Advisor News Insight |

||

|

News • AFRs • Facts • Website • Recommended • Tools • Requirements • Featured • CE |

||

|

||

INDUSTRY NEWS |

||

IRA Planning |

||

Trust Divides IRA Among Individuals and CharityIn PLR 202506004, the IRS ruled on the Income Tax Treatment of IRA benefits payable to a trust. (IRS, 02/07/2025) |

||

Medicare & HSAs |

||

How does Medicare enrollment affect HSA eligibility?The complex rules for Medicare and health savings accounts lead to many client questions. Here are answers to some of the most common ones. (Kelley C. Long, CPA/PFS, Personal Financial Coach and Consultant, Journal of Accountancy, 02/01/2025) |

||

Medicare’s tricky rules on HSAs after age 65As this article discusses, individuals who enroll in Medicare Part A are not allowed to continue funding their HSA, and anyone postponing Medicare enrollment must be diligent about how applying for Social Security or Medicare after age 65 impacts HSA contribution amounts. (Kelley C. Long, CPA/PFS, Personal Financial Coach and Consultant, Journal of Accountancy, 05/16/2023) |

||

Retirement Planning |

||

Morningstar’s Retirement Income Research: Reevaluating the 4% Withdrawal RuleMorningstar’s research concluded that 3.3% was a more realistic estimate of a safe starting withdrawal rate in 2021 -- assuming a balanced portfolio, fixed real withdrawals over a 30-year retirement, and a 90% probability of success. That number has fluctuated in the years since.... [T]hese are conservative estimates for fixed withdrawal rates, and retirees can also use flexible withdrawal systems to enlarge their starting and lifetime withdrawals. (Amy C. Arnott, CFA, Christine Benz, Director of Personal Finance and Retirement Planning, and Jason Kephart, Director of Multi-Asset Ratings, Morningstar, Inc., 02/11/2025) |

||

Morningstar’s: What’s a Safe Retirement Spending Rate for 2025Starting safe withdrawal rates have declined, but staying flexible and enlarging guaranteed income can help boost lifetime payouts. Flexible portfolio spending strategies help enlarge lifetime spending relative to static spending systems. The Report examines how such strategies can work hand in hand with other ways of enlarging lifetime income: specifically, delaying social Security, setting up a laddered portfolio of Treasury Inflation Protected Securities, or purchasing an annuity. Employing such strategies helps enlarge lifetime income. Moreover, seeking out stable sources of in-retirement cash flows can help offset the cash flow volatility inherent in flexible spending systems. (Christine Benz, Director of Personal Finance and Retirement Planning, Morningstar, Inc., 12/11/2024) |

||

The Big Retirement Risk Most Advisors’ Models MissYou’re a financial advisor, and you’ve recommended a “conservative” portfolio for your 65 year old client, by every measure of traditional retirement planning a prudent strategy. But what if your client lives well past 100? How well will that strategy hold up? (Michael S. Fischer, Contributing Writer, ThinkAdvisor, 2/19/2025) A new white paper from Dunham & Associates Investment Counsel, “Is Our Industry Prepared for Retirees’ Longer Lifespans?,” examines what it says could be a critical flaw in traditional retirement planning. |

||

Social Security Planning |

||

“How Much More Will I Get?”: Calculating The Impact Of WEP and GPOs Repeal ON Social Security BenefitsWhile it may take a while for the adjustments to take place, advisors can still help their clients plan for the effect of WEP and GPO’s repeal by estimating how much the client will be receiving in Social Security benefits once the new law is implemented. But the challenge in making such an estimate is the fact that SSA doesn’t clearly show many individuals what their full benefits would be without the reduction for WEP or GPO. While future retirees can find non-reduced benefit estimates on their Social Security statements or online accounts, those already receiving benefits don’t have access to this information – making it necessary to find a different way to predict how much their payments will increase once the law is fully implemented. (Ben Henry-Moreland, Senior Financial Planning Nerd, kitces.com and Joe Elsasser, Founder and President, Covisum®, 02/12/2025) |

||

Social Security Announces Expedited Retroactive Payments and Higher Monthly Benefits for Millions – Actions Support the Social Security Fairness ActThe Social Security Administration (SSA) announced it is immediately beginning to pay retroactive benefits and will increase monthly benefit payments to people whose benefits have been affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions reduced or eliminated the Social Security benefits for over 3.2 million people. Many beneficiaries will be due a retroactive payment because the WEP and GPO offset no longer apply as of January 2024. Most people will receive their one-time retroactive payment by the end of March, which will be deposited into their bank account on record with Social Security. (SSA, 02/25/2025) |

||

SSA Answers Social Security Fairness Act QuestionsThe SSA answered more questions about implementing the Social Security Fairness Act, which repeals the Windfall Elimination Provision (WEP) and government Pension Offset (GPO). For instance, SSA explained that if you never applied for retirement, spousal or survivors’ benefits because of WEP or GPO, “you may need to file an application” and that the date of the application “might affect when your benefits begin and your benefit amount.” (SSA, 02/03/2025) |

||

Practice Management |

||

63 brokers suspended, 4 banned in CE cheating schemeThere has been an unusually high number of disciplinary actions filed by FINRA over a curious kind of advisor misconduct: cheating to get continuing education credits. (Brian Wallheimer, Editor-in-chief, FinancialPlanning, 11/26/2024) |

||

Cheating For CE Credits Is On The RiseA rash of cheating reported to FINA raises the question: Are continuing education requirements really that bad? (Emile Hallez, Editor, InvestmentNews, 06/03/2024) |

||

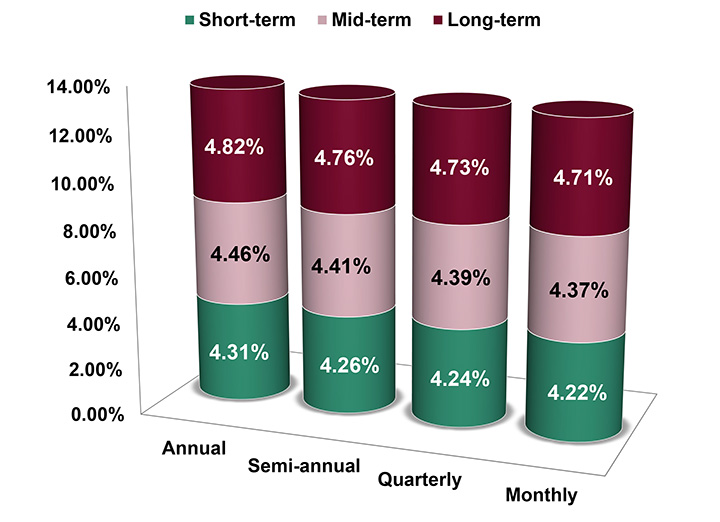

ASSUMED FEDERAL RATES (AFRs) |

||

§7520 Rate for March is: 5.40% |

||

|

||

FINANCIAL FACTS |

||

Financial Advisor Industry Statistics

|

||

USEFUL FINANCIAL WEBSITE |

||

|

||

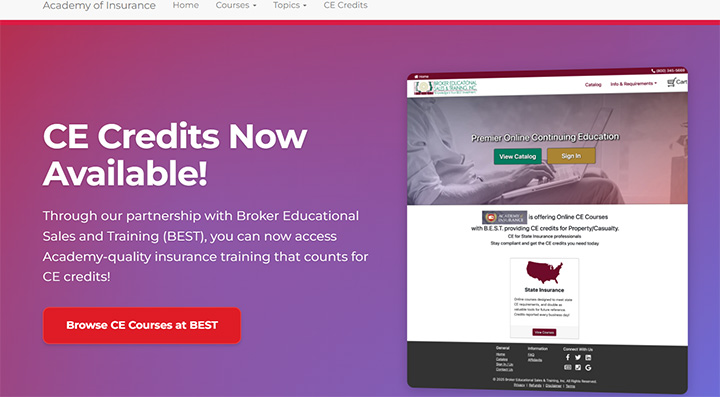

Exciting News: B.E.S.T. Partners with

|

||

RECOMMENDED READING |

||

|

||

ADVISOR TOOLS |

||

Free 2025 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

STATE REQUIREMENT UPDATES |

||

Stay Up-to-Date on Your

|

||

FEATURED COURSE(S) |

||

IAR CE Credits |

||

B.E.S.T. CE PROGRAMS |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, March 20, 2025 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.) Registering includes the following three web pages: (each may open in a separate window)

NOTE: Do not close any of your web pages / browsers |

||

|

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Meet Your 6-hr or 12-hr IAR CE Requirement—Online and On Your Schedule!B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

Ethics for Financial and Insurance Professionals (6-hour) Course #: C27297 | 6 CE Credit Hours | Starting at $47.95* This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs). What’s Included in the Course:

Online Exam:

Bonus Credits:

Ready to Enroll? Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence! |

||

|

Guide to Social Security and Ethical Practices (12-Hour - split course) Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95* This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements. What’s Included in the Online Course:

Online Exam:

Bonus Credits:

Why Choose This Course?

Get Started Today Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go! |

||

|

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

DISCLAIMER |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

|

||

B.E.S.T. INFORMATION / SERVICES |

||

B.E.S.T. Links |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||