ADVISOR NEWS INSIGHT |

|||

|

News • AFRs • Recommended • Tools • Requirements • Featured • CE |

|||

| |||

Wishing you a safe and happy Thanksgiving filled with gratitude.

|

|||

Industry News |

|||

Start Fulfilling Your 12-hour

|

|||

|

Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: see below Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of the course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. Courses only available for states that have adopted the NASAA Model Regulations. |

|||

|

|||

|

Online course includes:

Cost per license type:

Above listed costs include the following fees:

|

|||

|

|||

|

Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||

Retirement Planning |

|||

|

Proposed: Retirement Security Rule: Definition of an Investment Advice Fiduciary The Depart of Labor’s Employee Benefits Security Administration (DOL) has released its new fiduciary rule proposal, the Retirement Security Rule: Definition of an Investment Advice Fiduciary. The plan seeks to amend the regulation defining when a person renders “investment advice for a fee or other compensation, direct or indirect” with respect to any moneys or other property of an employee benefit plan, for purposes of the definition of a “fiduciary” in the Employee Retirement Income Security Act of 1974. (DOL, 10/24/2023) Read more | The Proposed Security Rule | Proposed Amendment to PTE 84-24 |

|||

Annuity Planning |

|||

|

LIMRA: Strong Performances in Fixed Indexed and Fixed-Rate Deferred Annuities Drive Robust Overall Sales Results in Third Quarter 2023 With economic conditions continuing to be favorable for annuities, total sales increased 11% year-over-year to $89.4 billion in the third quarter 2023, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey. “Equity markets rebounding in 2023 combined with a strong increase in interest rates has allowed insurance companies to add additional value in their annuity offerings to investors,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “LIMRA expects 2023 sales will surpass the record sales set in 2022.” (LIMRA, 10/25/2023) Read more | Preliminary U.S. Annuity Third Quarter 2023 Sales Estimates |

|||

IRA Planning |

|||

|

James Caan’s IRA Transfer Penalty Upheld in Court The estate of actor James Caan lost its five-year quest to avoid paying nearly $1 million in tax deficiencies and penalties relating to a partnership interest in a hedge fund in his IRA. In an October 18, 2023 ruling by the U.S. Tax Court, the late actor’s estate fell short in a bid for relief from $935,898 in payments to the IRS based on the distribution of the hedge fund holding from an Individual Retirement Account. (Kaplan, Inc., 10/21/2023) |

|||

Long-Term Care Planning |

|||

|

Long-Term Care Planning Using Trusts Are some of your clients who are retired, or nearing retirement lie awake at night wondering how they would be able to afford the astronomical costs of long-term care such as a nursing home, which can cost thousands of dollars per month for an untold number of years. Have you discussed with them how setting up an Irrevocable Trust may benefit them and protect certain assets transferred into the trust. (Dave Strausfeld, J.D., Senior Editor, Journal of Accountancy, 10/9/2023) |

|||

Medicare / Medicaid Planning |

|||

|

2024 Medicare Parts A & B Premiums and Deductibles The Centers for Medicare and Medicaid Services (CMS) released what the 2024 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2024 Medicare Part D income-related monthly adjustment amounts. (CMS, 10/12/2023) |

|||

|

Expansion of Medigap Consumer Protections Are Necessary To Promote Health Equity in the Medicare Program This article explores how expansions of consumer protections for private Medigap supplemental insurance are necessary to promote health equity in the Medicare program. The article outlines the background of Medigap and Medicare Advantage and discusses how the limited federal consumer protections in Medigap create barriers for individuals who wish to exit Medicare Advantage in order to enroll in traditional Medicare. (Kata Kertesz, JD, Senior Policy Attorney, Center for Medicare Advocacy, 07/2022) |

|||

Social Security Planning |

|||

|

How to Recover Unclaimed Social Security Benefits After a Parent’s Passing Losing a loved one is a challenging and emotionally draining experience. Amidst the grief, it’s essential to take care of practical matters, including any unclaimed Social Security benefits that your deceased parent may have left behind. Fortunately, there is a process in place to recover these unpaid benefits, providing certain conditions are met. (Norm Haug, RSSA®, Vice President of Operations, RSSA®, 09/18/2023) |

|||

|

Social Security’s Cost of Living Adjustment (COLA) Will Be Missing Its Silver Lining in 2024 With four of the past 15 years resulting in either no COLA or a historically low 0.3% COLA, a 3.2% increase to Social Security checks in 2024 will look good on paper. Unfortunately, next year’s COLA won’t have the silver lining that program recipients enjoyed in 2023. (Sean Williams, Author, The Motley Fool, 10/08/2023) |

|||

Practice Management |

|||

|

8 Ways Advisors Can Improve Their Social Media Marketing If you think of yourself as too old-fashioned (or just too old) to market your practice on social media, it may be time to change your perspective. For one thing, social media is as close to traditional, long-term prospect nurturing as the digital age gets. Technology allows you to connect and interact with prospects, both in real time and over longer periods, to create organic relationships that can be turned into new business. (Capital Group®, 10/17/2023) |

|||

Assumed Federal Rates (AFRs) |

|||

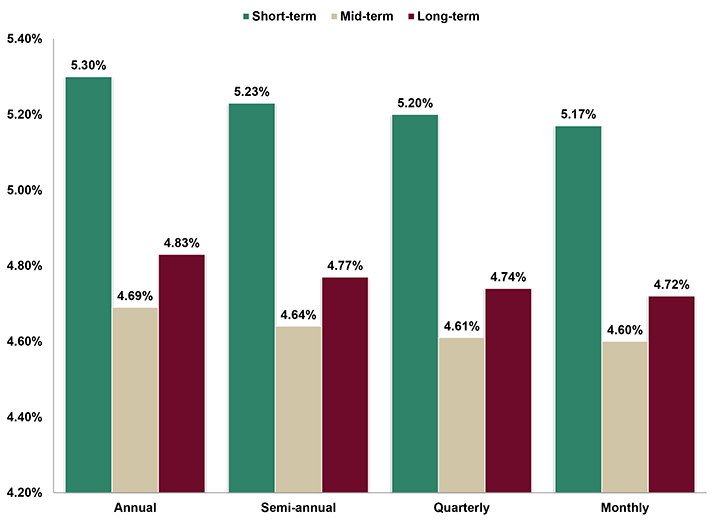

§7520 Rate for November is: 5.60% |

|||

|

|||

|

|||

Recommended Reading |

|||

|

|||

|

|||

Advisor Tools |

|||

2023 Tax & Social Security / Medicare Guides |

|||

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. |

|||

Financial / Insurance Calculators & Websites |

|||

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. |

|||

|

|||

State Requirement Updates |

|||

|

Stay up-to-date on CE requirements in your state by checking out our State Requirements page. |

|||

|

|||

Featured Course |

|||

Small Business Retirement Plans and

|

|||

|

|||

B.E.S.T. CE Programs |

|||

Take our online courses at your own pace and at a price that won’t hurt your wallet. |

|||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

|||

|

|||

Live 2-hour CFP® Ethics CE Webinar |

|||

|

Thursday, November 30 | 2:00PM - 4:00PM ET | Costs: See below Live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. Cost per license type:

NOTE: Do

not close any of your web pages / browsers Registering involves the following three web pages:

|

|||

|

|||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNERTM, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE Ethics credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) |

|||

Start Fulfilling Your 12-hour

|

|||

|

Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: see below Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of the course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. Courses only available for states that have adopted the NASAA Model Regulations. |

|||

|

|||

|

Online course includes:

Cost per license type:

Above listed costs include the following fees:

|

|||

|

|||

|

Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||

Disclaimer |

|||

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

|||

B.E.S.T. Information / Services |

|||

Learn More |

|||

Resources |

|||

|

Click the button below to access our comprehensive suite of resources, including calculators, websites, tax and Social Security and Medicare quick-reference guides, monthly newsletters and recorded webinars. |

|||

Social Media |

|||

Physical Address & Hours of Operation |

|||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

Miscellaneous |

|||

|

* Unsubscribe / remove me from your mailing list. Please allow up to five (5) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||