|

Web Version • Past Issues • Subscribe • Unsubscribe • Contact Us |

Advisor News Insight |

|

|

As we welcome the new year, we want to sincerely thank you, our valued clients, for your support. We wish you a joyful, healthy, and prosperous 2025! We’re also grateful for your continued interest in the B.E.S.T.’s monthly newsletter. For 14 years, it has been our privilege to share this resource with over 65,000 financial and insurance professionals across the country. Our newsletter is designed to provide you, the dedicated professional, with carefully selected articles, white papers, podcasts, web links, and books—all personally reviewed to help you deliver top-notch services to your clients. We hope we’ve met this goal and look forward to supporting you in 2025. Thank you for your trust, and may the new year bring you and your loved ones happiness, health, and success! Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC® CPFA®, AIF®, Founder, CEO, and President. Please feel free to share our newsletter with friends and colleagues. Sign up here: http://best-ce.com/newsletter/archives/ |

INDUSTRY NEWS |

Estate Planning |

NY Times: How One of The World’s Richest Men Is Avoiding $8 billion in Estate & Gift Taxes.The story of Mr. Huang’s tax avoidance is a case study in how the ultra-rich bend the U.S. tax system for their benefit. His strategies were not explicitly authorized by Congress. (Paul Caron, Duane and Kelly Roberts Dean, Pepperdine University Caruso School of Law, 12/9/2024) |

Wealthy Baby Boomers Will Make heirs Wait, Schwab Survey SaysBaby boomers are far and away the stingiest generation by at least one measure: desire to pass on their riches during their lifetimes. That’s according to a new survey from Charles Schwab, which found just 21% of boomers with at least $1 million in investable assets said they “want the next generation to enjoy my money while I’m alive.” That compares with 53% of millennials and 44% of Gen X Americans with assets in the same range. (Suzanne Woolley, Journalist, Bloomberg, 12/6/2024) |

Retirement Planning |

IRS: RMD Comparison Chart (IRAs vs. Defined Contribution Plans)This chart from the IRS highlights some of the basic RMD rules as applied to IRAs and defined contribution plans (e.g., 401(k), profit-sharing, and 403(b) plans). (IRS, 12/10/2024) |

Six Retirement Withdrawal Strategies That Stretch SavingsAccording to analysts, higher equity valuations and lower fixed-income yields caused them to reduce their average safe withdrawal rate from 4.0% in 2023. Morningstar Inc. has lowered what the investment research firm considers a safe retirement savings withdrawal rate for new retirees based on a 30-year outlook, according to the firm’s annual “State of Retirement Income” report. (Alex Ortolani, Reporter, PLANADVISER®, 12/11/2024) |

Social Security Planning |

WEP/GPO Repeal Clears Congress, Biden’s Signature RemainsThe Senate passed the Social Security Fairness Act, by a vote of 76-20. The bill was previously passed by the House in November and would repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). President Biden is expected to sign the bill into law. (Paul Mulholland, Content Writer and Reporter, NAPA, 12/21/2024) |

Practice Management |

CFP Board mulls (mostly) tougher certification requirementsThe CFP Board, a professional group for wealth managers, is mulling nine proposed changes to the competency criteria it uses to decide who can hold the CFP designation. The board now counts more than 101,000 certificate holders — financial planners of all stripes pledging to hold themselves to the highest conduct standards of their profession. The proposal would raise the CFP Board’s criteria mainly by increasing the number of continuing education hours advisors have to log to maintain their certifications. It could also require CFP aspirants to have specific financial planning-related experience before they’re eligible to be brought into the fold. (CFP BOARD, 12/17/2024) |

Practice Management for Financial and Insurance ProfessionalsEffective practice management is critical for financial and insurance professionals aiming to grow their businesses, enhance client satisfaction, and stay competitive in an evolving market. (B.E.S.T., 12/23/2024) |

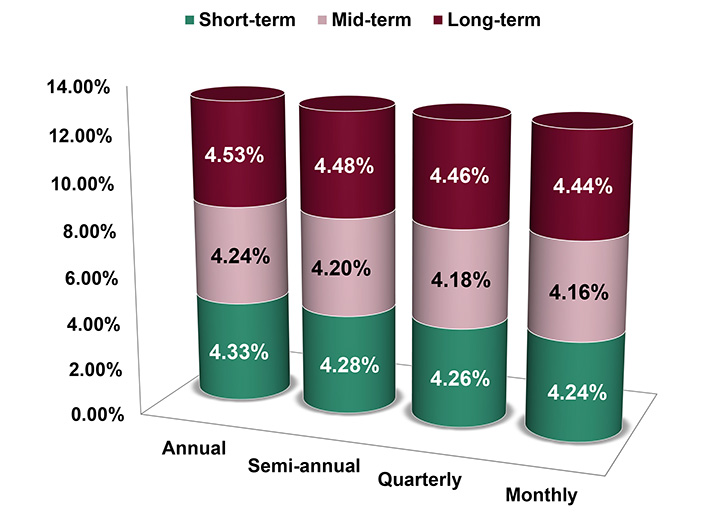

ASSUMED FEDERAL RATES (AFRs) |

§7520 Rate for January is: 5.20% |

|

ADVISOR TOOLS |

Free 2025 Federal Income Tax and

|

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

STATE REQUIREMENT UPDATES |

Stay Up-to-Date on Your

|

FEATURED COURSE(S) |

CE Credits |

B.E.S.T. CE PROGRAMS |

Take Our Online or Self-Study Courses at Your Own Pace and Take Advantage of Affordable Prices |

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

Meet Your 6-hr or 12-hr IAR CE Requirement—Online and On Your Schedule!B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit Hours | Starting at $47.95* This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs). What’s Included in the Course:

Online Exam:

Bonus Credits:

Ready to Enroll? Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence! |

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95* This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements. What’s Included in the Online Course:

Online Exam:

Bonus Credits:

Why Choose This Course?

Get Started Today Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go! |

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

DISCLAIMER |

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

|

B.E.S.T. INFORMATION / SERVICES |

B.E.S.T. Links |

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

Social Media |

|

Physical Address & Hours of Operation© 1986 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |