Advisor News Insight |

|||||||||||||||

|

News • AFRs • Recommended • Tools • Requirements • Featured • CE |

|||||||||||||||

|

|||||||||||||||

INDUSTRY NEWS |

|||||||||||||||

Social Security & Medicare Planning |

|||||||||||||||

Treasury Releases Social Security and Medicare Trustees ReportsThe Social Security and Medicare Boards of Trustees, the U.S. Department of the Treasury—joined by Departments of Health and Human Services and Labor, the Centers for Medicare & Medicaid Services, and the Social Security Administration—released the annual Social Security and Medicare Trustees Reports. (U.S. Department of the Treasury, 06/18/2025) |

|||||||||||||||

How To Report Death to Social Security and Get a Credit Report for a Deceased PersonThe Equifax article, “How to Report Death to Social Security and Get a Credit Report for a Deceased Person,” outlines critical post-death administrative steps to protect the deceased’s identity and ensure survivors receive any due Social Security benefits. This article focuses on how to notify authorities, secure financial records, and use credit reports to close out or verify the deceased’s estate. (Gabrielle Glass, Associate Editor, Wealth Strategies Journal, 06/11/2025) |

|||||||||||||||

Medicare & Medicaid Planning |

|||||||||||||||

Income Adjustments Can Soften IRMAA Medicare SurchargesHigher-income earners who get sticker shock from the IRMAA surcharge on their monthly Medicare premiums should make sure they’re delving into strategies to mitigate the fees. IRMAA, or Income-Related to Monthly Adjustment Amount, generally applies to Medicare Part B, which provides medical insurance coverage, and Part D prescription drug coverage. If the client’s modified adjusted gross income (MAGI) from two years ago tops a certain threshold, IRMAA kicks in. (Jeff Stimpson, Freelance Journalist, Tax and Personal Finance Writer, 06/16/2025) |

|||||||||||||||

Elder Planning |

|||||||||||||||

Ten-Year Effects of the Advanced Cognitive Training for Independent and Vital Elderly Cognitive Training Trial on Cognition and Everyday Functioning in Older AdultsOlder adults with dementia misjudge their financial skills – which may make them more vulnerable to fraud, new research finds. (Various Authors, Journal of the American Geriatrics Society, 01/13/2014) |

|||||||||||||||

IRA Planning |

|||||||||||||||

Are My SEP and SIMPLE IRAs Safe from Creditors?The answer is NO when non-bankruptcy creditors come after those funds after winning a lawsuit. Many workplace retirement plans are shielded from these creditors because the plans are covered by the federal ERISA law, which usually provides rock-solid protection. SEP and SIMPLE IRAs are technically considered ERISA retirement plans. So, what’s the problem? The problem is that ERISA denies those plans the complete protection against general creditors that it gives to other employer plans. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 06/16/2025) |

|||||||||||||||

When You Should Name a Trust as IRA BeneficiaryNaming a Trust as an IRA Beneficiary can cause many unnecessary complications. Trusts won’t help with income taxes. In fact, they can increase the tax hit because IRA funds may be subject to high trust tax rates (on income over $15,650 in 2025). According to the Slott Report, naming a trust is not something that should be done without clear purpose. The report provides six good reasons to name a trust as an IRA Beneficiary. (Sarah Brenner, JD, Director of Retirement Education, Ed Slott and Company, LLC, 06/11/2025) |

|||||||||||||||

Retirement Planning |

|||||||||||||||

Investor Literacy, and Literacy, About Retirement LongevityLife expectancy has increased by 17 years since the inception of Social Security nearly 90 years ago presenting both opportunities and challenges. Because we cannot know with certainty how long we will be retired, planning and preparing for retirement can be difficult. In the face of uncertainty, expectations about at what age retirement will begin, and life expectancy, will likely influence retirement-related decisions and behavior. A recent study titled, “Retired for How long? Worker expectations for how long they’ll live in retirement,” investigated how individuals estimate the length of their retirement and, crucially, what factors drive these expectations. Investors and researchers in the study focused on the relationship between expected years in retirement and expected lifespan, aiming to understand whether people accurately anticipate how long they will spend in retirement and how this affects their financial planning. (Larry E. Swedroe, Author/Co-author of 18 books on investing with the latest being “Enrich Your Future,” 06/09/2025) |

|||||||||||||||

Self-Employed Retirement Plans: How to Pick Between Solo 401(k) and SEP IRAOver the last decade, there’s been a growing number of people striking out on their own to become self-employed, whether it’s their full-time job or a side hustle. According to the Pew Research latest data, there are about 15 million such workers in the United States — or 10% of the US workforce. I would assume that many of your clients are considered self-employed. Which qualified retirement plan would be best for them? Solo 401(k) or SEP IRA? (Kristina Sarcione, Senior Director of Product, Guideline, Inc., 06/10/2025) |

|||||||||||||||

|

B.E.S.T. Is Your One-Stop Solution for CE Credits Stop searching for multiple courses. Our self-study program, “Small Business Retirement Plans and Ethical Practices”, is the streamlined solution you need. Get all 12 hours for your IAR CE and 10 hours for CFP®, IWI®, and CPE, all in one place. |

|||||||||||||||

Long-Term Care Planning |

|||||||||||||||

How to Keep Long-Term-Care Costs from Derailing Retirement PlansAccording to the Urban Institute, the population of Americans age 65 and older is on track to increase nearly 50% in the next 15 years, to more than 80 million. That means demand for long-term care will almost certainly rise, too, and it won’t come cheap. Advisors who fail to account for the potential drain on retirement outcomes are distorting their projections, experts warn, and setting their clients up for failure.

|

|||||||||||||||

Tax Planning |

|||||||||||||||

The Biggest Changes in Senate Tax Bill“Very expected” similarities between the House and Senate versions of the One, Big, Beautiful Bill Act include an extension of the current tax brackets as well as the repeal of miscellaneous itemized deductions, financial planning expert Jeff Levine said Tuesday on LinkedIn. Other similarities were “less anticipated, but are now reasonably likely to find themselves in the final version of the package.” (Melanie Waddell, Senior Editor and Washington Bureau Chief, ThinkAdvisor, 06/17/2025) |

|||||||||||||||

Practice Management |

|||||||||||||||

81% of Wealth Inheritors Say They’ll Fire Their Parents’ AdvisorDespite global wealth on the rise, 81% of inheritors plan to switch firms within one to two years of inheritance. Potentially losing these unsatisfied clients is going to create significant risk for the global wealth management sector. (Michael S. Fischer, Contributing Writer, ThinkAdvisor, 06/12/2025) |

|||||||||||||||

HNW Practices: Most Valuable Resources from Asset Managers, 2023The Cerulli Report—U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2023: The Evolution of Service Delivery, analyzes the U.S. high-net-worth (HNW) (investable assets greater than $5 million) and ultra-high-net-worth (UHNW) (investable assets greater than $20 million) marketplaces. (Cerulli Associates, 2023) |

|||||||||||||||

Using AI to write that client email? Think twice.If you are taking advantage of generative artificial intelligence. And not just in the back-office, but for communications as well. You should read this article and download a recent study from Morningstar, “What Do Investors Think About Generative AI in Financial Advisors’ Workflow.” The study found that clients who figured out their advisors were using generative AI to craft personal emails were willing to pay an average of $20 per hour less than those who simply wrote their own. (Rob Burgess, Reporter/award-winning Journalist, FinancialPlanning, 06/12/2025) |

|||||||||||||||

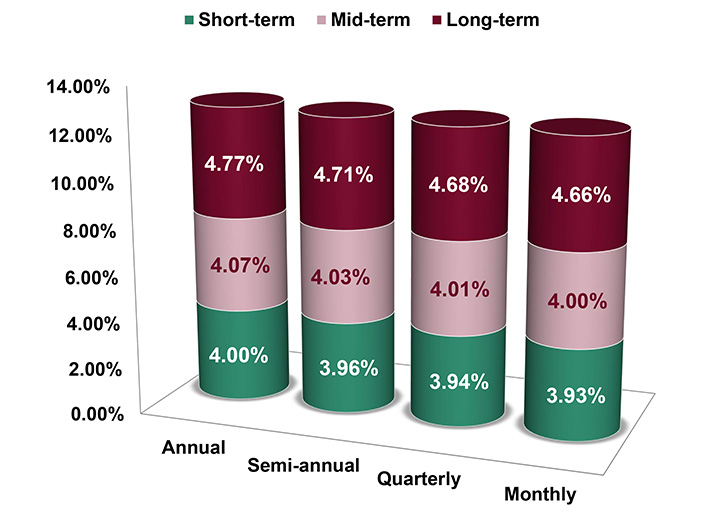

ASSUMED FEDERAL RATES (AFRs) |

|||||||||||||||

§7520 Rate for July is: 5.00% |

|||||||||||||||

|

|||||||||||||||

RECOMMENDED SUMMER READING |

|||||||||||||||

|

|||||||||||||||

ADVISOR TOOLS |

|||||||||||||||

Free 2025 Federal Income Tax and

|

|||||||||||||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

|||||||||||||||

STATE REQUIREMENT UPDATES |

|||||||||||||||

Illinois Becomes First State to

|

|||||||||||||||

Stay Up-to-Date on Your

|

|||||||||||||||

FEATURED COURSE(S) |

|||||||||||||||

CE Credits |

|||||||||||||||

B.E.S.T. CE PROGRAMS |

|||||||||||||||

Take Our Online or Self-Study Courses at

|

|||||||||||||||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

|||||||||||||||

CFP Ethics Webinar |

|||||||||||||||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of CIMA®/CPWA®/RMA® and IAR Ethics Date: Thursday, July 17, 2025 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost options per license type:

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.) Registering includes the following three web pages: (each may open in a separate window)

NOTE: Do not close any of your web pages / browsers |

|||||||||||||||

|

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||||||||||||||

IAR CE Programs |

|||||||||||||||

Meet your 6-hour IAR Ethics and

|

|||||||||||||||

|

|||||||||||||||

Our Virtual Super CE Program

|

|||||||||||||||

Pricing Options

|

|||||||||||||||

Meet Your 6-hr or 12-hr IAR CE Requirement—Online and On Your Schedule!B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit Hours | Starting at $47.95* This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs). What’s Included in the Course:

Online Exam:

Bonus Credits:

Ready to Enroll? Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence! |

|||||||||||||||

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95* This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements. What’s Included in the Online Course:

Online Exam:

Bonus Credits:

Why Choose This Course?

Get Started Today Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go! |

|||||||||||||||

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||||||||||||||

DISCLAIMER |

|||||||||||||||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

|

|||||||||||||||

B.E.S.T. INFORMATION / SERVICES |

|||||||||||||||

B.E.S.T. Links |

|||||||||||||||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

|||||||||||||||

Social Media |

|||||||||||||||

|

|||||||||||||||

Physical Address & Hours of Operation© 1986 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

|||||||||||||||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

|||||||||||||||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

|||||||||||||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||||||||||||||