ADVISOR NEWS INSIGHT |

|||

|

News • AFRs • Website • Tools • Requirements • Featured • CE |

|||

| |||

Industry News |

|||

Running out of time? Meet your

|

|||

|

Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: Starting at $105.95** Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of the course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. Courses only available for states that have adopted the NASAA Model Regulations. |

|||

|

|||

|

Online course includes:

**Cost includes governing board filing fees of $36.00. CFP® and / or IWI (CIMA® / CPWA® / RMA®) credits are also available for additional fees.

($37.50 for 10 credit hours of CFP® and / or $25.00 for |

|||

|

|||

|

Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||

Employee Benefit Planning |

|||

|

Splitting the Difference: Why Careful Structuring and Regular Monitoring of a Split-Dollar Life Insurance Plan Might Benefit Employers and Employees Split-dollar life insurance can serve a multitude of uses. In times of a tight and competitive hiring market, employers may consider split-dollar life insurance as one of many diverse strategies to attract and retain desired employees. These plans are best established for key employees as a fringe benefit (Bryan Bloom, Partner, and Brian M. Balduzzi, Associate, Faegre Drinker Biddle & Reath LLP, 08/30/2023) |

|||

Life Insurance Planning |

|||

|

LIMRA: Record Number of Americans Plan to Purchase Life Insurance The life insurance story in the United States is some good news offset by a little bit of bad news. First, the bad news: Just 52% of U.S. adults report having life insurance, down from 63% in 2011, LIMRA reported. On the plus side, a record-high number of Americans (39%) say they plan to purchase life insurance this year. There was more good news than bad, according to new LIMRA data. (John Hilton, Senior Editor, InsuranceNewsNet, 09/13/2023) |

|||

Medicare / Medicaid Planning |

|||

|

As Medicare Premiums Whipsaw, Focus on the Big Picture With the industry starting to focus on 2024 Medicare premium increases, it’s important to see the forest, not just the trees. As advisors know, Medicare can be a bear for its complexity. (Ron Mastrogiovanni, Chairman and CEO, HealthView Services, 08/29/2023) |

|||

Retirement Planning |

|||

|

10th Annual Retirement Savers Survey The journey to a fulfilling retirement is paved with sentiments about past savings efforts and anticipation about what lies ahead. American Century’s, The Retirement Journey—Reflection, Risk and Resolve, the tenth national survey of participants and plan sponsors reinforced this again. (American Century Investments®, 2023) |

|||

|

2023 Retirement Plan Landscape Report Millions of Americans rely on the U.S. retirement system to save and invest for their futures. Expanding access to employer-sponsored retirement plans is essential to ensuring Americans are saving enough for the future, but it’s also necessary for the current system to address its weaknesses. (Morningstar, 04/2023) |

|||

|

Fidelity Research: America’s Retirement Preparedness Level Declines Amid Continued Volatility Fidelity Investments has published a new savings assessment based on fresh insights from more than 3,500 survey responses from clients using the firm’s retirement planning platform. A key finding is that Americans’ financial strength has declined in recent years. (Fidelity®, 03/21/2023) |

|||

|

How To Fix the American Retirement Crisis The American retirement system is in crisis. Workers don’t save enough. They draw down their nest eggs too soon and too quickly. And even professionals face enormous challenges in determining how to ensure someone’s savings will last their lifetime. Three experts, Michael Finke, Angie Chen, and Christine Benz, weigh in on the challenges and potential solutions. (TIAA, 06/2023) |

|||

|

Replacement Rates and the Retirement Crisis Is there a retirement savings “crisis?” According to a recent op-ed in The Wall Street Journal, and a working paper from the American Enterprise Institute’s Andrew Biggs, a frequent critic of what he says are sensationalized reports in the consumer and financial press of widespread poverty in retirement, the answer is no. In the paper, titled Replacement Rates and the Retirement Crisis, Biggs, former principal deputy commissioner of the Social Security Administration (SSA), argued that it’s really all a matter of “keeping up with the Joneses.” If having enough money in retirement is defined as maintaining one’s own pre-retirement standard of living, then Americans are generally doing just fine. (Andrew G. Biggs, Senior Fellow, American Enterprise Institute (AEI), 08/29/2023) |

|||

Roth IRA Planning |

|||

|

Roth IRAs: The Mathematics For High-Wealth Taxpayers Benjamin Franklin famously observed, “The only two things you can count on in life are death and taxes.” To which an unknown wag offered the sardonic and almost equally famous rejoinder, “That may be true, but at least death doesn’t get worse every time Congress reconvenes.” (Joseph B. Darby III, Founder and Senior Tax Attorney, Joseph Darby Law PC, 08/14/2023) |

|||

Social Security Planning |

|||

|

Social Security Recipients Are Getting Another COLA Increase in 2024. How Much to Expect Even after this year’s record hike, Social Security beneficiaries can expect another increase next year. (Katie Teague, Writer II, CNET, 09/19/2023) |

|||

Tax Planning |

|||

|

General Explanation of the Administration’s Fiscal Year 2024 Revenue Proposals The White House released President Biden’s Fiscal Year 2024 Budget (FY24 Budget) on March 9. Later that day, the US Treasury released the General Explanation of the Administration’s Fiscal Year 2024 Revenue Proposals, commonly referred to as the ‘Green Book.’ The Green Book explains the revenue proposals in the President’s budget and serves as a guidepost to Congress for tax legislation by describing current law, proposed changes, the rationale from a policy perspective, and Treasury’s revenue projections. According to the Administration’s projections, if the FY24 Budget were enacted in its entirety, it would reduce the federal budget deficit by $2.858 trillion over 10 years. (Department of the Treasury, 03/09/2023) |

|||

Annuity Planning |

|||

|

Annuitize Old Contracts to Generate Retirement Income Old annuity contracts have one very important advantage: They were designed with vastly different assumptions about mortality and interest rates. If the contract is old enough — 15 to 20 years old — these assumptions can be beneficial to the policyholder because the older the contract, the more potentially valuable it is. (Scott Stolz, Managing Director, iCapital Solutions, 05/17/2023) |

|||

|

SOA Research Institute: Rating Agency Perspective on Insurance Company Capital The purpose of this research paper is to aid students and practitioners with their understanding of the rating agencies as they affect the insurance industry. The paper examines the insurance company credit ratings, including the fundamental principles of the licensed rating agencies, the rating types, the rating process, and the rating scales that four major rating agencies use. It will then discuss from different perspectives the impact that rating agencies have on the insurance industry. (Society of Actuaries Research Institute, 08/2023) |

|||

Practice Management |

|||

|

How to Quarantine Your Practice Against the ‘Fiduciary Flu’ Don Trone – During this Covid-19 crisis, what skills did you draw upon so that you could properly serve your clients? Did you find a greater need to demonstrate your capacity for compassion and authenticity? Did you acquire a greater appreciation for the critical leadership role you play in the lives of your team, staff, and clients? (Don Trone, CEO and one of the co-founders of the Center for Board Certified Fiduciaries, 401(k) Specialist, 04/26/2020) |

|||

|

Why Clients Leave Their Financial Advisor Earlier this year Morningstar published research titled, “Why Do Investors ‘Break Up’ With Their Financial Advisor?” It’s a great article based on data from 184 investors who fired their financial advisors. The article provides the top reasons for their actions. The article also presents three ways in which advisors could protect against clients leaving. (Sheryl Rowling, CPA & Columnist, Morningstar, 06/07/2023) |

|||

Assumed Federal Rates (AFRs) |

|||

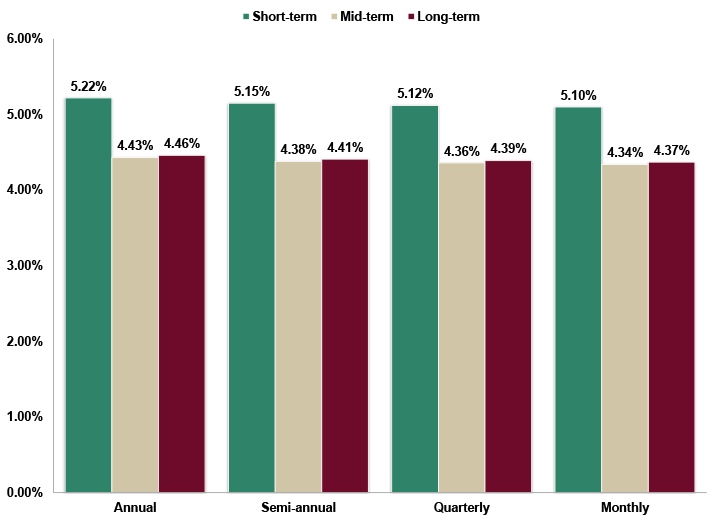

§7520 Rate for October is: 5.40% |

|||

|

|||

|

|||

Useful Financial Website |

|||

|

Morningstar Center for Retirement & Policy Studies Mission is to help improve the U.S. retirement system by arming decision-makers with unbiased and actionable data and analysis. View website address below. |

|||

|

|||

Advisor Tools |

|||

2023 Tax & Social Security / Medicare Guides |

|||

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. |

|||

Financial / Insurance Calculators & Websites |

|||

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. |

|||

|

|||

State Requirement Updates |

|||

|

Stay up-to-date on CE requirements in your state by checking out our State Requirements page. |

|||

|

|||

Featured Course |

|||

Small Business Retirement Plans and

|

|||

|

|||

B.E.S.T. CE Programs |

|||

Take our online courses at your own pace and at a price that won’t hurt your wallet. |

|||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

|||

|

|||

2-hour CFP® Ethics CE Live Webinar |

|||

|

Thursday, October 19 | 1:00PM - 3:00PM ET | Costs: See below* Live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. *Cost per license type:

This webinar presentation does NOT include state insurance CE credit. NOTE: Do not

close any of your web pages / browsers Registering involves the following three pages:

|

|||

|

|||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNERTM, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||

Disclaimer |

|||

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

|||

B.E.S.T. Information / Services |

|||

Learn More |

|||

Resources |

|||

|

Click the button below to access our comprehensive suite of resources, including calculators, websites, tax and Social Security and Medicare quick-reference guides, monthly newsletters and recorded webinars. |

|||

Social Media |

|||

Physical Address & Hours of Operation |

|||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

Miscellaneous |

|||

|

* Unsubscribe / remove me from your mailing list. Please allow up to five (5) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||