||||||||||||

Charitable Gift Annuities Gaining in PopularityCharitable gift annuities are one of the simplest ways of giving but one of the most overlooked. That was the word from two members of PNC Institutional Asset Management’s planned giving solutions group, who gave a webinar advising financial professionals of the ins and outs of this financial and philanthropic tool. CGAs are gaining in popularity with donor prospects as they work with the charitable organizations of their choice, said Chip Giese, senior regional manager. (Susan Rupe, Managing Editor, InsuranceNewsNet, 04/07/2025) |

|||||||||||||||

IRA Planning |

|||||||||||||||

Higher Federal Bankruptcy IRA Protection Limit Became Effective On April 1When you file for bankruptcy, one thing you usually don’t have to worry about is protecting your IRA funds from your bankruptcy creditors. That’s because, in just about every case, all of your IRA (and Roth IRA) monies are off limits. Under the federal bankruptcy law, IRA assets up to a certain dollar limit cannot be reached by creditors. That dollar limit is indexed every three years based on the cost-of-living. On April 1, the dollar limit increased from $1,512,350 to $1,711,975, effective through |

|||||||||||||||

Retirement Planning |

|||||||||||||||

401(k) Contribution Limits to Get $1,000 Boost in 2026: New EstimateParticipants in 401(k)s will likely see a $1,000 boost to the amount they can contribute in 2026 — jumping from $23,500 in 2025 to $24,500 next year, according to Milliman’s 2026 Internal Revenue Service Limits Forecast. (Melanie Waddell, Senior Editor and Washington Bureau Chief, ThinkAdvisor, 04/23/2025) |

|||||||||||||||

How the 4% Rule Would Have Failed in the 1960s: Reflections on the Folly Fixed Rate WithdrawalA popular rule in retirement planning isn’t reliable, a new paper indicates — and even the rule’s originator says it’s oversimplified. According to Edward McQuarrie, a professor emeritus at the Leavey School of Business at Santa Clara University, he argues that fixed-rate withdrawal strategies — like the 4% rule — are fundamentally flawed for retirement planning. (Edward F. McQuarrie, Professor of Marketing, Santa Clara University - Leavey School of Business, 02/06/2025) |

|||||||||||||||

Practice Management |

|||||||||||||||

5 Top Reasons Clients Leave AdvisorsA recently released survey by Capintel, Inc., a B2B, sheds light on what investors value most in their relationship with financial advisors. It also underscores what can lead to dissatisfaction and prompt them to change advisors. (Michael S. Fischer, contributing writer, ThinkAdvisor, 03/25/2025) |

|||||||||||||||

How Advisors Can Bridge The Gap With Women InvestorsEconomic uncertainty and market volatility are top of mind for all investors these days. But for some women investors, family caregiving responsibilities are compounding these concerns, impacting their ability to retire with financial security. In fact, according to a Nationwide Retirement Institute survey, 18% of women investors say supporting children or aging parents has prevented them from saving for retirement. (Suzanne Ricklin, Vice President of Retention & Sales, Nationwide Financial, 04/23/2025) |

|||||||||||||||

Jury Delivers Split Decision in Jeffrey Cutter Annuity Sales TrialA Massachusetts jury delivered a split verdict Wednesday against an advisor accused of making improper annuity sales. The jury determined that Jeffrey Cutter and Cutter Financial Group did not violate Section 206(1) of the Investment Advisers Act of 1940, but did find violations of Section 206(2). Section 206(2) bars advisors from engaging “in any transaction, practice or course of business which operates as a fraud or deceit upon any client or prospective client.” (Patrick Donachie, Senior Reporter, WealthManagement.com, 04/25/2025) |

|||||||||||||||

IAR VIRTUAL SUPER CE PROGRAM |

|||||||||||||||

Meet your 6-hour IAR Ethics and

|

|||||||||||||||

|

|||||||||||||||

Our Virtual Super CE Program

|

|||||||||||||||

Pricing Options

|

|||||||||||||||

ASSUMED FEDERAL RATES (AFRs) |

|||||||||||||||

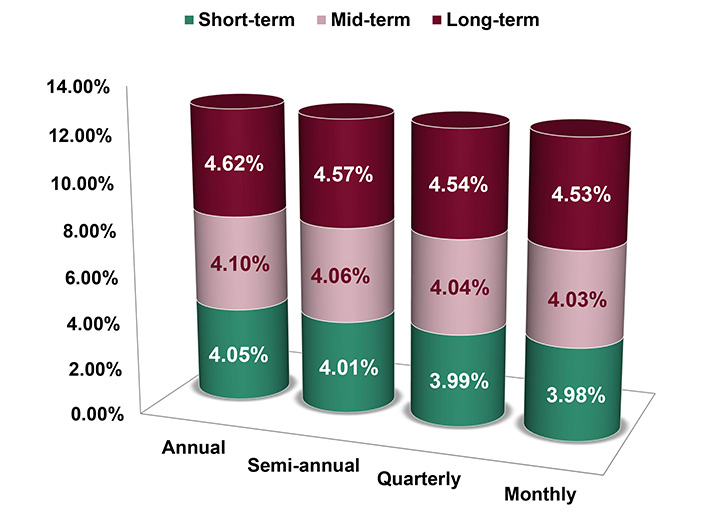

§7520 Rate for May is: 5.00% |

|||||||||||||||

|

|||||||||||||||

ADVISOR TOOLS |

|||||||||||||||

Free 2025 Federal Income Tax and

|

|||||||||||||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

|||||||||||||||

STATE REQUIREMENT UPDATES |

|||||||||||||||

Stay Up-to-Date on Your

|

|||||||||||||||

FEATURED COURSE(S) |

|||||||||||||||

12-Hours of IAR CE Credits |

|||||||||||||||

B.E.S.T. CE PROGRAMS |

|||||||||||||||

Take Our Online or Self-Study Courses at

|

|||||||||||||||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

|||||||||||||||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, May 22, 2025 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost options per license type:

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.) Registering includes the following three web pages: (each may open in a separate window)

NOTE: Do not close any of your web pages / browsers |

|||||||||||||||

|

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||||||||||||||

Meet Your 6-hr or 12-hr IAR CE Requirement—Online and On Your Schedule!B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit Hours | Starting at $47.95* This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs). What’s Included in the Course:

Online Exam:

Bonus Credits:

Ready to Enroll? Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence! |

|||||||||||||||

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95* This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements. What’s Included in the Online Course:

Online Exam:

Bonus Credits:

Why Choose This Course?

Get Started Today Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go! |

|||||||||||||||

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||||||||||||||

DISCLAIMER |

|||||||||||||||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

|

|||||||||||||||

B.E.S.T. INFORMATION / SERVICES |

|||||||||||||||

B.E.S.T. Links |

|||||||||||||||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

|||||||||||||||

Social Media |

|||||||||||||||

|

|||||||||||||||

Physical Address & Hours of Operation© 1986 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||||||||||||||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

|||||||||||||||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

|||||||||||||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||||||||||||||