Advisor News Insight |

|||||||||||||||||||||||||

|

News • AFRs • Recommended • Podcast • Tools • Requirements • Featured • CE |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

INDUSTRY NEWS |

|||||||||||||||||||||||||

Estate Planning |

|||||||||||||||||||||||||

Estate Planning with Cryptocurrency AssetsDigital currencies are quickly evolving from niche investments to mainstream assets. Whether you’re a believer or a skeptic, it’s increasingly important to understand how cryptocurrency fits into modern estate planning. Even if your clients don’t currently own cryptocurrency, it could still affect their estate planning, either through their investments, an inheritance or their responsibilities as a trustee, executor or power of attorney. Taking simple steps to update estate plans to account for these investments can prevent valuable assets from disappearing after death, preserve legacies and protect loved ones from additional burdens. (Matthew Wright, Associate, Isaac Wiles, 09/17/2025) |

|||||||||||||||||||||||||

How Iconic Estate Plans Teach the Affluent About Wealth PreservationIn estate and tax planning, certain names transcend their celebrity or fortune and come to define the very strategies they deployed. These individuals and families did not merely follow the rules; they reshaped them. (Jeff T. Getty, JD, MS (Tax), CFP®, CM&AA®, Chief Tax Strategist, Callan Family Office, 08/12/2025) |

|||||||||||||||||||||||||

The Hazards of Not Changing Beneficiaries Post-DivorceA recent case by the Tennessee Court of Appeals highlights the importance of changing one’s insurance and retirement policy beneficiaries after divorce. This is true no matter what the divorce documents say and no matter what any order signed by a Judge says. (Stuart Scott, Litigation Attorney, Dickinson Wright, 07/16/2025) |

|||||||||||||||||||||||||

IRA Distribution Planning |

|||||||||||||||||||||||||

A 5-Step Framework for Navigating SECURE Act Inherited IRA DistributionsMany clients who inherited IRAs in 2020 are now facing the reality that half of their 10-year window has passed. This issue will only become more prevalent as the baby boomer generation continues to pass wealth to their heirs, making SECURE Act planning an increasingly critical component of comprehensive financial planning. Without proper post-mortem planning, beneficiaries risk significant tax consequences from being forced into higher tax brackets during the final distribution years. (Debbie Taylor, CPA/PFS™, JD, CDFA®, Managing Partner and Chief Tax Strategist, Carson Wealth, 09/16/2025) |

|||||||||||||||||||||||||

Retirement Planning |

|||||||||||||||||||||||||

How the 4% Rule Would Have Failed in the 1960s: Reflections on the Folly of Fixed Rate WithdrawalsIn a new paper, “How the 4% Rule Would Have Failed in the 1960s: Reflections on the Folly of Fixed Rate Withdrawals,” Edward McQuarrie, a professor emeritus at the Leavey School of Business at Santa Clara University, argues that fixed-rate withdrawal strategies — like the 4% rule — are fundamentally flawed for retirement planning. (Edward F. McQuarrie, Emeritus, Santa Clara University, Leavey School of Business, 02/06/2025) |

|||||||||||||||||||||||||

Retirement Trends Advisors Can’t IgnoreThe 2025 BlackRock® Read on Retirement® survey provides a decade of insights from an annual research study of workplace savers and retirees in the United States which was conducted between April 10 and May 19, 2025. Over 450 plan sponsors were also surveyed between February 2 and March 19, 2025. (BlackRock®, 2025) |

|||||||||||||||||||||||||

Why SECURE 2.0 and State Mandates are Powering a Micro 401(k) BoomThe small and micro 401(k) plan segments are set to rapidly expand over the next few years due to incentives provided by SECURE 2.0, and more states implementing mandates to increase the number of individuals covered by some form of retirement savings vehicle, according to Cerulli Associates. (Ayo Mseka, Finance Reporter, Insurance NewsNet, 08/26/2025) |

|||||||||||||||||||||||||

Roth 401(k) Planning |

|||||||||||||||||||||||||

Industry Best Practices & Procedures for Roth Catch-Up Contributions

|

|||||||||||||||||||||||||

Social Security Planning |

|||||||||||||||||||||||||

Why Delaying Social Security Benefits Isn’t Always The Best Decision“...the assumptions used in traditional Social Security research have significant flaws. By focusing exclusively on expected value, they ignore the important concept of expected utility -- that is, the value individuals place on outcomes based on satisfaction (or dissatisfaction) those outcomes provide.” (Derek Tharp, Ph.D., CFP®, CLU®, RICP®, Lead Researcher, Kitces.com, 09/17/2025) |

|||||||||||||||||||||||||

Practice Management |

|||||||||||||||||||||||||

Top 15 States for High-Income HouseholdsThe U.S. Census Bureau fed financial services forecasting and marketing systems fresh data Thursday by posting the American Community Survey 1-year estimates for 2024.The number with income over $200,000 rose 12%, to 18.3 million, or 14% of all households. For a look at the 15 states with the most households in that attractive income category, review the report. (Allison Bell, Senior Reporter, ThinkAdvisor and BenefitsPRO, 09/12/2025) |

|||||||||||||||||||||||||

Wealth Think 10 Blunders Advisors Make with Newly Widowed ClientsHere are 10 biggest mistakes advisors make with widows, as well as how to avoid them. And remember — what’s at stake is not just the advisor-client relationship, but a woman’s sense of identity, stability and legacy. (Connie Hougland, Founder, WidowRISE, 08/19/2025) |

|||||||||||||||||||||||||

ASSUMED FEDERAL RATES (AFRs) |

|||||||||||||||||||||||||

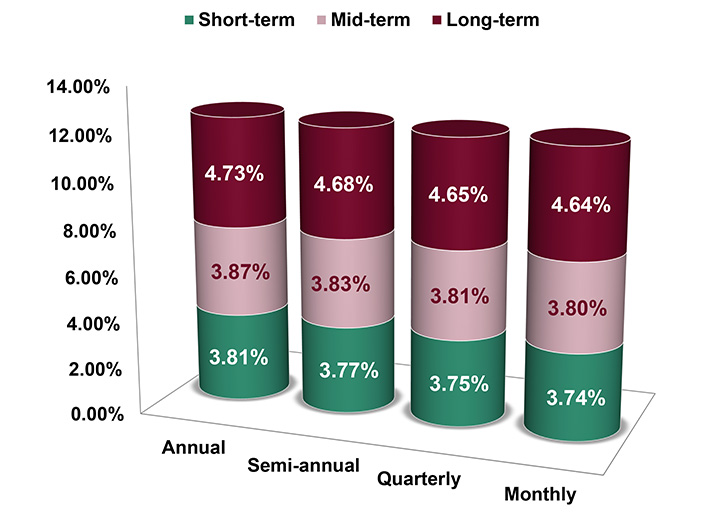

§7520 Rate for October is: 4.60% |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

RECOMMENDED READING |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

RECOMMENDED PODCAST |

|||||||||||||||||||||||||

ThinkAdvisor Podcast CenterListen to interviews, discussions and advice from ThinkAdvisor Senior Reporter John Manganaro and top financial and insurance leaders. |

|||||||||||||||||||||||||

ADVISOR TOOLS |

|||||||||||||||||||||||||

Free 2025 Federal Income Tax and

|

|||||||||||||||||||||||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

|||||||||||||||||||||||||

STATE REQUIREMENT UPDATES |

|||||||||||||||||||||||||

Stay Up-to-Date on Your

|

|||||||||||||||||||||||||

FEATURED COURSE(S) |

|||||||||||||||||||||||||

CE Credits |

|||||||||||||||||||||||||

B.E.S.T. CE PROGRAMS |

|||||||||||||||||||||||||

Take Our Online or Self-Study Courses at

|

|||||||||||||||||||||||||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

|||||||||||||||||||||||||

CFP® Ethics CE Webinar |

|||||||||||||||||||||||||

Join Us for Our Upcoming Live Webinar and

|

| When: Thursday, October 16, 2025 | Where: 2-hour Live webinar (GoToWebinar platform) |

| Time: 2:00 p.m. - 4:00 p.m. ET | Price: See detailed pricing options below. |

2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required.

This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit.

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| CFP® credit ONLY: | $61.50 | CFP® credit PLUS IAR credit: | $92.50 | |

| IWI credit ONLY: | $59.00 | IWI credit PLUS IAR credit: | $90.00 | |

| IAR credit ONLY: | $65.00 | CFP® credit PLUS IWI credit PLUS IAR credit: |

$117.50 | |

| CFP® credit PLUS IWI credit: | $86.50 |

NOTE: Additional fee includes CFP Board fee of $1.25 per credit hour/per student. If you add IAR CE credits, there is also an additional IAR’s governing board filing fee of $3.00 per credit hour/per student. (IAR CE credits are approved in the states that have adopted the NASAA Model Regulations.)

Registering includes the following three web pages: (each may open in a separate window)

- Payment: Enter your payment information. A detailed breakdown of costs and fees will appear before you confirm your payment.

- Attendee Registration: Fill out the Attendee Registration form to provide your contact details and any other information necessary to receive your CE credit.

- GoToWebinar Registration: Enter your First Name, Last Name and Email Address, then click the ‘Register’ button to complete registration for the live webinar.

NOTE: Do not close any of your web pages / browsers

until you are completely done registering. (SEE ABOVE.)

CFP®: This program fulfills the requirement of CFP Board approved Ethics CE. This program is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct, which is effective July 1, 2024.

IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®)

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

IAR CE Programs

Join Us for Our Upcoming Live Webinar and

Meet your 6-hour IAR Ethics and

Professional Responsibility CE Requirement.

Starting at only $74.95.

Also approved for 6 CE credit hours of CFP® and / or

6 CE credit hours of IWI (CIMA® / CPWA® / RMA®) in addition to IAR CE credits.

(CFP® and IWI ONLY credits NOT available.)

IAR Virtual Super CE Program Agenda

|

Our Virtual Super CE Program

Consists of the Following:

- 1-hour live webinar presentation: Ethical Practices and Professional Responsibility

(No CE credit.) - Self-study course: Ethics for Financial and Insurance Professionals (Course #: C25280)

- Virtual final exam (online): Requires you to spend 6 hours of reading and reviewing the self-study course material PRIOR to taking the exam. The 60-question exam requires an invite code that is given to all attendees during the live webinar presentation. To receive CE credit, advisors must obtain a passing grade of 70% or higher. If the exam is not passed on the first attempt, students have two (2) additional retakes for a maximum of three (3) attempts.

This presentation is designed to present financial and insurance professionals with the ethical practices and standards required when conducting business in their state.

This course is designed to meet the mandatory 6-hour CE credit requirement under the Ethics and Professional Responsibility for Investment Adviser Representatives (IARs).

Pricing Options

| License Type(s) | Cost | License Type(s) | Cost | |

|---|---|---|---|---|

| IAR credit ONLY: | $74.95 | IAR PLUS IWI credits: | $99.95 | |

| IAR PLUS CFP® credits: | $99.95 | IAR PLUS CFP® PLUS IWI credits: |

$124.50 |

Meet Your 6-hr or 12-hr IAR CE Requirement

Online and On Your Schedule!

B.E.S.T. offers two comprehensive courses to help you meet your IAR CE requirements:

- 6-Hour Ethics and Professional Responsibility Course

- 12-Hour Guide to Social Security and Ethical Practices Course

(6 hours Products & Practices + 6 hours Ethics)

Ethics for Financial and Insurance Professionals (6-hour)

Course #: C27297 | 6 CE Credit Hours | Starting at $47.95*

This course is specifically designed to fulfill the 6-hour Ethics and Professional Responsibility CE requirement for Investment Adviser Representatives (IARs).

What’s Included in the Course:

- 6 CE credit hours focused on Ethics and Professional Responsibility

- *$18 Governing Board Fee included in the cost

Online Exam:

- 60-question online exam

- To pass, achieve a 70% or higher score (Maximum of three (3) attempts allowed by NASAA).

Bonus Credits:

- 6 CE credit hours for CFP® certification

- 6 CE credit hours for IWI certifications (CIMA® / CPWA® / RMA®)

Ready to Enroll?

Ensure your compliance with minimal time commitment, all online, and at a competitive price. Don’t miss out—Start Today and meet your IAR CE requirements with confidence!

Guide to Social Security and Ethical Practices (12-Hour - split course)

Course #1: C26873 | Course #2: C26874 | 12 CE Credit Hours | Starting at $69.95*

This in-depth course is designed to equip financial advisors with essential knowledge on Social Security programs, rules, and regulations, guiding you through the complexities that impact your aging Baby Boomer clients, their spouses, and dependents. Gain the expertise you need to better serve your clients while fulfilling your IAR CE requirements.

What’s Included in the Online Course:

- 12 CE Credit Hours Total:

- 6 CE credit hours on Products and Practices

- 6 CE credit hours on Ethics and Professional Responsibility

- *$36.00 Governing Board Fee included in the course cost.

Online Exam:

- 120-question online exam

- To pass, achieve a 70% or higher score (Maximum of three (3) attempts allowed by NASAA).

Bonus Credits:

- 10 CE credit hours for CFP® certification

- 10 CE credit hours for IWI certifications (CIMA® / CPWA® / RMA®)

Why Choose This Course?

- Comprehensive and up-to-date content designed to meet all your IAR CE needs.

- Flexible online format allows you to complete the course at your own pace.

- Competitive pricing that includes all required fees.

- Equip yourself with practical knowledge to guide your clients through the complexities of Social Security while maintaining high ethical standards.

Get Started Today

Don’t miss the chance to stay compliant while expanding your expertise. Sign up now and fulfill your IAR CE requirements in one go!

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.)

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.”

DISCLAIMER

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.).

Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content.

It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T.

Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness.

THIS

NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND

DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR

LEGAL ADVICE.

B.E.S.T. INFORMATION / SERVICES

B.E.S.T. Links

Resources

Access a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings.

Social Media

Physical Address & Hours of Operation

© 1992 - 2025 Broker

Educational Sales & Training, Inc. All Rights Reserved.

7137 Congress Street, New Port Richey, FL 34653 | Toll Free:

1-800-345-5669

Hours of Operation: Monday - Friday, 8:30 a.m. to 5:00 p.m.

Eastern Time

Miscellaneous

About Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe*

*Remove from mailing list. Please allow up to five (5) business days for removal.

Ensure newsletter delivery to your inbox by adding [email protected] to your address book.