Advisor News Insight |

|||||||||||||||||||||||||

|

News • AFRs • Podcast • Tools • Requirements • Featured • CE |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

INDUSTRY NEWS |

|||||||||||||||||||||||||

Updated 2025 Federal Income Tax Guide |

|||||||||||||||||||||||||

|

Get the latest tax information! Our free Federal Income Tax Guide has been updated to reflect the One Big Beautiful Bill Act. (No business or personal information required for download.) |

|||||||||||||||||||||||||

Annuity Planning |

|||||||||||||||||||||||||

How In-Plan Annuities Enable Participants to Turn Savings Into IncomeWhen employers decide how to help retirement plan participants turn savings into income, no one solution is a clear winner, but annuities are the only means to provide guaranteed income within a defined contribution (DC) plan. However, annuities are not commonly available as distribution options and expanding participant access to lifetime income is an important avenue to increasing retirement security. (Tamiko Toland, Education Fellow, Michael Finke, PhD, CFP®, professor of wealth management, Retirement Income Institute, 07/2025) |

|||||||||||||||||||||||||

IRA Planning |

|||||||||||||||||||||||||

IRA Rollover Assets to Surpass $T by 2030Rollovers from defined contribution (DC) plans are the leading source of funding for individual retirement accounts (IRAs), accounting for 97% of all IRA inflows in 2022, reported recent findings from LIMRA. The surge in growth will likely continue, LIMRA reported, up to $855 billion in retail rollover activity by this year. IRA rollover activity is also anticipated to jump 34% to $1.15 trillion by 2030. (Amanda Umpierrez, Managing Editor, 401(k) Specialist magazine, 07/28/2025) |

|||||||||||||||||||||||||

Long-Term Care Planning |

|||||||||||||||||||||||||

Employee Perspective on Long-Term CareThe Employee Long-Term Care (LTC) Survey, conducted by the Employee Benefit Research Institute (EBRI) fielded in late 2024, examined employees’ awareness of, access to, and perspectives on LTC financing. Findings from the survey of 2,445 workers ages 20–74 uncovered emerging insights while also reaffirming well-established trends in LTC awareness and preparedness. (Bridget Bearden, Ph.D., Employee Benefit Research Institute, 05/01/2025) |

|||||||||||||||||||||||||

The Overlooked Cost: How Long-Term Services and Supports Impacts Retirement-Income AdequacyA recent study by Morningstar found that costs for long-term services and supports (LTSS), including things like in-home care, assisted living and nursing home facilities, can have a dramatic impact on retirement plan failure rates. (Various Authors, Morningstar, 05/2025) |

|||||||||||||||||||||||||

Retirement Planning |

|||||||||||||||||||||||||

Total U.S. Retirement Assets Down 1.6% in Q1 2025; IRAs Growing

|

|||||||||||||||||||||||||

Wade Pfau: Four Ways To Beat Sequence RiskBumpy markets are no fun for anyone, but for clients about to retire or who are recently retired, volatility can be downright terrifying. (Jennifer Lea Reed, Senior Writer, Financial Advisor, 07/17/2025) |

|||||||||||||||||||||||||

Social Security Planning |

|||||||||||||||||||||||||

Guide on Taking Social Security: 62 vs. 67 vs. 70You may be eligible to collect Social Security as early as 62, but waiting until age 70 yields greater benefits for most people. Here’s help on how to decide. (Rob Williams, CFP®, RICP®, CPWA®, Managing Director, Financial Planning, Retirement Income and Wealth Management, Schwab Center for Financial Research, 03/14/2025) |

|||||||||||||||||||||||||

How to Calculate Your Social Security Break-Even AgeTo calculate your Social Security break-even age, you’ll need to compare the total lifetime benefits received at 62 vs. 67. vs. 70. The break-even point marks when later-claimed benefits catch up to and exceed the value of earlier claims. (Rebecca Lake, CEPF®, retirement, investing and estate planning expert, 03/28/2025) |

|||||||||||||||||||||||||

Two Misleading Narratives on the Social Security Funding Crisis - Part 1According to a new analysis published by Andrew Biggs, senior fellow at the American Enterprise Institute and former deputy commissioner of Social Security, one primary cause of the program’s looming insolvency has long been overlooked: the decision to index retirees’ initial benefit amounts to long-term wage and economic growth. Biggs writes, neither the aging population narrative nor the compensation narrative tells the full story about how Social Security’s financial challenges arose and what policymakers might do to address them. And once the full story is recognized, he argues, the argument for simply raising taxes to keep Social Security solvent is weakened. (Andrew Biggs, Senior Fellow, American Enterprise Institute, 07/16/2025) |

|||||||||||||||||||||||||

Why Are More Americans Filing for Social Security Benefits?More older Americans are claiming their Social Security benefits earlier, a potentially alarming trend that could significantly reduce the income many rely on in their golden years. (Andrew Dorn, digital reporter, NewsNation, 06/11/2025) |

|||||||||||||||||||||||||

Practice Management |

|||||||||||||||||||||||||

FinCEN says it will postpone effective date of anti-money-laundering ruleTreasury’s Financial Crimes Enforcement Network (FinCEN) said Monday that it plans to postpone the effective date of a rule bringing certain investment advisers within the standards of its anti-money-laundering and countering-the-financing-of-terrorism (AML/CFT) programs as it revisits the rule. (Martha Waggoner, Senior Writer, Association of International Certified Public Accountants (AICPA®) & CIMA®, 07/21/2025) |

|||||||||||||||||||||||||

The New Face of Wealth: The Rise of the Female InvestorWomen are increasingly recognized as the new face of wealth, but industry players have yet to fully capture the growth opportunity presented by the rising share of assets controlled by women. In the United States, total assets controlled by women rose from about $10 trillion in 2018 to about $18 trillion in 2023, expanding from 31 percent to 34 percent of US AUM. Female-controlled assets are now projected to nearly double to $34 trillion, representing about 38 percent of total US assets, by 2030. (Various authors, McKinsey & Company, 05/08/2025) |

|||||||||||||||||||||||||

ASSUMED FEDERAL RATES (AFRs) |

|||||||||||||||||||||||||

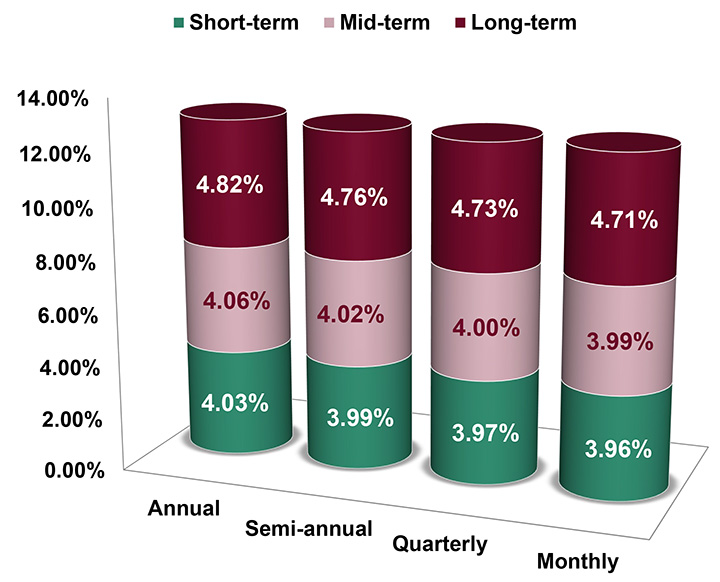

§7520 Rate for August is: 4.80% |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

RECOMMENDED PODCAST |

|||||||||||||||||||||||||

The Simple Math of the Big BillThe bill formerly known as the One Big Beautiful Bill has officially passed. |

|||||||||||||||||||||||||

ADVISOR TOOLS |

|||||||||||||||||||||||||

Free 2025 Federal Income Tax and

|

|||||||||||||||||||||||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

|||||||||||||||||||||||||

STATE REQUIREMENT UPDATES |

|||||||||||||||||||||||||

Stay Up-to-Date on Your

|

|||||||||||||||||||||||||

FEATURED COURSE(S) |

|||||||||||||||||||||||||

12 Hours of IAR CE Credits |

|||||||||||||||||||||||||

B.E.S.T. CE PROGRAMS |

|||||||||||||||||||||||||

Take Our Online or Self-Study Courses at

|

|||||||||||||||||||||||||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

|||||||||||||||||||||||||

CFP® Ethics CE Webinar |

|||||||||||||||||||||||||

Complete Your CFP® Ethics CE Requirement

|

| When: Thursday, August 21, 2025 | Where: 2-hour Live webinar presentation (GoToWebinar platform) |

| Time: 2:00 p.m. - 4:00 p.m. ET | Price: See detailed pricing options below. |

Presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required.

This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit.

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| CFP® credit ONLY: | $61.50 | CFP® credit PLUS IAR credit: | $92.50 | |

| IWI credit ONLY: | $59.00 | IWI credit PLUS IAR credit: | $90.00 | |

| IAR credit ONLY: | $65.00 | CFP® credit PLUS IWI credit PLUS IAR credit: |

$117.50 | |

| CFP® credit PLUS IWI credit: | $86.50 |

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.)

Registering includes the following three web pages: (each may open in a separate window)

- Payment: Enter your payment information. A detailed breakdown of costs and fees will appear before you confirm your payment.

- Attendee Registration: Fill out the Attendee Registration form to provide your contact details and any other information necessary to receive your CE credit.

- GoToWebinar Registration: Enter your First Name, Last Name and Email Address, then click the ‘Register’ button to complete registration for the live webinar.

NOTE: Do not close any of your web pages / browsers

until you are completely done registering. (SEE ABOVE.)

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024.

IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®)

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

IAR CE Programs

Meet your 6-hour IAR Ethics and

Professional Responsibility CE Requirements

Starting at only $74.95.

Also approved for 6 CE credit hours of CFP® and / or

6 CE credit hours of IWI (CIMA® / CPWA® / RMA®) in addition to IAR CE credits.

(CFP® and IWI ONLY credits NOT available.)

IAR Virtual Super CE Program Agenda

|

Our Virtual Super CE Program

Consists of the Following:

- 1-hour live webinar presentation: Ethical Practices and Professional Responsibility

(No CE credit.) - Self-study course: Ethics for Financial and Insurance Professionals (Course #: C25280)

- Virtual final exam (online): Requires you to spend 6 hours of reading and reviewing the self-study course material PRIOR to taking the exam. The 60-question exam requires an invite code that is given to all attendees during the live webinar presentation. To receive CE credit, advisors must obtain a passing grade of 70% or higher. If the exam is not passed on the first attempt, students have two (2) additional retakes for a maximum of three (3) attempts.

This presentation is designed to present financial and insurance professionals with the ethical practices and standards required when conducting business in their state.

This course is designed to meet the mandatory 6-hour CE credit requirement under the Ethics and Professional Responsibility for Investment Adviser Representatives (IARs).

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| IAR credit ONLY: | $74.95 | IAR PLUS IWI credits: | $99.95 | |

| IAR PLUS CFP® credits: | $99.95 | IAR PLUS CFP® PLUS IWI credits: |

$124.50 |

Meet Your 6-hr or 12-hr IAR CE Requirement

Online and On Your Schedule!

B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

- 6-Hour Ethics and Professional Responsibility Course

- 12-Hour Guide to Social Security and Ethical Practices Course

(6 hours Products & Practices + 6 hours Ethics)

Ethics for Financial and Insurance Professionals (6-hour)

Course #: C27297 | 6 CE Credit Hours | Starting at $47.95*

This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs).

What’s Included in the Course:

- 6 CE credit hours focused on Ethics and Professional Responsibility

- *$18 Governing Board Fee included in the cost

Online Exam:

- 60-question online exam

- To pass, achieve a 70% or higher score (Maximum of three (3) attempts allowed by NASAA).

Bonus Credits:

- 6 CE credit hours for CFP® certification

- 6 CE credit hours for IWI certifications (CIMA® / CPWA® / RMA®)

Ready to Enroll?

Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence!

Guide to Social Security and Ethical Practices (12-Hour - split course)

Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95*

This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements.

What’s Included in the Online Course:

- 12 CE Credit Hours Total:

- 6 CE credit hours on Products and Practices

- 6 CE credit hours on Ethics and Professional Responsibility

- *$36.00 Governing Board Fee included in the course cost.

Online Exam:

- 120-question online exam

- To pass, achieve a 70% or higher score (Maximum of three (3) attempts allowed by NASAA).

Bonus Credits:

- 10 CE credit hours for CFP® certification

- 10 CE credit hours for IWI certifications (CIMA® / CPWA® / RMA®)

Why Choose This Course?

- Comprehensive and up-to-date content designed to meet all your IAR CE needs.

- Flexible online format allows you to complete the course at your own pace.

- Competitive pricing that includes all required fees.

- Equip yourself with practical knowledge to guide your clients through the complexities of Social Security while maintaining high ethical standards.

Get Started Today

Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go!

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.)

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

DISCLAIMER

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.).

Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content.

It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T.

Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness.

THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR

LEGAL ADVICE.

B.E.S.T. INFORMATION / SERVICES

B.E.S.T. Links

Resources

Access a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings.

Social Media

Physical Address & Hours of Operation

© 1992 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

7137 Congress Street, New Port Richey, FL 34653 | Toll Free:

1-800-345-5669

Hours of Operation: Monday - Friday, 8:30 a.m. to 5:00 p.m.

Eastern Time

Miscellaneous

About Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe*

*Remove from mailing list. Please allow up to five (5) business days for removal.

Ensure newsletter delivery to your inbox by adding [email protected] to your address book.