Advisor News Insight |

||

|

||

Industry News |

||

Elder Abuse Planning |

||

10 Common Scams that Target Seniors and How to Avoid ThemLearn the warning signs to identify and steer clear of senior scams. Every year, thieves target individuals to get access to their personal information and money, and they tend to zero in on older people. (Rachel Hartman, Contributor, U.S. News & World Report L.P., 02/02/2024) |

||

Estate Planning |

||

Estate, Gift, GST & Related Income Tax Proposals – What is the White House Doing?This article from the law firm of Rivkin Radler, describes the White House’s recently released Fiscal Year 2025 Budget and the administration’s wish list for the “reformation” of the income tax and transfer tax regimes applicable to an individual’s lifetime and testamentary dispositions of property for the benefit of the individual’s family (for our purposes, the “transfer tax regime”). (Louis Vlahos, Partner, Rivkin Radler LLP, 03/18/2024) |

||

What to Know About the New Bill Targeting GRATs and ‘Abusive Trusts’The Getting Rid of Abusive Trusts Act is intended to make these trusts less attractive for tax avoidance. (John Manganaro, Senior Reporter, ThinkAdvisor, 03/21/2024) |

||

Retirement Planning |

||

Helping Sole Proprietors Choose Between a Solo 401(k) and a SEP-IRAThe simplified employee plan–individual retirement account (SEP-IRA) has long been the star option for sole proprietors seeking to reduce income taxes and save for retirement beyond the lower contribution limits of traditional individual retirement arrangements (IRAs). However, with discount brokerage firms’ improvements in ease of account establishment and management, the IRS-termed one-participant 401(k) plan, often referred to as the solo 401(k), is growing in popularity. (Kelley C. Long, CPA®/PFS, CFP®, Personal Financial Coach and Consultant Kelley C Long Consulting LLC., 02/20/2024) |

||

Improving Your FinancesIn this article/video with Christine Benz of Morningstar and Ed Slott, “Brace Yourself for Higher RMDs in 2024,” they explain why many investors who are subject to required minimum distributions—which currently commence at age 73—are apt to find themselves with their largest distributions ever in 2024. Not only does the percentage of their tax-deferred account balance that they’re required to take out and pay taxes on the increase as they age, but most people’s balances are elevated thanks to a soaring stock market in 2023. (Christine Benz, Director of Personal Finance and Retirement Planning, Morningstar, and Ed Slott, CPA, Best-Selling Author, Ed Slott and Company, LLC, 03/13/2024) |

||

Retirement Insecurity 2024: Americans’ Views of RetirementA national opinion poll finds that working age Americans are increasingly worried about retirement, and they see a return to pensions to restore the American Dream of retirement. Eighty-three percent of respondents say that all workers should have a pension so they can be independent and self-reliant in retirement, and more than three-fourths of Americans agree that those with pensions are more likely to have a secure retirement. The survey results are detailed in the “Retirement Insecurity 2024: Americans’ Views of Retirement” from the National Institute on Retirement Security. (Dan Doonan, Executive Director, and Kelly Kenneally, Communications Consultant, National Institute on Retirement Security, 02/2024) |

||

The New Fiduciary Rule (24): The DOL Fiduciary Rule Requires a Recommendation. What is That?Here is another article from Fred Reish.com offering timely updates and insights on retirement industry for service providers, plans sponsors, and registered investment advisors. In this update, Mr. Reish describes the significance of the term “What Is a Recommendation.” (C. Frederick Reish, Partner, Faegre Drinker Biddle & Reath LLP, 03/21/2024) |

||

Social Security Planning |

||

Social Security Claiming: The Case of the Age and Earnings GapThe Scenario: Married, Different Ages, Different Earnings: Greg and Alice are a married couple. Greg is a high earner and Alice is a middle-income earner, and there is over seven years’ difference in their ages. (John Manganaro, Senior Reporter, ThinkAdvisor, 02/29/2024) |

||

Filing Rules for Retirement and Spouse BenefitsThe Bipartisan Budget Act of 2015 made some changes to Social Security’s laws about filing for retirement and spousal benefits. Determining when to start your Social Security benefits is a personal decision. The Social Security Administration (SSA) has released a bulletin explaining the timing of Multiple Benefits also called “Deemed Filing.” (SSA) |

||

When Delayed Social Security Claiming Doesn’t Go as PlannedHere is another series of Social Security Claiming case studies from Think Advisor. In the case study of a high-earning spouse, the optimal claiming approach proved surprising. The big takeaway was that when to claim spousal benefits in cases with big differences in earnings histories can make waiting until age 70 a suboptimal strategy. Delaying is going to be better than claiming a significantly reduced benefit at age 62, but the earlier collection of the full benefits will pay off in the end — unless one member of the couple lives a long time. (John Manganaro, Senior Reporter, ThinkAdvisor, 03/19/2024) |

||

Tax Planning |

||

Ed Slott: 7 RMD, IRA and Estate Planning Points for 2024The simple truth is that the issues that come into play when financial advisors and their clients are working to achieve tax optimization in the retirement income planning process are monumentally complex. Slott said the confusion is understandable because the calculation and timing of RMD has been something of a nightmare in the past few years thanks to repeated changes in the law and the publication of interim interpretive regulations. (John Manganaro, Senior Reporter, ThinkAdvisor, 03/12/2024) |

||

Practice Management |

||

5 Top Lead-Generation Strategies For 2024Yes, advisors who want to market well need a well-designed website, an engaging social presence and responsive communications. But those things are just the beginning. Standing out means doing more. (Susan Theder, Chief Marketing and Experience Officer, FMG Suite, 03/01/2024) |

||

FINRA Regulatory Notice 23-20: Regulation Best InterestThis Notice discusses the guidance and other resources available to assist members with their compliance efforts in connection with the Securities and Exchange Commission’s (SEC) Regulation Best Interest (Reg BI). FINRA highlights the SEC’s series of Staff Bulletins (Bulletins) reiterating standards of conduct for broker-dealers (BDs or members) and investment advisers (IAs): (FINRA, 12/05/2023) Staff Bulletins: |

||

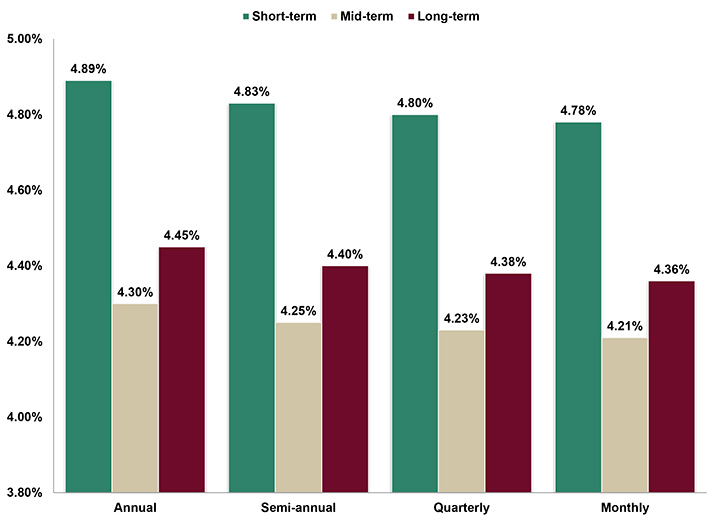

Assumed Federal Rates (AFRs) |

||

§7520 Rate for April is: 5.20% |

||

|

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesA comprehensive list of online financial and insurance tools and information.Discover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

Life Insurance, Annuity and Ethical Practices |

||

B.E.S.T. CE Programs |

||

Take Our Online Courses at Your Own Pace and

|

||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) & IAR Ethics. Date: Thursday, April 18, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

Comprehensive List of Online Finance and

|

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@ to your address book. |

||