| Past Issues • Subscribe • Unsubscribe • Contact Us | ||||

Advisor News Insight |

||||

|

||||

Merry Christmas & Happy Holidays |

||||

Industry News |

||||

Estate Planning |

||||

The State of Estate PlanningThe State of Estate Planning Report, newly released for 2025, is a window into consumers’ wants, needs, and expectations for advisors and other financial professionals. Each year, Vanilla surveys 1,000 people in the US to identify the emerging trends and sentiments advisors need to know to successfully guide intimate estate planning conversations with clients. (Vanilla, 11/19/2024) |

||||

Health Care Planning |

||||

For Two-Thirds of Americans, Medicare’s Solvency Woes Spark Retirement FearsDoubts and fears about the future of Medicare are on the rise, with 63 percent of Americans worried the program may not be available when they retire, according to a survey by the Nationwide Retirement Institute. The 2024 Nationwide Retirement Institute Health Care Costs in Retirement consumer survey found that Medicare is a top-of-mind issue, with one in five respondents citing the program’s potential insolvency as their most important retirement planning concern. (Leo Almazora, Author, InvestmentNews, 09/24/2024) |

||||

Retirement Planning |

||||

12 New Findings on Spending in RetirementLack of sufficient savings, inflationary pressures and rising credit card debt are contributing to dampened spending by retirees, according to a new study from the Employee Benefit Research Institute. “Compared with 2020, fewer retirees indicated that they would spend down all or a significant portion of their financial assets over the course of their retirement,” Bridget Bearden, an EBRI research and development strategist, said in a statement. “These spending constraints contribute to declining levels of well-being in retirement, with retirees rating two out of three well-being measures lower in 2024 than they did in 2020 and 2022.” (Michael S. Fischer, Writer, ThinkAdvisor, 11/15/2024) |

||||

Déjà Vu All Over Again – Insecurity for ERISA’s Retirement Security Rule After Trump’s Election?The Trump election is bound to have some obvious, fundamental and high-profile consequences for various federal agencies. One particular potential area of impact relates to the recently adopted Retirement Security Rule under ERISA (i.e., the Employee Retirement Income Security Act of 1974). In this regard, some in the market have been wondering if and when financial institutions will move to dismantle ERISA-related compliance efforts regarding rollover solicitations in response to years of ebbing and flowing regulatory activity that has been undertaken by the U.S. Department of Labor (often referred to as the “DOL”) with respect to the definition of “investment advice” under ERISA’s fiduciary rules. To understand where we might now be in this saga, it’s important to know how we got here. One place to start is shortly after ERISA’s enactment in 1974. (Andrew L. Oringer, Partner, General Counsel, The Wagner Law Group, 11/19/2024) |

||||

SECURE 2.0 Developments and Guidance for 2024The SECURE 2.0 Act is an extensive piece of retirement plan legislation passed on Dec. 29, 2022. Its stated goals are to expand and increase retirement savings and to simplify and clarify retirement plan rules. Its passage affects virtually all forms of retirement plans and increases conformity across different types of plans. The legislation expands and builds upon the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, which was known for increasing the age for required minimum distributions (RMDs) and eliminating age requirements for traditional IRA contributions. (Dr. Nell Adkins, CPA, Ph.D. and B. Charlene Henderson, CPA, Ph.D. The Tax Advisor, 01/01/2024) |

||||

Social Security Planning |

||||

More Than Half of Non-Retired US Adults Expect to Rely on Social Security in RetirementSocial Security is by far one of the most popular government programs in the United States because it is critical for so many retirees’ financial security.

|

||||

Tax Planning |

||||

Advisory Practices Aren’t Meeting Clients’ Tax Demands, Study FindsConsumers from at least 90% of households with more than $250,000 in assets told Herbers & Company that they wanted tax planning services, while 73% of advisory practices reported that they currently provide them, according to a survey this year of nearly 1,600 investors and more than 700 advisory firms. (Herbers & Company, 2023) |

||||

Practice Management |

||||

How To Connect With New ‘Ideal’ ClientsA significant obstacle to your success as a wealth manager is connecting with your “ideal clients.” There are many ways to connect with such, and anecdotes show that just about anything can work. Moving beyond the anecdotes, there is solid evidence of what works best. (Jerry D. Prince and Russ Alan Prince, Financial Advisor, 11/05/2024) |

||||

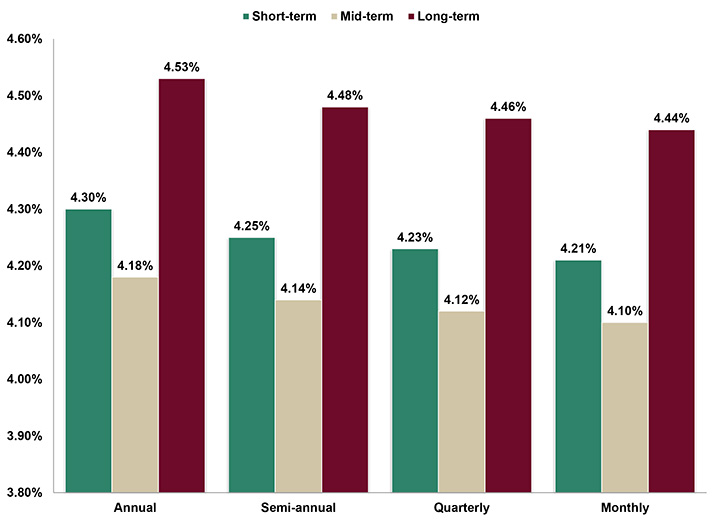

Assumed Federal Rates (AFRs) |

||||

§7520 Rate for December is: 5.00% |

||||

|

||||

Advisor Tools |

||||

Free 2025 Federal Income Tax and

|

||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||||

State Requirement Updates |

||||

Stay Up-to-Date on Your

|

||||

Featured Course |

||||

IAR CE CreditsMeet Your 12-hour IAR CE Requirements

|

||||

|

|

||||

|

||||

B.E.S.T. CE Programs |

||||

Take Our Online or Self-Study Courses at

|

||||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Tuesday, December 10, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.) Registering includes the following three web pages: (each may open in a separate window)

NOTE: Do not close any of your web pages / browsers |

||||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||||

Meet Your 6-hr or 12-hr IAR CE RequirementB.E.S.T. has created the following courses. The first course provides 6 hours of IAR Ethics and Professional Responsibility CE credit. The 2nd course provides all 12 hours of IAR CE credit (6 CE credit hours of Products and Practices & 6 CE credit hours of Ethics and Professional Responsibility). Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit hours | Cost: Starting at $47.95* This course is designed to meet the mandatory 6-hour continuing education (CE) credit requirement under Ethics and Professional Responsibility for Investment Adviser Representatives (IARs). What’s Included in the Online Course:

Online Exam:

Additional Credit Hours:

|

||||

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit hours | Cost: Starting at $69.95* This course is an educational tool to help advisers through the maze of programs, rules and regulations that affect many if not all their aging Baby Boomer clients, their spouses and dependents. What’s Included in the Online Course:

Online Exam:

Additional Credit Hours:

|

||||

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) |

||||

Reminders for IAR CE End of YearAs your trusted source for the latest news and information, B.E.S.T. works closely with organizations and state regulators to keep you informed. Here are some important reminders about end-of-year IAR CE processing and reporting: Course Completion Rosters B.E.S.T. reports completed courses every business day and will keep doing so until the end of the year. Note: NASAA has set December 26th as the last day the CRD system will process rosters. Any course rosters submitted before that date will be processed for the 2024 renewal. Rosters submitted between December 27th and December 31st will not be processed until January 2, 2025, when the system reopens. We encourage you to finish your CE courses before December 27, 2024. Verify Status Make sure to check your status and track course completions on the Financial Professional Gateway (FinPro). If you have any questions, please reach out to our Regulatory Department at [email protected] or call 1-800-345-5669. We’re here to help! |

||||

|

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||||

Disclaimer |

||||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||||

B.E.S.T. Information / Services |

||||

B.E.S.T. CE |

||||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||||

Social Media |

||||

|

||||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||||