Advisor News Insight |

|||

|

NEWS |

AFRs |

FACTS |

TOOLS

|

|||

| |||

INDUSTRY NEWS |

|||

Estate Planning |

|||

Portability Extension ElectionInternal Revenue Service (IRS) In Rev. Proc. 2022-32, the IRS established a five-year time-period for filing returns for portability when the estate is below the filing threshold. This simplified method which doesn’t require a user fee should be used instead of the Private Letter Ruling process. To claim the relief, the executor must file a completed Form 706 and state on top of the Form that the return is quote: “Filed Pursuant to Rev. Proc. 2022-32 to elect Portability under Section 2010 (c)(5)(a).” Under this new procedure this extension request must be made on or before the fifth anniversary of the decedent’s death. |

|||

|

|||

Health Care Planning |

|||

How Much Does Health Spending Eat Away at Retirement Income?Melissa McInerney, Professor of economics at Tufts University, Matthew S. Rutledge, Associate Professor of the Practice of Economics at Boston College and a Research Fellow at the Center for Retirement Research at Boston College (CRR) and Sara Ellen King, graduate student at the University of Maryland and a former Research Associate at the CRR. This study shows that, at the median, out-of-pocket (OOP) medical costs – including premiums, cost-sharing, and uncovered services (excluding long-term care) – leave only 75 percent of Social Security benefits available for spending on other items. Premiums for Medicare Parts B and D, Medicare Advantage, and supplemental plans (including retiree health insurance) make up the lion’s share of medical spending for most retirees, except those with the highest spending. |

|||

|

|||

Long-Term Care Planning |

|||

Most Older Adults Are Likely to Need and Use Long-Term Services and SupportsRichard W. Johnson and Melissa M. Favreault, Urban Institute, Judith Dey, William Marton, and Lauren Anderson Department of Health and Human Services Most Americans underestimate the risk of outliving their financial resources in retirement or experience economic hardship stemming from large, unanticipated health and long-term care costs in later life. According to a recent Issue Brief released by ASPE within the Department of Health and Human Services, reported that more than one-half of older adults, regardless of their lifetime earnings, are projected to experience serious LTSS needs and use some paid LTSS after turning 65. More than one-third (39%) will receive nursing home care. |

|||

|

|||

Medicare & Medicaid Planning |

|||

Inflation Reduction Act of 2022: Changes to Medicare Part D Prescription Drug Coverage 2023 and BeyondA number of changes are included in the “Inflation Reduction Act of 2022” that will impact future Medicare Part D prescription drug plan coverage and costs. Here is a year-by-year summary of some of the top Medicare Part D plan changes: Beginning 2023

Beginning 2024

Beginning 2025

Beginning 2026

Beginning 2027

Beginning 2028

Beginning 2029

|

|||

|

|||

Retirement Planning |

|||

Record Increases Projected for 2023 Retirement Plan LimitsTed Godbout, Writer / Editor at American Retirement Association Announcement of the official limits is still a few months away, but early projections from Mercer suggest that nearly all qualified retirement plan limits will increase by unprecedented amounts next year. The 2023 limits will reflect increases in the Consumer Price Index for All Urban Consumers (CPI-U) from the third quarter of 2021 to the third quarter of 2022. Using this measure, inflation is projected to reach its highest level since indexing began, causing 7% – 11% increases for most limits, based on their rounding levels, according to benefits consultant Mercer, whose past projections have been rather accurate. |

|||

|

|||

Social Security Planning |

|||

AARP Public Policy Institute: 2022 Social Security

|

|||

|

|||

Practice Management |

|||

The Future of Work in Investment Management: The Future of Skills and LearningCFA Institute®, Future of Finance In this report, the CFA Institute, identifies gaps between the supply and demand for skills, outline strategies for career development, and propose structural changes to investment teams to better leverage the diversity of talent and the combined power of discrete but complementary skills. Furthermore, the report, challenges investment professionals and investment industry leaders — at all career stages — to continue to build their skills and increase their knowledge. An investment industry that prioritizes competency, ethics, and adaptability will be well-positioned to thrive now and in the future. |

|||

|

|||

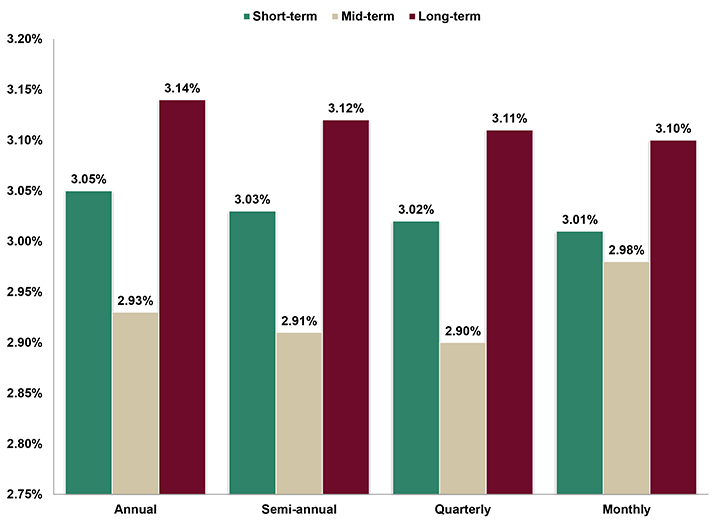

ASSUMED FEDERAL RATES (AFRs) |

|||

§7520 Rate for September is: 3.6% |

|||

|

|||

|

|||

FINANCIAL FACTS OF THE MONTH |

|||

Did You Know That… |

|||

|

Source: Social Security Administration (SSA) 55% of adult Social Security beneficiaries in 2019 were women. |

|||

|

|||

September is Life Insurance Awareness Month |

|||

|

Source: LIMRA Every September, the industry — led by Life Happens — comes together to sponsor Life Insurance Awareness Month. This campaign is designed to educate consumers about the importance of life insurance and the role it plays in protecting families’ financial security. LIMRA is proud to support Life Insurance Awareness Month (LIAM). |

|||

|

|||

September’s Name is Inaccurate |

|||

|

Source: The Fact Site September’s name is really quite inaccurate these days. It was originally the seventh month of the ancient Roman calendar, and as such it was named Septem, which translates into “the seventh month.” It wasn’t until 451 BC that the months of January and February were added to the calendar, making September the ninth month. |

|||

|

|||

September 17th |

|||

|

Source: The Fact Site September 17th is an incredibly important day for the US, as it was on this day in 1787 that the US Constitution was adopted. If it weren’t for the Constitution, the US could be an incredibly different country today, with far fewer civil liberties! |

|||

|

|||

Taxes in America |

|||

|

Source: Blue Water Credit The average American pays an effective federal income tax rate of 13.5%. They also pay 9.9% in state and local income taxes, 3.3% in Social Security taxes, and 1.45% to Medicare. |

|||

|

|||

ADVISOR TOOLS |

|||

2022 Federal Income Tax Guide |

|||

|

Our Tax Guide contains tax information such as:

|

|||

2022 Social Security & Medicare Reference Guide |

|||

|

Our Reference Guide contains information such as:

|

|||

Financial / Insurance Calculators & Websites |

|||

|

An extensive list of online calculators and informational websites. |

|||

REQUIREMENT UPDATES |

|||

State Updates |

|||

|

View updates by state, CE requirements and more by clicking on the link below. |

|||

|

|||

FEATURED COURSE |

|||

Life Insurance, Annuity and Ethical Practices |

|||

|

and their suitability. The course ends with ethical practices which will provide the essentials of ethics, market conduct and compliance. |

|||

|

Complete your CE requirement quickly and easily. This online course allows for convenient access to course material and includes: self-paced courses, unlimited retakes of review questions and final examination, instant grading, course material accessible for up to one year from date of purchase, and excellent customer support. |

|||

|

Prices start at only $29.95.

|

|||

B.E.S.T. CE PROGRAMS |

|||

Online CE Courses |

|||

|

At B.E.S.T. we provide you with a lot of CE credit. Courses are cost-effective, updated annually and nationally approved for state insurance and professional designation credits (CFP® & IWI). Our CE courses are specifically designed for quick completion and include:

|

|||

|

|||

Save 20% on Your Order When You Purchase Our Online CE Courses |

|||

|

Simply order courses and enter Promo Code: CENOW in the “Enter promotion code (optional)” input box located on the shopping cart page. (Promo code ONLY valid at time of purchase. Code cannot be combined and expires on 09/30/2022.)

|

|||

Meet Your Mandatory CFP® Ethics Requirement(Also approved for 2 hours of IWI Ethics.) |

|||

|

Ethics CE: CFP Board’s Revised Code and Standards:

Ethics for CFP® Professionals Earn two (2) credit hours of CFP® Ethics CE with NO EXAM REQUIRED! (“Investments & Wealth Institute™ has accepted this CFP Board approved Ethics webinar for 2 hours of CE credit towards the IWI certifications.”) WEBINAR DOES NOT INCLUDE STATE INSURANCE CREDIT! *PAYMENT OPTIONS:

NOTE: Attendees MUST participate in all exercises during the webinar. Credit received for attendee time logged and participation, and there will be no exam. (A $10.00 cancellation fee will apply for all refunds requested.) |

|||

|

|||

Self-Study CE Course List |

|||

|

As a top-notch continuing education provider we:

|

|||

|

|||

DISCLAIMER |

|||

|

Reproductions of our

Advisor News Insight newsletter are prohibited

unless you have received prior authorization from

Broker Educational Sales & Training, Inc. (B.E.S.T.),

but you are free to email this copy (in its

entirety) to colleagues.

THIS

NEWSLETTER IS PROVIDED FOR |

|||

INFORMATION |

|||

|

© 1986 - 2022 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||

SERVICES |

|||

|

UNSUBSCRIBE* | ABOUT B.E.S.T. | CONTACT US | PRIVACY NOTICE | REFUND POLICY |

|||

|

*Unsubscribing? Please allow one (1) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||