Advisor News Insight |

||

|

News • AFRs • Website • Recommended • Tools • Requirements • Featured • CE |

||

|

||

INDUSTRY NEWS |

||

Charitable Planning |

||

IRS Warns Taxpayers About Fraudulent Charitable LLC SchemesTypically, these schemes encourage higher-income taxpayers to establish limited liability companies (LLCs), contribute cash or other assets to these LLCs, and then donate a significant percentage of nonvoting, non-managing membership units to a charity. Meanwhile, the taxpayer retains control over the voting units and may reclaim the cash or assets for personal use, either directly or indirectly. (JD Supra®, 12/30/2024) Read more | IRS Alert | Additional reporting from CharityLawyer |

||

Life Insurance Planning |

||

Life Insurance Facts and Statistics 2025Life insurance is an important financial planning tool, as its primary use is to provide financial protection to those who rely on you. This begs the question, why do 30 percent of surveyed Americans recognize they need life insurance but don’t have any? Do Americans find the process too confusing? Is it too expensive? Bankrate explores life insurance ownership — including important facts, statistics and common myths — to help answer lingering questions you may have about buying life insurance. (Ashlyn Brooks, Writer II, Insurance, Bankrate, 01/02/2025) |

||

Mortality in the United States, 2023This report presents final 2023 U.S. mortality data on deaths and death rates by demographic and medical characteristics. These data provide information on mortality patterns among U.S. residents by variables such as sex, age, race and Hispanic origin, and cause of death. Life expectancy estimates, age-adjusted death rates, age-specific death rates, the 10 leading causes of death, infant mortality rates, and the 10 leading causes of infant death were analyzed by comparing 2023 and 2022 final data. (Various authors, National Center for Health Statistics (NCHS), 12/2024) |

||

Using A 1035 Exchange To Turn An Unneeded Life Insurance Policy Into An Annuity...as life circumstances change over time, tools like permanent life insurance may no longer meet an individual’s needs. And while other strategies like taking a policy loan or simply surrendering the policy might be viable in some circumstances, a 1035 exchange into an annuity can be a more tax-efficient way to access the policy’s underlying value when the need for life insurance is replaced by a need for retirement income. (Ben Henry-Moreland, Senior Financial Planning Nerd, Kitces.com, 01/01/2025) |

||

Retirement Planning |

||

Retirement Saving and Income handbookThe Insured Retirement Institute (IRI) Retirement Saving and Income Handbook is a guide to commonly available annuities and non-annuity alternatives. It provides basic information about the structure, benefits and limitations of each solution, combined with visual representations of the mechanics of each solution and a robust glossary of key terminology. (Insured Retirement Institute, 3/5/2024) |

||

Roth IRA Planning |

||

Backdoor Roth IRA PlanningRecall that the Backdoor Roth IRA is a two-step transaction. If there are two steps of the Backdoor Roth IRA, that begs a question: Just how long do I have to wait between the two steps, i.e., how long does the nondeductible traditional IRA contribution have to sit in the traditional IRA prior to the Roth conversion step? A minute? A day? A month? A year? (Sean Mullaney, Financial Planner and President, Mullaney Financial & Tax, Inc., 01/02/2025) |

||

Social Security Planning |

||

Biden Signs Social Security Fairness ActPresident Joe Biden signed the Social Security Fairness Act into law. The Social Security Fairness Act repeals the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) provisions of Social Security. (Melanie Waddell, Senior Editor and Washington Bureau Chief, ThinkAdvisor, 01/05/2025) |

||

Debate: Is the Social Security Fairness Act Fair?Two professors and authors of ALM’s Tax Facts with opposing political viewpoints share their options about Congress’s recent decision to repeal the WEP and GPO. (Robert Bloink, Esq., LL.M., and William H. Byrnes, Esq., LL.M., CWM, Texas A&M University School of Law and the Thomas Jefferson School of Law, 01/03/2025) |

||

How the Social Security Fairness Act Affects Claiming StrategiesAdoption of the Social Security Fairness Act is a major development in the lives of government workers. Some spouses of public workers who never filed for benefits may now wish to do so and clients who recently claimed early-retirement benefits may want to revoke their claim, but these decisions must be made carefully. This article will provide some illuminating case studies with the WEP and GPO, by HealthView Services, a provider of health care, Social Security and retirement income planning tools. (John Manganaro, Senior Reporter, ThinkAdvisor, 01/08/2025) |

||

Practice Management |

||

Resolve to Set Goals Differently This YearMost individuals, teams and firms focus on goal setting and care about creating clear outcomes for their teams. However, the goals are often focused on the quantifiable pieces. When thinking about goals, make sure you are considering the qualitative piece along with the quantitative one. (Beverly Flaxington, The Human Behavior Coach®, The Collaborative, 12/31/2024) |

||

ASSUMED FEDERAL RATES (AFRs) |

||

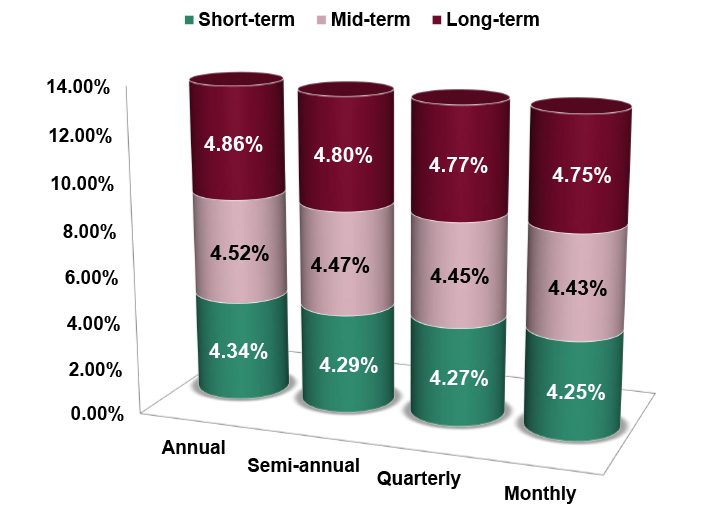

§7520 Rate for February is: 5.40% |

||

|

||

USEFUL FINANCIAL WEBSITE |

||

AlphaGammaAlphaGamma is a business portal for young professionals.Informing young professionals, founders, and students – about the latest career and business-related tips, trends and opportunities from around the world. The 15 best finance websites you should bookmark right now [2025 Edition].AlphaGamma has compiled a list with the best finance websites where you can learn all about the finance world: from the available finance careers and terminology to developing your personal investment strategies and getting the access to stock market data. |

||

RECOMMENDED READING |

||

|

||

ADVISOR TOOLS |

||

Free 2025 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

STATE REQUIREMENT UPDATES |

||

Stay Up-to-Date on Your

|

||

FEATURED COURSE(S) |

||

CE Credits |

||

B.E.S.T. CE PROGRAMS |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, February 20, 2025 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.) Registering includes the following three web pages: (each may open in a separate window)

NOTE: Do not close any of your web pages / browsers |

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Meet Your 6-hr or 12-hr IAR CE Requirement—Online and On Your Schedule!B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit Hours | Starting at $47.95* This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs). What’s Included in the Course:

Online Exam:

Bonus Credits:

Ready to Enroll? Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence! |

||

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95* This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements. What’s Included in the Online Course:

Online Exam:

Bonus Credits:

Why Choose This Course?

Get Started Today Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go! |

||

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

DISCLAIMER |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

|

||

B.E.S.T. INFORMATION / SERVICES |

||

B.E.S.T. Links |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||