Advisor News Insight |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Merry Christmas & Happy Holidays |

|||||||||||||||||||||||||

INDUSTRY NEWS |

|||||||||||||||||||||||||

NEW 2026 Federal Income Tax and

|

|||||||||||||||||||||||||

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations (includes OBBBA). Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. (No personal or business emails required for download.) |

|||||||||||||||||||||||||

Tax Planning |

|||||||||||||||||||||||||

2025 End-of-Year Tax Planning Under OBBBA: Roth Conversions, Charitable Contributions, QBI Planning, And MoreThe One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, largely serves to extend and modestly expand several provisions of the 2017 Tax Cuts and Jobs Act (TCJA), providing advisors and their clients with a clearer tax planning landscape heading into 2026. While many of the most impactful provisions – such as the enhanced State And Local Tax (SALT) deduction and new below-the-line deductions for tips and overtime – are already in effect for 2025, OBBBA still introduces several nuanced planning opportunities with looming year-end deadlines, offering advisors an opportunity to help a variety of clients before the end of 2025. (Ben Henry-Moreland, CFP®, EA, Senior Financial Planning Nerd, Kitces.com, 11/05/2025) |

|||||||||||||||||||||||||

Charitable Planning |

|||||||||||||||||||||||||

Charitable Giving Just Changed—Here’s How to Navigate Year-End (Individuals)On July 4, 2025, Congress passed the awkwardly named “One Big, Beautiful Bill Act.” For donors, the changes are straightforward: non-itemizers get a meaningful above-the-line deduction, itemizers face a small floor before charitable deductions begin, and the 60% of AGI limit for cash gifts to public charities is now permanent. That mix creates planning opportunities—and a few traps—as we head toward December 31. (Ellis McGehee Carter, Attorney J.D., LL.M. in Taxation, Caritas Law Group P.C., 11/03/2025) |

|||||||||||||||||||||||||

Education Planning |

|||||||||||||||||||||||||

How Divorce Impacts College Financial AidHelping children get into college can be draining and complicated. As unpleasant as the experience can be, it can be even trickier for divorced households. In recent years, various changes have affected divorced parents seeking financial help for college. This article’s focus will be on some of the key changes and how families can potentially avoid being penalized by them. (Lynn O'Shaughnessy, Columnist: College Planning, WealthManagement.com, 10/17/2025) |

|||||||||||||||||||||||||

State Tax Treatment of 529-to-Roth IRA RolloversThe SECURE 2.0 Act provision permitting 529 funds to be rolled over to Roth IRAs. Because of this new law, parents and grandparents can fund 529 plans without worrying as much about having to pay taxes and penalties if the funds aren’t used for qualified education expenses. But this rollover opportunity comes with several restrictions. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 10/13/2025) |

|||||||||||||||||||||||||

Status Board: State Income Tax Treatment on 529 Distributions to Roth IRAsStates differ in their treatment of 529-to-Roth IRA rollovers. Of course, this isn’t an issue for the 9 states that have no state income tax to begin with: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. (Note that Washington state taxes some long-term capital gains.) The following information comes from a very useful website run by Paul Curley, CFA and is current as of September 17, 2025. (Paul Curley, CFA , Executive Director, ISS Market Intelligence, 11/15/2023) |

|||||||||||||||||||||||||

IRA Planning |

|||||||||||||||||||||||||

Good Reasons to Name a Trust as IRA BeneficiaryMany estate planning experts would say, a trust should not be named as beneficiary of an IRA unless there is a legitimate reason to do so. And there are valid reasons to name trust as IRA beneficiary. Good reasons to name a trust as IRA beneficiary are discussed in this article. (Andy Ives, CFP®, AIF®, Ed Slott and Company, LLC, 10/15/2025) |

|||||||||||||||||||||||||

Long-Term Care Planning |

|||||||||||||||||||||||||

Genworth Returns to Active Long-Term Care Insurance SalesGenworth is making its first effort to write significant amounts of individual long-term care insurance since early 2016. The Richmond, Virginia-based company’s CareScout Insurance Company subsidiary is starting to sell a new CareScout Care Assurance LTCI policy through distributors in 35 states. |

|||||||||||||||||||||||||

Social Security Planning |

|||||||||||||||||||||||||

As 2026 Social Security COLA Wait Continues, Research Shows Use of ‘Wrong Index’ Costly for SeniorsA new analysis from The Senior Citizens League shows how the average senior has been hurt by the government using “the wrong price index” to calculate the annual COLA. The Senior Citizen’s League finds using the CPI-W instead of the CPI-E has cost retired seniors $5,000 since 1999. ( Brian Anderson, Editor-in-Chief, 401(k) Specialist , 10/17/2025) |

|||||||||||||||||||||||||

Hedging the Risk of a Long-than-Expected Life: The Value of a Social Security Bridge StrategyThis recent white paper from the Bipartisan Policy Center (released July 2025) explores the virtues of Social Security “bridge” strategies, drawing insights from its former chief economist Jason Fichtner. Delaying claiming Social Security benefits, as the report details, is a powerful strategy that many Americans could use to maximize financial wellness in the face of significant uncertainty and risk. Delaying, however, comes with costs and is not well understood by the general public, leading to behavioral challenges that must be addressed by advisors recommending the strategy. (Emerson Sprick, Director, Retirement and Labor Policy, Bipartisan Policy Center, 07/11/2025) |

|||||||||||||||||||||||||

Social Security Announces 2.8 Percent Benefit Increase for 2026Social Security benefits and Supplemental Security Income (SSI) payments for 75 million Americans will increase 2.8 percent in 2026. On average, Social Security retirement benefits will increase by about $56 per month starting in January. (Social Security Administration (SSA), 10/24/2025) |

|||||||||||||||||||||||||

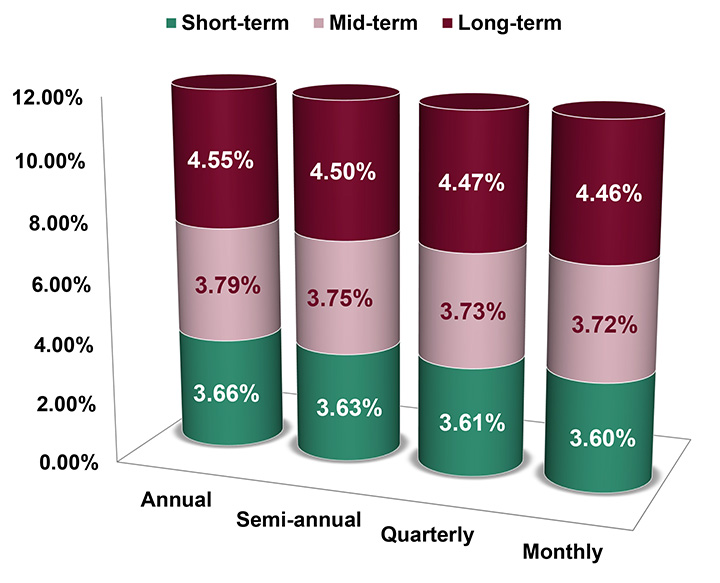

ASSUMED FEDERAL RATES (AFRs) |

|||||||||||||||||||||||||

§7520 Rate for December is: 4.60% |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

ADVISOR TOOLS |

|||||||||||||||||||||||||

Free 2026 Federal Income Tax and

|

|||||||||||||||||||||||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

|||||||||||||||||||||||||

STATE REQUIREMENT UPDATES |

|||||||||||||||||||||||||

Stay Up-to-Date on Your

|

|||||||||||||||||||||||||

FEATURED COURSE(S) |

|||||||||||||||||||||||||

CE Credits |

|||||||||||||||||||||||||

B.E.S.T. CE PROGRAMS |

|||||||||||||||||||||||||

CFP® Ethics CE WebinarJoin Us for Our Upcoming Live Webinar and

|

| When: Thursday, December 11, 2025 | Where: 2-hour Live webinar (GoToWebinar platform) |

| Time: 2:00 p.m. - 4:00 p.m. ET | Price: See detailed pricing options below. |

2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required.

This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit.

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| CFP® credit ONLY: | $61.50 | CFP® credit PLUS IAR credit: | $92.50 | |

| IWI credit ONLY: | $59.00 | IWI credit PLUS IAR credit: | $90.00 | |

| IAR credit ONLY: | $65.00 | CFP® credit PLUS IWI credit PLUS IAR credit: |

$117.50 | |

| CFP® credit PLUS IWI credit: | $86.50 |

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.)

Registering includes the following three web pages: (each may open in a separate window)

- Payment: Enter your payment information. A detailed breakdown of costs and fees will appear before you confirm your payment.

- Attendee Registration: Fill out the Attendee Registration form to provide your contact details and any other information necessary to receive your CE credit.

- GoToWebinar Registration: Enter your First Name, Last Name and Email Address, then click the ‘Register’ button to complete registration for the live webinar.

NOTE: Do not close any of your web pages / browsers

until you are completely done registering. (SEE ABOVE.)

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024.

IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®)

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

IAR Ethics Virtual Super CE Program

NO WEBINAR AVAILABLE THIS MONTH.

(2026 schedule coming soon.)

“NASAA Reminder for Investment Adviser Representatives: IARs must complete IAR CE courses and IAR CE Providers must report those course completions to FINRA before the CRD system shutdown at 4 p.m. ET on December 26 to ensure IAR CE credits are applied before the end of the year. Avoid any impact to your IAR registrations by finishing your coursework well ahead of the deadline. For more details, click here.”

NASAA Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

DISCLAIMER

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.).

Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content.

It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T.

Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness.

THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR

LEGAL ADVICE.

B.E.S.T. INFORMATION / SERVICES

B.E.S.T. Links

Resources

Access a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings.

Social Media

Physical Address & Hours of Operation

© 1994 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

7137 Congress Street, New Port Richey, FL 34653 | Toll Free:

1-800-345-5669

Hours of Operation: Monday - Friday, 8:30 a.m. to 5:00 p.m.

Eastern Time

Contact Information & Miscellaneous

About Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe*

*Remove from mailing list. Please allow up to five (5) business days for removal.

Ensure newsletter delivery to your inbox by adding [email protected] to your address book.