ADVISOR NEWS INSIGHT |

|||

|

News • AFRs • Website • Tools • Requirements • Featured • CE |

|||

| |||

B.E.S.T. IAR Online CE Courses |

|||

|

Start fulfilling your 12-hour IAR CE requirements today! |

|||

|

Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: Starting at $105.95** Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of the course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. Courses only available for states that have adopted the NASAA Model Regulations. |

|||

|

|||

|

Online course includes:

**Cost includes governing board filing fees of $36.00. 10 CE credit hours of CFP® and / or 10 CE credit hours of IWI (CIMA® / CPWA® / RMA®) are also available. Learn more by clicking the button below. |

|||

|

|||

|

Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||

Industry News |

|||

Education Planning |

|||

|

A New FAFSA Form Is Coming, Along With Changes in College Aid In addition to the new form, the federal government will expand eligibility for federal aid in the biggest overhaul in decades. In addition to the new form, the federal government will expand eligibility for federal aid in the biggest overhaul in decades. (Ann Carrns, Contributor, The New York Times, 08/11/2023) |

|||

|

What Are the Rules For Penalty-Free Higher Education Expense Withdrawals? If you have clients who are under age 59½ and are facing the unpleasant prospect of paying college bills for the fall semester, they may be thinking of tapping into their retirement savings to help with the costs. You need to explain the following rules to those clients. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 08/07/2023) |

|||

Estate Planning |

|||

|

Distribution of the Estate Tax The Tax Policy Center releases information on Distribution of Estate Taxes in tax year 2021. (Tax policy Center, 10/28/2023) |

|||

|

SOI Tax Stats – Gift Taxes U.S. taxpayers reported owing a total of $2.8 billion in gift taxes and generation-skipping transfer (GST) on returns filed in 2021, up from $409 million the year before, according to new data from the Internal Revenue Service. The number of returns showing taxpayers owed gift or GST taxes increased to 1,820, from 528 in 2020, and the total of returns showing gift or GST obligations of $1 million or more rose to 1,101, from 266. More high-net-worth clients are thinking about gift and GST taxes. IRS officials suggested in a data summary that one reason for the increase in 2021 gift and GST tax obligations could be taxpayers’ efforts to use the temporary gift, estate and GST tax exemption changes included in the Tax Cuts and Jobs Act of 2017. The TCJA provision is set to expire in 2026. (IRS, 08/2023) |

|||

Medicare / Medicaid Planning |

|||

|

Options for Increasing Medicare Revenues Medicare faces serious short term and long-term financial pressures. Given that cost containment measures need to be implemented gradually, it seems likely that Congress will have to address at least some of the Medicare’s financial shortfall with additional tax revenues. The Tax Policy Center has released a report titled, “Options for Increasing Medicare Revenues” which examines the revenue and distributional effects of several options to increase revenues for Medicare and discusses their relative pros and cons. The report analyzes 12 options including increasing Medicare tax rates, increasing individual income tax rates, broadening the tax base, increasing corporate income tax rates, and enacting a value added tax. (Tax policy Center, 02/2023) |

|||

Retirement Planning |

|||

|

IRS Announces Administrative Transition Period for New Roth The Internal Revenue Service (IRS) announced on August 25, 2023 an administrative transition period that extends until 2026 the new requirement that any catch-up contributions made by higher-income participants in 401(k) and similar retirement plans must be designated as after-tax Roth contributions. At the same time, the IRS also clarified that plan participants who are age 50 and over can continue to make catch-up contributions after 2023, regardless of income. (IRS, 08/25/2023) |

|||

|

RMD Relief? No Thank You At first it may seem that every beneficiary who is subject to the 10-year rule and would otherwise be required to take an RMD for 2023 should take advantage of the opportunity to skip their 2023 RMD. It may seem like a no brainer to keep the funds in the account if not needed and avoid an immediate tax bill. However, this may not actually be a smart planning move. (Sarah Brenner, JD, Director of Retirement Education, Ed Slott and Company, LLC, m/d/yy) |

|||

|

Second Judge Strikes Down DOL Rollover Guidance A second judge has ruled the Labor Department’s guidance that declared rollover advice fiduciary advice should be struck down. The ruling is a victory for the Federation of Americans for Consumer Choice, an advocacy group representing independent insurance distributors. In the U.S. District Court for the Northern District of Texas, Judge Rebecca Rutherford ruled on June 30 to vacate portions of Labor’s Prohibited Transaction Exemption 2020-02, Improving Investment Advice for Workers & Retirees, which establishes more stringent rollover rules. (Melanie Waddell, Washington Bureau Chief, Investment Advisory Group, LLC, 07/10/2023) |

|||

Social Security Planning |

|||

|

5 Reasons to Pause Social Security Benefits Among the most common tasks retirement-focused financial planners are asked to do on behalf of their clients and prospects is to help optimize the claiming of Social Security, with the goal generally being to maximize the amount of wealth a person or couple receives from the federal program. So, it may come as a surprise that, in certain limited circumstances, it can actually make sense for a client to temporarily stop their Social Security benefit. (John Manganaro, Senior Reporter, ThinkAdvisor, 07/25/2023) |

|||

|

Just 10% of Non-Retired Americans Will Wait Until 70 to Take Maximum social Security Benefits According to the 2023 Schroders US Retirement Survey, only 10% of non-retired Americans say they will wait until 70 to receive their maximum Social Security benefit payments. This includes 17% of non-retired respondents on the verge of retirement (ages 60-65). Overall, 40% of non-retired respondents plan to take their Social Security benefits between 62-65, leaving them short of qualifying for their full retirement benefits. The choice to forgo larger Social Security payments is a deliberate one, as 72% of non-retired investors – and 95% of non-retired ages 60-65 – are aware that waiting longer earns higher payments. “Why are so many non-retired Americans taking their Social Security benefits before age 70?” (Schroder Investment Management North America Inc., 08/08/2023) |

|||

|

Retirees Face a $17,400 Cut if Social Security Isn’t Saved As the 2024 presidential campaign ramps up, candidates are facing pressure to pledge not to touch Social Security. While this pledge is framed as ‘protecting benefits,’ it is – in reality – an implicit endorsement of a 23 percent across-the-board benefit cut in 2033, when the Social Security retirement fund becomes insolvent. In that year, annual benefits would be cut by $17,400 for a typical newly retired dual-income couple. (US Budget Watch 2024, 08/08/2023) |

|||

|

Social Security’s “Surprise Inside:” Delayed Retirement Credits Delaying Social Security old-age benefits until age 70 means a generous reward for those with the willpower or the resources to hold out for larger benefits checks. Yet more than 90% of Americans won’t wait to take full advantage of so-called delayed retirement credits (DRCs). Some are probably your clients. When discussing their retirement income plans, are you prepared to explain DRCs to clients? Here are some facts to have in your pocket and some resources for you and your clients. (Alyson Dorosky, Marketing and Social Security Specialist, LifeYield, LLC, 07/31/2023) |

|||

Trust Planning |

|||

|

FDIC Insurance Changes Will Affect Trusts FDIC insurance is an important element of bank safety. The Federal Deposit Insurance Commission (FDIC) is an independent agency that protects depositors against losses when an insured bank fails. The recent uptick in large bank failures may have had you double checking that your accounts are insured by the FDIC. In times of economic insecurity our first instinct is often to check our personal accounts, but the FDIC also insures trust accounts. For a personal account, FDIC coverage is relatively simple. The FDIC insures personal accounts up to $250,000. Coverage limits on trust accounts are a little more complicated. (Jordan Young, Legal Columnist, Fleming & Curti PLC, 08/13/2023) |

|||

Practice Management |

|||

|

The DOL’s Regulatory Agenda and a New Fiduciary Rule The anticipated DOL proposed fiduciary regulation could be sent to the Office of Management & Budget (OMB) in a matter of weeks. The proposal will likely say that a rollover recommendation to a participant in an ERISA governed retirement plan is a fiduciary act. The DOL will also likely propose amendments to prohibited transaction exemptions (PTEs) including PT-84-24, the exemption used for fiduciary rollover recommendations into individual annuity contracts. (Fred Reish, Partner, Faegre Drinker’s Benefits & Executive Compensation Practice Group, 08/08/2023) |

|||

Assumed Federal Rates (AFRs) |

|||

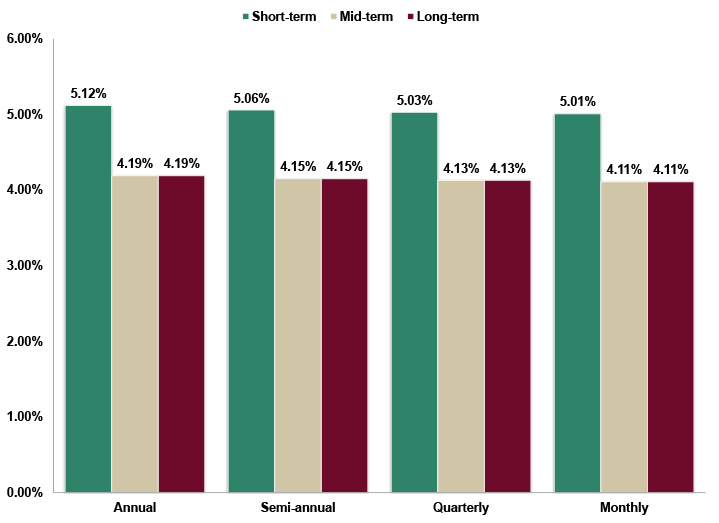

§7520 Rate for September is: 5.00% |

|||

|

|||

|

|||

Useful Financial Website |

|||

|

Tax Policy Center The Urban-Brookings Tax Policy Center produces independent, timely, and accessible analyses of current and longer-term tax issues. “Our goal is to help the public, the media, and policymakers make informed decisions about critical fiscal issues and support better policy outcomes.” The Tax Policy Center (TPC) is a joint venture of the Urban Institute and Brookings Institution. The Center is made up of nationally recognized experts in tax, budget, and social policy who have served at the highest levels of government. |

|||

|

|||

Advisor Tools |

|||

2023 Tax & Social Security / Medicare Guides |

|||

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. |

|||

Financial / Insurance Calculators & Websites |

|||

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. |

|||

|

|||

State Requirement Updates |

|||

|

Stay up-to-date on CE requirements in your state by checking out our State Requirements page. |

|||

|

|||

Featured Course |

|||

Retirement Planning |

|||

|

of retirement plan distributions and the many rules and regulations that surround this issue. Finally, the course addresses the subject of health care and long-term care planning in retirement with a discussion of Health Savings Accounts, Medicare, and LTC Planning with the use of LTCI and Hybrid LTCI policies as well as the use of reverse mortgages. |

|||

|

|||

B.E.S.T. CE Programs |

|||

Take our online courses at your own pace and at a price that won’t hurt your wallet. |

|||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

|||

|

|||

2-hour CFP® Ethics CE Live Webinar |

|||

|

Thursday, September 28 | 2:00PM - 4:00PM ET | Costs: See below* Live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. *Cost per license type:

Prices do NOT include CFP Board filing fees where applicable. (CFP® Fee: $1.25 per credit hour, per student.) (DOES NOT INCLUDE STATE INSURANCE CE CREDIT.) |

|||

|

|||

Disclaimer |

|||

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

|||

B.E.S.T. Information / Services |

|||

Learn More |

|||

Resources |

|||

|

Click the button below to access our comprehensive suite of resources, including calculators, websites, tax and Social Security and Medicare quick-reference guides, monthly newsletters and recorded webinars. |

|||

Social Media |

|||

Physical Address & Hours of Operation |

|||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

Miscellaneous |

|||

|

* Unsubscribe / remove me from your mailing list. Please allow up to five (5) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||