Advisor News Insight |

|||

|

NEWS |

AFRs |

FACTS |

WEBSITE |

RECOMMENDED

|

|||

| |||

INDUSTRY NEWS |

|||

Cybersecurity Planning |

|||

IRS reports significant increase in texting scams; warns taxpayers to remain vigilantInternal Revenue Service (IRS) The Internal Revenue Service today warned taxpayers of a recent increase in IRS-themed texting scams aimed at stealing personal and financial information. So far in 2022, the IRS has identified and reported thousands of fraudulent domains tied to multiple MMS / SMS / text scams (known as smishing) targeting taxpayers. In recent months, and especially in the last few weeks, IRS-themed smishing has increased exponentially. |

|||

|

|||

Elderly Planning |

|||

How the SEC Works to Protect Senior InvestorsStephen Deane, SEC Office of the Investor Advocate The SEC is recommending that firms educate their advisors on declining cognitive ability. The SEC has developed this paper that describes what the SEC is doing to protect senior investors. It places those actions in the broader context of regulatory and legal developments that gives financial professionals new tools to protect seniors. |

|||

|

|||

How Your Risk of Financial Exploitation Increases as You AgeCameron Huddleston, Carefull Family Finance Expert You know that you can expect to be at an increased risk of health issues as you age. However, what you might not realize is that aging puts you at a greater risk of another issue: financial exploitation. In fact, the rate at which adults over the age of 60 can expect to experience financial exploitation—1 in 20—is higher than the incidence of many age-related diseases, according to research published in The Journals of Gerontology. And that’s likely an underestimate of the problem because, according to the report, “many older adults are unaware or unwilling to report exploitation.” |

|||

|

|||

Health Care Planning |

|||

Projected Retiree Health Costs Remain Far North of 6 FiguresRobert L. Schmidt and Eric Walters of Milliman, Inc. Many planning for retirement do not have a clear understanding of what their retiree healthcare will cost but — based on new estimates — they might want to take a closer look. According to estimates by Milliman, a healthy 65-year-old will spend on average between $137,000 and $300,000. The firm’s 2022 Retiree Health Cost Index projects the total premiums and out of pocket expenses a healthy 65-year-old can expect to spend on medical and prescription drug costs in retirement. The report also looks at cost variations across sex, geography, and the two most common coverage options for Medicare-eligible retirees. |

|||

|

|||

Medicare & Medicaid Planning |

|||

CMS Announces Medicare Part B Premiums for 2023Centers for Medicare & Medicaid Services (CMS) Officials at the Centers for Medicare and Medicaid Services (CMS) — the arm of the U.S. Department of Health and Human Services that runs Medicare — said Part B premiums will fall 301% in 2023 because spending on a new Alzheimer’s drug, Aduhelm, and on other types of care turned out to be lower than expected. |

|||

|

|||

Open Enrolment PeriodThe Medicare Open Enrollment Period lasts from October 15 - December 7 every year. What is the Medicare Open Enrollment Period? This is the time when all people with Medicare can change their Medicare health plans and prescription drug coverage for the following year to better meet their needs. Existing Medicare enrollees can do the following:

Steps to prepare:

Once they have this information you can provide value to your clients by helping them with making a decision about their Medicare plan, or help them seek out a professional who could assist them. |

|||

|

|||

Retirement Planning |

|||

Actuaries Post Retirement Guide Aimed at Older RetireesThe Society of Actuaries (SOA) has posted a retirement planning guide, “Late in Life Decision Guide,” aimed at retirees who are starting to think more about assisted living than where to build a fishing lodge. I would recommend that you send a copy of this report to all of your retiree clients for them to read. |

|||

|

|||

Mercer Projects Record Increases for 2023 Retirement Plan LimitsMercer LLC., Law and Policy Group All key Internal Revenue Code (IRC) limits for qualified retirement plans will rise by unprecedented amounts from 2022 to 2023, Mercer projects. The 2023 limits will reflect increases in the Consumer Price Index for All Urban Consumers (CPI-U) from the third quarter of 2021 to the third quarter of 2022. Using this measure, inflation is projected to reach its highest level since indexing began. |

|||

|

|||

Retirement Security: Recent Efforts by other Countries to Expand Plan Coverage and Facilitate SavingsU.S. Government Accountability Office (GAO) As America changes how it takes care of its retirees, it may benefit from looking at how other countries handle theirs. One federal agency, the Government Accountability Office (GAO) has just done that and submitted its report, Retirement Security Recent Efforts by other Countries to Expand Plan Coverage and Facilitate Savings, to Congress. The document studies retirement plans in five other nations: the United Kingdom, Canada, Lithuania, the Netherlands and New Zealand. In particular, it found different approaches in four areas: auto-enrollment in retirement plans, financial incentives to contribute, default plan options and plan flexibilities. |

|||

|

|||

Social Security Planning |

|||

2023 COLA Estimated to be 8.7%The Senior Citizens League — a nonpartisan seniors group — estimated last week that the 2023 cost-of-living adjustment (COLA) for Social Security retirement benefits could be 8.7%. This would be the largest increase in nearly 40 years. |

|||

|

|||

Bill Repealing Social Security’s WEP and GPO Advances in the HouseReaching more than 290 cosponsors, the Social Security Fairness Act (HR 82) entered an important stage in its path toward a possible full floor vote after the House Ways and Means Committee advanced the bill by voice vote on Tuesday. The proposed legislation would repeal the windfall elimination provision (WEP) and the government pension offset (GPO). |

|||

|

|||

Tax Planning |

|||

Estimated 2023 Tax Brackets AvailableThomson Reuters Tax & Accounting Thomson Reuters Checkpoint has calculated the 2023 tax brackets, as well as other inflation-adjusted tax numbers based on the recently released August 2022 inflation rate. |

|||

|

|||

Managing Tax Efficient Withdrawal Strategies for RetirementSenior National Director of Insights and Solutions Field Team, Nationwide Retirement Institute Retirement income decisions on the sequencing of withdrawals interact with each other, income tax provisions and the client’s financial goals. What appears to be a sound decision could produce unintended costs unless the advisor considers the interaction of retirement income sufficiency, income taxes and potential estate taxes. A white paper by Carlo Cordasco, senior national director of the Nationwide Retirement Institute, “Withdrawal Sequencing Strategies That Could Enhance Tax Efficiency,” examines these interactions. |

|||

|

|||

Practice Management |

|||

Worries of the WealthySpectrem Group, The Voice of the Investor “Money doesn’t buy happiness,” is a phrase that has been around for a very long time and is often used to illustrate that happiness comes from within, not from a balance in bank accounts, investments, or material possessions. What this phrase doesn’t cover however is if money eliminates worries. Are financial worries eliminated when investors reach a net worth in excess of $5 million? Do these Ultra High Net Worth (UHNW) investors not have personal concerns as a result of having that level of wealth? |

|||

|

|||

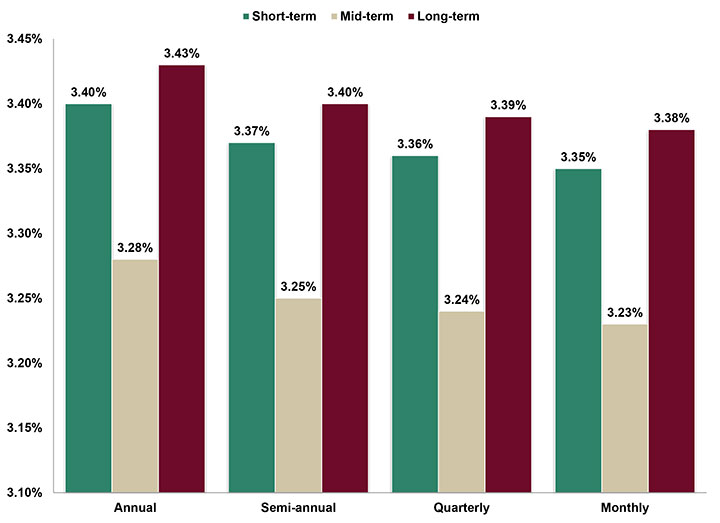

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for October is: 4.0% |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Down, but Still a Long Life |

|||

|

Source: National Vital Statistics Report In 2021, life expectancy at birth was 76.1 years, declining by 0.9 year from 77.0 in 2020 (3). Life expectancy at birth for males in 2021 was 73.2 years, representing a decline of 1.0 year from 74.2 years in 2020. For females, life expectancy declined to 79.1 years, decreasing 0.8 year from 79.9 years in 2020. Life expectancy at birth is the highest in Hawaii (80.7), and the lowest is Mississippi (71.9). |

|||

|

|||

It’s an Index |

|||

|

Source: U.S. Bureau of Labor Statistics In August, the Consumer Price Index for All Urban Consumers increased 0.1 percent, seasonally adjusted, and rose 8.3 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.6 percent in August (SA); up 6.3 percent over the year (NSA). |

|||

|

|||

October is National Financial Planning Month |

|||

|

Source: National Today Financial Planning Month is observed nationwide during October. With the holiday season coming up (aka hefty gifting expenses) and the new year just around the corner, Financial Planning Month is a great opportunity to get your finances and budgets in order before life gets too busy. |

|||

|

|||

Older Workers Are Forced Out of the Workforce |

|||

|

Source: Schwartz Center for Economic Policy Analysis The New School New research shows that even before the COVID-19 recession, 55.3 percent of workers age 55 and up in the bottom half of the income distribution were forced to leave the workforce and 32.4 percent in the next 40% of the income distribution – the middle class – were forced out of work in old age. |

|||

|

|||

USEFUL FINANCIAL WEBSITE |

|||

Medicare Open Enrollment 2023 Guide |

|||

|

Medicare open enrollment for 2022 coverage starts on October 15, 2022 continues through December 7, 2022. Everything you need to know about this year’s enrollment dates, coverage costs, eligibility details and opportunities to change coverage. |

|||

|

|||

RECOMMENDED READING |

|||

Employment and Retirement Among Older Workers During the Covid-19 Pandemic |

|||

|

pandemic retirement transitions were employment in high contact occupations and part-time work schedules. I estimate that part-time workers made up roughly 70% of the increase in net year-to-year employment-to-retirement transitions during the first year of the pandemic. This finding has implications for recent Social Security claiming behavior and for the possible persistence of the pandemic retirement boom. |

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

|

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

|

|||

Financial / Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

The Advisors Guide to Social Insurance Programs |

|||

|

Prices start at only $19.95.

|

|||

B.E.S.T. CE PROGRAMS |

|||

Online CE Courses |

|||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

Save 20% on Your Order When You Purchase Our Online CE Courses |

|||

|

Simply order courses and enter Promo Code: CENOW in the “Enter promotion code (optional)” input box located on the shopping cart page. (Promo code ONLY valid at time of purchase. Code cannot be combined and expires on 10/31/2022.) |

|||

Meet Your Mandatory CFP® Ethics Requirement(Also approved for 2 hours of IWI Ethics.) |

|||

|

Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP® Professionals Earn two (2) credit hours of CFP® Ethics CE with NO EXAM REQUIRED! (“Investments & Wealth Institute™ has accepted this CFP Board approved Ethics webinar for 2 hours of CE credit towards the IWI certifications.”) WEBINAR DOES NOT INCLUDE STATE INSURANCE CREDIT! *PAYMENT OPTIONS:

NOTE: Attendees MUST participate in all exercises during the webinar. Credit received for attendee time logged and participation, and there will be no exam. (A $10.00 cancellation fee will apply for all refunds requested.) |

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY NOTICE | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||