Advisor News InsightAFRs | FACTS | TOOLS | REQUIREMENTS | BEST CE |

|||||

|

|||||

INDUSTRY NEWS |

|||||

IRA PlanningIRA Trustees Wipe Out an Inherited IRA — Their OwnBy Ed Slott, President of Ed Slott and Company LLC. A lifetime of accumulation and growth goes up in smoke because the beneficiaries don’t know the IRA trust tax rules. Advisers can help their clients avoid such colossal blunders. |

|||||

|

|||||

Retirement PlanningGuaranteed Income: A License to SpendBy David Blanchett, Head of Retirement Research, DC Solutions at QMA LLC. and Michael S. Finke, Professor and Frank M. Engel Chair of Economic Security at The American College. This study explores how the composition of retirement assets is related to retirement spending and find that retirees who hold a higher percentage of their wealth in guaranteed income spend more than retirees whose wealth consists primarily of non-annuitized assets. Marginal estimates suggest that investment assets generate about half of the amount of additional spending as an equal amount of wealth held in guaranteed income. |

|||||

|

|||||

Making Sense of the 401(k) Multiple Plan LimitsBy Ed Slott, President of Ed Slott and Company LLC. There are actually two different contribution limits – the “deferral limit” and the “overall limit.” This makes things very confusing, especially if you’re in multiple plans at the same time or you change jobs in the middle of the year. |

|||||

|

|||||

Present Law and Background Relating to Retirement PlansThe Joint Committee on Taxation has released its publication, “Present Law and Background Relating to Retirement Plans,” on July 26, 2021. |

|||||

|

|||||

Social Security PlanningSocial Security: The Windfall Elimination Provision (WEP)This Congressional Research Service (CRS) Report explains how the windfall elimination provision works, who it affects, and describes legislative proposals to eliminate or modify it. Updated July 26, 2021. |

|||||

|

|||||

Tax PlanningCOVID-19 Tax Relief Added to Increasing Share of Households Paying No Income TaxBy Garrett Watson, Senior Policy Analyst at Tax Foundation. The Tax Policy Center (TPC) released estimates on the portion of households with no federal income tax liability, finding that in 2020, about 60.6 percent of households did not pay income tax, up from 43.6 percent of households in 2019. Much of the 2020 increase was due to pandemic-related factors. |

|||||

|

|||||

FACT SHEET: The Build Back Better Agenda Will Provide Greater Tax Fairness for Small BusinessesA White House fact sheet outlines President Biden’s tax proposals which include raising the corporate income tax rate, implementing a minimum tax on corporate book income, and permanently extending the expanded child tax credit, among other measures. |

|||||

|

|||||

Substantially Equal Periodic PaymentsIRS updates FAQs for substantial Equal Periodic Payments. This page from the IRS website answers questions about the exception to tax under Code section 72(t). |

|||||

|

|||||

Practice ManagementRepresentative Barred from FINRA for Cheating on CEBy Jacqueline Sergeant, Communications and Multimedia Professional at Financial Advisor. According to a recent FINRA disciplinary actions notice, a registered representative from Montpelier Virginia was barred from any FINRA member in all capacities for using an “imposter” to take his continuing education courses for him. While leniency was requested, FINRA confirmed that the “standard sanction for using an impostor in the Regulatory Element is a bar.” |

|||||

|

|||||

Three Must-Have Components to a Sustainable Referral ProcessBy Michelle R. Donovan, Referral Coach and Business Consultant at Productivity Uncorked. How long have you been searching for the silver bullet of referrals? You’re not alone. Financial advisors have been searching for decades. I’ve been coaching on the topic of referrals for nearly 20 years. Everyone has an opinion on everything, including referrals. Unsurprisingly, there is no silver bullet, and you will discover some methods are ineffective. What I’ve realized is that advisors want a referral process that works and is comfortable, sustainable and repeatable. Facing off with clients at the end of a review meeting with a referral request makes everyone squirm. |

|||||

|

|||||

Young Financial Advisors Need a NicheBy Kristen Luke, Founder of Kaleido Creative Studio. Niche marketing is the path to success for younger advisors, who can naturally develop marketing strategies based on sharing their expertise. Firm owners should coach their younger advisors and, in the process, groom the next generation of leaders. |

|||||

|

|||||

ASSUMED FEDERAL RATES (AFRs) |

|||||

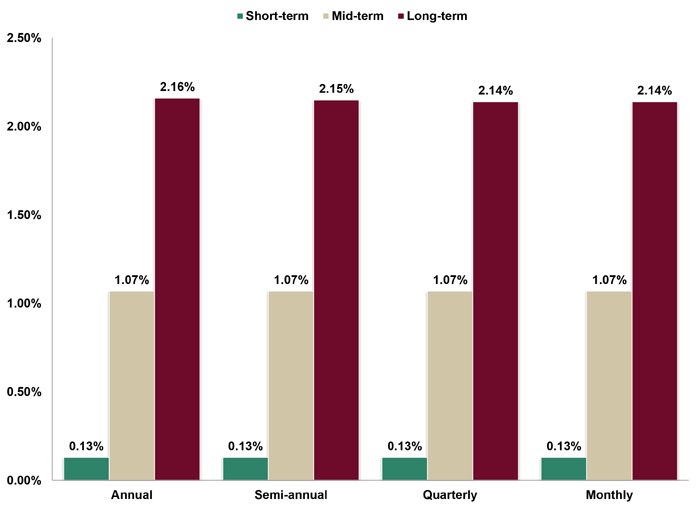

§7520 Rate for September is: 1.0%Break down: |

|||||

|

|||||

FINANCIAL FACTS OF THE MONTH |

|||||

Are You Wealthy?Source: Charles Schwab Corporation. Charles Schwab 2021 Modern Wealth Survey. The average response from 1,000 Americans surveyed in the first half of 2021 is that it takes a net worth of $1.9 million in order to be considered “wealthy” in the United States today. |

|||||

|

|||||

DeathSource: NBC News, Meet the Press: First Read The first American death from the COVID-19 pandemic occurred on 2/06/20. As of 9am ET on 8/06/21, i.e., 18 months later, 619,158 Americans had died from the pandemic, an average of 7,938 deaths per week. 3,273 Americans died of COVID-19 in the last week. |

|||||

|

|||||

Happened Earlier than ExpectedSource: Schwartz Center for Economic Policy Analysis Between March 2020 (i.e., the beginning of the global pandemic) and June 2021, 1.7 million more Americans retired from the workforce than would have normally retired if historical trends had continued. |

|||||

|

|||||

Largest Drop Since World War IISource: Centers for Disease Control and Prevention (CDC) The combination of hundreds of thousands of deaths due to the spread of COVID-19, opioid overdoses and a surge in murders in the US in 2020 saw the country’s average life expectancy drop 1.5 years to 77.3 years in 2020, the largest such drop since World War II. |

|||||

|

|||||

Living LongSource: CDC US life expectancy at birth was 60.8 years in 1921. US life expectancy at birth was 77.8 years in 2021. Thus, life expectancy has increased by a year every 6 years over the last century. |

|||||

|

|||||

Not Just KidsSource: Federal Reserve Bank of New York 19% of Americans that have outstanding student loan debt from college are over age 50, i.e., 8.7 million borrowers out of 44.7 million total borrowers. |

|||||

|

|||||

Only OnceSource: US Department of Labor Inflation, using the “Consumer Price Index” (CPI) as the measurement, was up +5.4% on a trailing 1-year basis as of 6/30/21. In the last 30 years, there was only 1 month when trailing 1-year inflation was greater than +5.4%. Inflation was up +5.6% for the 1-year ending 7/31/08. |

|||||

|

|||||

Stocks and PoliticsSource: BTN Research In the last 60 years (1961-2020), the S&P 500 has been up +17.5% per year (total return) under a Democratic President and a Republican-led Congress, nearly 4 times the +4.5% annual return achieved under a Republican President and a Congress controlled by the Democrats. The stock index gained +11.8% per year when the White House and Congress were controlled by the same political party, as is the present situation in Washington in 2021. When the House and the Senate were controlled by different parties (regardless of which party is in the White House), the S&P 500 has been up +11.3% per year. |

|||||

|

|||||

That Would Be NiceSource: Mary Johnson, The Senior Citizens League Social Security retirement benefits are projected to increase +5.3% in 2022, a “cost of living adjustment” (COLA) that would be its largest since 2009. The actual COLA bump will be announced in October 2021 by the Social Security Administration. |

|||||

|

|||||

Taxing and SpendingSource: Congressional Budget Office (CBO) The Congressional Budget Office (CBO) forecasted on 7/01/21 that during fiscal year 2021, i.e., the 12 months ending 9/30/21, the US government will receive $3.8 trillion of tax revenue, spend $6.8 trillion, resulting in a $3.0 trillion fiscal year deficit. During the next 10 fiscal years, i.e., fiscal year 2022 through and including fiscal year 2031, the US government is projected to receive $51.3 trillion of tax revenue, spend $63.4 trillion, resulting in a $12.1 trillion deficit over the next decade. |

|||||

|

|||||

The High Cost of CareSource: Center for Retirement Research at Boston College 12% of US retirees, i.e., 1 out of 8, will spend at least 4 years in a nursing home. |

|||||

|

|||||

ADVISOR TOOLS |

|||||

2021 Federal Income Tax GuideOur Tax Guide contains tax information such as:

Download the Tax Guide below: |

|||||

2021 Social Security & Medicare Reference GuideOur Reference Guide contains information such as:

Download the Reference Guide below: |

|||||

Financial / Insurance Calculators & WebsitesAn extensive list of online calculators and informational websites. |

|||||

REQUIREMENT UPDATES |

|||||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||||

|

|||||

BEST CE PROGRAMS |

|||||

Online CE CoursesAt BEST we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP, CIMA, CPWA and RMA). Our CE courses are specifically designed for quick completion and include:

|

|||||

|

|||||

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar“Ethics CE: CFP Board’s Revised Code and Standards:

|

|||||

|

|||||

Self-Study CE Course ListAs a top-notch continuing education provider we:

|

|||||

|

|||||

DISCLAIMER |

|||||

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues. THIS NEWSLETTER IS PROVIDED FOR

INFORMATIONAL PURPOSES ONLY AND |

|||||

INFORMATION |

|||||

|

© 1986 - 2021 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||||

SERVICES |

|||||

|

UNSUBSCRIBE* | ABOUT BEST | CONTACT US | PRIVACY POLICY | REFUND POLICY |

|||||

*Unsubscribing? Please allow one (1) business days for removal. |

|||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||||